(MENAFN- Investors Ideas)

Wealth Minerals Prudently, Albeit Slowly, Advancing in Chile <>

<>

<>

100% of the analysts and industry consultants that I trust most believe the MS report should not be relied upon. Without diving into it, I think it's wrong because it included in the analysis massive lithium supply additions from Chile's Atacama salar that look increasingly uncertain in size, and especially uncertain in timing.

The Drama in the Atacama (Chile) Continues

It doesn't take a rocket scientist to recognize that Albemarle and SQM do not have great relationships with the main interested parties in Chile. One needs to be on sides with 1) local communities, 2) mining and governmental agencies, 3) in some cases, CORFO (a state-controlled entity), 4) CCHEN (another state-controlled entity) plus 5) local and national-level politicians.... all the way up to the president. Just this month Albemarle announced that regulator CCHEN denied an application it had submitted in March to increase its production quota. Albemarle and SQM have had, and continue to have, challenges with one or more of these key constituencies!

Even if Albemarle and SQM can improve critical relationships in Chile, there's still a huge challenge few seem to be talking about. Albemarle and SQM are attempting to greatly increase production (for instance SQM from 50,000 tonnes/yr to 180,000 tonnes/yr) without increasing the volumes of lithium enriched brine being pumped. They are working with black-box technologies to increase evaporation pond recoveries (yields). And, they claim to have other tricks up their sleeves to more than triple production. Yet, if the recovery of lithium from ponds in the Atacama salar is currently around 40%-50%, how could production possibly triple without increased pumping? That would mean recovering >100% of the in-situ lithium?!?

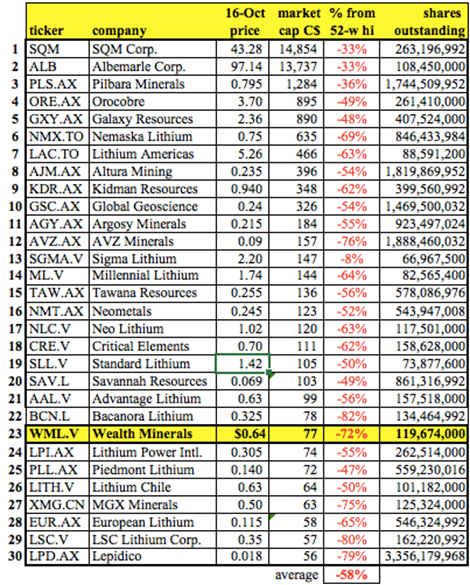

So, if the world is not going to be flooded with a tsunami of new Chilean lithium supply in 2019, or in 2020 for that matter-AND all evidence suggests that EV and ESS demand is trending higher, not flat or down-what does that mean for contract pricing? I believe that prices will hold above US$12,000/tonne for at least the next five years. Once this realization sinks in, beaten down lithium shares could stage a meaningful rebound. If Wealth Minerals were to gain back half of what it has lost (from C$2.34/share), the stock would increase ~130% to ~C$1.50/share.

A long-winded answer to my opening question, is the lithium sector oversold? Yes, I think it is, due to irrational fears about global lithium prices collapsing. While it's true that a select few lithium spot prices in China have fallen quite a bit this year, those prices are not indicative of the overall contracted market. The concern about industry pricing is in the process of being debunked. Where does this leave Wealth Minerals? {please see new, October corporate presentation }

Wealth is not immune to uncertainties regarding the circumstances under which lithium from Chile will be allowed to be produced, and a large portion of it exported. Like Albemarle and SQM, Wealth needs to get along with a number of interested parties. Management has made considerable progress on that front, most notably by agreeing to partner with State-controlled ENAMI(National Mining Company of Chile) to develop their two primary projects. By partnering with ENAMI, Wealth has significantly de-risked its property holdings. But, the market is not focused on the de-risking provided by ENAMI, all eyes are on drilling Wealth's giant, (46,200 hectares) 100%-owned, royalty-free Atacama project.

Readers may recall that management had a setback last month when locals did not allow drilling in the Atacama to start as planned. Management now believes that it will gain access to two sites and begin drilling three shallow and three deep holes within the next 30 days. Turnaround time for the drill results from the shallow holes is expected to be fairly quick, so we could see results in November.

Wealth Hires Chilean Lithium Brine Expert

It's widely known, and is causing increasing anxiety among lithium juniors, that experienced, well-respected lithium brine technical professionals are very hard to find. Wealth Minerals just landed one of the top available technical people in the world. Executives with Cesar Jil's credentials are very highly sought after. Mr. Jil was most recently the manager of lithium extraction technologies at Albemarle.

He's an expert in the latest technologies and methodologies regarding lithium beneficiation from natural brines and worked for Albemarle in multiple areas: the Atacama, Argentina's Antofalla salar and at Nevada's Silver Peak. Prior, Cesar was a process engineer for Sociedad Chilena de Litio, a world leader in processing lithium to lithium carbonate and lithium chloride for the global chemicals industry.

There simply are not that many operating brine fields in Argentina and Chile where technical people have learned enough to become true experts. FMC and Orocobre have active brine facilities in Argentina, and there's Albemarle and SQM in Chile. But, there are only a few other smaller and/or private operations, probably under 10 active operations in the entire Lithium Triangle. Therefore, the number of expert, (non-retired), lithium brine technicians globally could be as few as just 20 or 30. Of that select group, only a small handful are looking for new positions at any given time.

In my opinion, this is a tremendous vote of confidence in Wealth's Atacama project. There are dozens of lithium brine projects around the globe, many in great need of someone with Cesar's excellent credentials. I'm confident that Cesar could have found a senior role at a number of more advanced lithium brine projects in Chile or northern Argentina. Choosing Wealth's Atacama project suggests to me that Cesar is fairly confident in the prospective geology, in the ability to work collaboratively with locals and the ability of Wealth's team, working with ENAMI, to advance its flagship project.

While it's somewhat speculative (pre-drilling) to rely on the salar comparison chart on the right, the size of the prize is enticing. As management points out, if drill results were to show lithium values that are half as robust at that of Albemarle's and SQM's in the southern part of the salar, (1,840 ppm Li) that would still be higher grade than any other project or producing mine (outside of Chile) on the planet.

Although the start of drilling has been delayed, management has not been sitting idle. The company followed up on positive geophysical surveys at the Atacama project by completing a comprehensive re-interpretation of the results and identifying a sizable 100 sq. km area of anomalous data. Wealth's expert technical team, now led by Mr. Jil, believes that this area represents high-salinity brines at depth. Given this enhanced view, management started another geophysical survey, including surrounding ground that Wealth is now in discussions about acquiring.

Additionally, management continues to work on a third-party PEA for its 100% controlled (by option), royalty-free Laguna Verde project.

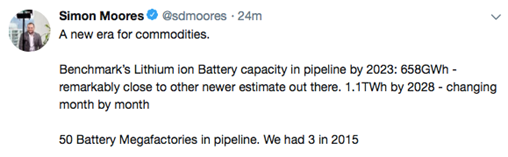

Management is busy on other fronts as well, for the past year they have been evaluating cutting-edge lithium extraction/processing technologies. These third-party technologies are unproven at commercial scale (for lithium). However, there's a growing feeling that the use of evaporation ponds could be a thing of the past, not imminently, but the construction of new ponds could be forbidden sometime next decade. New technologies that eliminate the need for costly, complex, unpredictable, time-consuming evaporation ponds promise far less water consumption, faster cycle times and much higher lithium recoveries.

Conclusion

I believe the lithium sector is oversold and I think Wealth Minerals (TSX-V: WML)/(OTCQX: WMLLF) has substantially more upside from C$0.64/share than it does downside. It might take a rebound in the sector to really get Wealth shares moving higher, but with the start of drilling as soon as this month, and drill results possibly in November, news flow could be impactful.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis, and he is a Chartered Financial Analyst (CFA). He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Wealth Minerals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Wealth Minerals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares and/or stock options in Wealth Minerals and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal <>

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and graphics provided by author.

Gold-MiningStocks.com - investing ideas in gold and mining stocks Like Gold Stocks? View our Gold / Mining Stocks Directory

Get News on Mining Stocks

More Info:

This news is published on the Investorideas.com Newswire - a global digital news source for investors and business leaders

Disclaimer/Disclosure: Investorideas.com is a digital publisher of third party sourced news, articles and equity research as well as creates original content, including video, interviews and articles. Original content created by investorideas is protected by copyright laws other than syndication rights. Our site does not make recommendations for purchases or sale of stocks, services or products. Nothing on our sites should be construed as an offer or solicitation to buy or sell products or securities. All investment involves risk and possible loss of investment. This site is currently compensated for news publication and distribution, social media and marketing, content creation and more. Contact each company directly regarding content and press release questions. Disclosure is posted for each compensated news release, content published /created if required but otherwise the news was not compensated for and was published for the sole interest of our readers and followers. More disclaimer info: https://www.investorideas.com/About/Disclaimer.asp

Additional info regarding BC Residents and global Investors: Effective September 15 2008 - all BC investors should review all OTC and Pink sheet listed companies for adherence in new disclosure filings and filing appropriate documents with Sedar. Read for more info: https://www.bcsc.bc.ca/release.aspx?id=6894 . Global investors must adhere to regulations of each country.

Please read Investorideas.com privacy policy: https://www.investorideas.com/About/Private_Policy.asp

MENAFN2010201801420000ID1097593628