(MENAFN- News Direct) Naples, Florida | February 14, 2023 11:00 PM Eastern Standard Time

The market is poised for the next metals and mining bull market to commence. The theme for the last bull market was centered on globalization and the emergence of a new middle class in what we defined as BRIC (Brazil, Russian, Indian, China).

From 2002 to 2012, the demand created by these new consumers drove the prices of commodities to new price levels and created significant valuations in equity markets. The leading market for exploration and development capital and companies is the TSX Venture Exchange that illustrates the approximately 10-year bull/bear cycles.

-figcaption

Countries will continually become more nationalistic as it relates to strategic resources and limit exportation or even potentially nationalize assets of great national economic importance. The new arms race is over control of the world's essential commodities.

Global conflict such as the war in Ukraine has shown us that dependences on foreign nations can easily disrupt critical commodity supply chains. Building tensions over China and Taiwan has the potential to further disrupt these supply chains as China currently has the dominant position in the supply and processing of key commodities including lithium, rare earth elements and cobalt. This gives China significant leverage of developed nations dependent on these critical commodities.

This overall situation has been underscored by a general lack of domestic resource exploration expenditures over the last 10 years and resulted in domestic security of supply issues for many developed nations. 'Not In My Backyard' has been the mantra of the day.

Mineral resources are finite and without new discoveries become scarce. Global ambitions for electrification will also result in transitioning what has traditionally been demand for hydrocarbons to the minerals critical for energy storage. This is exasperating the problem.

The country most vulnerable to the outsourcing of commodity supply and processing is none other than what has been the world's leading economy of the 21st century. The United States of America.

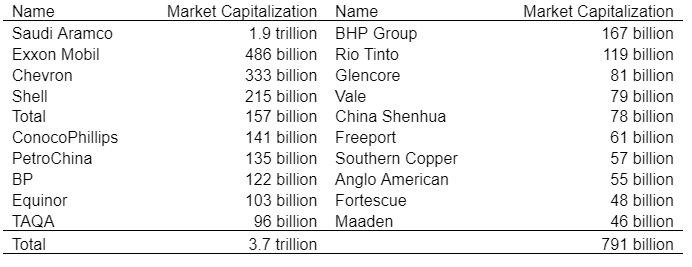

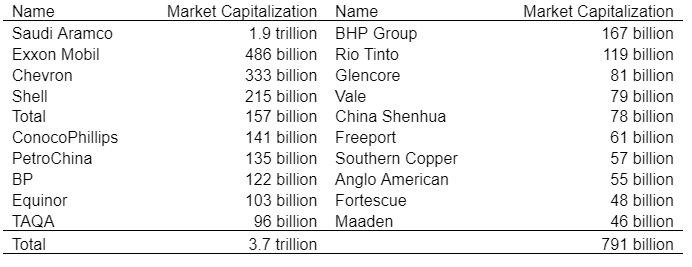

The market capitalization comparison of the world's largest oil companies to the world's largest mining companies illustrates a significant disconnect. If only a moderate percentage of investor capital flowed from the oil companies to the mining companies, the result would be very significant in terms of driving the valuation.

-figcaption

US Critical Metals Corp. (“USCM”) (TSXV: USCM, FSE: 0IU0, OTCQB: USCMF). The business model of the company is perfectly aligned with these significant global trends. USCM has built a portfolio of discovery focused assets in leading US jurisdictions that address those commodities with the greatest forecasted supply shortfalls and have the most critical applications to national interests. Specifically, electrification and national defense.

The portfolio includes lithium in the Clayton Valley area of Nevada, the only lithium producing region in the US, rare earth elements in Montana, the region surveyed by the US Geological Survey (“USGS”) and Rio Tino (second largest mining company in the world) as a new potential source of rare earth elements in the US, and cobalt in Idaho, the only known place in the US where cobalt is being produced as a primary metal in deposits.

Lithium Clay in Nevada

USCM has a lithium clay asset the company calls the Clayton Ridge Project. This source of lithium is very similar to what is currently being developed by Lithium Americas Corp. (Thacker Pass Project) (TSX: LAC, market capitalization: $4.4 billion CAD), ioneer Ltd . (Rhyolite Ridge Project) (ASX: INR, market capitalization: $886 million), American Lithium Corp . (TLC Project) (TSX: LI, market capitalization: $971 million) and Century Lithium Corp. (Clayton Valley Project) (TSX: LCE, market capitalization: $207 million).

Lithium from clay has the potential to address the significant lithium shortfall forecasted in the US. Although proven on a pilot plant scale to produce approximately 90% recoveries of lithium from clay (reference Century Lithium pilot plant results), these projects have not been proven on a commercial scale. However, it looks like that is about to change and could drive a significant asset valuation rerating across US lithium clay assets and companies, as Thacker Pass moves close towards commercial production.

General Motors, the largest automaker in the US, recently committed to invest $650 million in Thacker Pass (Lithium America Corp.) on very specific conditions, including but not limited to, 1. A positive outcome of a litigation issue involving environmentalist, ranchers, and indigenousness groups to halt the projects progression, 2. The separation of the US (Thacker Pass) and Argentinian assets into separate companies. This highlights some themes discussed above, in addition to the certainty that General Motors completed a massive amount of technical due diligence to ensure that lithium from clay is viable at commercial scale.

First, approximately one week after this announcement, the Obama appointed judge presiding over the litigation case issued a decision referring the permitting process back to the Bureau of Land Management. This demonstrates that the“Not In My Backyard” theme of the day will be set aside in the context of ensuring US national security of supply in key commodities. The judge did comment that US ambitions did not influence her discission. However, when the largest automaker in the US and political supporter of the Democrats is saying this project represents the source of the lithium need for its evolving fleet of electric cars and trucks, it would certainly be career suicide to block its advancement. What we do is always a much better indicator than what we say.

Second, the separation of these assets addresses a significant issue. The Ganfeng Group, the largest lithium producer in China, owns about 20% of Lithium Americas. This is a significant security of supply issue for General Motors and the US, and by separating these assets, the Chinese can secure their stake in the Argentinian asset, while General Motors can focus on the US asset, Thacker Pass. This highlights the nationalistic investing and protectionist trend that will continue to unfold in commodities.

As these themes continue to play out, USCM is perfectly positioned in Nevada.

The company has broadly disseminated lithium clay beds at surface, significant estimated thickness of clay beds of up to 200 meters, and economic lithium grades sampled across the property.

If drilling results, which are planned for this year, as the company must drill 1,500 meters this year to complete its acquisition of 100% of the project, come though consistent with the initial work completed, USCM could see a very significant value increase.

Interestingly enough, this asset was sourced from the same group that prospected the original acreage positions for ioneer and American Lithiun. Both approximately billion-dollar companies. This is only one of the assets currently held by USCM.

Rare Earth Elements in Montana

USCM is targeting a district scale opportunity in Montana called Sheep Creek, in partnership with a company lead by the former rare earth analyst at USGS and current advisor to USCM. Interestingly enough, USGS and Rio Tinto, the second largest mining company in the world, flew airborne geophysics over the south of the state. It is quite possible given this mutual connection that USCM is partnered on what could be key acreage in the area.

The grade of total rare earth elements is outstanding. Up to approximately 18% with significant amounts of neodymium and praseodymium. The highest value of the light rare earth elements and the elements used in batteries as well as other critical applications including laser-rangefinders and precision guided munitions applications. Using current prices, these rock samples are comparable to about 50 grams per ton of gold equivalent. It is no wonder the US Army Research Lab has been providing funding to Montana Tech to study Sheep Creek due to the potential critical need for rare earth elements in national defense technologies.

The property was previously mined for niobium (to strengthen stainless steel) from three historic mines. USCM and its partner have opened up these mines and seen the same mineral formations underground as present on surface. Historic sampling has identified about a 2.5 kilometer corridor of high grade rare earth mineralization between these historic mines in structures called carbonatites.

Over 50 carbonatite structures have identified across the property. To put that in perspective, Mountain Pass, the only rare earth element producing asset in the US was discovered off one carbonatite. MP Materials, owner of Mountain Pass, current has a market capitalization of $5.5 billion USD.

USCM and its partner intend to further refine targets and drill this asset in the coming year. If these grades are encountered over any amount of reasonable drill width, USCM could have a world class type rare earth discovery in the US. USCM has an agreement to earn-in for up to 75% of the project over the next five years.

Cobalt in Idaho

USCM has an acreage position literally in the heart of the Idaho Cobalt Belt in Idaho. Located directly next to the only producing mine of its type in the US, USCM has what is likely a highly sought after piece of the larger puzzle.

The project is 100% owned by USCM and was sourced from the same group of prospectors that assembled the acreage position for Patriot Battery Metals, a hard rock lithium company with a market capitalization of $1.4 billion CAD.

Owned by Jervois Global, the mine located next to USCM is the only one of its type in the US due to the fact that cobalt is one of the primary metals in the deposit. Generally cobalt is a very small percentage of the economic minerals in a deposit and often a credit to gold and copper production.

The mine is very economic with almost a 40% post-tax IRR but has an NPV at 8% of slightly below $100 million USD. Jervois needs more reserves and USCM possibly has them given USCM has the majority of the historic underground workings on its side of the property boundary and has sampled grades at surface consistent with the mine reserves.

USCM plans to sample, map, survey and permit the property and will explore options to further advance the asset with a drilling program. A discovery here has a natural outcome and could be yet another significant win for USCM.

Corporate Background

USCM is lead by a highly experienced team of financial and technical professionals. The company is led by Darren Collins, CEO and Director, a highly experienced financial professional with the background required to finance, manage and monetize these projects, and Marco Montecinos, Vice President of Exploration and Director, an exploration geologist with 35 years of experience finding mineral deposits for some very notable mining companies.

The company currently has about a $20 million CAD market capitalization and last reported $3.8 million dollars of cash. Insiders of the company control over 40% ownership in the company.

USCM has multiple upcoming catalysts including drilling, sampling and permitting milestones across its portfolio of unique discovery focused projects. These assets are perfectly aligned with major global trends unfolding.

To learn more about the company, the corporate presentation can be accessed at the link below and provides an excellent overview of the various aspects of this article.

Conclusion

All the pieces are coming together for what could be the biggest metals and mining bull market of our lifetimes. Companies such as US Critical Metals Corp. that are poised to make discoveries in critical commodities that are the building blocks of our new age economy have the potential to create enormous returns for investors. We highly encourage you to review the company and learn more about why we are so excited about this company and its prospects.

Disclaimers: This article contains sponsored content. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor with regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, assumptions, objectives, goals, and assumptions about future events or performance are not statements of historical fact and may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements, indicating certain actions & quotes; may, could or might occur Understand there is no guarantee past performance is indicative of future results. Investing in micro-cap or growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor's investment may be lost or due to the speculative nature of the companies profiled. CaptalGainsReport 'CGR' (owned by RazorPitch Inc.) is responsible for the production and distribution of this content. CGR is not operated by a licensed broker, a dealer, or a registered investment advisor. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. CGR authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. CGR has been compensated thirty-five hundred dollars by U.S. Critical Metals Corp to produce content related to USCMF. As part of that content, readers, subscribers, and webs are expected to read the full disclaimers and financial disclosure statement that can be found on our website.

capitalgainsreport.com

CapitalGainsReport is a financial website and newsletter for investors seeking nanocap and microcap opportunities. Please join our free newsletter at capitalgainsreport.com

Comments

No comment