(MENAFN- ING)

Indexing pensions to inflation could increase demand for fixed receivers

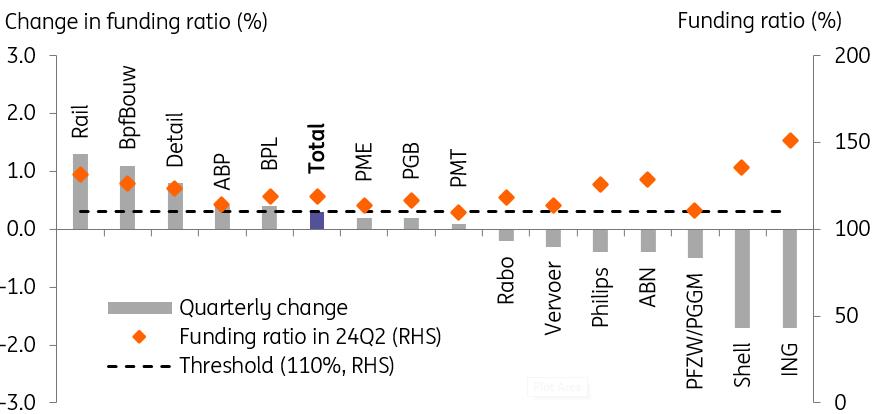

The overall funding ratio of the Dutch pension sector rose in the second quarter of this year, indicating better solvency and health, and enabling funds to adjust pension payments to keep up with inflation (indexation). If a fund has a funding ratio higher than 110% (or 105% in some cases), the regulator allows a maximum increase of pensions commensurate with CPI inflation, which was determined to be 3.6% for this round.

Most funds are well above the 110% threshold, but some of the larger funds in particular have very little or no room for indexation. At 109%, PMT and PFZW even fall below the indexation threshold. Falling rates can further pressure the funding ratios since this increases the present value of future liabilities. This is the reason that the largest fund, ABP with €530bn assets, already signalled this year's indexation could be a challenge.

Largest funds have little or no headroom for indexation

Source: ING, DNB

For funds with adequate funding ratios, the indexation would add to the future liabilities of a pension fund. For a fund to maintain a constant interest rate risk coverage ratio, the rise in liabilities would have to be matched by increased hedges. For example, in response to the high inflation in 2022, ABP increased pension payouts by almost 12%, yet the interest coverage ratio remained constant that quarter at 44%. A fund could decide to let the interest coverage ratio fall because of the indexation, but portfolio managers are usually tied to a mandated range in which they would want to steer their interest rate risk.

In effect, more demand for fixed receiver swaps can be expected from those funds with large indexations. But given the headroom for the major funds is relatively small this year and funds are risk averse going into the reforms, we do not expect much increase from indexations. Pension funds may maintain higher funding ratios now and redistribute the headroom during the transition to the new system. Having said that, there could be pressure for indexation so that current pensioners already receive a higher income for 2025.

Stylised example of increased interest rate hedges due to indexation Source: ING, DNB

Hedging in preparation of reforms likely more impactful

Whilst we think the indexations could trigger some demand for fixed receiver swaps, the flows stemming from the upcoming reforms could still be of more significance. Most of the Dutch pension funds intend to transition from a defined benefits system to a defined contributions system by early 2026 or early 2027. After the actual transition, pension funds will see less need for long-term hedges . But until then, we foresee funds shunning risk to guarantee a smooth transition.

If the coverage ratio of a pension fund falls below a certain threshold, the distribution of assets will become a more contentious process whereby certain groups of participants may end up worse off than under the current system. For this reason, funds will try to steer their exposures in such a way as to mitigate the risks of the coverage ratio falling below 105%. In theory, swaptions and equity options would be effective steering tools, but due to their costs and complexity, most pension funds are likely to stick to dynamic hedging strategies using interest rate swaps.

The latest supervisory data from 2Q24 shows that funds continue to increase their interest rate hedges to protect their funding ratios. PMT even increased its interest coverage ratio by 12ppt, which is the largest increase of any of the major pension funds over the past few years. The earlier rise in coverage ratios can be attributed to rising rates, but this does not explain the recent jump given rates traded relatively sideways during 2Q.

Interest coverage ratios all ticked up again in 2Q24 Source: ING, DNB

Compared to recent history the interest rate coverage ratios for the top five funds look high, but when including the broader universe of funds we see more upward potential. The median interest coverage ratio is 72%, which is more than 10ppt above the current ratio of PME, ABP and PFZW.

The largest funds also have relatively low funding ratios, which puts them more at risk for the transition to the new system. Funds have a strong incentive to lock in a funding ratio of above 105% for a smooth transition and thus funds like PFZW may want to look at further hedging interest exposures. The big jump in interest rate hedges for PMT may already be related to this practice as PMT has one of the weakest financial positions.

The largest funds have relatively low funding and interest coverage ratios Source: ING, DNB

The duration of hedges has shortened in anticipation of the reforms

Our analysis suggests the Dutch pension sector currently targets fixed receivers with an average duration of around 23Y to hedge their interest rate risk exposures. This has been estimated by looking at the quarterly changes of the net derivatives position and correlating these against changes of different yield maturities. The correlation is highest for changes in the 23Y yields and much lower for e.g. 10-year maturities.

Interest rate derivatives closest correlated to 23Y rates Source: ING, DNB

When running our analysis over time, pension funds already seem to have reduced the duration of their derivatives portfolio from around 27 to 23 years, which is in line with our working hypothesis. After the reforms, Dutch pension funds will require fewer long-dated hedges , and thus we expect less demand for 30Y fixed receivers and more for 20Y swaps.

Hedging has already shifted to shorter durations Source: ING, DNB

We therefore stick to our view that the 20s30s EUR swap curve can steepen further. Our fair value model suggests the currently inverted slope could revert to a positive slope again and the Dutch pension fund dynamics should support the current upward momentum.

Going forward, we expect Dutch pension funds to remain risk-averse and any market moves against them could further increase interest rate hedges. Increased hedging demand may have even already played a role in accelerating the recent swap spread moves and could continue to have an impact.

A worst-case scenario would be one with falling euro rates while equities also sell off since this increases liabilities but reduces overall assets. A Trump administration is therefore quite a risk because a global risk-off event on growing trade tensions could hit funding ratios hard.

MENAFN12112024000222011065ID1108877970

Author:

Michiel Tukker

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.