Semiconductor Cycle Shows Signs Of Peaking

Demand for semiconductors and the equipment used in their production has been sky high in recent years, an up-and-up trend industry forecasters expect to continue for the foreseeable future. At the same time, signs of a cyclical downturn are becoming more and more apparent across the industry.

Lee Pei-Ing, president of Nanya Technology, Taiwan's largest DRAM memory chip maker, recently told media that semiconductor sales are likely to decline in the second half of 2022 as inflation causes consumers and corporations to reduce spending on smartphones, personal computers (PCs), servers and cloud computing and data center services.

Lee's comments contrast with those of many other industry sources who, even if they have doubts about the sustainability of overall semiconductor market growth, have generally been confident that 5G and data center-related demand would continue to expand.

Japan's Ibiden, for example, expects sales growth to drop to zero in the six months to September as demand for remote work, online education and operating system upgrades declines. Ibiden is one of the world's top suppliers of integrated circuit (IC) package substrates

Meanwhile, South Korea's Samsung Electronics has reportedly cut orders for components used in consumer electronics, including smartphones, by as much as 70% in order to reduce excess inventories.

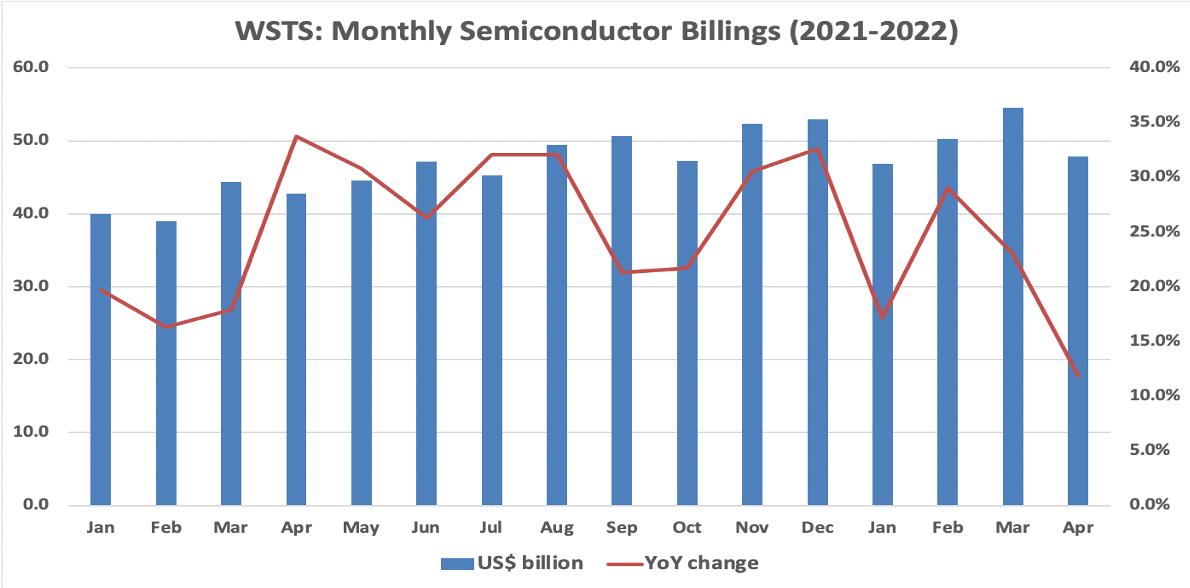

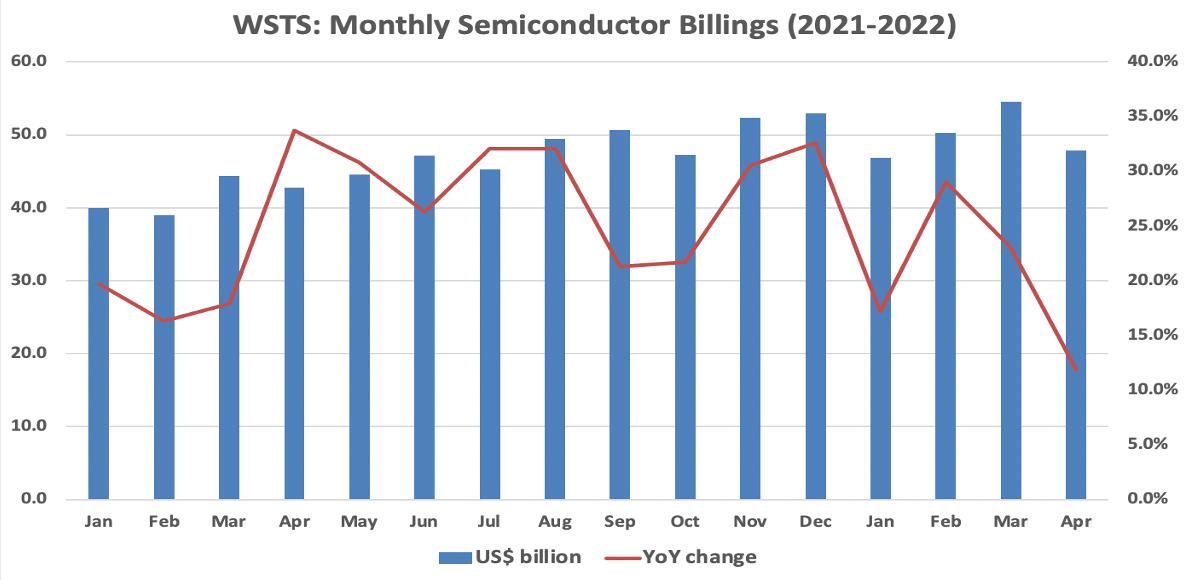

This anecdotal evidence calls into question the latest WSTS Semiconductor Market Forecast, which has total worldwide sales of semiconductors rising by 16% this year (down from 26% in 2021), before dropping to 5% in 2023. But the slowdown may come sooner than that forecast.

WSTS (World Semiconductor Trade Statistics) was founded in 1986 as a non-profit association of semiconductor product companies. In addition to making forecasts, it provides monthly semiconductor industry sales data.

That data shows year-on-year semiconductor sales growth dropping to 12% in April from more than 30% in November and December of last year and 29% in February.

WSTS annual data shows semiconductor sales increased by 35% from 2019 to 2021 and will have risen by 57% if its forecast for 2022 is correct. Compared to 2015, the 2022 forecast implies a 93% increase.

This remarkable growth has failed to prevent the semiconductor shortage that is blamed for supply chain problems in the automobile and other industries, as well as in various consumer markets.

For example, a university professor in Canada complained to Asia Times in an email:

I ordered a MacBook Pro and a Panasonic Lumix camera for my video project in February. I was supposed to get the camera in mid-April, but it's not here yet. The MacBook was supposed to come in around 10 May, but it turned out to be 10 June.

Obviously, there is a supply chain problem here. But whether the culprit is semiconductors or something else is not altogether clear.

Getting back to the WSTS data, note what can happen in a down year. In 2009, the so-called“Lehman Shock” caused a 9% decline in the value of semiconductor billings. In 2019, weak memory prices caused by oversupply led to a 12% decline.

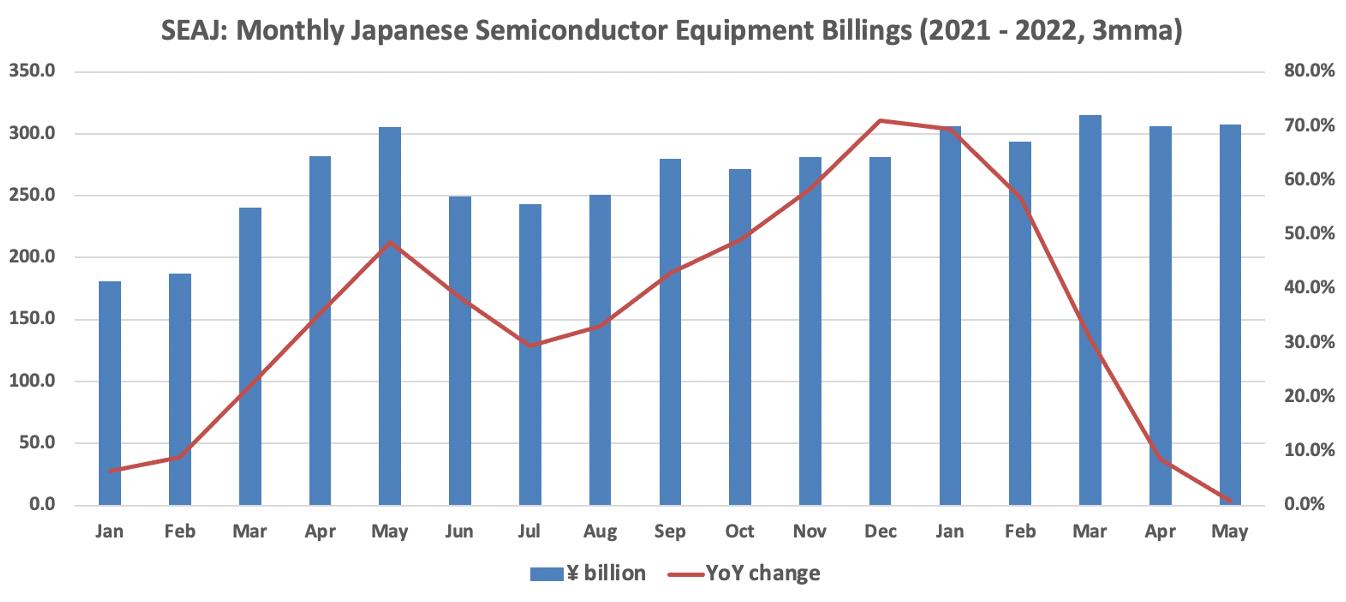

Which brings us to capacity expansion and demand for semiconductor production equipment.

Monthly data from the SEAJ (Semiconductor Equipment Association of Japan) shows year-on-year sales growth dropping from 71% in December 2021 to 1% in May 2022. Annual data for 2021 shows sales up 37% from 2020, up 57% from 2019 and up 2.2 times from 2015 to an all-time high.

As for the downturns, sales of Japanese semiconductor equipment dropped by 73% in 2008 -2009, by 25% in 2011 – 2012 (due to natural disasters), and by 12% in 2019.

Semiconductor capital spending – and, therefore, demand for semiconductor production equipment – is extremely sensitive to market conditions.

When they deteriorate, companies cut spending to avoid over-expansion, unprofitable capacity utilization rates and falling prices. It has happened before and it can happen again. In extreme cases, new factories can sit empty for years.

SEMI, the global semiconductor equipment and materials industry association headquartered in California, is now forecasting a 20% increase in wafer fab equipment (“front-end” production equipment, as opposed to“back-end” assembly and test equipment) spending in 2022.

We will see how long this forecast holds.

Follow this writer on Twitter @ScottFo83517667

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment