(MENAFN- ING) Will a change in leadership lead to a change in policy? The bank of Japan's

Governor, Haruhiko Kuroda, will step down on 8 April after serving 10

years at the Japanese central bank. Kuroda is credited as being the main advocate of Japan's super-easy monetary policy stance. And his looming retirement means that market expectations are growing over whether the next governor will shift the BoJ's policy stance.

His successor nominee will be presented to

Parliament on 10 February, but a couple of names are already circulating, notably those of the current deputy governor or his predecessor.

Based on their past remarks, it's expected they would both reduce the extent of accommodation, although there is a

'hawk-dove' division as far as the policy spectrum's concerned. So, the

pace and extent of any changes will surely vary, but even small modifications can shock the market, as was demonstrated after the December policy tweak.

Consequently, a conservative policy transition is likely to be pursued. We also think that the next governor is likely to continue to focus

on prices, as the current above-4% inflation rate is not considered sustainable and is expected to fall

below 2% in the coming quarters. That's

why we believe the spring wage negotiations, known as Shunto, are the key variable to watch.

Wage increases are essential to escape the vicious cycle of deflation

As we mentioned in our research note 'why is japan's inflation so low?' , there are structural problems which have led to Japanese consumers' wage and wealth

growth stagnating. Core CPI

inflation, excluding fresh food, is expected to exceed 4% in January. But this is driven mainly by supply-side pressures and will be transitory. Therefore, from the BoJ's perspective, there is still concern about deflation. This is why the spring salary negotiation is important. Without wage growth, it is going to be very difficult to achieve a sustainable inflation target of 2%.

The government has offered incentives to companies

for wage increases, but in our view, wage growth will rise more slowly than the 3% sought by the BoJ. Base salaries

may pick up, reflecting high inflation, but this may be largely offset by a reduction in bonuses and incentives as corporate earnings are likely to be squeezed. The latest labour market reports suggest that wage pressures remain

relatively weak. However, if wages do

rise by around 3%, then the pace of policy adjustment by the BoJ is expected to accelerate.

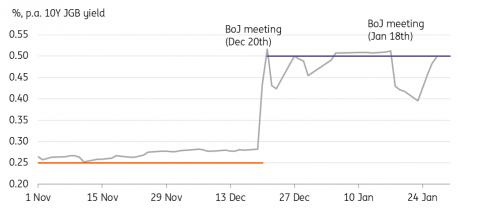

10-year JGB runs just below the BoJ's target band

CEIC

BoJ watch

We think it will be

difficult for Kuroda to try

any policy changes at the March meeting just before he steps down. A

lack of upward wage pressure, along with slowing inflation, may also prevent the new governor from taking immediate action in April.

We think he will likely adjust the

forward guidance and call for a policy review with the Ministry of Finance. This will give the BoJ more flexibility in policymaking.

As we argued in our outlook report, there could well be a re-examination of

the inflation target – from the current 'at the earliest possible time' to making the 2% target a 'long-term goal'. Thereafter, we think the BoJ will lift the mid-point target for the 10Y Japanese government bond

from 0% to 0.25% in early 2024,

followed by raising its short-term policy rate from -0.1% to 0.0% in the second quarter of 2024.

If wage growth is stronger than

we expect and inflation stays above 2% until the third quarter of this year, then the timing could be brought forward

to the end of this year.