“I think this will be a massive transformation of the bilateral economic space because it has bigger implications,” former Australian diplomat Kevin Evans, director of the Australia-Indonesia Centre, told the Australian Broadcasting Corp (ABC).

“It's not just about the Australia-Indonesian corridor,” he said.“It's actually about doing things together that allows a move into much bigger markets around the region and the world.”

It will also depend on the active involvement of the Indonesian private sector and willingness of Indonesia-based companies to take a stake in West Australian lithium mines to shore up their supply chains.

“It will depend on Indonesia understanding that things are done here on a commercial basis,” says one Australian official, noting the Indonesian government's interventionist role in making things happen in its economy.“It will still take time and a lot of effort.”

Prime Minister Anthony Albanese, who scored points with Widodo by making Jakarta his first port of call after he was sworn in last year, spoke of the often-turbulent relationship as“shifting up a gear.”

Latest stories

new uk warship design speaks to indo-pacific ambitions

latest raid will do little to shake jenin's reputation

wagner's tentacles still go deep in africa

Central to that is the potential symbiotic partnership that could develop around EV batteries and Indonesia's interest in importing Australian lithium, which along with some rare earth minerals is the one significant component it lacks.

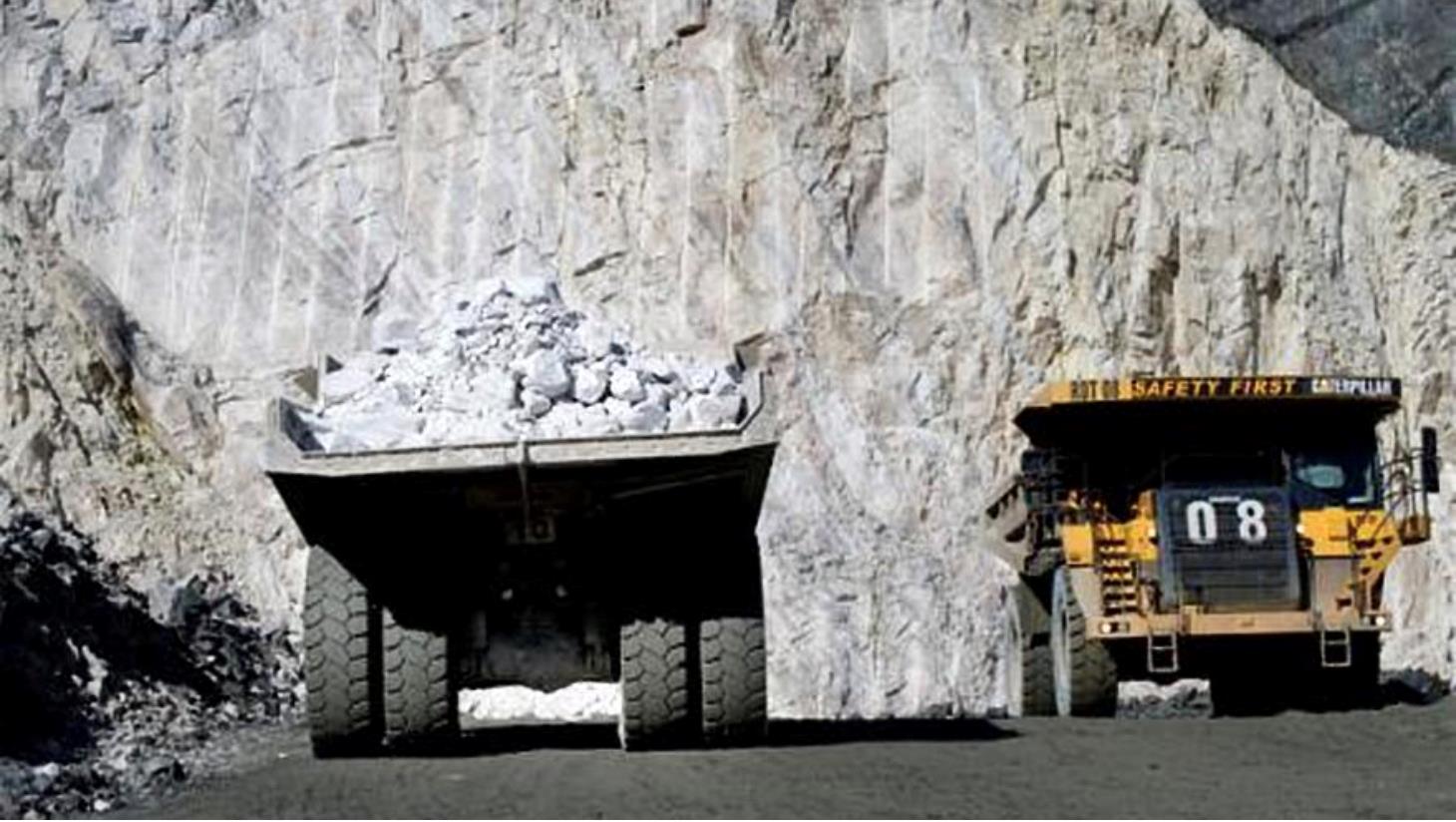

Australia has the lithium Indonesia needs to power its EV ambitions. Image: Twitter

Shortly before the leaders met, the Indonesian Chamber of Commerce and Industry (Kadin), signed a so-called Action Plan with the state government of West Australia, to bring both parties closer together in the critical minerals sector.

“The signing of the action plan is essential to seize opportunities and gather all parties involved in the critical mineral sector with those parties who will support them financially to realize more concrete cooperation,” said Indonesian Economic Coordinating Minister Airlangga Hartarto.

Australia is the world's largest lithium producer, with last year's output totaling 61,000 tonnes, or nearly half of global production, as trade in all EV battery ingredients – and their prices – rises significantly.

About 96% of Australia's lithium exports last year went to China, which accounts for 58% of global lithium processing capacity and nearly 80% of global lithium battery manufacturing capacity, a dominance that worries the US.

Analysts say the lithium trade provides an opportunity to take full advantage of the 2020 Indonesia-Australia Comprehensive Economic Partnership Agreement (IA-CEPA), which aims to unlock the trade and investment potential of both countries.

Under one of four side agreements, A-CEPA provides Indonesian companies with preferential access to the Australian market by lowering the level of Australian content required in EV battery manufacturing.

Indonesian firms are understood to have had initial discussions with the owners of several West Australian lithium mines, but the only signed deal so far is an MOU between state-owned holding company MIND ID and Australian salt and potash supplier BCI Minerals.

In Indonesia, United Tractors, a subsidiary of car-maker Astra International, is taking a 19.99% interest in Australian-owned Nickel Industries Ltd, which supplies nickel ore to

the Morawali and Weda Bay smelters in Central Sulawesi and Maluku.

Despite their proximity, Indonesia counts Australia as its 15TH

top trading partner with imports last year of just US$3.5 billion, lagging Bangladesh ($3.9 billion) and Pakistan ($4.3 billion).

Australia, on the other hand, puts last year's figure of Australian exports to Indonesia at $12.4 billion and Indonesian imports at $5.9 billion, a trade deficit in goods that Jakarta regularly complains about to Canberra's bemusement.

The discrepancy is explained by the fact that Indonesia doesn't take services into account, including money spent by the 1.2 million Australian tourists who are now flocking back to Bali after the Covid hiatus.

More than that, Indonesia ranked 27th

as a destination for sluggish Australian foreign investment, much of it in the mining sector, and a lowly 38th

place as a source of investment to Australia.

Indonesia's electric vehicle industry is motoring ahead but could use Australia's help. Image: Facebook / Caixin

Australian officials say one significant impediment is the Indonesian mindset that it is unpatriotic to invest in other countries, one of many factors that expose over-regulated Indonesia's failure to sell itself on the world stage.

Former ambassador to Jakarta John McCarthy has noted the absence of any real diplomatic crisis in recent years in a relationship once marred by heated disputes over East Timor and Papua and also by the execution of two Australian drug traffickers in 2015, the year after Widodo came to power.

“If this lack of fireworks continues, we should be diverted even less by the need for crisis management and be able to focus more on what we want from the relationship,” McCarthy wrote in the Australian Financial Review.

Like this:Like Loading... Related