Worst Productivity Drop Ever Means More Inflation

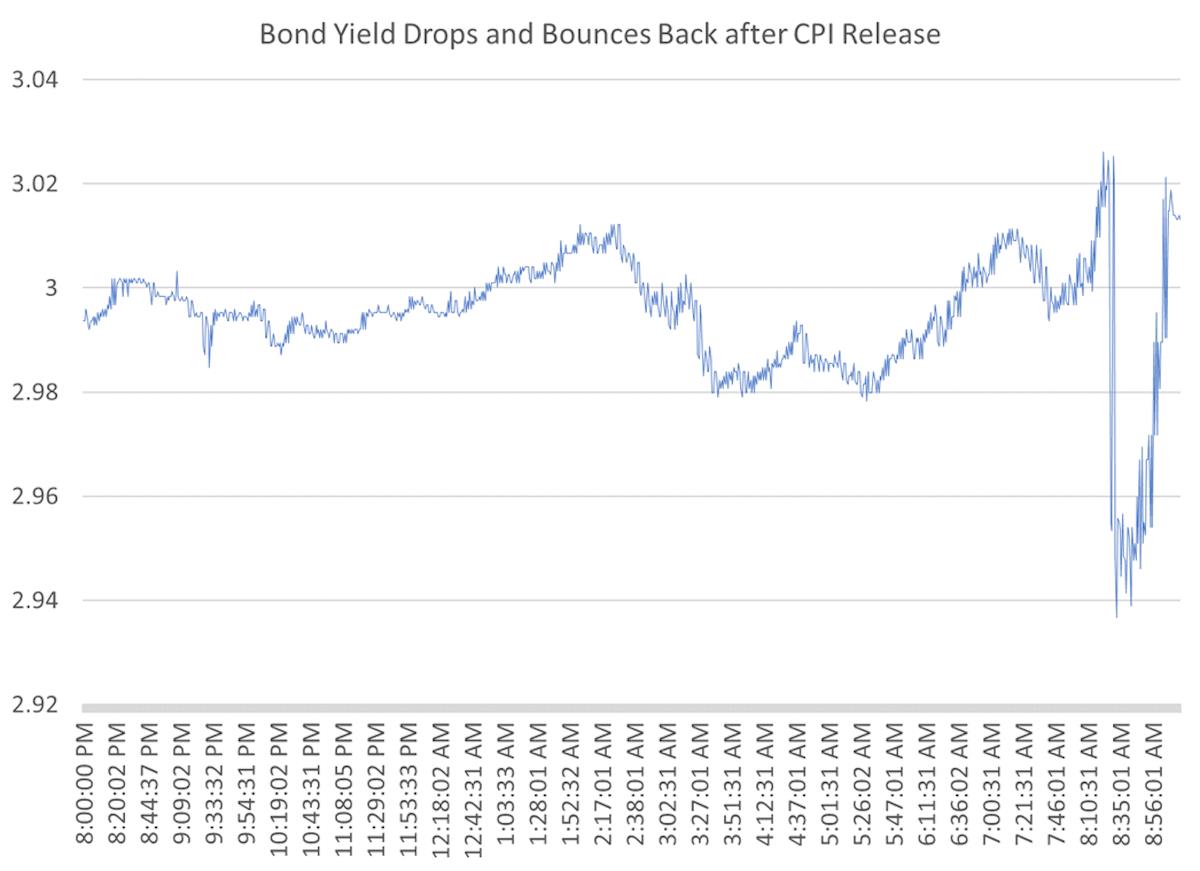

July inflation was“only” 8.5% year-on-year vs. 9.1% year-on-year in June, mainly because energy prices fell on the month. In the hope that fading inflation would slow the Federal Reserve's monetary tightening, the 30-year US Treasury bond yield dropped – for about 10 minutes.

Traders decided that the light at the end of the tunnel was probably the headlamp of the oncoming express, and the 30-year bond yield snapped back.

A close look at the numbers suggests that resurgent inflation is far from under control. Rent inflation, the Bureau of Labor Statistics reckons, is rising at a 6.1% annual rate. The Zillow index of rental costs, based on actual transactions made on its website, shows 15% rental inflation as of the end of June.

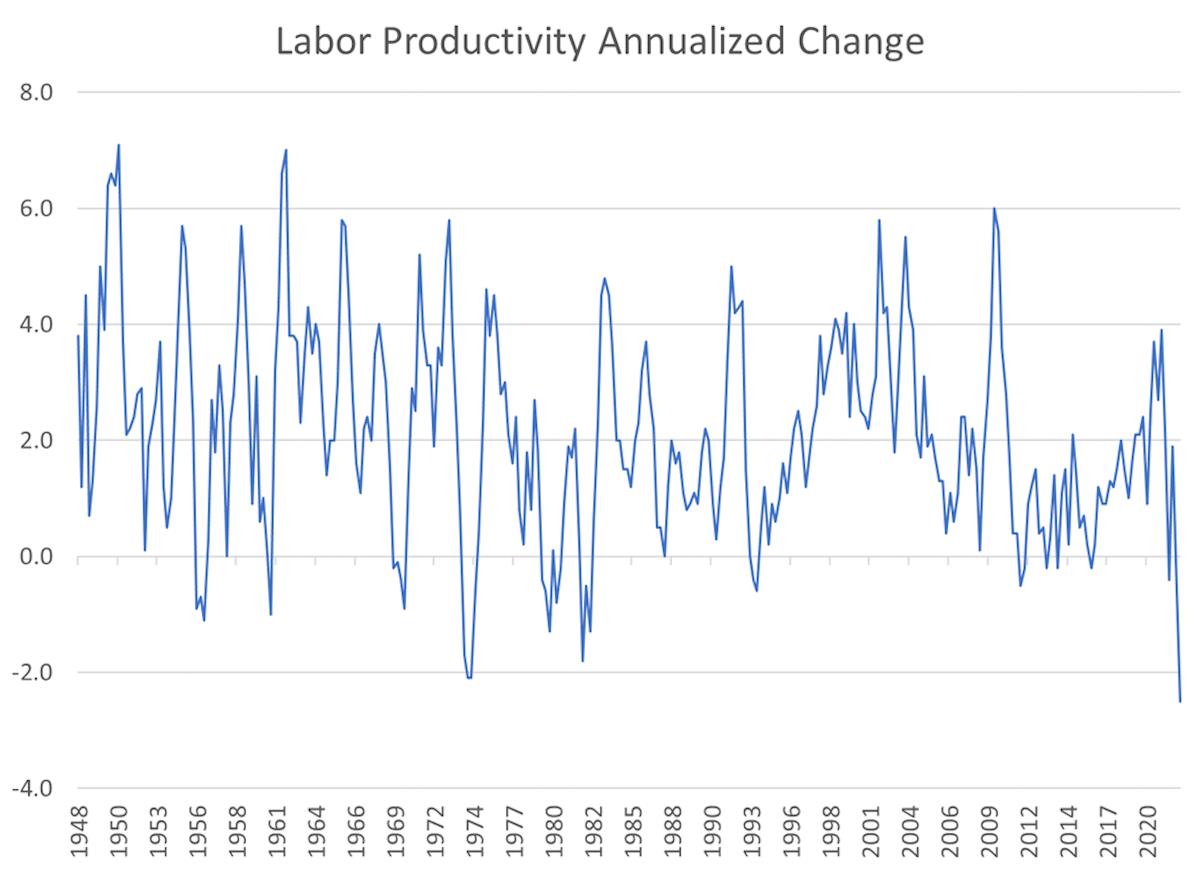

The worst labor productivity decline on record during the second quarter of 2022, meanwhile, points to long-term and persistent inflation. Output per manhour in the nonfarm business sector declined by 2.2% at an annual rate. Think of it as the economic equivalent of long Covid.

We haven't seen labor productivity declines of this magnitude since the 1970s, during the last great wave of inflation.

Productivity is the ultimate arbiter of the price level. In the short term, a flood of government-created demand can push up the price level. The US government's $6 trillion stimulus after the Covid recession of 2022 pushed up prices, exacerbated by supply factors. A global semiconductor shortage reduced auto output, environmental regulation suppressed US domestic energy production and Covid disrupted logistics globally.

After stimulating demand with a $6 trillion expansion of its balance sheet, the Federal Reserve is now choking off demand by raising interest rates. That will have some impact on prices, to be sure, but it doesn't address the far more important problem. After years of underinvestment in plant and equipment, worker training and infrastructure, the United States faces falling productivity. Businesses can't get enough incremental output for every new increment of labor.

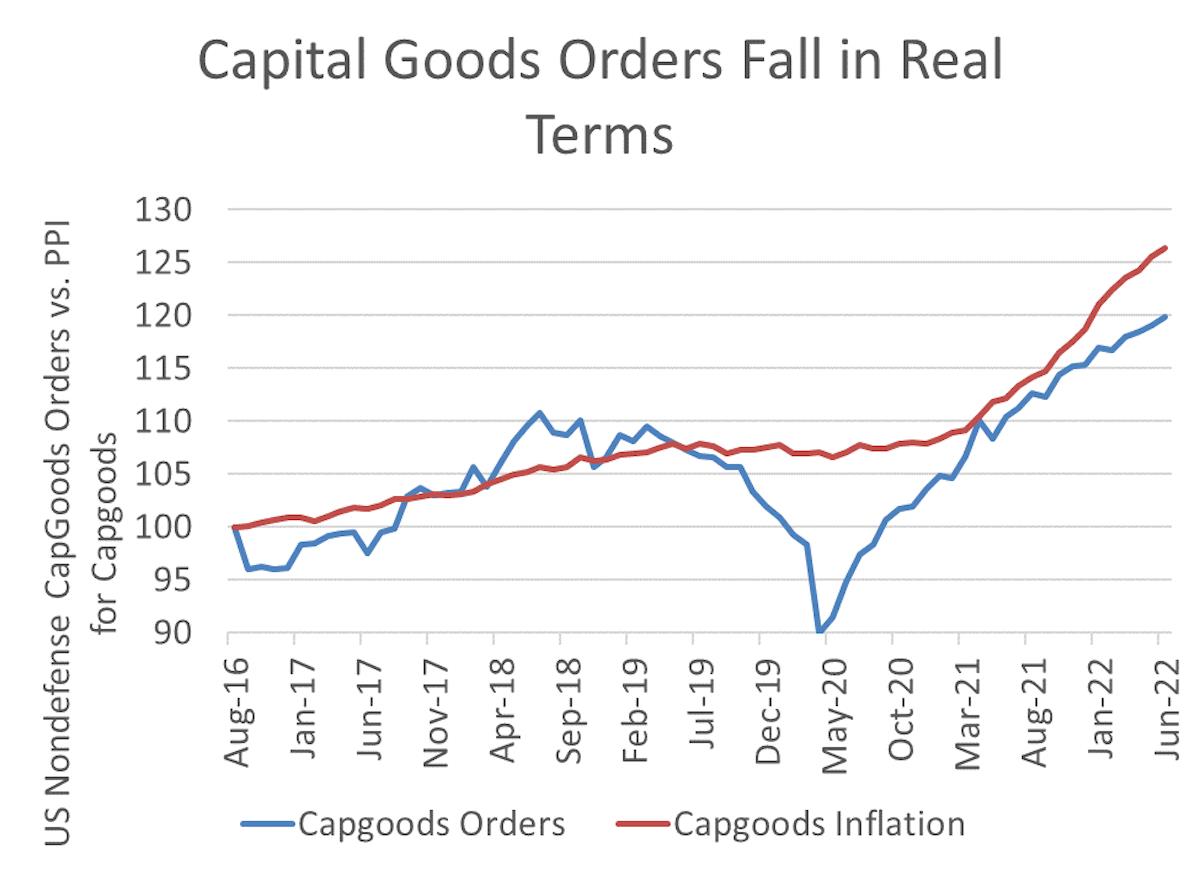

The cause of the productivity drop isn't hard to diagnose. American business isn't investing. US orders for nondefense capital goods (excluding transportation) are lower in real terms than they were in 2016 (and haven't begun to catch up after they collapsed in 2020).

The Federal Reserve today is trying to run with one leg. The great inflation of the 1970s came to an end with a two-legged approach: Tight money to reduce inflation, and tax cuts to incentivize investment.

In addition, the Federal government in the late 1970s and early 1980s spent 1.2% of GDP on federal R&D, funding the invention of the Digital Age. Tax cuts on income and capital gains provided the incentive for entrepreneurs to bet on these new technologies, creating the longest peacetime expansion in American history.

“Supply-side economics,” the watchword of the Reagan Administration, meant that producing more goods more efficiently was the cure for inflation—not monetary policy alone. Now the supply side of the US economy is getting worse, not better.

The Biden Administration's $52 billion subsidy for domestic chip production has a reasonable justification on national security grounds, but it won't do anything for US productivity. It doesn't matter to General Motors whether it buys chips made in Taiwan or Texas. As long as US productivity lags, inflation will persist.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment