Omicron fear and inflation angst panic US markets

NEW YORK – The Fed, the US Senate and the Omicron strain of Covid-19 were too much for the S&P 500 Index, which fell by nearly 4% on Monday at mid-session from last Thursday's intraday peak.

The Fed is tapering purchases of Treasuries after a US$5 trillion post-Covid binge, the Senate balked at Biden's $1.75 trillion fiscal stimulus and Omicron threatens yet another wave of lockdowns.

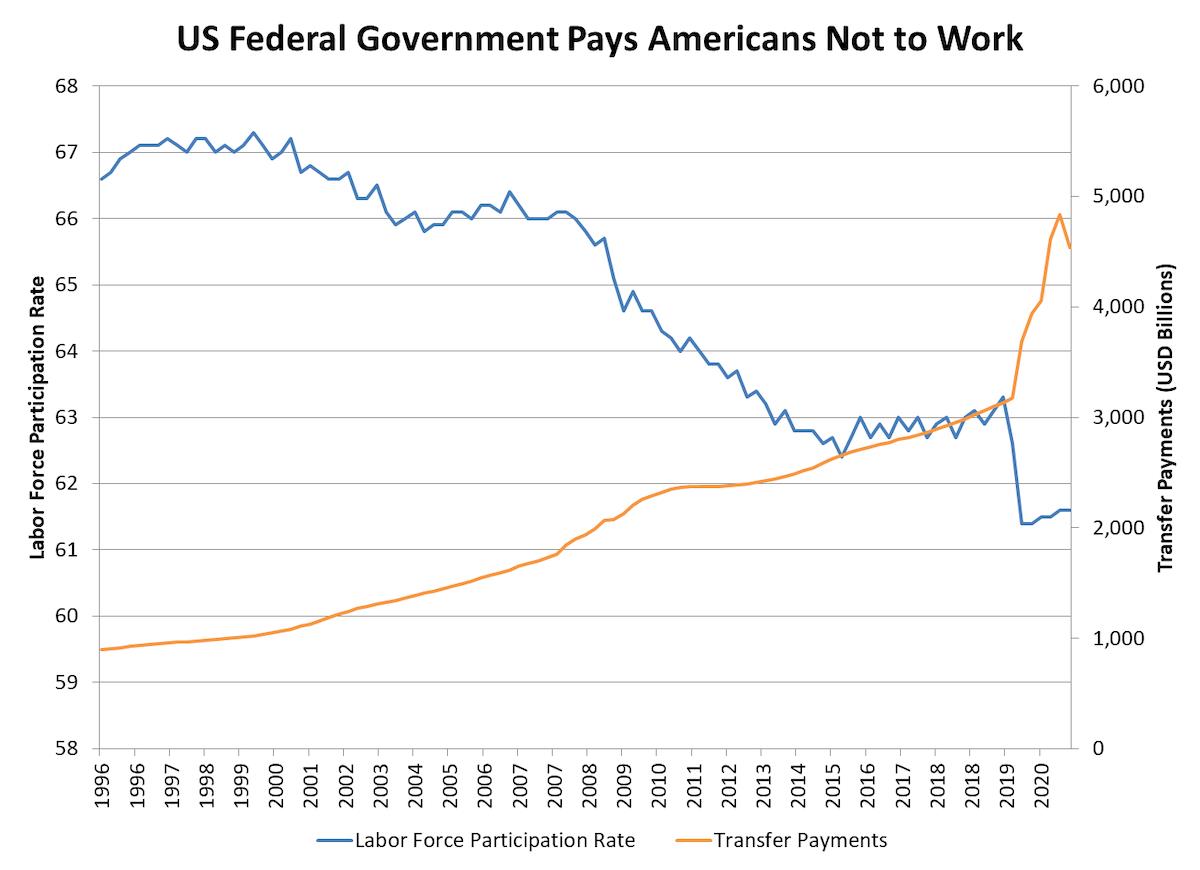

These three ill omens are facets of the same problem – the government pays people more money to sit at home than they ever earned at work, and the central bank prints money to finance it.

Prices soar and corporations jack up their margins but people keep spending because they fear that money will be worthless in the future. It has to stop some time, either because the politicians balk at more handouts, or the central bank fears the consequences of more money-printing, or because people stop spending, or all of the above at once.

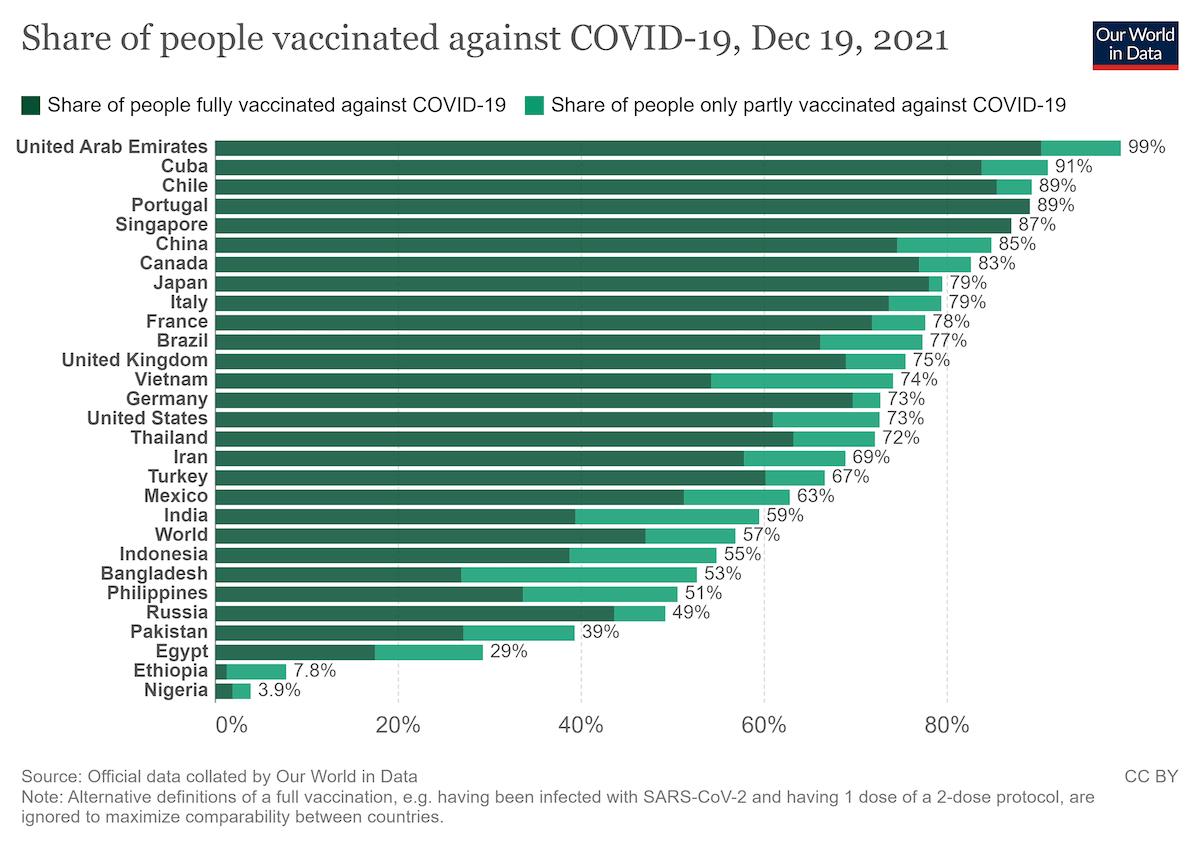

Exacerbating the spending effect is the strangest form of social protest to afflict modern societies, namely refusing vaccination. The United States politicizes just about everything, but politicizing public health is new.

Although the Trump administration claimed credit for the rapid development of the Covid-19 vaccine under Operation Warp Speed, vaccination became a Democratic thing after Trump left office. According to a September 29 Gallup poll,“92% of Democrats, 68% of Independents and 56% of Republicans” have been vaccinated.

As a result, the United States has the lowest Covid-19 vaccination rate of any of the industrial countries, and, presumably, the highest susceptibility to the Omicron strain. In some parts of the United States, a sense of panic is evident.

On Monday, New York State had more than 21,000 new cases, surpassing the January 2021 daily peak. Public testing facilities have several-hour queues and many have run out of test kits.

The chart below does not capture the whole of the $6 trillion stimulus, some of which was paid by the states rather than the federal government, but it illustrates the point: as federal transfers soared, the percentage of Americans working or seeking work shrank.

That's the nub of the so-called supply chain crisis: If you pay people not to work, you get less work and less goods and services, while the public attempts to spend its $6 trillion stimulus.

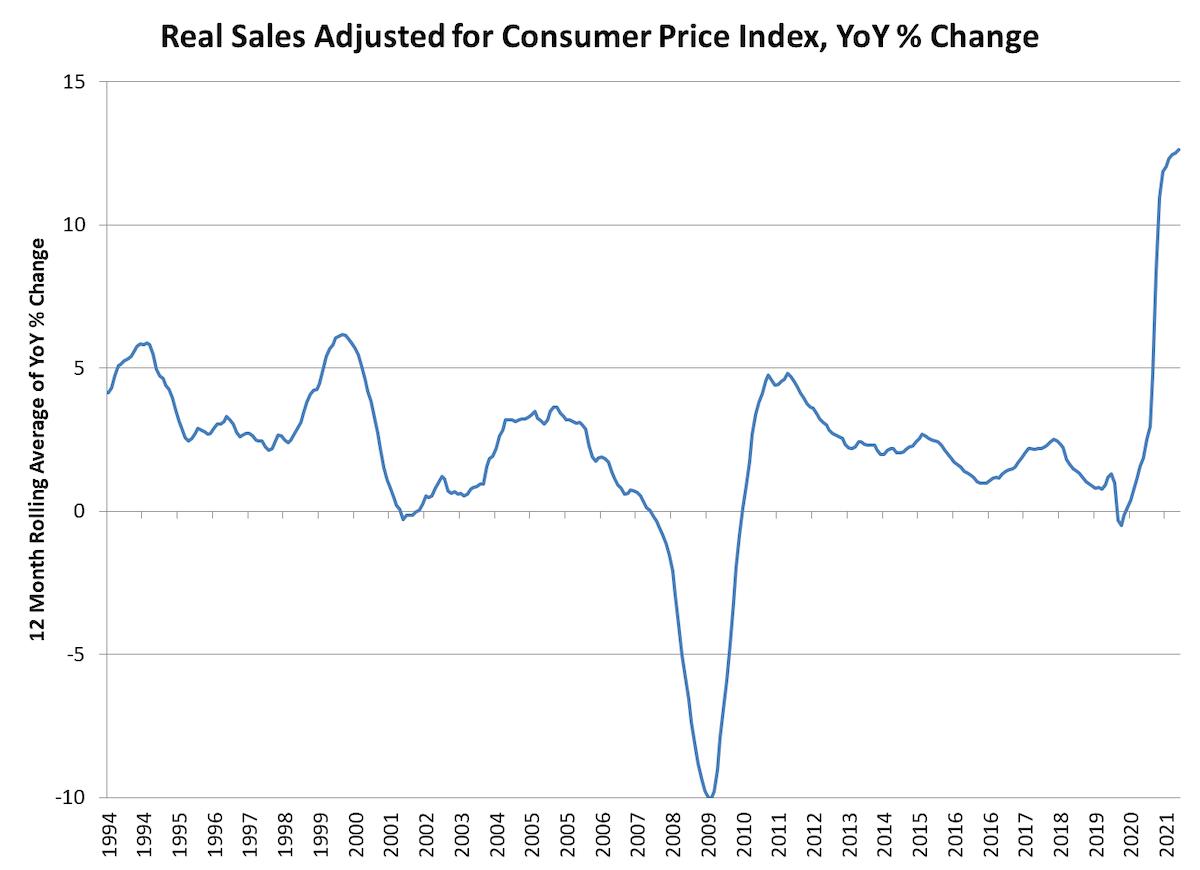

This $6 trillion fueled a retail buying binge without recent precedent.

That produces wild inflationary effects, some direct and some indirect. America's creaky supply chain and diminished labor force couldn't produce enough to meet the surge in demand, so Americans went on an overseas buying binge, especially from China.

US imports from China are 30% higher than in early 2018, when the Trump administration imposed tariffs on many Chinese imports, and 50% higher than at the end of 2019, just before the pandemic struck.

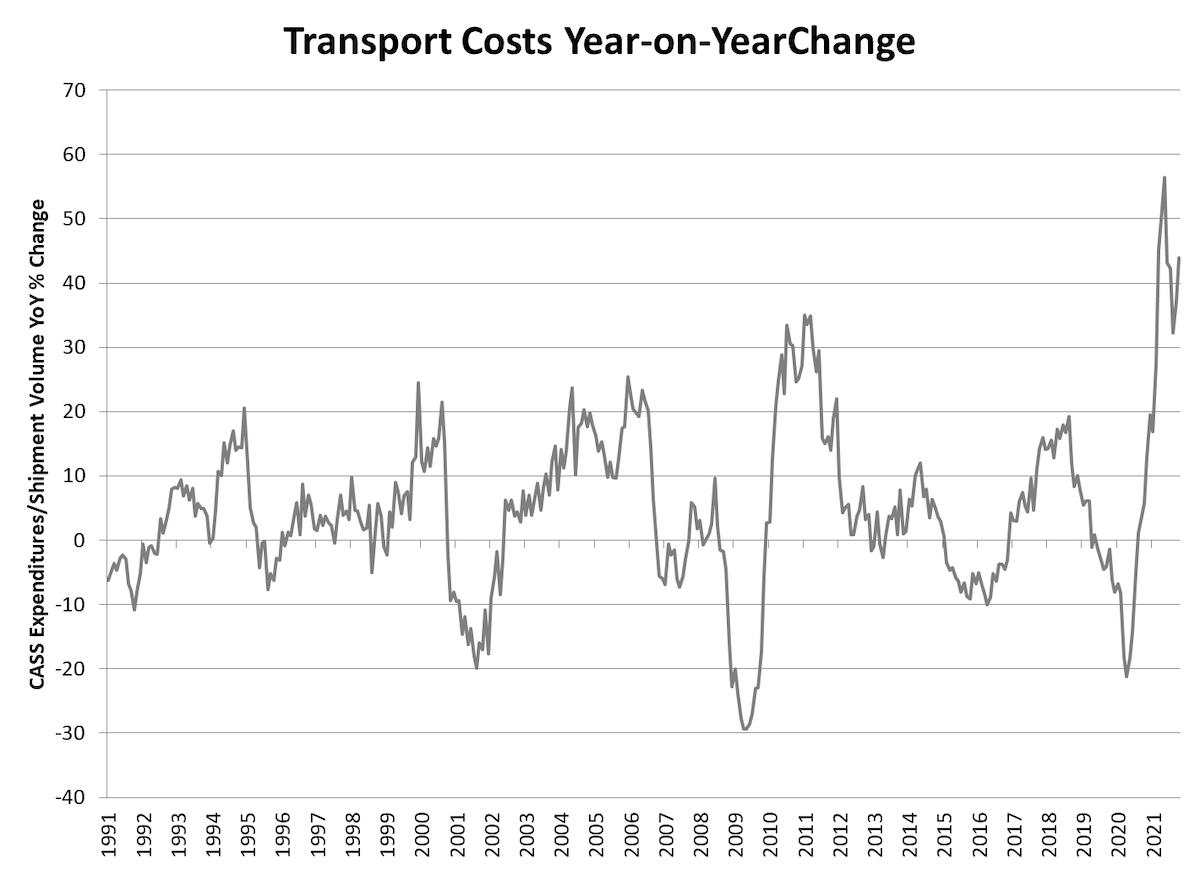

The shipping industry could not find enough containers to bring these goods to America. The cost of moving a container from Hong Kong to Los Angeles rose by 120% over the past year.

Once goods arrived in the United States, there weren't enough trucks to ship them. The American Trucking Association claims that the US is short 80,000 drivers. US transportation costs have risen in the past year by the most on record.

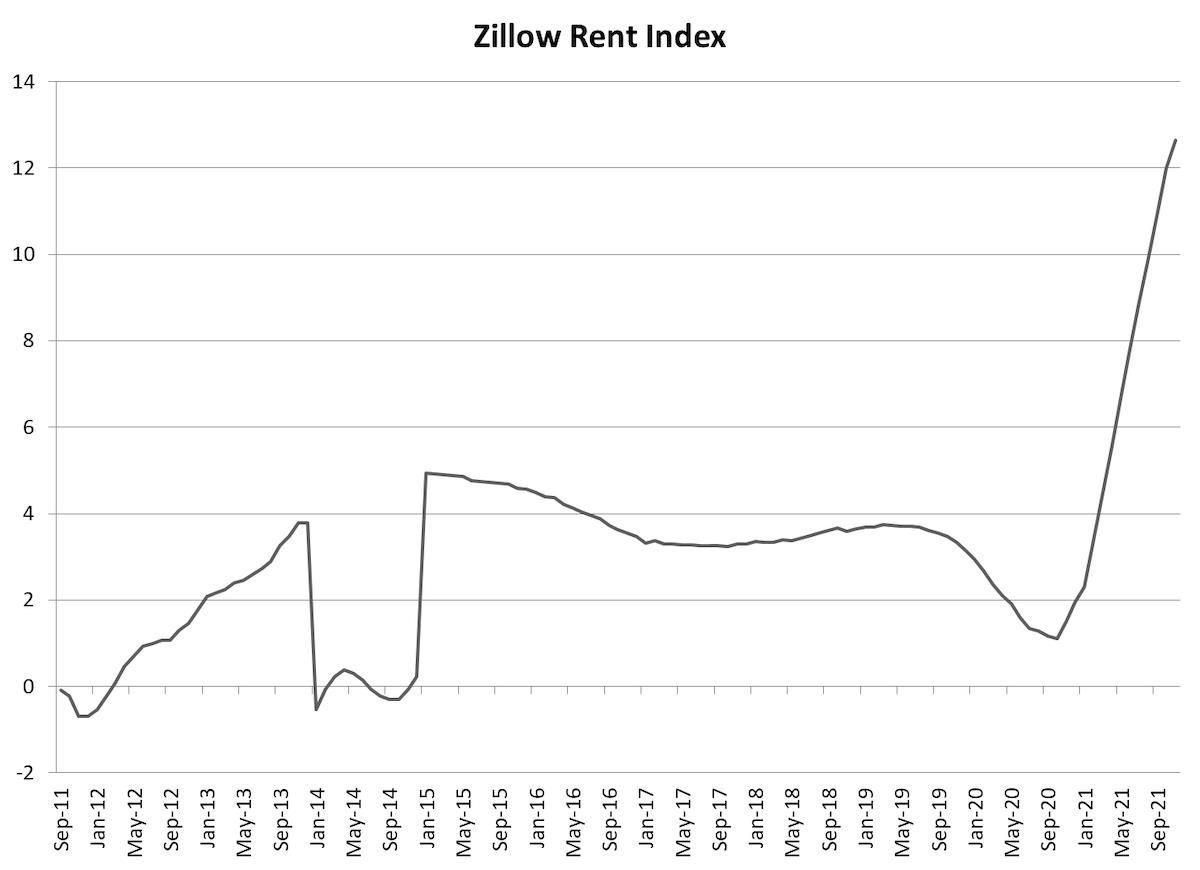

Rents in the US rose by the most on record during the past year.

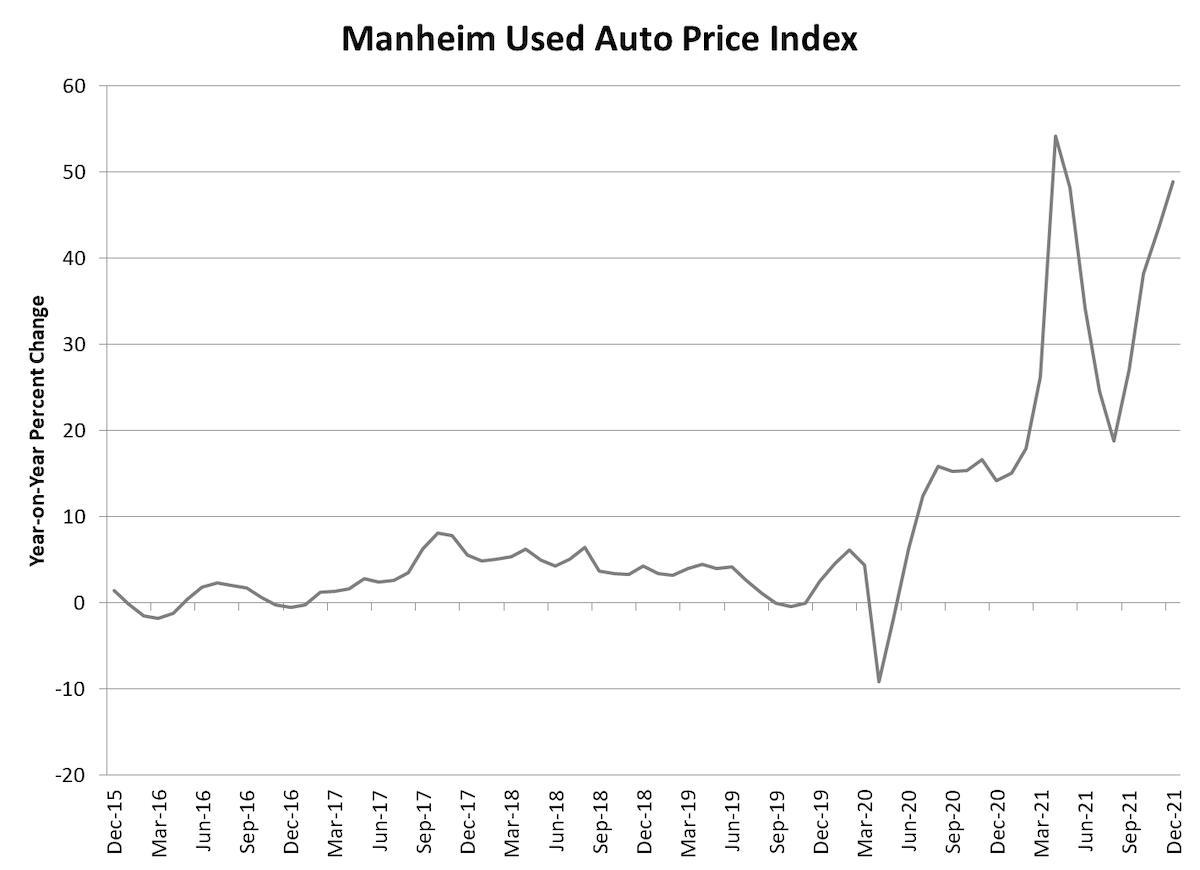

Meanwhile, a cut in auto production due to a semiconductor shortage ran into more demand for cars, as Americans avoided public transport during the pandemic. As of mid-December, the price of used cars was rising at a 50% annual rate.

There is no end in sight to the vicious cycle of restricted production and galloping demand. Either prices will keep rising, wiping out the effect of the stimulus, or the government will cut demand.

The likeliest outcome is some of both, which is stagflation: Prices keep rising, but consumers balk at buying, and businesses balk at producing. That's the toxic mix that brought down the dollar in 1979 and forced the Fed to boost interest rates to 20%.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment