(MENAFN- ING) 10Y Bund yields have marched towards 3% as markets come

to terms with the 'high for longer' theme on this side of the Atlantic. But there is little actual data driving the sell-off, and the recovery in USTs overnight. That may change today with important US data releases and CPI

in the eurozone

In this article Rates still under upward pressure... ... but risk assets including sovereign spreads may give reason for pause Today's events and

market view

Rates still under upward pressure...

The sell-off in rates extended for another day yesterday, without much support from the data front. Oil hit new highs overnight but actually started sliding yesterday morning. In the eurozone, CPI data from Spain and Germany came in a little lower than anticipated; still, 10Y Bund yields marched higher peaking close to 2.98% late in the afternoon.

What then halted the sell-off is difficult to know. Other data from the US was mixed: better jobless claims figures and second-quarter GDP unrevised at 2.1%, but surprisingly weak personal consumption in the quarter.

Risk assets were trading weaker with European equity indices staking out the lowest levels since March, and in the sovereign bond space, all eyes were on Italian government bonds where the key 10Y spread versus Bunds briefly widened above 200bp.

... but risk assets including sovereign spreads may give reason for pause

There are multiple factors coming together that have weighed on Italian bonds. The announcement of higher budget deficits has raised investor scrutiny about the sustainability of the government's fiscal plans. This falls amid discussions by European Central Bank officials to prematurely end what is effectively the ECB's first line of defence to guard sovereign spreads: the flexible reinvestment of pandemic emergency purchase programme holdings.

Naturally, that puts more focus on the Transmission Protection Mechanism, the second line of defence – whose deployment is also tied to conditions, including“sound and sustainable” fiscal policies. The ECB does give itself some leeway in its decisions, saying it dynamically adjusts the criteria to the unfolding risks and conditions. But this suggests that the hurdle to activate the TPI could have moved higher as the Italian government now plans with higher deficits.

For now, the spread dynamics still tie in with the outright directionality of rates, meaning the widening is in part owed to the higher beta of Italian bonds. Recently, some other risk measures have also started to rise, including implied volatility that spiked higher yesterday. But as we noted before, what hasn't budged thus far is the Bund asset swap spread. This would support the notion that the widening is indeed more directional and flow-related for now, and we are not seeing a larger flight to safety.

Next week, Italy will issue its second BTP Valore retail bond, which raised an impressive €18bn in its first issue. Another large take-up might also give sovereign spreads some much-needed reprieve.

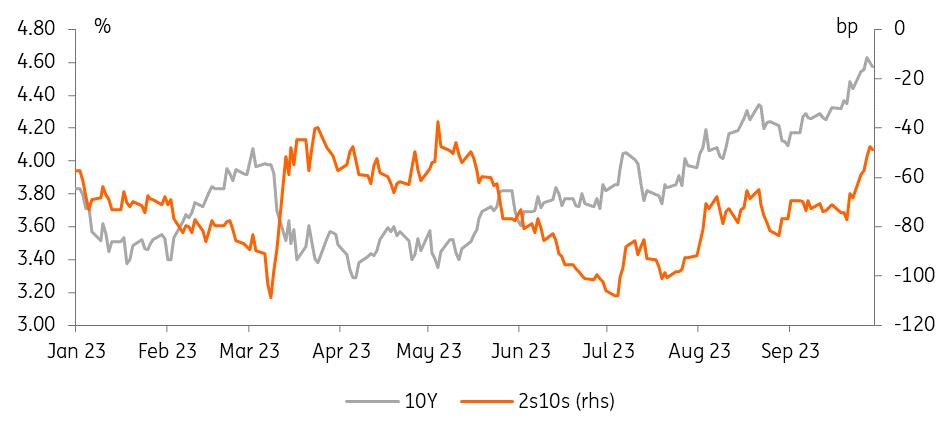

2s10s UST back to levels prevailing after March, but then was a different story...

Refinitiv, ING Today's events and market view

With outright rates on long-term highs, there are very few guideposts and markers to go by. But looking at the curve, it shows that 2s10s in Treasuries is now above -50bp and thus back to levels which roughly prevailed between March and May. Amid the wider bear steepening pressure of late, that might also give the outright levels some grip. We actually did see yesterday's Treasury sell-off turn around, and switch the curve dynamic into a bull steepening for the session, but we think it is too early to dismiss 10Y USTs reaching 5%.

Data will move into focus again today with the release of US personal income and spending data as well as the PCE deflator. In the eurozone, the flash CPI moves into the spotlight, but slightly better country data by itself wasn't enough to halt the rise in rates. While falling fast, absolute levels of inflation are still well above the ECB's target.

MENAFN29092023000222011065ID1107163249

Author:

Benjamin Schroeder, Padhraic Garvey, CFA

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.