(MENAFN- ING) Economic recovery starts to make its way into industrial prices

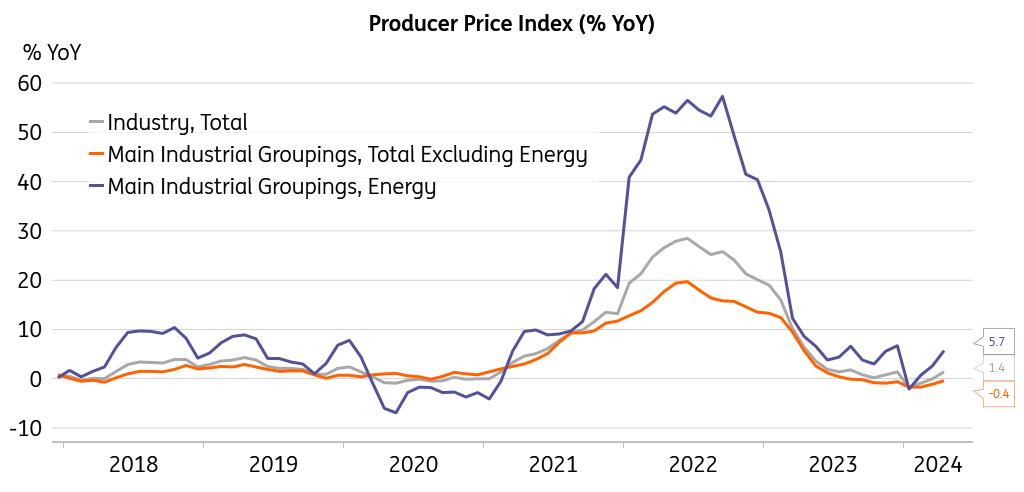

Producer price growth remained moderate in April and did not signal a build-up of consumer inflation pressures, with prices in industry coming in slightly below market expectations. Industrial prices increased by 1.4% year-on-year, predominantly due to higher energy costs. The double-digit fall in agricultural prices continued, while price increases in construction and business services reflected the economic recovery picking up steam amid relatively tight labour market conditions.

Energy prices in industry accelerated in April

Energy prices in industry have accelerated in April Year-on-year growth in overall industrial prices was still driven by energy and water costs. However, the month-on-month dynamics already reflected price increases in core manufacturing, going hand in hand with the ongoing economic recovery. Recent strong retail sales and a solid export performance, according to the balance of payments, are thus putting some pressure on the supply side, for now at the front of the production chain. Further acceleration in energy prices would put pressure throughout the production chain at a time when energy costs denote a pressing issue for the competitiveness of European goods in global markets.

Will falling agricultural producer prices translate into lower consumer prices?

Prices in agricultural production fell by a significant 13.4% year-on-year, declining for 12 months in a row. Compared to the high value of the index recorded in January 2023, agricultural producer prices slipped by about 20% cumulatively. However, this had hardly been the case for consumer food prices, which have remained almost unchanged over the same period. Whether falling producer prices eventually make their way to the consumer or remain hanging in retailers' margins should become apparent by the second half of the year at the latest.

Agricultural producer prices fall further

Agricultural producer prices fall further We do not alter our projection for headline consumer inflation on the back of the steep decline in agricultural prices so far. The timing and magnitude of the producer price pass-through to the consumer basket are uncertain. That said, we perceive the cumulative drop in agricultural prices as a downside risk to consumer food prices once the need for competition kicks in. However, this might take some time, given the lofty consumer confidence and elevated appetite for spending, with consumers likely doing what they do best in the coming quarters.

Prices in construction and services are propelled by the economic recovery

Construction price growth held at 2% and probably bottomed out in April, especially as consumer sentiment continues to improve. The currently high savings level likely reflects deferred property purchases due to increased uncertainty during the recent period of high inflation and anaemic economic performance. In contrast, the current economic upswing and boost to household real income will induce a lift-off in the real estate sector, lending support to prices in construction.

Elevated price dynamics were still evident in the business services sector, driven predominantly by continued nominal wage growth amid low unemployment. Producer prices in this area rose by 3.4% from a year earlier, while providing a reasonably good proxy for price developments in services purchased by households. Overall, the service sector remains a focal point for price pressures in the entire economy, representing a driver for consumer inflation to remain in the upper bound of the central bank's tolerance band over the second half of the year.

This is the main reason why the central bank board has become more cautious and will think twice before going ahead with monetary easing that imitates previous actions. We still see a 25bp cut as the most likely outcome of the June meeting, but talk of a break will also be on the table.

MENAFN20052024000222011065ID1108235864

Author:

David Havrlant

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.