Badlands Enters Into Agreement To Acquire Goliath Property

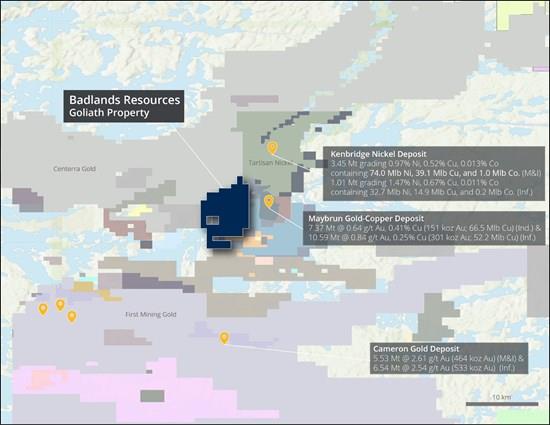

Figure 1. Badlands Resources' Goliath Property, highlighting regional ownership and adjacent deposits.

To view an enhanced version of this graphic, please visit:

About the Goliath Property

The Goliath Property is an early-stage exploration project located in the Atikwa Lake area of the Kenora Mining Division, northwestern Ontario. The project covers 97 contiguous single-cell mining claims totaling approximately 2,050 ha and lies approximately 70 km southeast of Kenora, accessible by road via Highway 71 and Maybrun Road.

Strategically positioned within the prolific Kakagi-Rowan Lakes greenstone belt on the western margin of the Wabigoon Subprovince, Goliath is prospective for multiple mineralization styles including copper-gold in pillowed mafic volcanic flows and nickel-copper sulfides in mafic to ultramafic intrusions.

The Goliath Property is situated in a prospective district, adjacent to the past-producing Maybrun copper-gold mine and near the Kenbridge nickel and Cameron gold deposits, all of which host NI 43-101 compliant resources:

- Maybrun (Cu-Au):

- Ind.: 7.37 Mt @ 0.64 g/t Au, 0.41% Cu (151 koz Au; 66.5 Mlb Cu) Inf.: 10.59 Mt @ 0.84 g/t Au, 0.25% Cu (301 koz Au; 52.2 Mlb Cu)1

- M&I: 3.45 Mt @ 0.97% Ni, 0.52% Cu, 0.013% Co (74.0 Mlb Ni; 39.1 Mlb Cu; 1.0 Mlb Co) Inf.: 1.01 Mt @ 1.47% Ni, 0.67% Cu, 0.011% Co (32.7 Mlb Ni; 14.9 Mlb Cu; 0.2 Mlb Co)2

- M&I: 5.53 Mt @ 2.61 g/t Au (464 koz Au) Inf.: 6.54 Mt @ 2.54 g/t Au (533 koz Au)3

The resources referenced at nearby deposits are drawn from publicly available technical reports. The presence of mineral resources on adjacent or nearby properties is not necessarily indicative of mineralization on the Goliath Property.

In connection with the Purchase Agreement, the Company will assume Laxmi's obligation to pay a 2% net smelter return royalty (the " Royalty ") to Blackwidow Geological Services Inc. (" Blackwidow "), with the Company retaining the right to buy back one-half of the Royalty (1%) for an aggregate payment to Blackwidow of $1,000,000.

The Transaction is subject to customary closing conditions, including acceptance by the TSX Venture Exchange (the " TSXV "). The Transaction is not an "arm's-length transaction" and therefore constitutes a "reviewable transaction" pursuant to TSXV Policy 5.3 as Nav Dhaliwal, Executive Chairman and a director of the Company, is an insider of Laxmi. No finders' fees will be paid in connection with the Transaction.

The technical content of this news release has been reviewed and approved by Devin Pickell, P.Geo., consultant to the Company and a Qualified Person pursuant to National Instrument 43-101.

Termination of Rett Option

The Company also announces that it has terminated its option to acquire mineral claims located in Thunder Bay, Ontario, known as the Rett Property. No fees were paid in connection with the termination.

On Behalf of the Board of Directors

BADLANDS RESOURCES INC.

R. Dale Ginn, President and CEO

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Kintsu Launches Shype On Hyperliquid

- Barunson, Studio Behind Parasite, To Launch Nplug IP Remixing Platform On Story And Bring Flagship IP Onchain

- Moonbirds And Azuki IP Coming To Verse8 As AI-Native Game Platform Integrates With Story

- Leverage Shares Launches First 3X Single-Stock Etps On HOOD, HIMS, UNH And Others

- Alchemy Markets Launches Tradingview Integration For Direct Chart-Based Trading

- Dexari Unveils $1M Cash Prize Trading Competition

Comments

No comment