(MENAFN- News Direct) Perth, Australia | November 28, 2022 07:00 AM Eastern Standard Time

-figcaption

< />

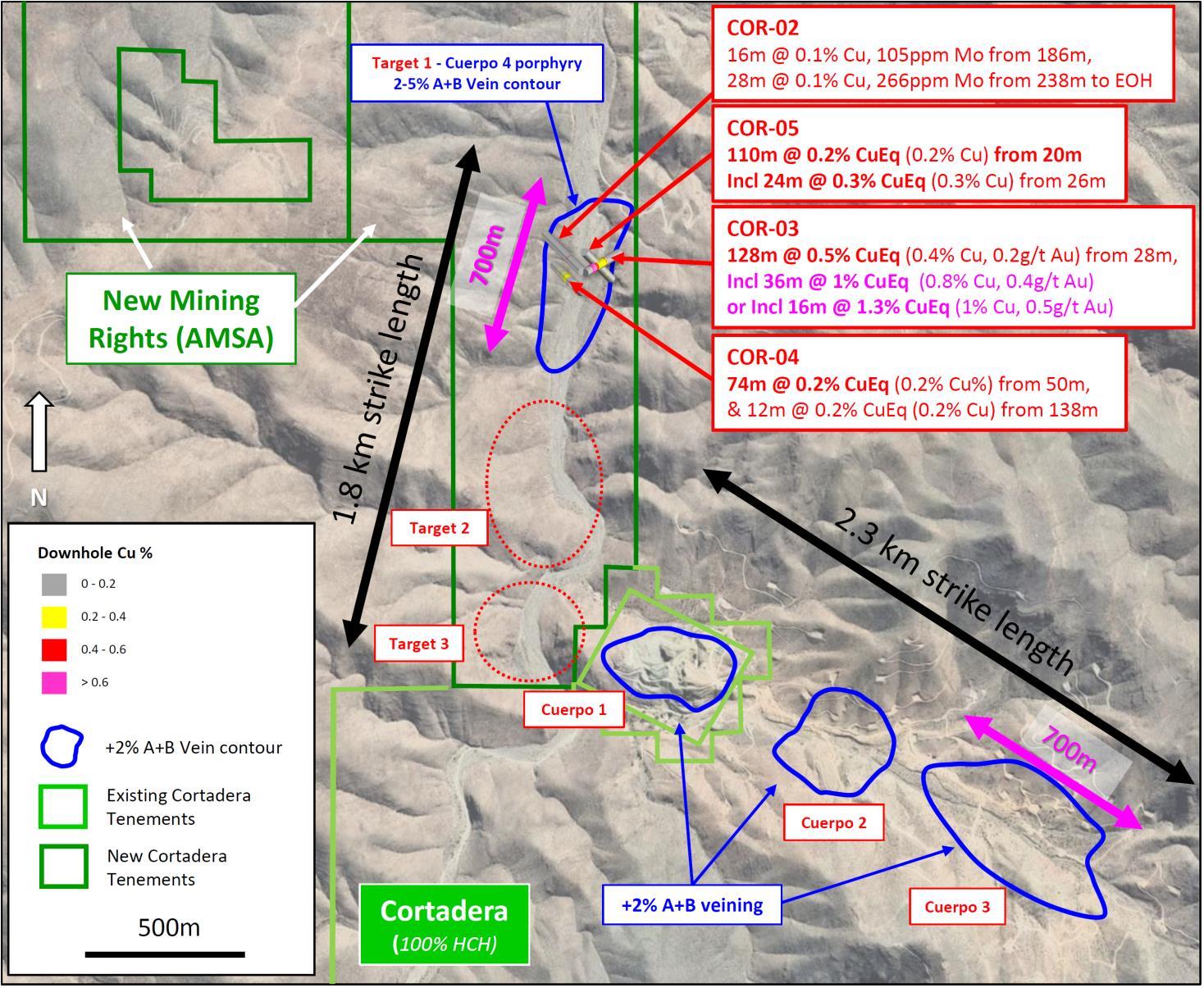

| Fourth Porphyry Added to Cortadera · Hot Chili has executed an Option Agreement with Antofagasta Minerals S.A. (AMSA) to acquire a 100% interest in five highly prospective mining rights, containing the potential western extension of Hot Chili's Cortadera copper-gold discovery , the centrepiece of the Company's low-altitude, Costa Fuego senior copper development in Chile · AMSA's mining rights contain a large outcropping mineralised porphyry ( Cuerpo 4 - 700m in strike length and 300m in width), with similar dimensions to Cortadera's main porphyry (Cuerpo 3) · The option enables the consolidation of Cortadera and near doubles the prospective strike length of the existing Cortadera discovery from 2.3km to 4.1km · Five shallow reverse circulation drill holes for 1,056m* completed across Cuerpo 4 in 2005 confirmed several significant shallow drilling intersections, including: o 128m grading 0.5% CuEq** (0.4% copper (Cu) & 0.1g/t gold (Au)) from 28m downhole depth, including 16m grading 1.3% CuEq** (1% Cu & 0.5g/t Au) from 28m · First-pass 6,000m drilling programme to start as soon as possible to assess a potential material resource addition to Costa Fuego · Low-cost transaction and strong cash position of A$15.4M as at 30 th September 2022 |

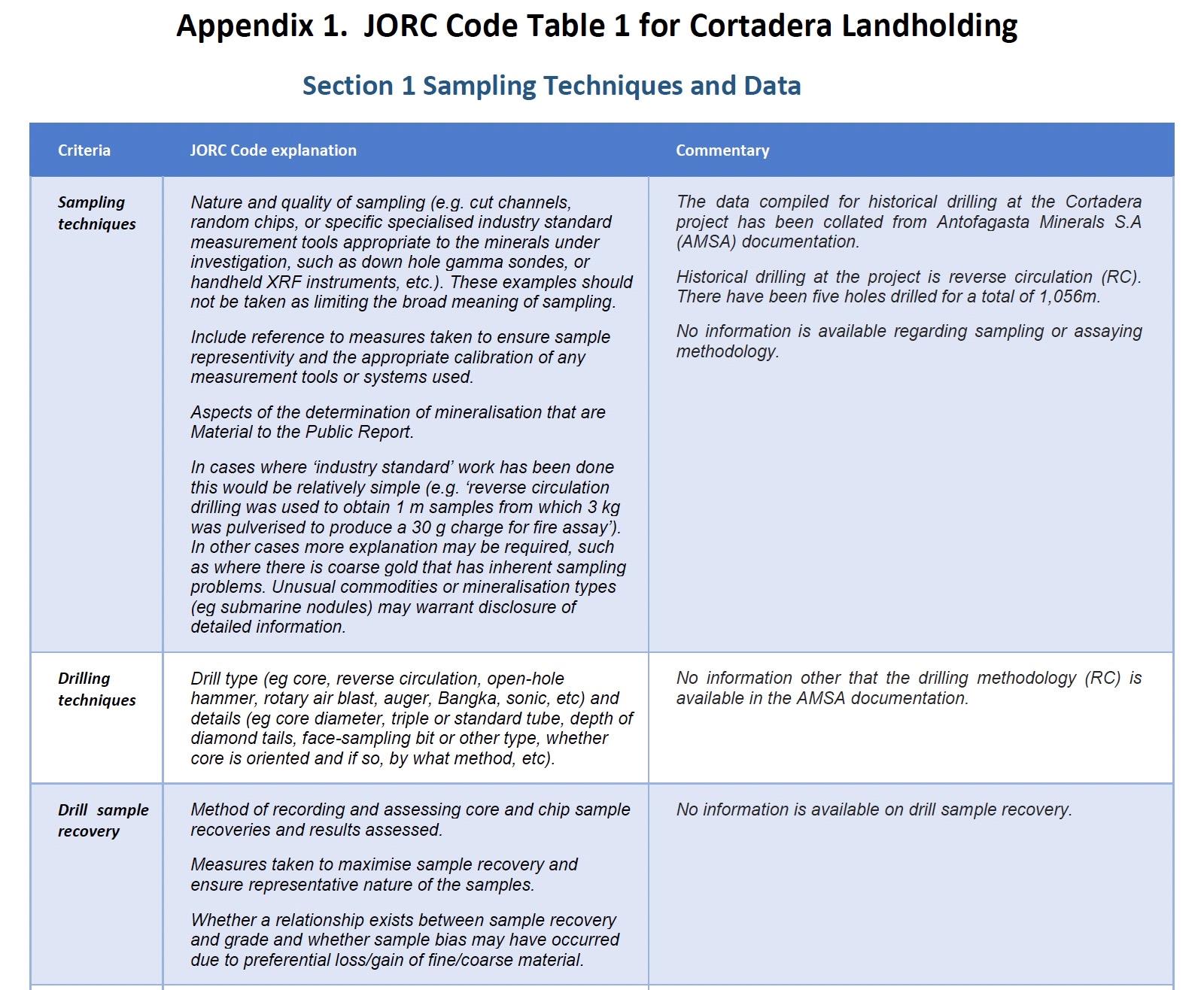

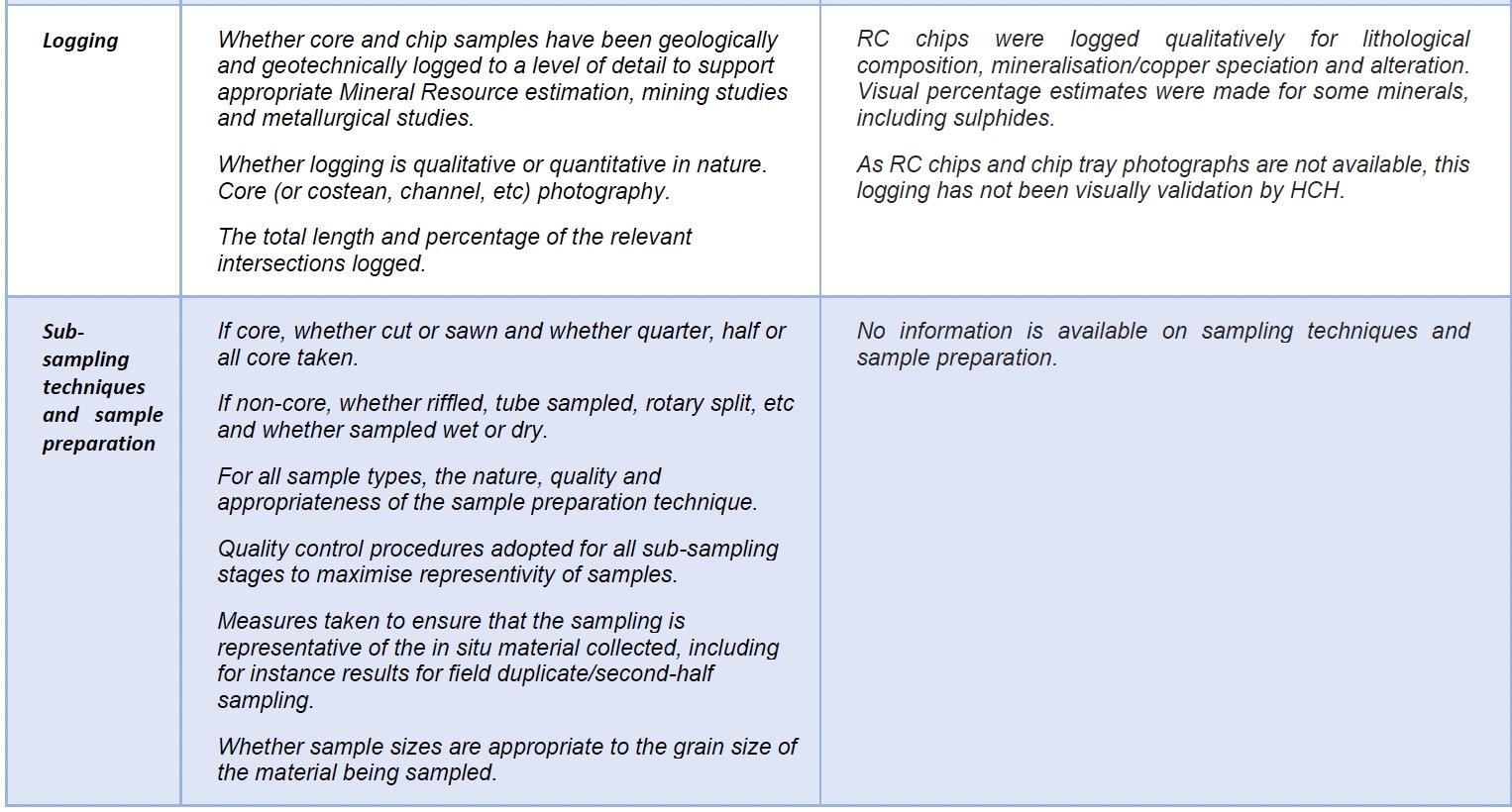

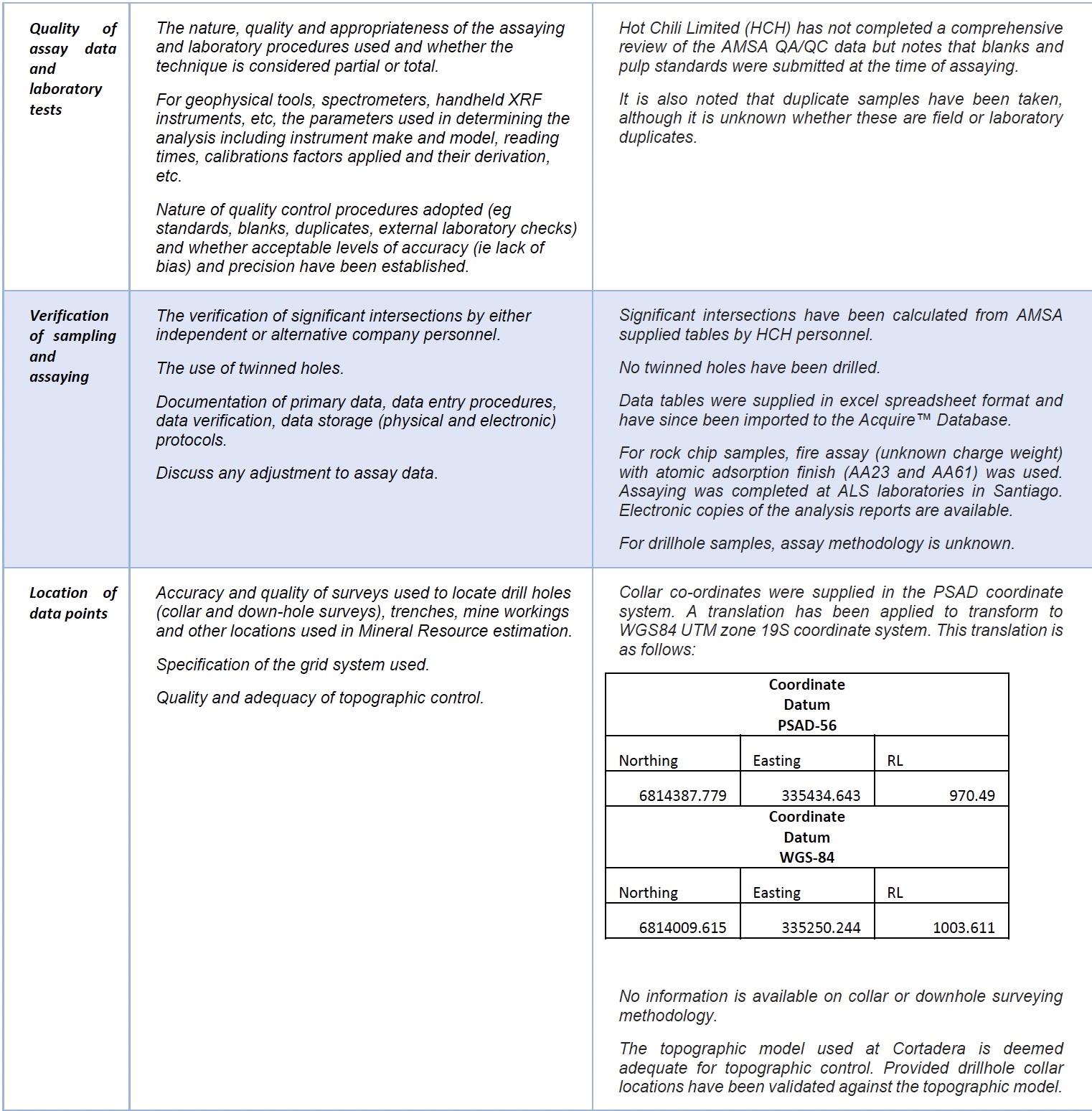

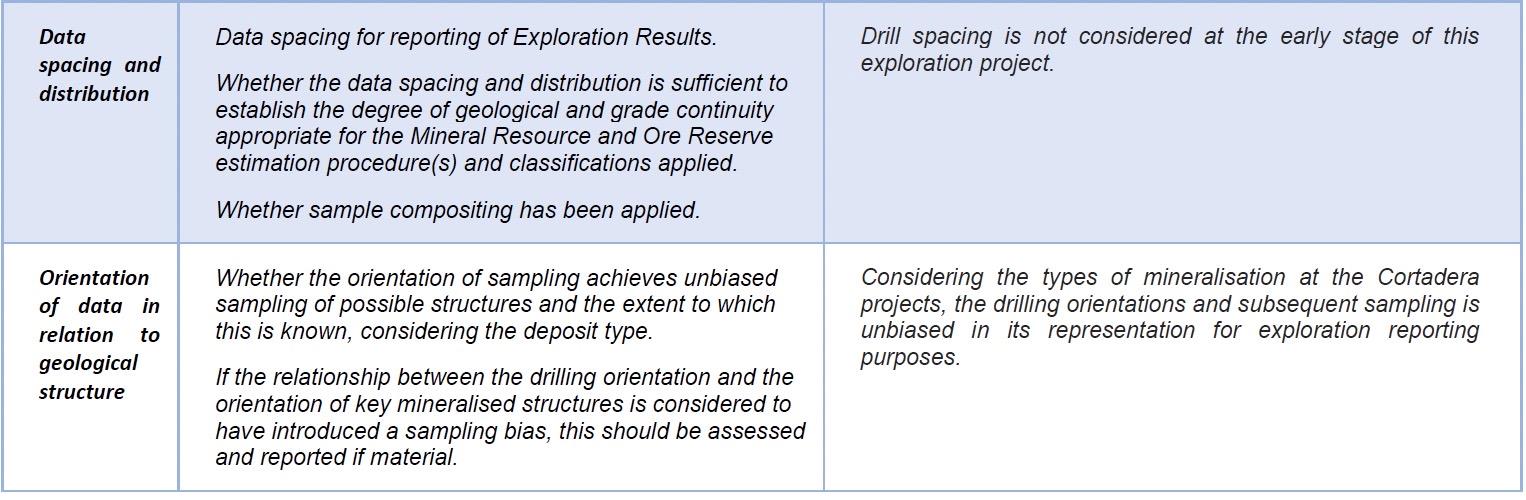

* Drilling data and associated drilling intersections not previously publicly reported, AMSA internal report, see JORC Code Table 1 in this announcement for further details)

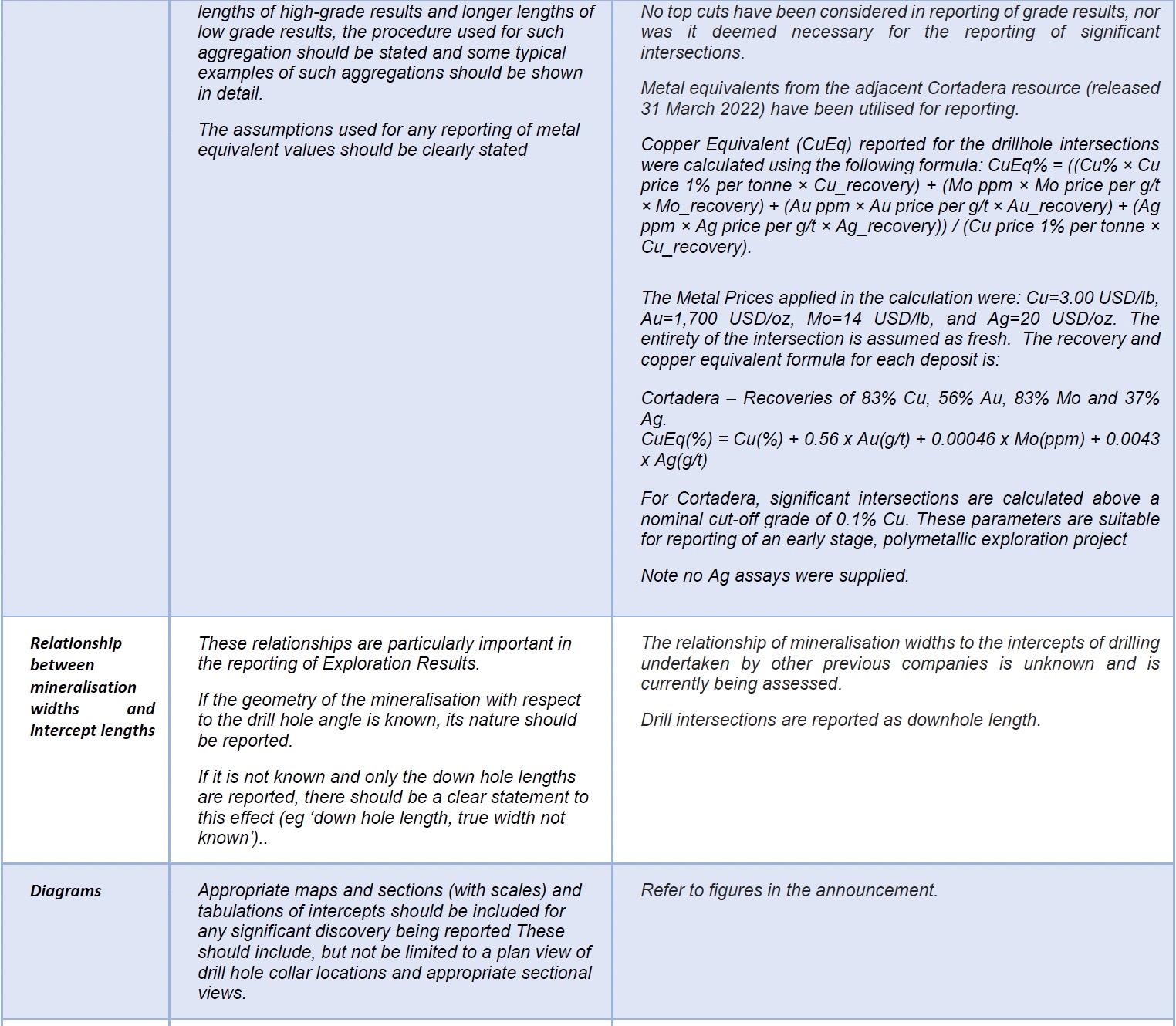

** Copper Equivalent (CuEq) reported for the drillhole intersections were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne × Cu_recovery). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. The entirety of the intersection is assumed as fresh. The recovery and copper equivalent formula for Cortadera – Recoveries of 83% Cu, 56% Au, 83% Mo and 37% Ag. CuEq(%) = Cu(%) + 0.56 x Au(g/t) + 0.00046 x Mo(ppm) + 0.0043 x Ag(g/t)

Hot Chili Limited (ASX: HCH) (TSXV:HCH) (OTCQX: HHLKF) (“Hot Chili” or“Company”) is pleased to provide details of a material transaction with Chilean copper major Antofagasta Minerals S.A. (AMSA).

Hot Chili has executed an Option Agreement enabling Hot Chili to acquire a 100% interest in AMSA's mining rights adjoining the western margin of Hot Chili's Cortadera copper-gold porphyry discovery, the centre-piece of the Company's Costa Fuego senior copper development in Chile.

This strategic option agreement consolidates the highly prospective AMSA mining rights, containing near-surface drill intersections of copper-gold porphyry mineralisation, with Hot Chili's contiguous Cortadera project.

Cortadera has been the growth engine for Hot Chili since the Company executed a transaction to acquire the project in 2019.

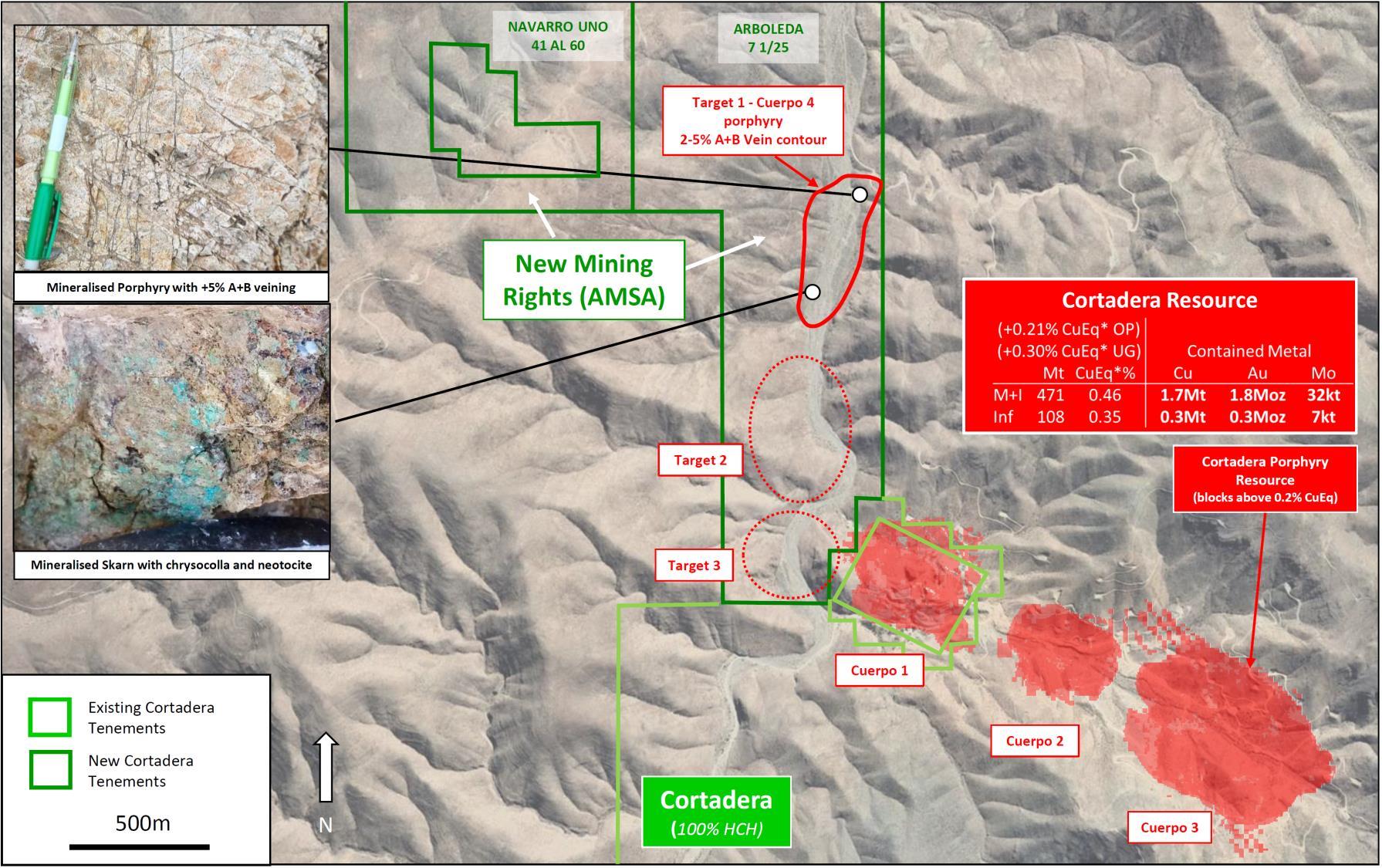

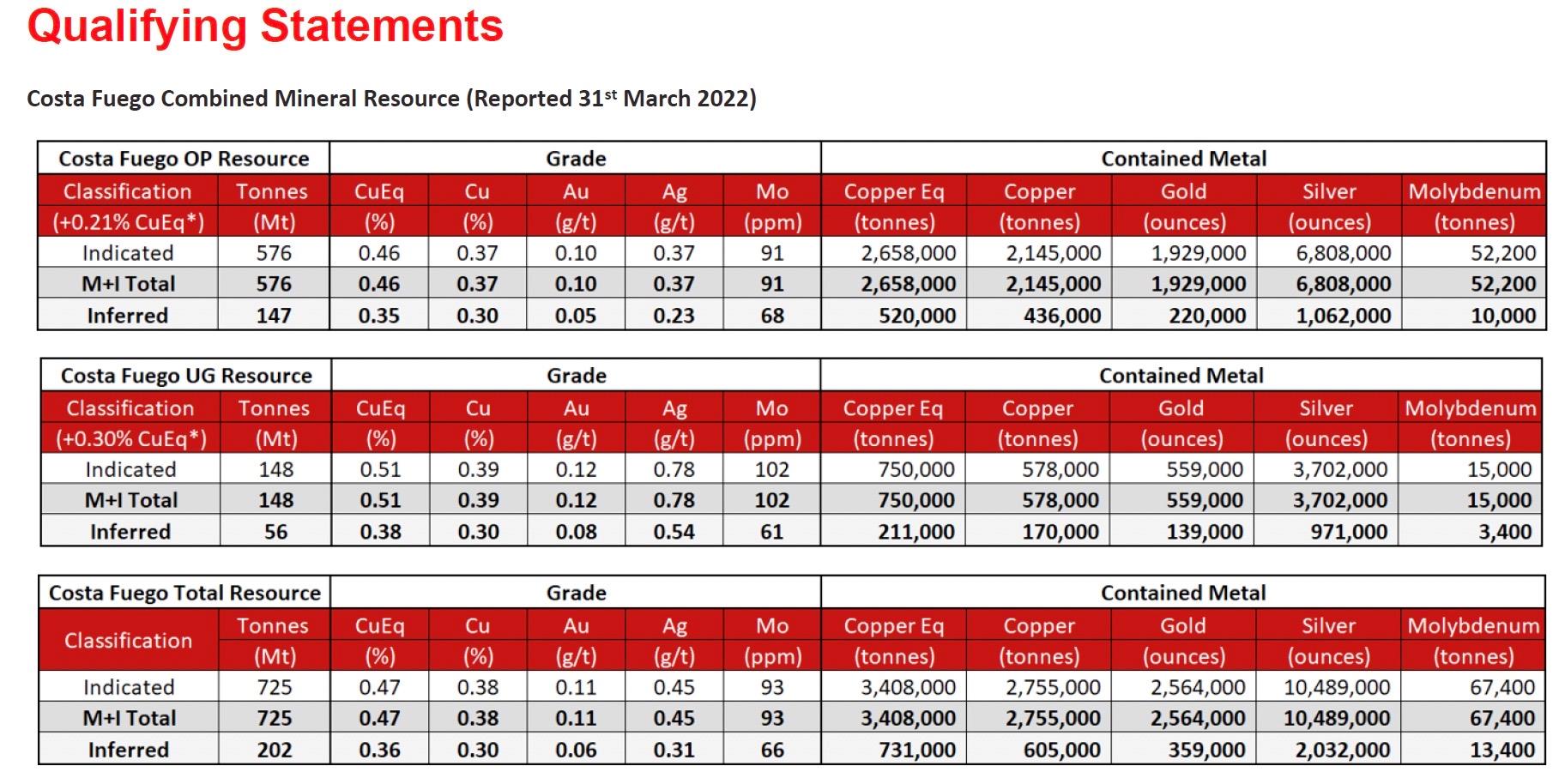

Cortadera's current Indicated resource of 471Mt grading 0.46% CuEq for 1.7Mt copper and 1.8Moz gold and Inferred resource of 108Mt grading 0.35% CuEq for an additional 0.3Mt copper and 0.3Moz gold (ASX announcement dated 31st March 2022) is contained within three porphyry centres, trending NW-SE, over a strike extent of 2.3km.

The option enables the consolidation of Cortadera and near doubles the prospective strike length of the discovery, increasing the near term, material resource growth potential for Hot Chili.

AMSA's five mining rights cover 517 hectares and contain a large outcropping mineralised porphyry (Cuerpo 4 - 700m in strike length by 300m in width) with similar dimensions to Cortadera's main porphyry (Cuerpo 3) as well as other identified porphyry targets, trending N-S, over a prospective strike extent of approximately 1.8km.

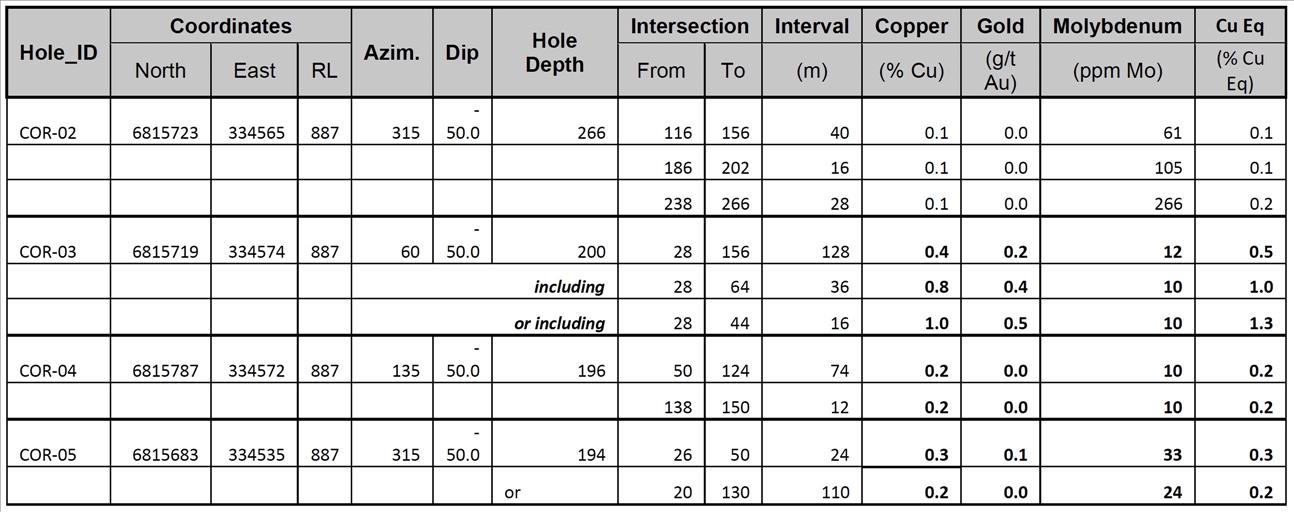

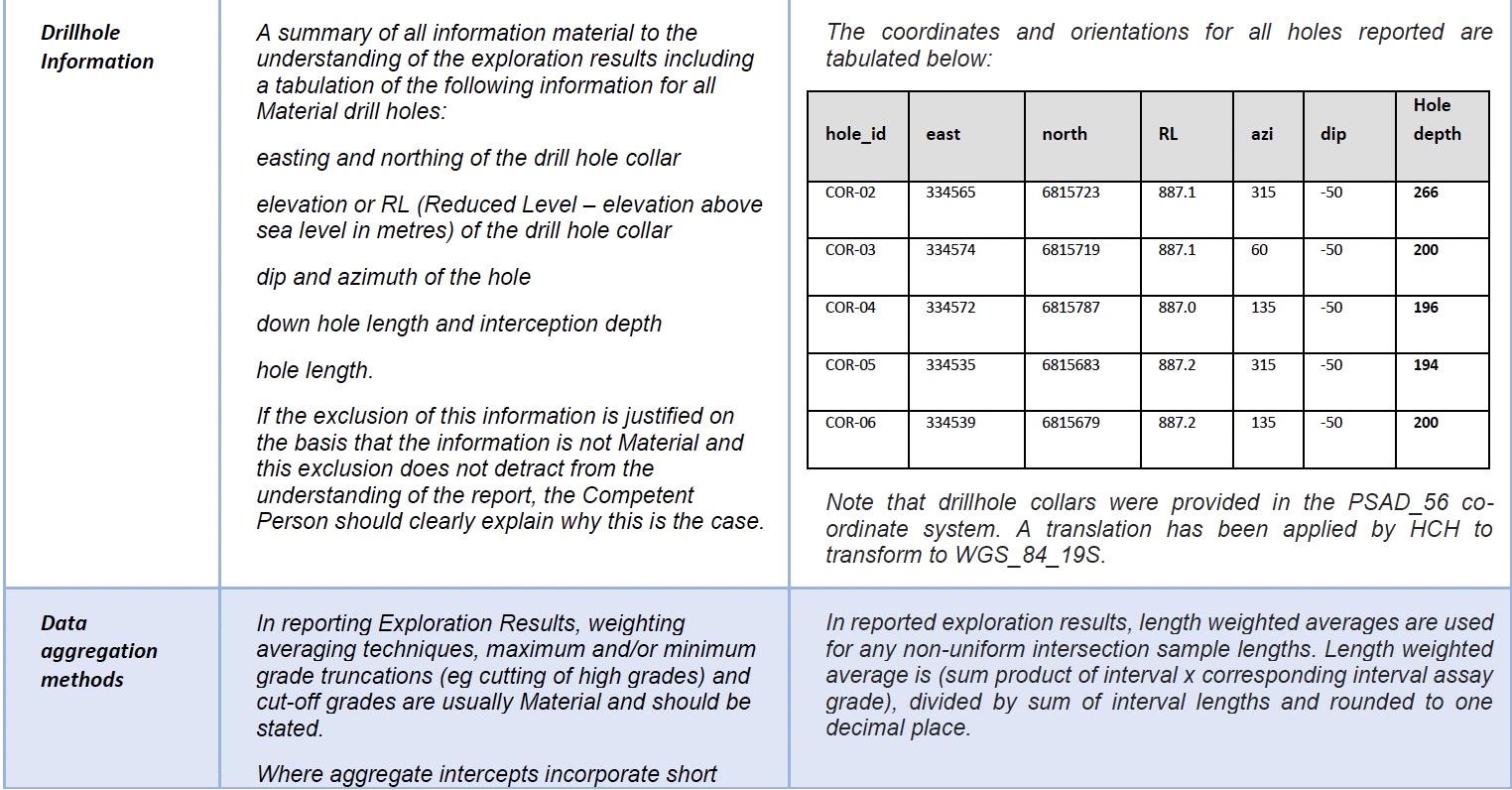

In 2005, AMSA intersected significant copper-gold-molybdenum mineralisation at Cuerpo 4, with five shallow Reverse Circulation (RC) drill holes totalling 1,056m (Drilling data and associated drilling intersections not previously publicly reported, AMSA internal report, see JORC Code Table 1 in this announcement for further details).

Four of AMSA's five drill holes recorded wide intersections of mineralisation, including COR-03 which recorded 128m grading 0.5% CuEq (0.4% Cu & 0.1g/t Au) from 28m downhole depth, including 16m grading 1.3% CuEq (1% Cu & 0.5g/t Au) from 28m.

The historical drilling across Cuerpo 4 clearly demonstrates open pit resource growth potential, given the shallow nature of copper-gold-molybdenum mineralisation, and near-surface, copper-gold enrichment.

Next Steps – Rapid Resource Definition

A first-pass drilling programme comprising 16 holes for 6,000m is expected to start as soon as possible.

Drilling will test Cuerpo 4 and two other targets within AMSA's landholding using RC and Diamond (DD) drilling. Hot Chili and AMSA have agreed on the detail and staging of the planned drilling programme after a collaborative and detailed geological review by both companies' technical teams.

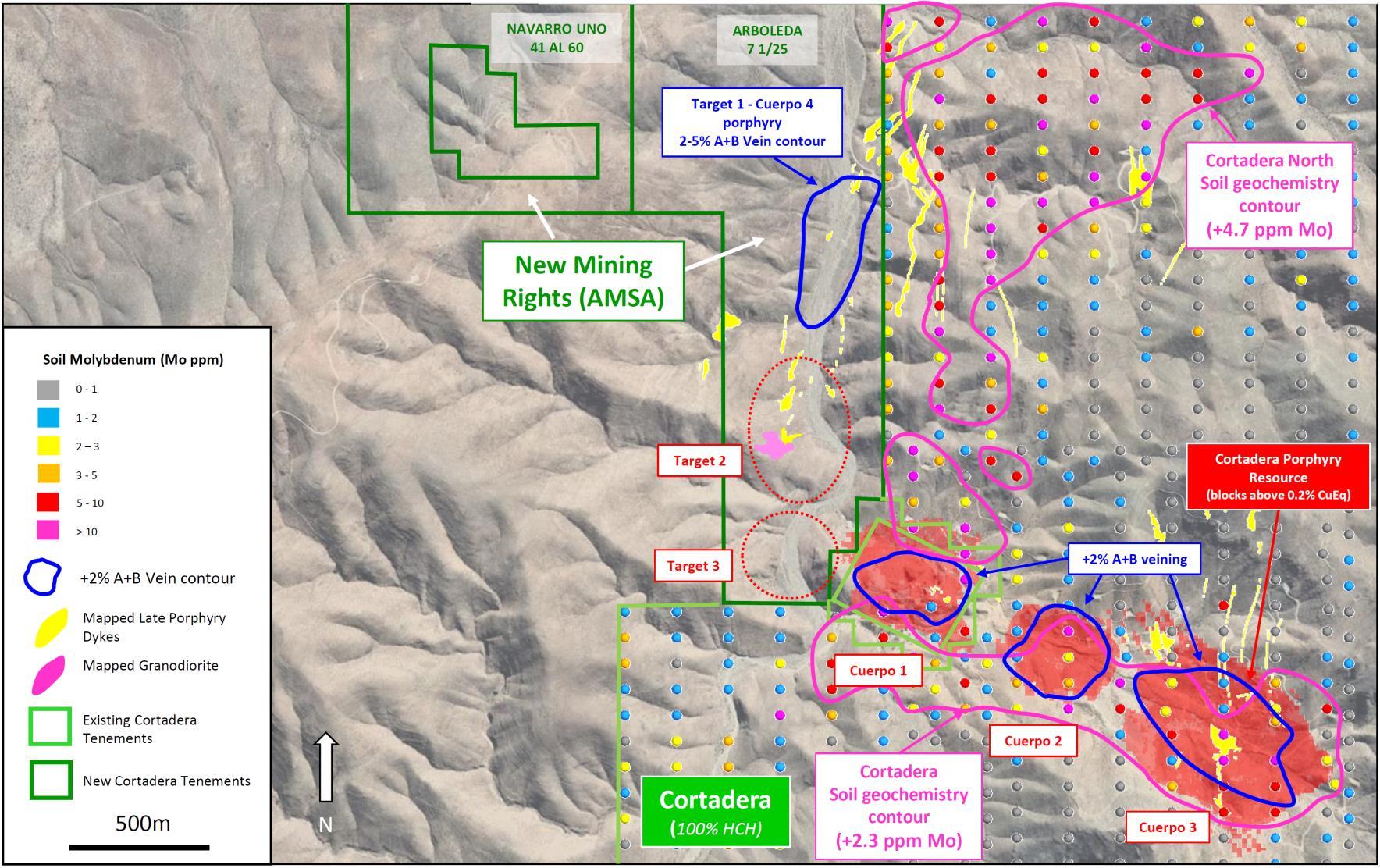

Drilling is also planned across Hot Chili's Cortadera North target, where earlier exploration drilling targeting a large surface molybdenum anomaly in 2020 intersected wide zones of silver mineralisation. This work vectored towards a sizeable copper-gold porphyry target (Cuerpo 4) on AMSA's adjacent mining right.

Hot Chili then ceased all exploration activities at Cortadera North until an agreement could be entered into with AMSA to enable Hot Chili to acquire the adjacent landholding.

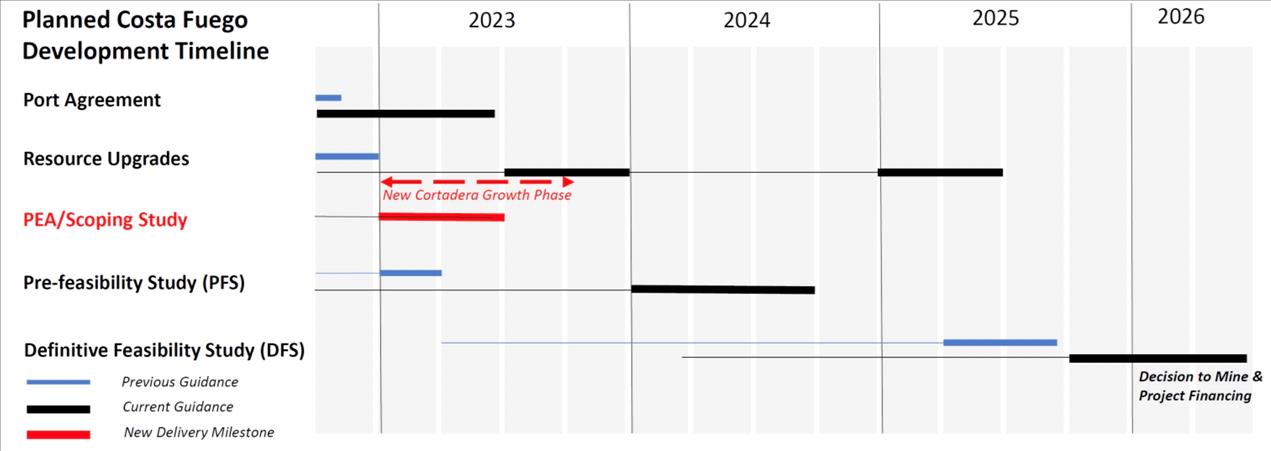

Revision to Costa Fuego Growth and Development Timetable

The transaction provides the next step in Hot Chili's long term growth strategy. The AMSA mining rights provide relatively low cost and highly accretive resource growth potential due to their proximity to the Company's Cortadera open pit resource base.

Hot Chili's next resource update, which was proposed to be delivered in late 2022, is now expected to be finalised in H2 2023 to include the proposed drilling on the AMSA mining rights.

The combined Pre-feasibility Study (PFS) for Costa Fuego, studying targeted annual production rates of up to 100kt Cu and up to 70koz Au for a +20 year life of mine, will be paused until the Company can assess the impact of resource growth potential at Cortadera. The Company's decision to pivot the PFS ensures that future expenditure relating to the PFS can be optimised for infrastructure location and a potentially larger scale copper operation.

Only critical PFS workstreams will be continued to secure long-lead time items (environmental and social) and key value additions (metallurgical) to ensure Costa Fuego remains on-track to potentially be delivered into production in 2028.

A Preliminary Economic Assessment (PEA) of the combined Costa Fuego project at the current 20Mtpa sulphide concentrator study scale is now planned to be delivered in H1 2023.

-figcaption

Costa Fuego remains one of a few front-runner, large copper development projects in the world that can be advanced to production in a timely manner due to Hot Chili's consolidation, development and permitting efforts over the last decade.

Recent positive developments in Chile's constitutional process and taxation review have reaffirmed Chile's stable and attractive standing as a top global mining investment jurisdiction.

Option Agreement to Acquire 100% Interest in AMSA's Cortadera Mining Rights

Under an Option Agreement (Option) between Frontera SpA (“Frontera” - 100% subsidiary of Hot Chili) and Antofagasta Minerals SA (AMSA), Frontera has the option to acquire a 100% interest in the AMSA mining rights adjoining Cortadera within a two-year period on the following terms:

· Completion of 6,000m of drilling of any type, and

· Upon completion of the 6,000m drill commitment, Payment of a US$1.5 million Option exercise price to acquire the AMSA's mining rights, and

· Following exercise of the Option, AMSA has the right to buy-back a 55% interest in the AMSA mining rights within 120 days of exercise of the Option, by repaying 55% of the Option exercise price and paying five times the exploration expenditure incurred during the option period.

This transaction represents a strategic consolidation of the Cortadera porphyry deposit area and has the potential to deliver relatively low-cost, organic resource growth to the Costa Fuego copper hub.

Hot Chili plans to commence systematic exploration and resource definition drilling across this new landholding addition at Cortadera as soon as possible.

The Directors thank AMSA for their commitment to work with Hot Chili and to enable the continued consolidation of a globally significant, emerging copper hub for the Vallenar region of Chile.

This announcement is authorised by the Board of Directors for release to ASX and TSX.

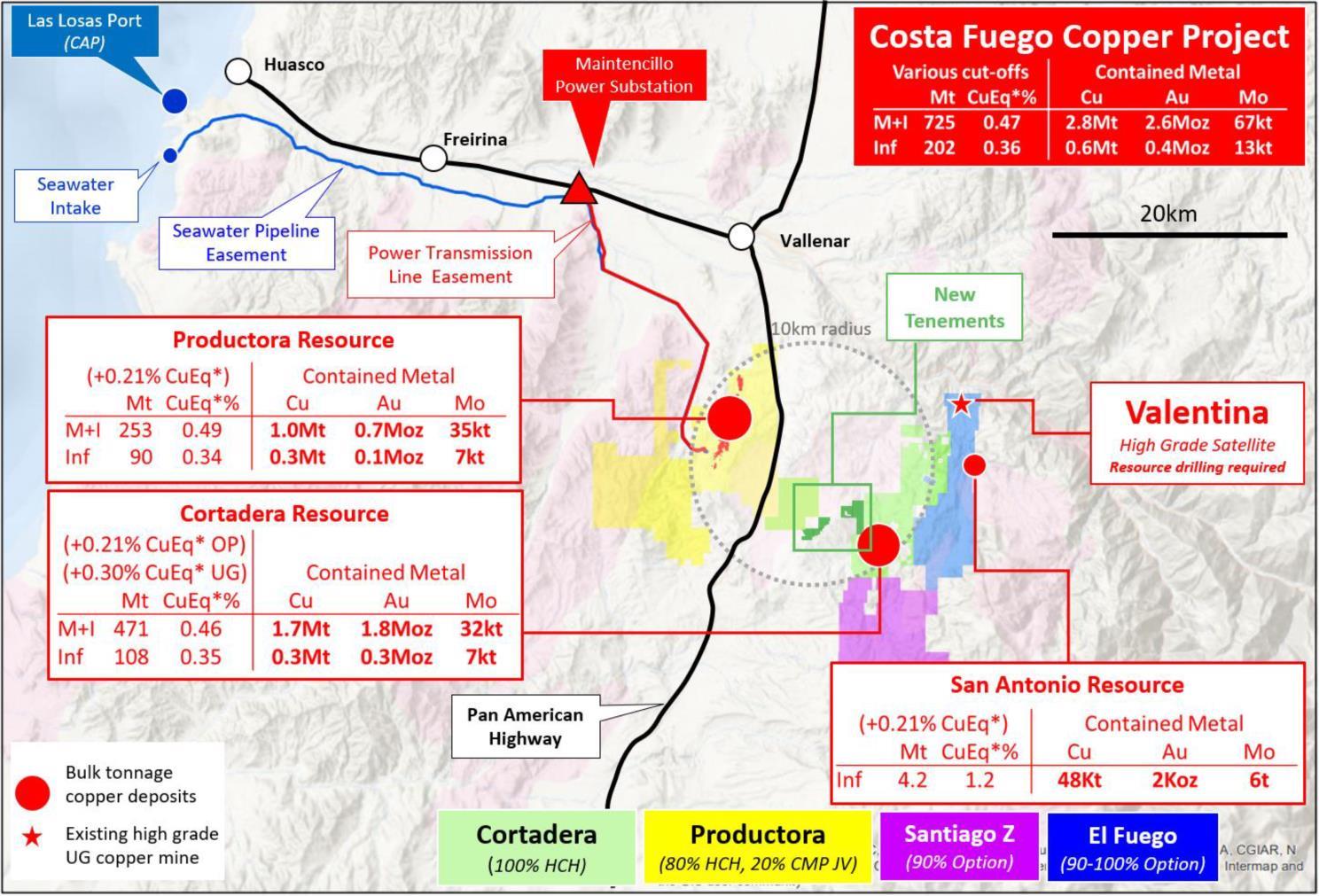

Figure 1. Location of new mining rights(AMSA) relating to Cortadera, Productora, San Antonio, Valentina and nearby coastal range infrastructure of Hot Chili's combined Costa Fuego copper-gold project, located 600km north of Santiago in Chile.

* Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne × Cu_recovery).

The Metal Prices applied in the CuEq calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. Metallurgical recovery averages for each deposit consider Indicated + Inferred material and are weighted to combine sulphide flotation and oxide leaching performance. The recovery and copper equivalent formula for each deposit is:

Cortadera and San Antonio – Weighted recoveries of 82% Cu, 55% Au, 82% Mo and 37% Ag.

CuEq(%) = Cu(%) + 0.56 x Au(g/t) + 0.00046 x Mo(ppm) + 0.0043 x Ag(g/t)

Productora – Weighted recoveries of 84% Cu, 47% Au, 47% Mo and 0% Ag (not reported)

CuEq(%) = Cu(%) + 0.46 x Au(g/t) + 0.00026 x Mo(ppm)

Costa Fuego – Weighted recoveries of 83% Cu, 53% Au, 69% Mo and 23% Ag

CuEq(%) = Cu(%) + 0.52 x Au(g/t) + 0.00039 x Mo(ppm) + 0.0027 x Ag(g/t)

** Reported on a 100% Basis - combining Mineral Resource Estimates for the Cortadera, Productora and San Antonio deposits. Figures are rounded, reported to appropriate significant figures, and reported in accordance with the JORC Code, CIM and NI 43-101. Metal rounded to nearest thousand, or if less, to the nearest hundred.

Total Resource reported at +0.21% CuEq for open pit and +0.30% CuEq for underground.

Table 1. Historical Significant DD Results from Cuerpo 4 (AMSA) at Cortadera

Note: All results represent 2m composites with appropriate analysis undertaken for Cu, Au and Mo by various independent laboratories in Chile. Refer to Table1 of this announcement for further detail on sampling methodology, analytical techniques and QA/QC procedures utilised.

* Copper Equivalent (CuEq) reported for the drillhole intersections were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne × Cu_recovery).

The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. The entirety of the intersection is assumed as fresh. The recovery and copper equivalent formula for each deposit is:

Cortadera – Recoveries of 83% Cu, 56% Au, 83% Mo and 37% Ag. CuEq(%) = Cu(%) + 0.56 x Au(g/t) + 0.00046 x Mo(ppm) + 0.0043 x Ag(g/t)

For Cortadera and Productora, significant intersections are calculated above a nominal cut-off grade of 0.2% Cu. Where appropriate, significant intersections may contain up to 30m down-hole distance of internal dilution (less than 0.2% Cu). Significant intersections are separated where internal dilution is greater than 30m down-hole distance. The selection of 0.2% Cu for significant intersection cut-off grade is aligned with marginal economic cut-off grade for bulk tonnage polymetallic copper deposits of similar grade in Chile and elsewhere in the world. Down-hole significant intersection widths are estimated to be at or around true-widths of mineralisation.

Figure 2. Location of Cuerpo 4 and other immediate porphyry targets within the AMSA landholding, lying immediately west of the Cortadera resource. Note outcrop photos from Cuerpo 4

Figure 3. Location of Cuerpo 4 and other immediate porphyry targets within the AMSA landholding, lying immediately west of the Cortadera resource. Note the location of significant historical diamond drilling intersections recorded in shallow drilling undertaken across Cuerpo 4 in 2005.

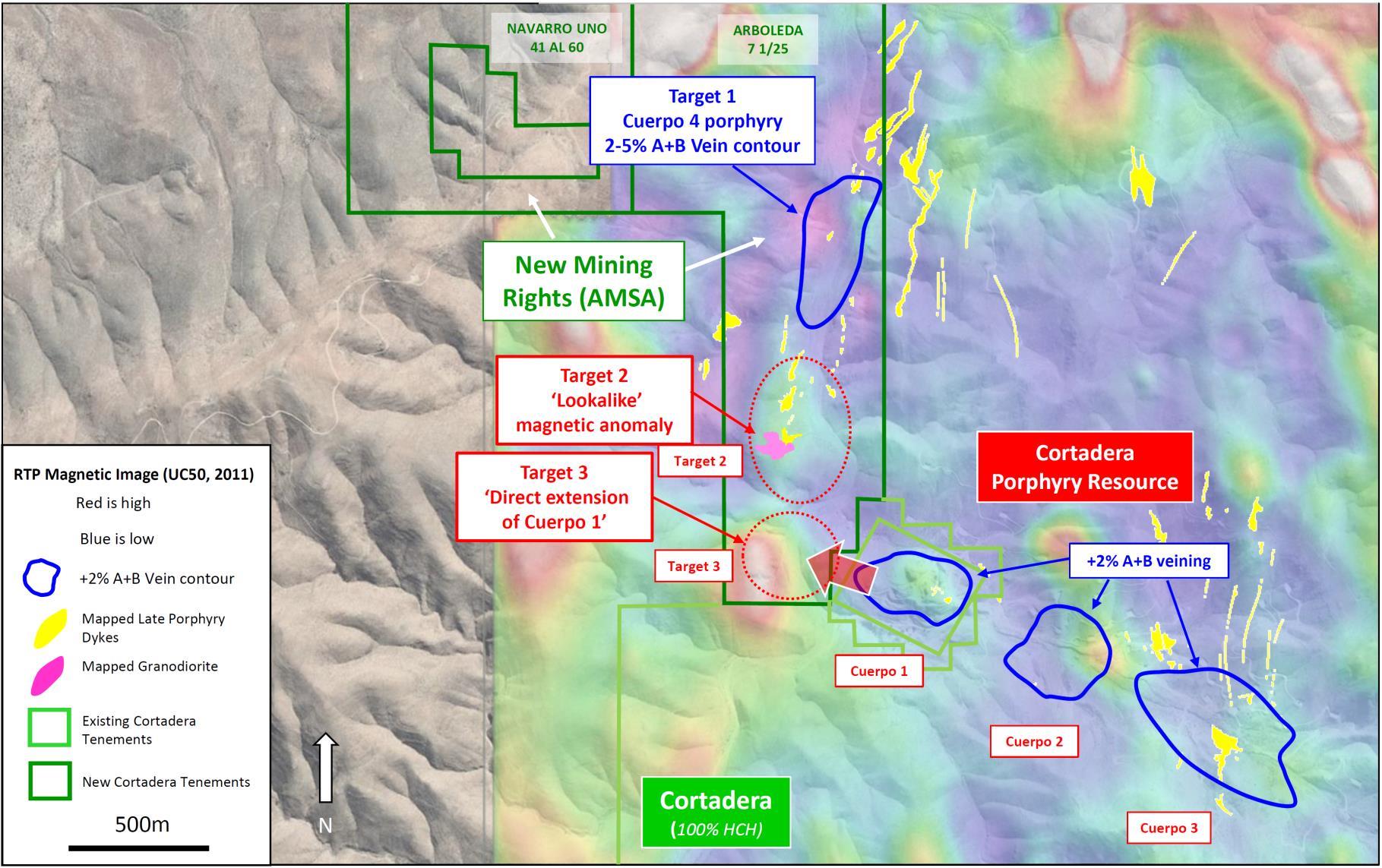

Figure 4. Location of Cuerpo 4 and other immediate porphyry targets within the AMSA landholding, lying immediately west of the Cortadera resource. Note magnetic (RTP magnetics image – blue is low, red is high) signature of the Cortadera deposit window in relation to A+B vein contours and late stage porphyry dykes.

11 Figure 5. Location of Cuerpo 4 and other immediate porphyry targets within the AMSA landholding, lying immediately west of the Cortadera resource. Note surface molybdenum anomalies at Cortadera and Cortadera North in relation to A+B vein contours and late stage porphyry dykes.

-figcaption

< />

Refer to ASX Announcement“Hot Chili Delivers Next Level of Growth” (31st March 2022) for JORC Code Table 1 information related to the Costa Fuego JORC-compliant Mineral Resource Estimate (MRE) by Competent Person Elizabeth Haren, constituting the MREs of Cortadera, Productora and San Antonio (which combine to form Costa Fuego).

* Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne × Cu_recovery).

The Metal Prices applied in the CuEq calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. Metallurgical recovery averages for each deposit consider Indicated + Inferred material and are weighted to combine sulphide flotation and oxide leaching performance. The recovery and copper equivalent formula for each deposit is:

Cortadera and San Antonio – Weighted recoveries of 82% Cu, 55% Au, 82% Mo and 37% Ag.

CuEq(%) = Cu(%) + 0.56 x Au(g/t) + 0.00046 x Mo(ppm) + 0.0043 x Ag(g/t)

Productora – Weighted recoveries of 84% Cu, 47% Au, 47% Mo and 0% Ag (not reported)

CuEq(%) = Cu(%) + 0.46 x Au(g/t) + 0.00026 x Mo(ppm)

Costa Fuego – Weighted recoveries of 83% Cu, 53% Au, 69% Mo and 23% Ag

CuEq(%) = Cu(%) + 0.52 x Au(g/t) + 0.00039 x Mo(ppm) + 0.0027 x Ag(g/t)

** Reported on a 100% Basis - combining Mineral Resource Estimates for the Cortadera, Productora and San Antonio deposits. Figures are rounded, reported to appropriate significant figures, and reported in accordance with the JORC Code, CIM and NI 43-101. Metal rounded to nearest thousand, or if less, to the nearest hundred.

Total Resource reported at +0.21% CuEq for open pit and +0.30% CuEq for underground.

** Note: Silver (Ag) is only present within the Cortadera Mineral Resource estimate

Competent Person's Statement- Exploration Results

Exploration information in this Announcement is based upon work compiled by Mr Christian Easterday, the Managing Director and a full-time employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a 'Competent Person' as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Competent Person's Statement- Costa Fuego Mineral Resources

The information in this report that relates to Mineral Resources for Cortadera, Productora and San Antonio which constitute the combined Costa Fuego Project is based on information compiled by Ms Elizabeth Haren, a Competent Person who is a Member and Chartered Professional of The Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Ms Haren is a full-time employee of Haren Consulting Pty Ltd and an independent consultant to Hot Chili. Ms Haren has sufficient experience, which is relevant to the style of mineralisation and types of deposits under consideration and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code of Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Ms Haren consents to the inclusion in the report of the matters based on her information in the form and context in which it appears. For further information on the Costa Fuego Project, refer to the technical report titled 'Resource Report for the Costa Fuego Technical Report', dated December 13, 2021, which is available for review under Hot Chili's profile at

Reporting of Copper Equivalent

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne × Cu_recovery). The Metal Prices applied in the CuEq calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. Metallurgical recovery averages for each deposit consider Indicated + Inferred material and are weighted to combine sulphide flotation and oxide leaching performance. The recovery and copper equivalent formula for each deposit is:

Cortadera and San Antonio – Weighted recoveries of 82% Cu, 55% Au, 82% Mo and 37% Ag.

CuEq(%) = Cu(%) + 0.56 x Au(g/t) + 0.00046 x Mo(ppm) + 0.0043 x Ag(g/t)

Productora – Weighted recoveries of 84% Cu, 47% Au, 47% Mo and 0% Ag (not reported)

CuEq(%) = Cu(%) + 0.46 x Au(g/t) + 0.00026 x Mo(ppm)

Costa Fuego – Weighted recoveries of 83% Cu, 53% Au, 69% Mo and 23% Ag

CuEq(%) = Cu(%) + 0.52 x Au(g/t) + 0.00039 x Mo(ppm) + 0.0027 x Ag(g/t)

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

About Hot Chili

Hot Chili Limited is a mineral exploration company with assets in Chile. The Company's flagship project, Costa Fuego, is the consolidation into a hub of the Cortadera porphyry copper-gold discovery and the Productora copper-gold deposit, set 14 km apart in an excellent location – low altitude, coastal range of Chile, infrastructure rich, low capital intensity. The Costa Fuego landholdings, contains an Indicated Resource of 725Mt grading 0.47% CuEq (copper equivalent), containing 2.8 Mt Cu, 2.6 Moz Au, 10.4 Moz Ag, and 67 kt Mo and an Inferred Resource of 202 Mt grading 0.36% CuEq containing 0.6Mt Cu, 0.4 Moz Au, 2.0 Moz Ag and 13 kt Mo, at a cut-off grade of +0.21% CuEq for open pit and +0.30% CuEq for underground. The Company is working to advance its Costa Fuego Project through a preliminary feasibility study (followed by a full FS and DTM), and test several high-priority exploration targets.

Certain statements contained in this news release, including information as to the future financial or operating performance of Hot Chili and its projects may include statements that are 'forward‐looking statements' which may include, amongst other things, statements regarding targets, estimates and assumptions in respect of mineral reserves and mineral resources and anticipated grades and recovery rates, production and prices, recovery costs and results, and capital expenditures and are or may be based on assumptions and estimates related to future technical, economic, market, political, social and other conditions.These forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Hot Chili, are inherently subject to significant technical, business, economic, competitive, political and social uncertainties and contingencies and involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from estimated or anticipated events or results reflected in such forward‐looking statements.

Hot Chili disclaims any intent or obligation to update publicly or release any revisions to any forward‐looking statements, whether as a result of new information, future events, circumstances or results or otherwise after the date of this news release or to reflect the occurrence of unanticipated events, other than as may be required by law. The words 'believe', 'expect', 'anticipate', 'indicate', 'contemplate', 'target', 'plan', 'intends', 'continue', 'budget', 'estimate', 'may', 'will', 'schedule' and similar expressions identify forward‐looking statements.

All forward‐looking statements made in this news release are qualified by the foregoing cautionary statements. Investors are cautioned that forward‐looking statements are not a guarantee of future performance and accordingly investors are cautioned not to put undue reliance on forward‐looking statements due to the inherent uncertainty therein.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.