CNB Preview: Inflation Temporarily Above The Tolerance Band

| 4.00% |

CNB key rate

25bp rate cut expected |

Another 25bp rate cut to 4.00% on Thursday seems like a done deal from a surveys perspective, so the main focus should be the new CNB forecast and the potential emphasis on the possibility of a pause in the cutting cycle. The central bank has delivered 275bp of easing since the start of the cutting cycle last December, and the key rate is by far the lowest in the CEE region.

At the same time, headline inflation has surprised to the upside in the last two months and seems fairly certain to move temporarily above the CNB's inflation target tolerance band in the rest of the year. So, the question for this meeting is how sensitive the CNB is to a rise in headline inflation despite the fact that this should only be a temporary effect.

CNB August forecast

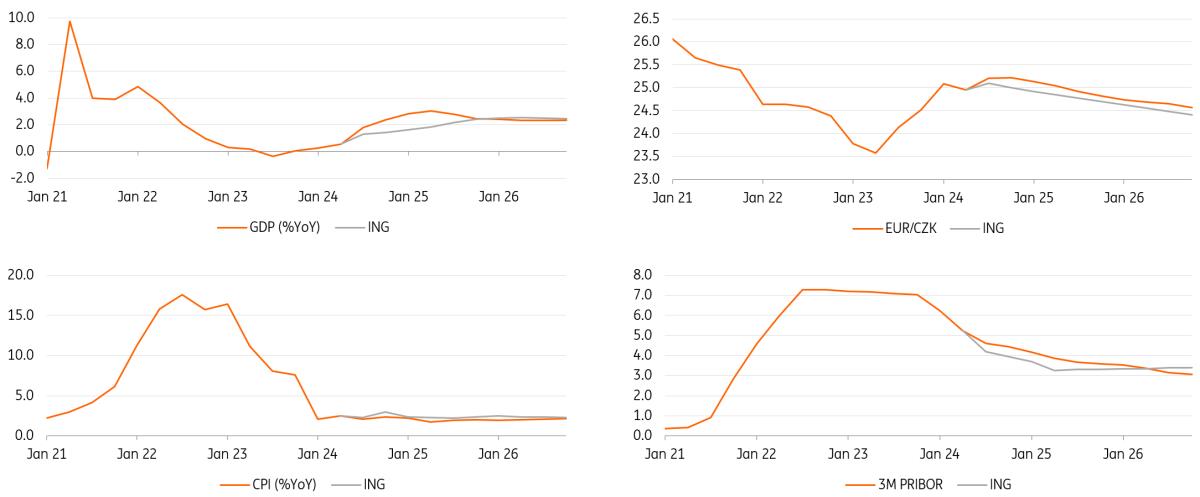

Source: Macrobond, ING New dovish forecast except headline inflation revision

The new forecast should bring several changes, especially in the dovish direction. Third quarter GDP surprised to the downside by 0.5pp vs. the CNB forecast, while there is little to suggest a strong recovery for next year (2.8% in the CNB forecast). So, we expect a downward revision to the growth forecast for this year and next. At the same time, wage growth has also surprised to the downside, and monthly industry numbers suggest a further slowdown, which should also lead to a downward revision.

EUR/CZK is trading close to the CNB forecast, and core inflation is almost in line with the projection. Additionally, the EURIBOR forecast should be revised significantly lower, pushing the CNB rate down in the forecast as well, which is already well above the current CNB rate.

The only hawkish factor here should be the upward revision to headline inflation, which has surprised to the upside in the last two months. The outlook for the next few months should lead the headline figure above 3% and then fall back again in the first quarter of next year.

October inflation key for December pause in the cutting cycleSome things may put the CNB on a more cautious footing: headline inflation and risks from rising food prices may prove more permanent, and a rebound in imputed rents and less impact from energy price cuts may also combine with the late stage of the cutting cycle. On the other hand, this is nothing new for markets, and so the message is likely to be very mixed thanks to a dovish forecast revision and another 25bps cut.

For us, the main challenge for this meeting is to get a sense of how sensitive the CNB is to further potential upside surprises in headline inflation. We believe from recent CNB interviews that we expect higher inflation than the CNB's new forecast, and we will see more upside inflation surprises between the November and December meetings, leading the central bank to pause in December. In particular, the October figure could already surpass 3%, while the CNB is likely to assume this only for December in the new forecast. The October number will thus, in our view, determine any pause in December.

What to expect in the FX and rates marketEUR/CZK is surprisingly stable, considering the high volatility within the CEE and EM space. The CZK has proven to be a defensive currency in the current environment and has outperformed CEE peers recently. Current EUR/CZK levels are close to CNB forecasts; FX is not the central bank's main focus at the moment. Given the CNB forecast revision, we would expect a slightly negative impact in FX from the upcoming meeting, but the hawkish tone may minimise this impact. However, given the proximity of the US election, we can expect EUR/CZK to be fully influenced by global factors.

In our view, the CZK is the most defensive currency in the CEE region for the US election, but the election outcome is still purely binary for EUR/CZK via the EUR/USD channel. However, in a Trump scenario, we believe losses are limited against other CEE currencies, specifically due to the CNB's stance and a possible halt in the cutting cycle for a longer period of time. For the longer horizon in the case of the Trump victory , we believe it may not be as negative for the CEE region as the market generally assumes, and weaker FX levels immediately after the election may appear to be a good entry point for some.

In rates, the market priced out much of the CNB easing in October, and we think the positioning is now more balanced. The terminal rate has moved from roughly 3.00% to 3.50% if we assume the PRIBOR premium returns to positive at the end of the cycle. Valuations could be seen to be more attractive, notably at the long end of the curve, with 5y5y at 3.90%, which is not as exposed to a potential CNB pause in the cutting cycle and would instead benefit from a market view of a weak economy and the CNB appearing to be behind the curve.

In the event of a Harris win, we expect a quick return of receivers to the market. In the event of a Trump victory, the CZK market would return to receiving mode later, and the immediate reaction would be pressure for another sell-off. However, with the market no longer pricing in many rate cuts at the moment and the economy continuing to surprise on the negative side, we believe the scope for a sell-off versus CEE peers is rather limited.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment