(MENAFN- ING) The growing biofuel industry in the US is at a crossroads between

future supply and demand shifts, which are largely policy-driven. Farmers and biofuel producers anticipate strong growth for vegetable oils as feedstock for renewable diesel, while the

stakes remain high for corn farmers and ethanol makers gaining access to new markets in aviation In this article A growing appetite for agricultural feedstocks Use of corn for ethanol stable, strong growth for many other feedstocks Biofuels at crossroads of future demand and supply shifts Ethanol demand growth weak in road transportation Strong growth potential in aviation Soybeans will see stronger demand from renewable diesel Policy provides support for biofuels, but emissions' intensity matters Future biofuels demand will greatly influence farmers' planting decisions

Corn for biofuels being harvested next to an ethanol production facility in Wisconsin A growing appetite for agricultural feedstocks Farmers are often both food producers and suppliers of a range of raw materials, with the latter now becoming more important than ever as biofuels increasingly replace fossil fuels in road transportation and aviation. Biobased feedstocks – including agricultural crops and animal-derived products – can often offer a more sustainable alternative and provide a crucial pathway towards net-zero emissions in 2050.

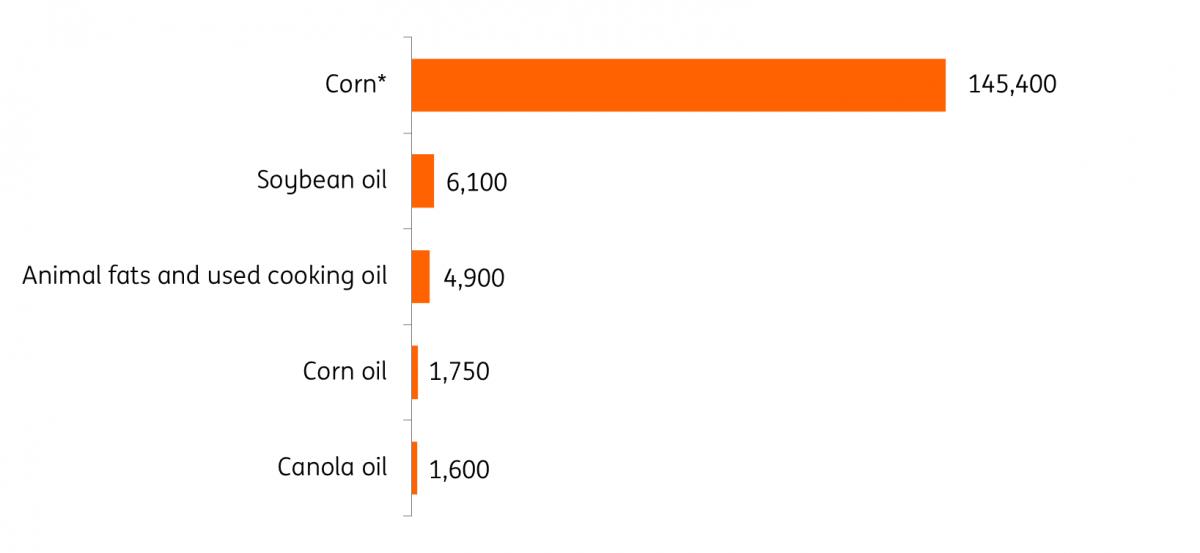

There are a number of feedstocks that the US biofuels industry uses to produce biofuels. Corn is by far the largest, representing over 90% of the volume, with most corn being processed into conventional ethanol. The second largest feedstock for biofuels is soybean oil, making up around 3% of the total feedstock used. Animal fats used cooking oil (UCO) and vegetable oils like soybean oil are generally turned into biodiesel or renewable diesel.

Corn trumps all other agricultural feedstocks in volume terms Million pounds used for biofuels per year, *including sorghum

U.S. Energy Information Administration, ING Research Use of corn for ethanol stable, strong growth for many other feedstocks Using corn to produce ethanol initially took off following the Renewable Fuel Standards (RFS) in the mid-2000s and California's Low-Carbon Fuel Standards (LCFS). We've written about these policies in a bit more detail previously here . The number of corn bushels used for ethanol has been relatively stable in the last decade.

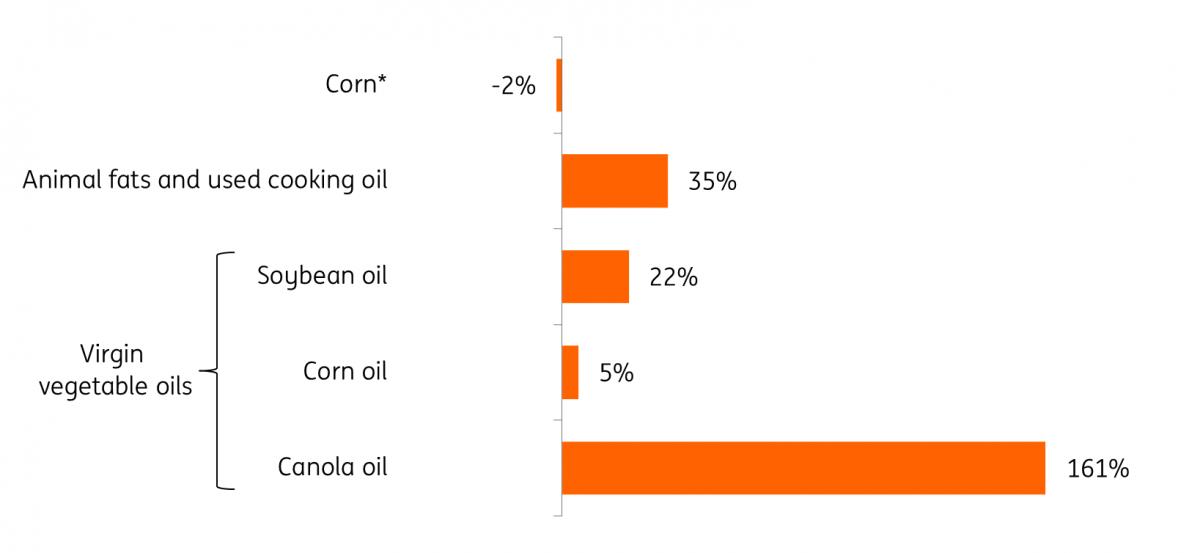

We're now seeing strong growth in the use of other feedstocks, which is mainly the result of a boom in renewable diesel production . The expansion in refining capacity has led to additional demand for animal fats and UCO, but we also see more soybean and canola oil from oilseed crushers and corn oil from distillers being turned into renewable diesel. Increased production of renewable diesel is mainly taking place at the expense of biodiesel, and total renewable diesel production volume has overtaken biodiesel production for the first time in 2023.

Both animal fats and UCO are rapidly approaching their supply limits, according to the International Energy Agency. The US already has high UCO collection rates, so it's also looking abroad for additional supply – and this means that competition between the US and the EU for Asian UCO supply is heating up. The future supply picture for animal fats is mixed. US cattle inventory is following a downward trend, limiting the growth potential for beef tallow, the most important animal fat used in biofuels. Larger supplies from the poultry industry can partly offset this due to the growth in the number of broilers.

Use of animal fats, used cooking oil and vegetable oils for biofuels continues to grow US feedstocks consumed for production of biofuels, growth H1 2023 compared to H1 2022

U.S. Energy Information Administration, ING Research Biofuels at crossroads of future demand and supply shifts The biofuel market continues to evolve, and we see varying demand outlooks for different feedstocks. Since corn ethanol demand from the road transportation sector has likely peaked already, overcoming hurdles to enter the market for sustainable aviation fuels remains a key concern. Given the ongoing growth in renewable diesel capacity, there is clearly more growth potential for fats and vegetable oils. Ethanol producers and oilseed crushers are also busy with upgrading the protein content in their other products to tap into higher value-added feed and food applications.

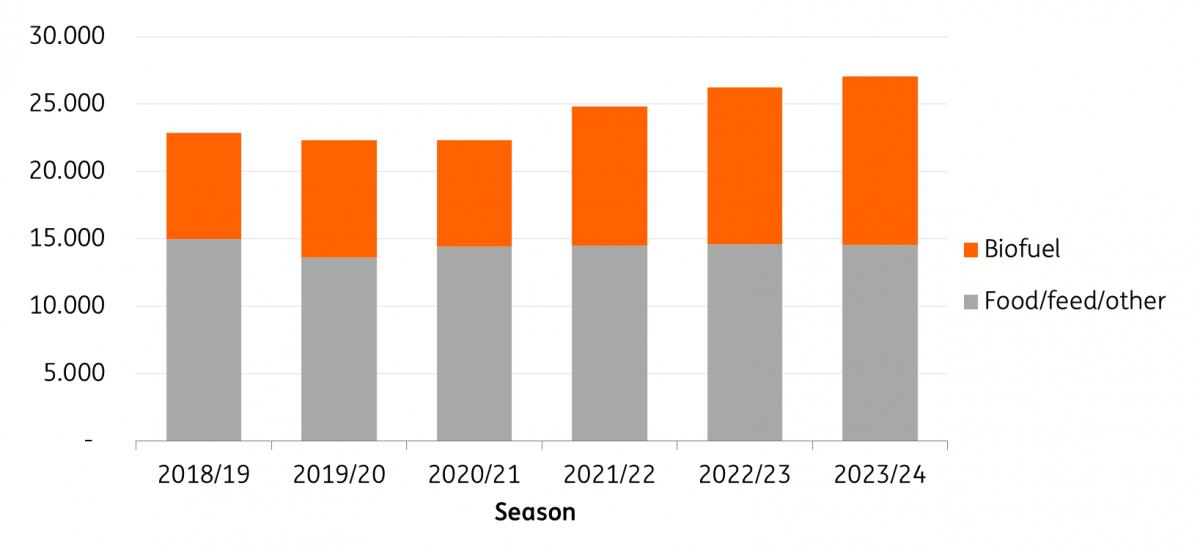

All the additional production of soybean oil is channelled towards biofuels Use of US soybean oil, in million pounds

USDA WASDE report, ING Research Ethanol demand growth weak in road transportation Corn is the most widely used feedstock when it comes to biofuel production in the US, specifically for ethanol production. The ethanol sector accounts for around 38% of total corn consumption, which is up significantly from just 6% in the early 2000s. Historically, the view has been that there is a blending wall for the US ethanol industry, with the widely accepted barrier being at 10%. However, it's become more apparent in recent years that this blend wall does not appear to be as impenetrable as previously thought, with the ethanol blending rate in the US exceeding 10% since 2016. The growing availability of E15 and the capacity for a larger share of the vehicle fleet running on it would have helped to break above 10%. Any car with a model year 2001 or newer is approved to run on E15, which is basically almost 96% of the car fleet.

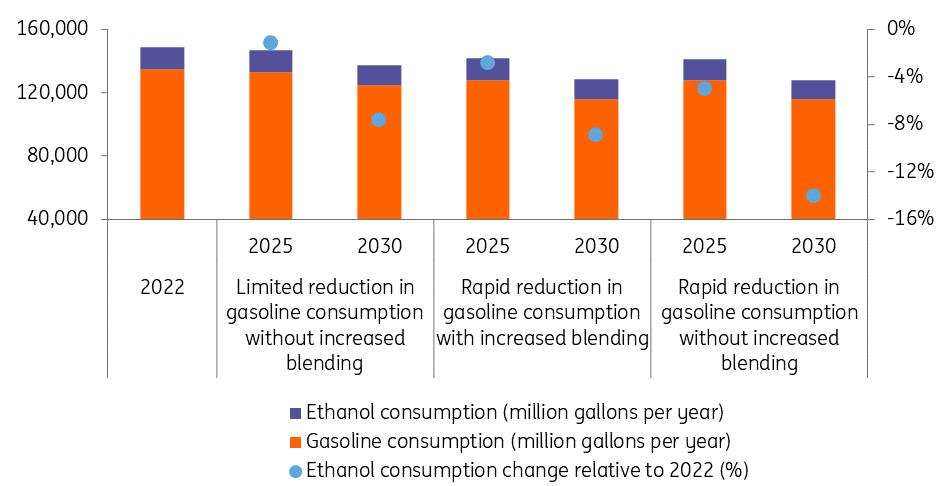

A further increase in blending rates will likely drive any growth in US ethanol demand from the road transportation sector. However, given efficiency gains in cars with combustion engines and the growing share of electric vehicle (EV) sales, road fuel demand in the US is likely to decline in the coming years. In turn, this will reduce the amount of ethanol that will be needed.

In the next decade, we expect downward pressure to emerge on the demand for biofuels in road transportation – especially in the latter part of this decade. Because current biofuel production for cars is primarily driven by the federal Renewable Fuel Standard (RFS) mandate to blend biofuels into fossil gasoline, the increasing adoption of EVs will replace both fossil gasoline and biofuel demand. Weaker-than-expected RFS biofuels blending mandates for 2023 to 2025 add further constraints to demand growth.

We estimate that, mainly because of EV development, current levels of ethanol demand are likely to decrease by 7.6% to 14% by 2030 based on different scenarios of gasoline consumption and ethanol blending rates. In the scenario of rapid reduction in gasoline consumption without increased blending, the 14% decline in ethanol demand works out at around 700 million bushels less in corn demand. This is equivalent to losing around four million acres of corn.

Reduced gasoline demand is likely to put pressure on ethanol demand Scenarios for

potential ethanol displacement in 2025 and 2030 compared to 2022

ING Research, IEA, EIA

Note: In the scenarios with increased blending, we assume the ethanol blending rate rises consistently from 10.4% in 2022 to 11% in 2030. In the scenarios without increased blending, we assume a constant ethanol blending rate of 10.4% from 2022 through 2030.

| 7.6-14% | Potential ethanol reduction in road transport

In 2030 compared to 2022 |

Strong growth potential in aviation

A potential key outlet for the corn and ethanol industry is the aviation sector, driven by soaring commitments from airlines to use Sustainable Aviation Fuels (SAFs) to power their fleets. The aviation sector is more difficult to decarbonise, and biofuels will likely have to play a more significant role in this. Biofuels still make up a marginal share of jet fuel. Feedstock availability and costs mean it is more challenging compared to road transport. However, given the large-scale and stable production of ethanol in the US, and with ethanol-to-jet technology becoming more widely available, we could expect the contribution of ethanol-to-jet fuel (EtJ) in total SAF production to increase.

US jet fuel demand is currently around 1.55m b/d (24 billion gallons), and the EIA expects it could approach close to 1.75 mb/d (27 billion gallons) by 2030. We estimate that the demand for SAFs in North America will rise to 0.9 billion gallons per year by 2025 . With current regulations allowing SAF blending rates of up to 50% with jet fuel, the demand potential is significant, particularly when considering that current blending rates are less than 1%. Assuming the aviation sector fully absorbs the 14% reduction in ethanol demand from road transportation, it would only take SAF blend rates up to around 4% by 2030, all else being equal. So, pressure on ethanol demand means the stakes are high for ethanol producers to open up new markets in aviation.

Soybeans will see stronger demand from renewable diesel

When it comes to biodiesel in the US, soybean oil is the largest feedstock. Around 11.6 billion pounds of soybean oil goes towards biofuels, which is almost 44% of total soybean oil demand. This is up significantly from less than 1% in the early 2000s. In order to produce the necessary amount of soybean oil, around 991m bushels of soybeans are needed (assuming 1 bushel of soybean produces 11.7 pounds of soybean oil).

The EIA forecasts that US diesel demand will fall from around 3.67m b/d (56 billion gallons) in 2022 to 3.31m b/d (51 billion gallons) in 2030. At face value, this suggests that the outlook for biodiesel is for demand to edge lower, which theoretically would mean that the demand for soybean oil from the biofuels industry would also trend lower over time. Obviously, this can be offset by higher blending rates of biodiesel into petroleum diesel.

However, the more significant factor which is likely to support soybean oil demand (along with other vegetable oils) from the biofuels industry is the growth in renewable diesel capacity. Renewable diesel can be used as an alternative to petroleum diesel so the potential demand growth is significant, given it can fully displace petroleum diesel rather than just be blended with it.

There has been significant investment in recent years in renewable diesel capacity-and the demand for renewable diesel is less likely going to be negatively impacted by the adoption of EVs. This is because renewable diesel serves trucks and other heavy-duty vehicles, and these vehicles are less well positioned to use batteries because of their large sizes and consequent long time to charge.

By the start of 2021, the US had around 791 million gallons of renewable diesel capacity, which grew to around 3 billion gallons by the start of 2023. Meanwhile, some forecasts suggest this capacity could reach as much as 6 billion gallons by 2025, and from 2026 onwards, capacity could total 7.4 billion gallons with a number of projects still in the pipeline. Looking at EIA numbers, we can derive that almost 30% of US renewable diesel was produced using soybean oil as a feedstock. If we were to assume a similar proportion was used for renewable diesel in future and total capacity of 7.4 bn gallons between 2026 and 2030, there would be additional demand for 16 pounds of soybean oil, which would equate to around 1.2b bushels of soybeans.

But, if we were to assume all new capacity was to use soybean oil as feedstock, this would increase the need for additional soybeans to almost 4.1b bushels. In reality, future demand needs will likely be somewhere in between this, with plenty of uncertainty over the feedstock mix, given availability issues. In addition, there are questions over whether all this planned capacity will actually come about.

That said, it is clear that the longer-term demand prospects for soybean oil are constructive. The US would need to see a combination of increasing soybean acreage, reducing soybean exports and increasing the domestic crush to meet future demand. Significantly stronger demand for soybean oil would mean the need to invest in domestic crushing capacity. Under this scenario, the US would move away from being a significant exporter of soybeans to a larger producer and exporter of soybean meal. The surplus meal produced could prove challenging for the industry in terms of logistics, whilst clearly weaker meal prices would mean that soybean oil prices will have to do most of the work to ensure margins remain attractive for crushers.

Policy provides support for biofuels, but emissions' intensity matters

The Inflation Reduction Act (IRA) is providing generous tax credits to the biofuels industry. Firstly, the IRA extends the previous biomass-based diesel blender's tax credits from December 2022 to December 2024. With biodiesel, renewable diesel, and some other kinds of alternative fuels eligible for application, these credits will continue to boost the production of biofuels for road transportation. Secondly, the IRA creates new tax credits for SAFs at $1.25-$1.75 per gallon until the end of 2024. This will strongly encourage the production of SAFs, especially when fuel production faces high upfront investment and still needs technological advancement. The clean fuel production credit will replace both sets of tax credits starting 2025 through 2027.

While the current SAF tax credits sound attractive to producers and investors, several areas deserve special attention. First, produced SAFs must achieve emissions reduction of at least 50% to be qualified for the tax credits under the IRA-and this is not easily the case for every SAF. For instance, different producers may have different life-cycle intensities even for the same SAF production pathway, but on average, producing SAF through the ethanol-to-jet fuel (EtJ) pathway with corn grains as the feedstock can emit as much as 66 gCO2e/MJ according to a research paper published on Journal Renewable and Sustainable Energy Reviews. This is not enough to meet the 50% emissions reduction threshold to be eligible for IRA SAF tax credits.

IRA contains several biofuel-related tax credits

Overview of relevant tax credits

US Government

So, the case for corn-based EtJ is less straightforward from a carbon reduction perspective unless corn-based ethanol producers are able to reduce carbon emissions, such as through on-farm measures and by applying carbon capture and storage (CCS) at production sites. Whilst plans for several pipelines are in place, they also face opposition. If only corn-based SAF that is equipped with carbon reduction technologies can meet the IRA tax credits' requirements, it will be put it at a more disadvantaged position when competing with other kinds of SAFs in the market.

Secondly, to receive the highest levels of tax credits, the prevailing wage requirement will need to be fulfilled. Biofuel producers need to pay their workers the minimum wage set by the Department of Labor and use at least 12.5% of the labour hours from workers registered under the federal apprenticeship programme or a state-level equivalent. There were roughly 600,000 active registered apprentices in the US in 2021, but large discrepancies exist across geography and industry. Therefore, it is not by default that companies can meet this requirement, and producers may find themselves in a position of needing to raise wages or recruit more qualified workers to take full advantage of the IRA.

Corn grain based feedstocks have a higher carbon intensity than many other feedstocks

Core life cycle assessment values, in grams of CO2 equivalent per megajoule of fuel, for a range of feedstocks compared to emissions from conventional jet fuel

Chemical process, FT = Fischer Tropsch, HEFA = Hydroprocessed Esters and Fatty Acids, EtJ = ethanol-to-jet fuel, Research paper CORSIA: The first internationally adopted approach to calculate life-cycle GHG emissions for aviation fuels, ING Research Future biofuels demand will greatly influence farmers' planting decisions

Growing demand for cleaner fuels offers companies along the agricultural value chain an opportunity to extract more value from their crops and by-products. Policy continues to play a key role in setting the pace. Recently updated Renewable Fuel Standards for 2023-2025 will likely slow down some of the anticipated expansion of soybean processing capacity. Markets are expecting more clarity from policymakers on the conditions for using corn ethanol in jet fuel by the end of this year.

That said, future biofuel demand will greatly influence farmers' planting decisions. Prices will need to do the work to ensure that farmers adjust plantings, which implies sowing more soybeans at the expense of corn. However, the potential opportunities for Ethanol to Jet (EtJ) in sustainable aviation fuels may complicate this.

MENAFN23102023000222011065ID1107285470

Author:

Coco Zhang, Thijs Geijer, Warren Patterson