(MENAFN- News Direct)

Perth, Australia | July 19, 2022 07:00 AM Eastern Daylight Time

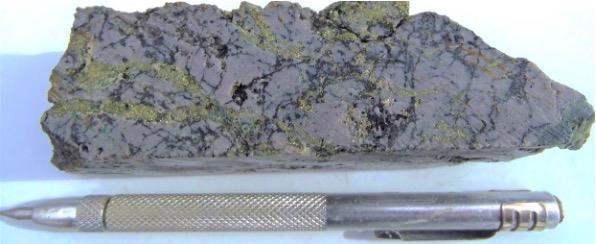

MET0027 (286.4m depth). Tourmaline breccia host rock at Productora. 5.4% Cu, 1.2g/t Au, 3.5g/t Ag, 594ppm Mo

Highlights • Assay results returned from Development Study drillholes for the Costa Fuego senior copper development in Chile confirm further high-grade growth ahead of next resource upgrade

• Standout copper (Cu) and gold (Au) drill results include:

o 484m grading 0.5% CuEq* (0.4% Cu, 0.1g/t Au from 548m depth down-hole (Cortadera)

including 56m grading 1.0% CuEq (0.8% Cu, 0.3g/t Au) from 644m depth,

and including 206m grading 0.7% CuEq (0.5% Cu, 0.2g/t Au) from 800m depth

o 45m grading 1.2% CuEq (1.0% Cu, 0.2g/t Au) from 280m downhole (Productora)

including 8m grading 3.6% CuEq (3.0% Cu, 0.8g/t Au)

o 39m 1 grading 1.1% CuEq (1.0% Cu, 0.1g/t Au) from 36m downhole (Productora)

including 12m grading 1.5% CuEq (1.4% Cu, 0.2g/t Au)

• Thirty-four drill holes complete and twelve drill holes remaining to drill at the high-grade San Antonio and Valentina copper deposits, results pending

• First drilling to commence at the large-scale Santiago Z porphyry target in early August

• Approximately A$22 million in cash, one drill rig in operation and fully funded into late 2023 following cost rationalisation initiatives

* Copper Equivalent (CuEq) reported for the drill holes were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. Average fresh rock metallurgical recoveries used for Cortadera were Cu=83%, Au=56%, Mo=82%, and Ag=37%. Average fresh rock metallurgical recoveries used for Productora/Alice were Cu=89%, Au=58%, Mo=60%, and Ag=0%. 1 including 3m unsampled outside of metallurgical test area

Hot Chili Limited (ASX: HCH) (TSXV: HCH) (OTCQX: HHLKF) (“Hot Chili” or“Company”) is pleased to announce another set of strong results from development study drilling across the Company's Costa Fuego costal range copper-gold project in Chile.

Drilling has returned higher grade results than expected at both the Cortadera and Productora deposits, as well as providing final inputs for metallurgical and geotechnical testwork programmes.

These new results add to a series of recent outstanding drill intersections, which are expected to have a positive impact on the forthcoming resource upgrade and Pre-feasibility Study (PFS) for Costa Fuego.

Development study drilling is complete and the Company has reduced its drilling operations from three drill rigs (5 shifts of drilling per day) to one drill rig (1 shift of drilling per day) along with implementing other cost rationalisation initiatives.

The Company looks forward to its next set of results from drilling undertaken across its high grade satellite deposits (San Antonio and Valentina) as well as first-ever drilling set to commence across the large-scale Santiago Z porphyry target in early August.

With treasury of approximately A$22 million, Hot Chili is fully funded into late 2023. The Company remains well positioned to deliver Costa Fuego as one of the nearest-term, meaningful new copper mines in the world.

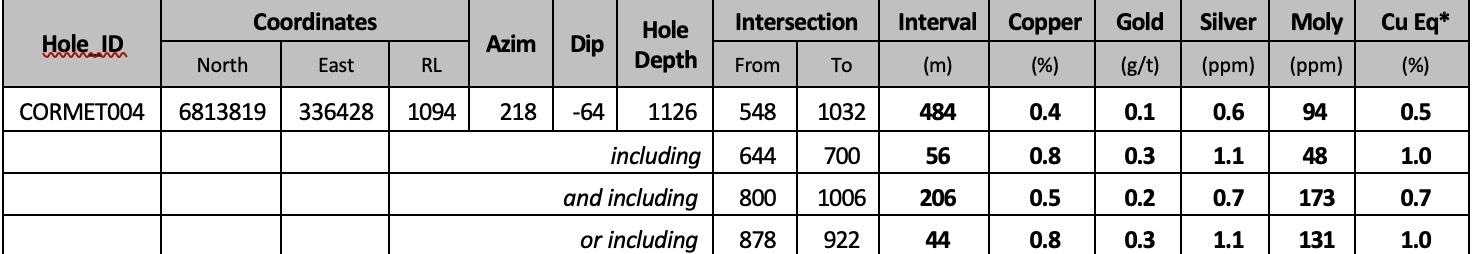

Assays Returned for Final Cortadera Development Study Drillhole

Diamond drillhole CORMET004 returned 484m grading 0.5% CuEq (0.4% Cu, 0.1g/t Au) from 548m depth, including 56m grading 1.0% CuEq (0.8% Cu, 0.3g/t Au) from 644m depth, and including 206m grading 0.7% CuEq (0.5% Cu, 0.2g/t Au) from 800m depth.

The new drill intersection in COREMET004 confirms further down plunge extensions of the high grade core to the main porphyry (Cuerpo 3), with 44m grading 1.0% CuEq (0.8% Cu, 0.3g/t Au) from 878m depth recorded outside of the current high grade (+0.6% Cu) resource domain .

CORMET004 represents the last of six Development Study drillholes completed at Cortadera in Q1 and Q2 2022 as part of a hydrological and geotechnical testwork program.

Assay results for this program have been exceptional (see announcements dated 4th April 2022, 29th April 2022 and 20th May 2022), confirming further growth of the high-grade resources, notably:

• 552m grading 0.6% CuEq from 276m depth, including 248m at 0.8% CuEq (CORMET003)

• 876m grading 0.5% CuEq from 246m depth, including 206m grading 0.9% CuEq (CORMET006)

• 658m grading 0.6% CuEq from 232m depth, including 134m grading 0.8% CuEq and including 130m grading 0.9% CuEq (CORMET005)

Drill results from the Development Study program will be included in the next Mineral Resource upgrade for Costa Fuego, expected in late 2022.

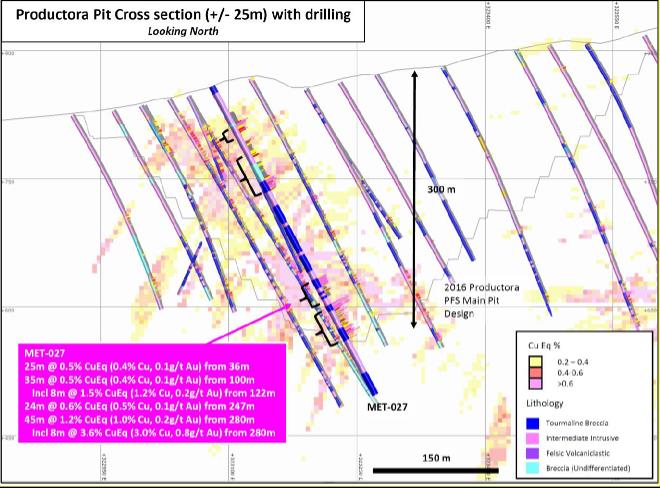

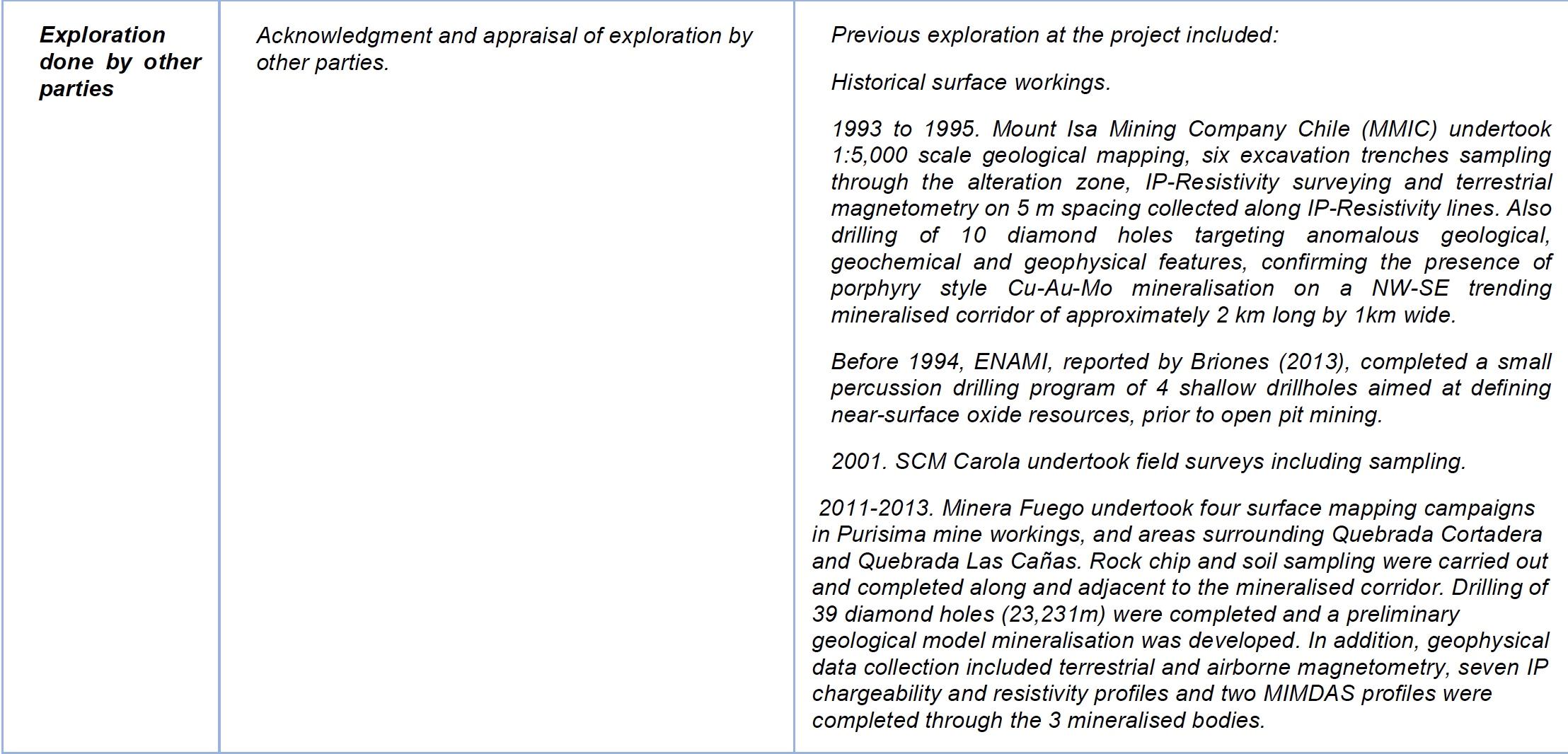

Assay Results for Productora Metallurgical Drilling Programme

Four diamond drillholes have been completed for metallurgical testwork across the Productora resource (three into the Productora central pit area and one into the Alice satellite pit area).

The goal of this testwork is to confirm the processing flowsheet (based on work completed since the 2016 Productora PFS), with a particular focus on material that will be extracted in the first three years of production at Productora.

While only the intervals to be used in the metallurgical testwork program have been assayed, every hole drilled achieved impressive intersections, including:

• 45m grading 1.2% CuEq (1.0% Cu, 0.2g/t Au) from 280m including 8m grading 3.6% CuEq (3.0% Cu, 0.8g/t Au) from 280m (MET027 - Productora)

• 39m 1 grading 1.1% CuEq (1.0% Cu, 0.1g/t Au) from 46m including 12m grading 1.5% CuEq (1.4% Cu, 0.2g/t Au) (1including 3m unsampled outside of metallurgical test area) from 60m (MET028 – Alice porphyry)

• 39m 0.9% CuEq (0.7% Cu, 0.2g/t Au) from 141m (MET026 – Productora)

• 39m 0.8% CuEq (0.7% Cu, 0.2g/t Au) from 78m (MET025 – Productora)

The intersection in MET028 is particularly exciting as it is located near-surface in the higher-grade Alice porphyry satellite pit.

MET028 (65m to 68m depth down-hole) near-surface, high grade, copper oxide drill intersection through Alice felsic porphyry host rock with 5 to 10% A-B vein abundance. High Grade Satellite Resource Drilling Continues

First-pass drilling is complete at the Valentina high-grade satellite copper deposit, with VALMET002 intersecting a shallow zone of copper sulphide and oxide mineralisation (see announcement dated 13th June 2022). Following the success of this program, an additional eleven drillholes were planned to further extend and define mineralisation at Valentina.

A total of 22 drill holes have been completed at Valentina, with a further 8 drill holes remaining to be drilled. Assay results are expected shortly and work is underway to create updated geological and mineralisation models ahead of a maiden Mineral Resource estimate later this year.

In addition to Valentina, 12 resource in-fill drill holes have been completed at the high-grade San Antonio satellite deposit, with assay results pending. A further 4 drill holes remain to be drilled at San Antonio.

San Antonio's maiden Inferred resource, reported in March 2022, extends from surface and already stands at 4.2Mt grading 1.2% CuEq (1.1% Cu, 2.1g/t Ag) for 48kt Cu and 287kt Ag.

Drilling at San Antonio is designed to upgrade the categorisation of the resource from Inferred to Indicated, as well as testing for down-plunge mineralisation extensions.

Both high-grade satellite deposits will be included in the next Mineral Resource upgrade and subsequent PFS open pit mine schedule, expected in Q1 2023.

The Company looks forward to releasing further updates from drilling and development study workstreams shortly.

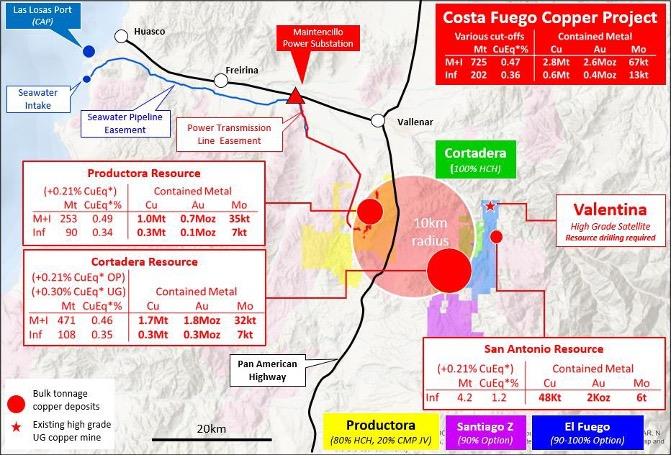

Figure 1. Location of Cortadera, Productora, San Antonio and Valentina in relation to coastal rangeinfrastructure of Hot Chili's combined Costa Fuego copper-gold project, located 600km north of Santiago in Chile

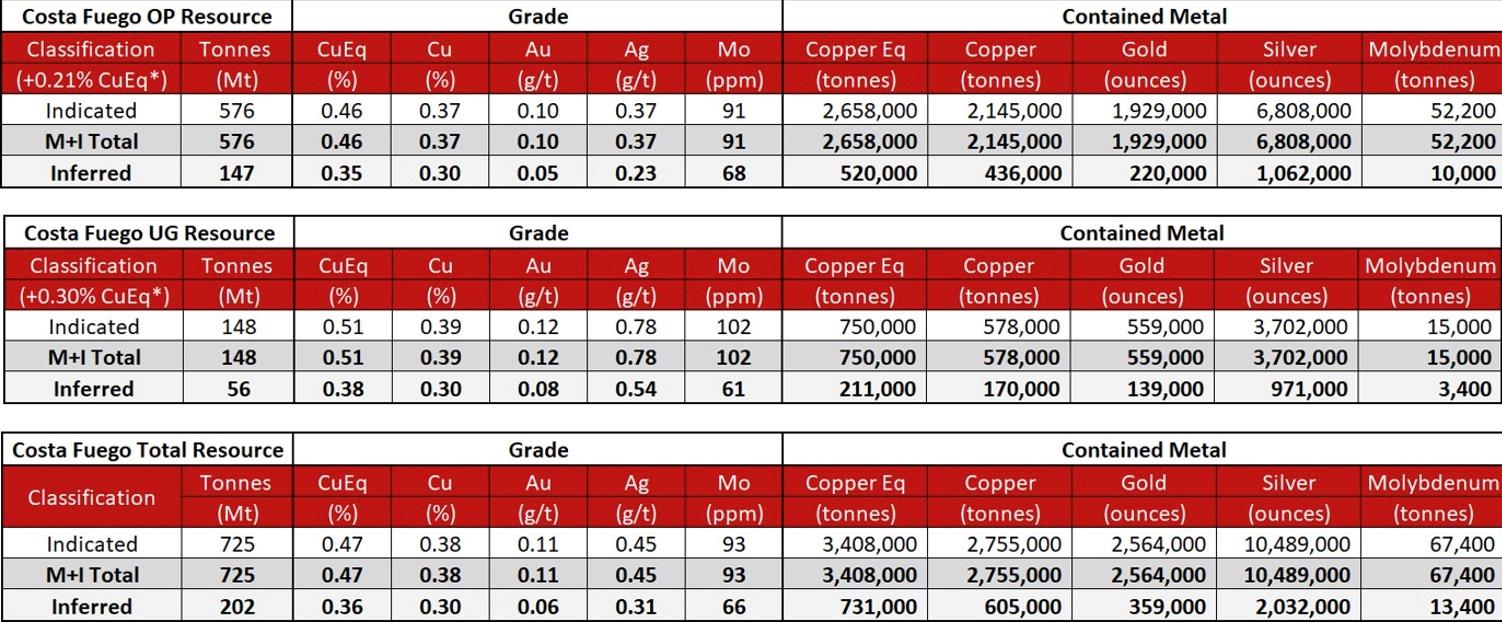

Reported on a 100% Basis - combining Mineral Resource estimates for the Cortadera, Productora and San Antonio deposits. Figures arerounded, reported to appropriate significant figures, and reported in accordance with CIM and NI 43-101. Metal rounded to nearestthousand, or if less, to the nearest hundred. Total Resource reported at +0.21% CuEq for open pit and +0.30% CuEq for underground.Refer to Announcement“Hot Chili Delivers Next Level of Growth” (31st March 2022) for JORC Table 1 information related to the Costa Fuego Mineral Resource estimates.

* Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. For Cortadera, San Antonio and Valentina (Inferred + Indicated), the average metallurgical recoverieswere Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average metallurgical recoveries were Cu=83%, Au=43% and Mo=42%.

Table 1. New Significant DD Results at Cortadera

Significant intercepts are calculated above a nominal cut-off grade of 0.2% Cu. Where appropriate, significant intersections may contain up to 30m down-hole distance of internal dilution (less than 0.2% Cu). Significant intersections are separated where internal dilution is greater than 30m down-hole distance. The selection of 0.2% Cu for significant intersection cut-off grade is aligned with marginal economic cut-off grade for bulk tonnage polymetallic copper deposits of similar grade in Chile and elsewhere in the world.

Down-hole significant intercept widths are estimated to be at or around true-widths of mineralisation

* Copper Equivalent (CuEq) reported for the drill holes at Cortadera were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)

+ (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Pricesapplied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. Average fresh rock metallurgical recoveries were Cu=83%, Au=56%, Mo=82%, and Ag=37%.

Figure 2. Location of development study diamond drill holes at Cortadera

Table 2. New Significant DD Results at Productora

Significant intercepts are calculated above a nominal cut-off grade of 0.2% Cu. Where appropriate, significant intersections may contain up to 30m down-hole distance of internal dilution (less than 0.2% Cu). Significant intersections are separated where internal dilution is greater than 30m down-hole distance. The selection of 0.2% Cu for significant intersection cut-off grade is aligned with marginal economic cut-off grade for bulk tonnage polymetallic copper deposits of similar grade in Chile and elsewhere in the world.

Down-hole significant intercept widths are estimated to be at or around true-widths of mineralisation

* Copper Equivalent (CuEq) reported for the drill holes at Productora were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)

+ (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Pricesapplied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. Average fresh rock metallurgical recoveries used were Cu=89%, Au=58%, Mo=60%, and Ag=0%

1including 3m unsampled outside of metallurgical test area

Figure 3. Location of metallurgical study diamond drill holes at Productora/Alice

Figure 4. Plan view displaying the significant drilling intersection recorded in CORMET004 targeting the north-eastern flank of the high-grade core at Cuerpo 3, Cortadera porphyry discovery.

5 % A- and B-type quartz veins, and adjacent pre- mineralization wall-rock.' height='492' src='https://public.newsdirect.com/854272076/1jPds9Zp.jpg' width='672' />

Figure 5. Cross section (looking north) displaying the new significant drilling intersection recorded in CORMET004 targeting the north-eastern flank of the high-grade core at Cuerpo 3, Cortadera porphyry discovery. Most of the Cu-Au-rich, 484m-long interval is hosted by early- and intra-mineralization tonalite porphyry intrusions, cut by 1 to > 5 % A- and B-type quartz veins, and adjacent pre- mineralization wall-rock.

Figure 6. Cross section (looking north) showing the MET027 significant intersections drilled for metallurgical testwork in the Productora open pit. The highest-grade mineralisation is hosted in the tourmaline breccia unit with lower-grade material in the adjacent felsic volcanic wall-rock.

Figure 7. Cross section (looking north) showing the MET028 significant intersections drilled for metallurgical testwork in the Alice open pit. High grade mineralisation is associated with felsic porphyryhosted limonites (within weathered rock) and intensely sericite altered felsic porphyry (within fresh rock).

Qualifying Statements

-figcaption

Reported on a 100% Basis - combining Mineral Resource estimates for the Cortadera, Productora and San Antonio deposits. Figures are rounded, reported to appropriate significant figures, and reported in accordance with CIM and NI 43-101. Metal rounded to nearest thousand, orif less, to the nearest hundred. Total Resource reported at +0.21% CuEq for open pit and +0.30% CuEq for underground. Refer toAnnouncement“Hot Chili Delivers Next Level of Growth” (31st March 2022) for JORC Table 1 information related to the Costa Fuego Mineral Resource estimates.

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t ×Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb,and Ag=20 USD/oz. For Cortadera and San Antonio (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%.For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Note: Silver (Ag) is only present within the Cortadera Mineral Resource estimate

Competent Person's Statement- Exploration Results Exploration information in this Announcement is based upon work compiled by Mr Christian Easterday, the Managing Director and a full- time employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient experiencethat is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a'Competent Person' as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and OreReserves' (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Competent Person's Statement- Costa Fuego Mineral Resources The information in this report that relates to Mineral Resources for Cortadera, Productora and San Antonio which constitute the combined Costa Fuego Project is based on information compiled by Ms Elizabeth Haren, a Competent Person who is a Member and Chartered Professional ofThe Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Ms Haren is a full-time employee of Haren Consulting Pty Ltd and an independent consultant to Hot Chili. Ms Haren has sufficient experience, which is relevant to the style of mineralisation and types of deposits under consideration and to the activities undertaken, to qualify as a Competent Person as defined in the2012 Edition of the 'Australasian Code of Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Ms Haren consents to theinclusion in the report of the matters based on her information in the form and context in which it appears. For further information on the Costa Fuego Project, refer to the technical report titled 'Resource Report for the Costa Fuego Technical Report', dated December 13, 2021, which is available for review under Hot Chili's profile at

Reporting of Copper Equivalent Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne ×Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. For Cortadera and San Antonio (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%,Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% andMo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

Disclaimer Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

Appendix 1. JORC Code Table 1 for Cortadera Section 1 Sampling Techniques and Data

-figcaption

-figcaption

-figcaption

-figcaption

-figcaption

-figcaption

-figcaption

-figcaption

-figcaption

-figcaption

-figcaption

-figcaption

-figcaption

-figcaption

-figcaption

-figcaption

-figcaption

-figcaption

About Hot Chili

Hot Chili Limited is a mineral exploration company with assets in Chile. The Company's flagship project, Costa Fuego, is the consolidation into a hub of the Cortadera porphyry copper-gold discovery and the Productora copper-gold deposit, set 14 km apart in an excellent location – low altitude, coastal range of Chile, infrastructure rich, low capital intensity. The Costa Fuego landholdings, contains an Indicated Resource of 725Mt grading 0.47% CuEq (copper equivalent), containing 2.8 Mt Cu, 2.6 Moz Au, 10.4 Moz Ag, and 67 kt Mo and an Inferred Resource of 202 Mt grading 0.36% CuEq containing 0.6Mt Cu, 0.4 Moz Au, 2.0 Moz Ag and 13 kt Mo, at a cut-off grade of +0.21% CuEq for open pit and +0.30% CuEq for underground. The Company is working to advance its Costa Fuego Project through a preliminary feasibility study (followed by a full FS and DTM), and test several high-priority exploration targets.

Certain statements contained in this news release, including information as to the future financial or operating performance of Hot Chili and its projects may include statements that are 'forward‐looking statements' which may include, amongst other things, statements regarding targets, estimates and assumptions in respect of mineral reserves and mineral resources and anticipated grades and recovery rates, production and prices, recovery costs and results, and capital expenditures and are or may be based on assumptions and estimates related to future technical, economic, market, political, social and other conditions.These forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Hot Chili, are inherently subject to significant technical, business, economic, competitive, political and social uncertainties and contingencies and involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from estimated or anticipated events or results reflected in such forward‐looking statements.

Hot Chili disclaims any intent or obligation to update publicly or release any revisions to any forward‐looking statements, whether as a result of new information, future events, circumstances or results or otherwise after the date of this news release or to reflect the occurrence of unanticipated events, other than as may be required by law. The words 'believe', 'expect', 'anticipate', 'indicate', 'contemplate', 'target', 'plan', 'intends', 'continue', 'budget', 'estimate', 'may', 'will', 'schedule' and similar expressions identify forward‐looking statements.

All forward‐looking statements made in this news release are qualified by the foregoing cautionary statements. Investors are cautioned that forward‐looking statements are not a guarantee of future performance and accordingly investors are cautioned not to put undue reliance on forward‐looking statements due to the inherent uncertainty therein.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

MENAFN20072022005728012573ID1104558597