Poland's Foreign Trade Deficit Narrowing Gradually

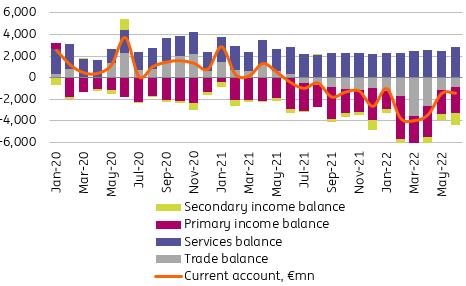

The current account balance recorded a deficit of just €1,468mn (INGF: €2,740mn; consensus: €2,368mn) in June, made up of a deficit in goods trade (€849mn), negative primary income (€2,460mn) and secondary income balances (€1,039mn) and a surplus in services trade (€2,880mn). On a 12-month basis, the current account deficit was 3.9% of GDP.

Current account balance and its composition (€mn)

NBP.

Visibly smaller trade deficits in the last two months than before were the main reason for the smaller scale of current account imbalances in May and June. In June, euro-denominated exports of goods increased by 25.8% year-on-year, while imports grew by 31.5% YoY (our forecasts of 26.7% YoY and 34.9% YoY respectively). The National Bank of Poland's press release paints an interesting picture of the impact of the war in Ukraine on Poland's foreign trade. Despite military activities Polish exports to Ukraine are growing (mainly fuel and used cars), which has moved the country to seventh place among major export partners. At the same time the embargo on Russian coal and the restriction of imports of gas and other energy resources from Russia have translated into a year-on-year decline in imports from this direction.

Slowing domestic demand and lower prices for some raw materials should curb the increase in the value of imports. At the same time, the unfavourable outlook for European industry may translate into lower demand for Polish exports, although recent industrial production data in the euro area have surprised on the upside. A trend of a gradual reduction in the imbalance in goods trade has emerged in recent months and should continue in the face of the economic slowdown.

The coming months are likely to see a further widening of the cumulative 12-month current account deficit, but unless the energy crisis intensifies, the level of external imbalance should stabilise around 5% of GDP. This is not a factor that is currently having a significant negative impact on the PLN exchange rate, which is currently mainly shaped by global sentiment and on the monetary policy outlook of the NBP and the Fed and European Central Bank.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment