Rates: On Bunds Swap Spreads...

Date

11/7/2024 11:12:08 PM

(MENAFN- ING)

Bund cheapening resumes amid German Political turmoil and persistent structural headwinds

After a brief break around the US elections the cheapening in Bunds has resumed, and if not is even accelerating. One trigger, as we mentioned yesterday, is the political turmoil in Germany where the governing coalition has fallen apart over amid negotiations for next year's budget. The backdrop for Bunds spreads has already been one of persistent structural headwinds, coming from mainly the supply side including the run-down of the European Central Bank's balance sheet (Schnabel's speech from yesterday is also recommended, illustrating the repo market drivers behind the Bund's tightening).

By now the accelerated pace of tightening since early October has cheapened 10Y Bunds from around 23bp below swaps to now 3bp above, and ramifications have been felt through assets. For example, SSAs have also been pushed wider versus swaps to varying degrees.

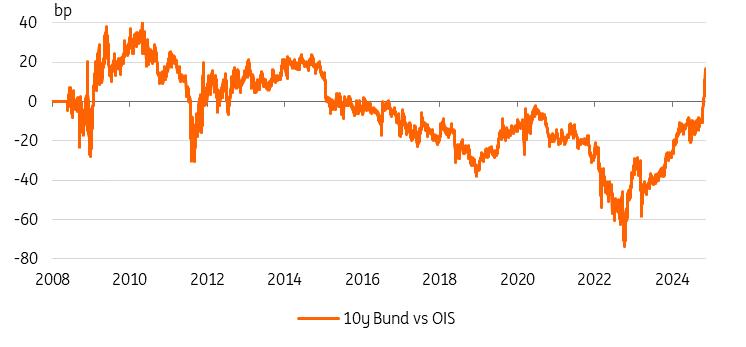

Bund spread versus OIS is now back to pre ECB QE levels

Source: Refinitiv, ING

How far can Bunds cheapen further?

The question is, how far this cheapening can extend. At least at the short end we seem to have found some anchor in repo market valuations already. Further out the picture remains less clear. If we take a longer history of 10Y Bunds versus OIS the current level of 16bp above corresponds to levels in the 15-20bp range seen just before the ECB started quantitative easing at the start of 2015. There are some caveats around this metric since we are using an adjusted EONIA to compare with current ESTR based OIS levels, nevertheless by now the impact of the ECB on Bunds seems to be fully unwound.

We have witnessed cheaper levels, but those were also associated with the wider deficits just after the global financial crisis. Those are now a fair concern as well with the spat around handling the constitutional debt brake leading to the fall of the government. Fears are that Germany might well have to spend its way out of looming trade and or geopolitical crises in the wake of the US election outcome.

The cheapening of government bonds versus swaps is a global phenomenon Source: Refinitiv, ING

Market observers also like to point to the global underperformance of government bonds versus OIS, from the US to the UK. That comparison would leave ample of scope for further cheapening particular in long end Bund spreads. We would still highlight that the US and the UK are playing more in a league alongside France when it comes to government debt and deficit metrics. If we also consider the notion that there should be a premium between French and German government bonds, since the latter are also AAA rated, then Bunds may not have to cheapen that much further – think of the European government bond spread spectrum fanning out around an average spread that is already comparable to its US or UK peers.

But Germany is still in a different league on its debt metrics Source: IMF, ING

While the above observations argue could for some stabilisation in Bund spreads versus swaps, the structural headwinds, domestic (political) and global sentiment make us wary of standing against the trend for now.

MENAFN07112024000222011065ID1108864299

Author:

Benjamin Schroeder

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.