(MENAFN- DailyFX) S & P 500 Price Outlook:

- The S & P 500 -linked SPY ETF has seen net outflows in the year-to-date as traders take profit

- Funds with exposure to 'safer underlying assets have also seen weeks of outflows on average

- What is an ETF? All you Need to Know About Exchange Traded Funds

S & P 500 Forecast: SPY ETF Clocks Outflows Alongside Gold, Treasury Funds

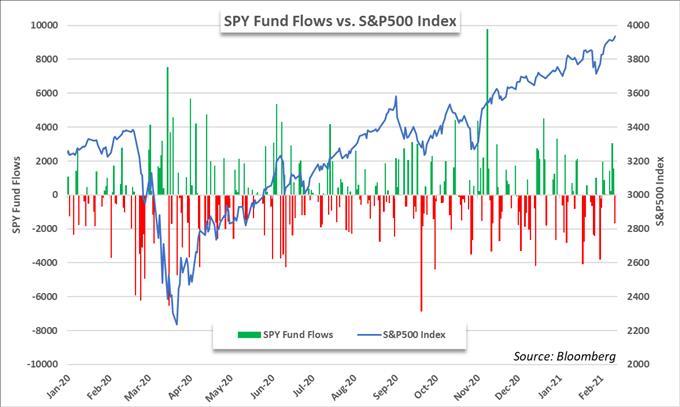

The S & P 500 trades at record levels alongside the Dow Jones and nasdaq 100 as the major indices continue to tick higher. Equity demand outside of the United States is similarly robust as the NIKKEI 225 surpassed 30,000 for the first time in three decades. Not to be outdone, highly speculative assets like Bitcoin have also established new highs. It is rather surprising then, that the S & P 500-tracking SPY ETF has registered net outflows in the year-to-date, while the index itself has climbed roughly 5%.

S & P 500 Price Alongside SPY Fund Flows

Even as price continues to climb, the SPY ETF has seen nearly $9 billion in net outflows since January 1. With few changes in the fundamental landscape and sentiment recovering nicely following the tumultuous resolution to January, it seems there is little to suggest stocks will suddenly reverse lower for the longer-term. Thus, it can be argued the net outflows from SPY might be attributable to mere profit-taking.

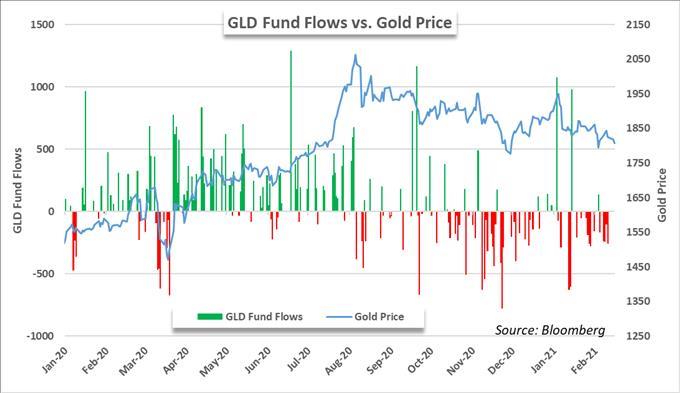

Gold Loses its Luster as Declines Continue and Investors Leave GLD ETF

Further still, exchange traded funds with exposure to safe haven assets like gold and US Treasuries have also suffered net outflows alongside price declines, hinting the withdrawals from SPY do not coincide with an uptick in safe haven demand.

Gold Price Alongside GLD Fund Flows

Barring a few notable inflows, GLD has seen outflows outpace inflows since gold's rally peaked in August, but outflows have become even more frequent in recent months. In the year-to-date, GLD has seen $1.6 billion leave its coffers as a result. As the price of gold appears vulnerable to further losses and the GLD ETF reveals a lack of demand for the yellow metal, price action and fund flow data coincide more closely with what one might expect to see when investors are reducing exposure to an ailing position rather than the current relationship between SPY flows and the S & P 500.

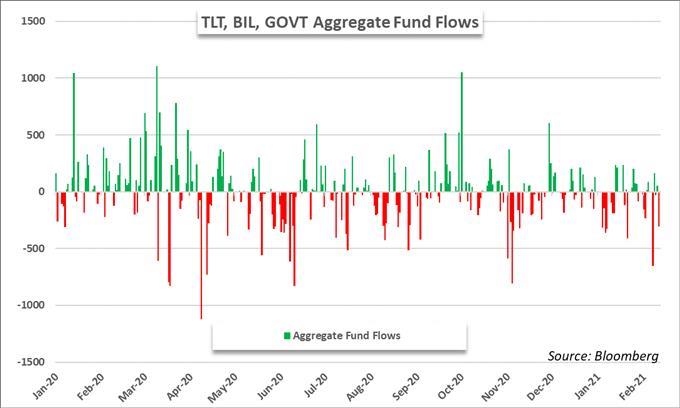

Traders Shy Away from Treasury-Tracking Funds as Yields Rise

Similarly, and perhaps more clearly, investors appear to be rotating out of funds with exposure to US Treasuries, widely considered the ultimate safe haven asset. Widespread outflows in a number of US government bond-tracking ETFs align with the recent uptick in Treasury yields.

US 10-Year Treasury Yield: Daily Time Frame (October 2019 February 2021)

As reflation hopes rage and yields tick higher, thereby sending bond prices lower, net outflows in BIL, TLT and GOV are rather unsurprising. In the year-to-date, the three have seen combined outflows of more than $2.2 billion. Simultaneously, the US10Y yield has climbed to its highest level since late February 2020.

Given the price divergence between gold and US government bonds and the S & P 500, it would seem market participants are positioning with the expectation of further risk appetite. Elsewhere, outflows from SPY might reveal prudent profit-taking among some investors.

Together, the changes in ETF data and price action, in conjunction with a fairly stable fundamental landscape, suggest there is currently little evidence to constitute a sudden reversal in the broader macroeconomic trends that have been unfolding in recent weeks. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

MENAFN16022021000076011015ID1101612583

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.