US Auto Industry Scam: Overpriced Parts, Repairs

Date

5/16/2024 3:24:05 PM

(MENAFN- Asia Times)

The US auto industry overcharges consumers for motor vehicle parts, while pricing vehicles outside the

range of most US households. That keeps profit margins high on new vehicles. Sales of new passenger cars and trucks are stagnant, but the industry compensates by selling expensive parts to consumers who keep their vehicles on the road longer.

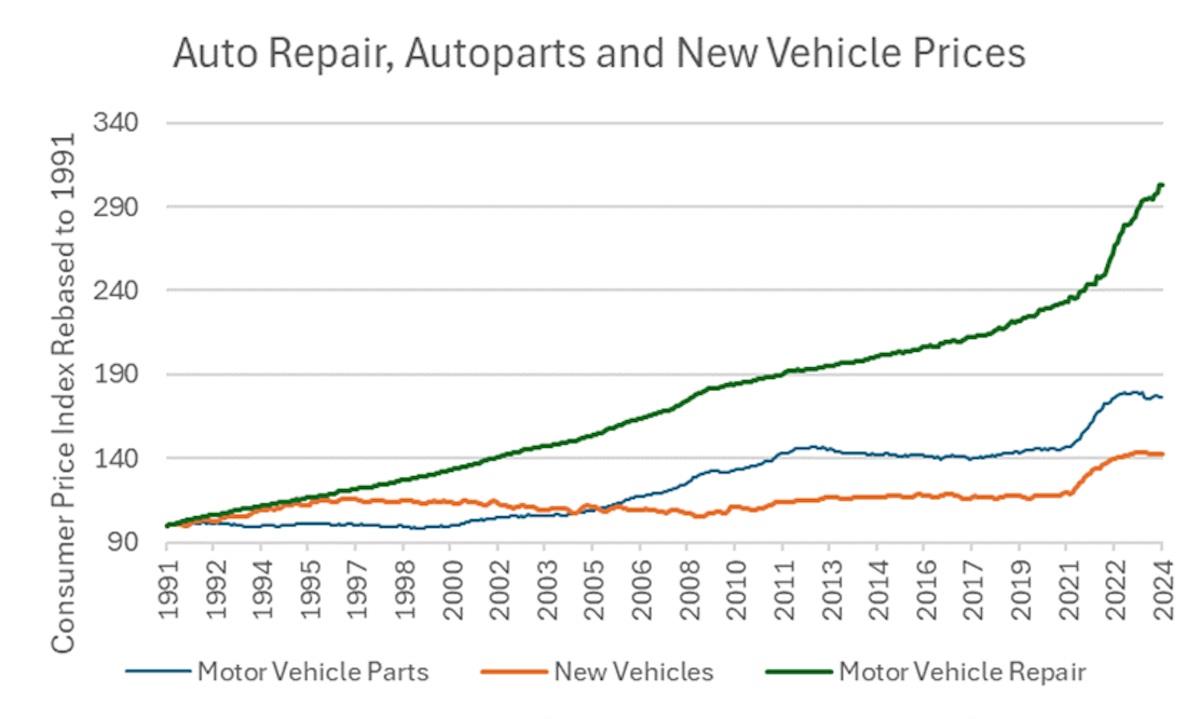

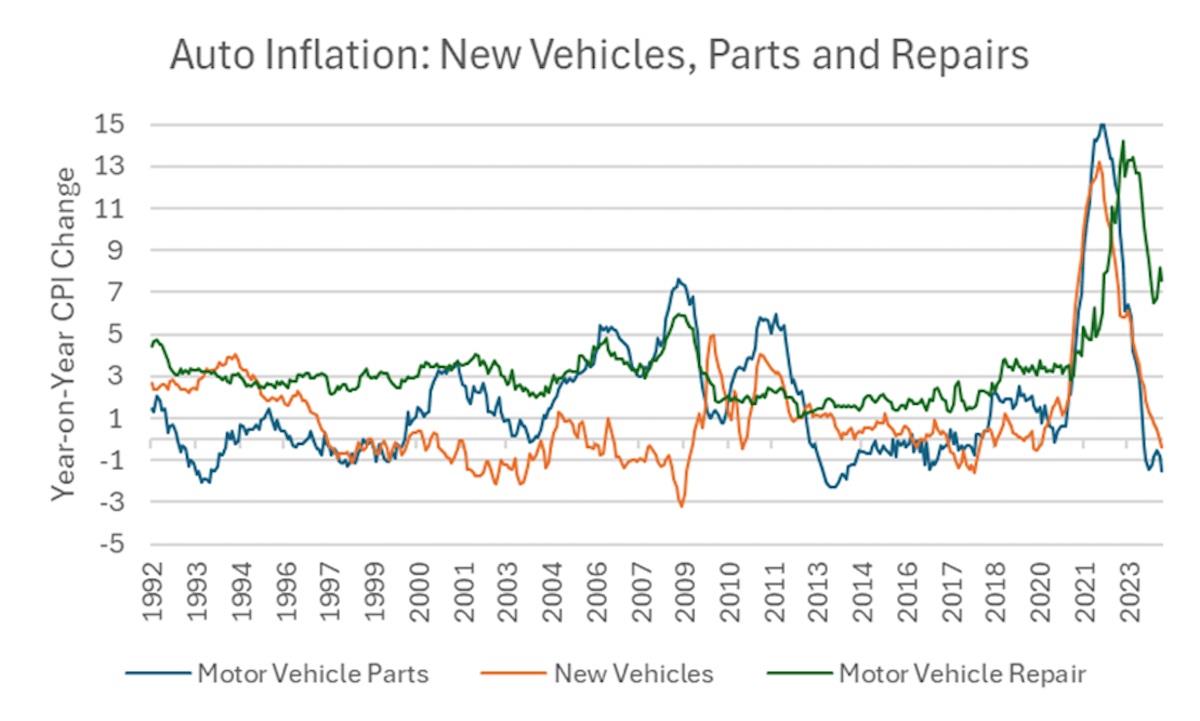

The cost of a new car has risen by about 40% since 1991, while the cost of repair parts has nearly doubled, as the above chart shows. The cost of auto repair, meanwhile, has tripled.

Nearly three-quarters of Americans depend on their cars to get to work, according to

Statista .

For most commuters, public transport isn't an option. American cities lack the

infrastructure to move people to their jobs.

Total revenues of US auto producers were a bit over $1.5 trillion in 2023, including parts sales of $230 billion, according to

KPMG . But the profit margin on parts was 32%, the accounting firm reckons, vs. a margin of 24% on new vehicles.

By redesigning parts every year or two, the automakers keep them proprietary, scarce and expensive, forcing consumers to pay up for original equipment.

The proliferation of new proprietary parts, in turn, pushes up repair costs, because specialized skills are required to install them. Training of auto mechanics has lagged behind the automakers' aggressive marketing of proprietary parts.

China's 150 automakers, by contrast, use standardized parts that are cheap and widely available, keeping repair costs low.

China's burgeoning EV industry, which offers well-made vehicles at a fraction of the cost of Western manufacturers, puts America in a dilemma. To a considerable extent, the American auto industry is a conspiracy to defraud the public, and inexpensive imports would

alleviate the crushing impact of transport costs on family budgets. But Chinese imports

would wipe out the American industry, just as Japanese

and German

imports destroyed Britain's auto industry

a generation ago.

Latest stories

Dit, dah, dit: Russia's army still uses Morse code

China floats world's first drone aircraft carrier

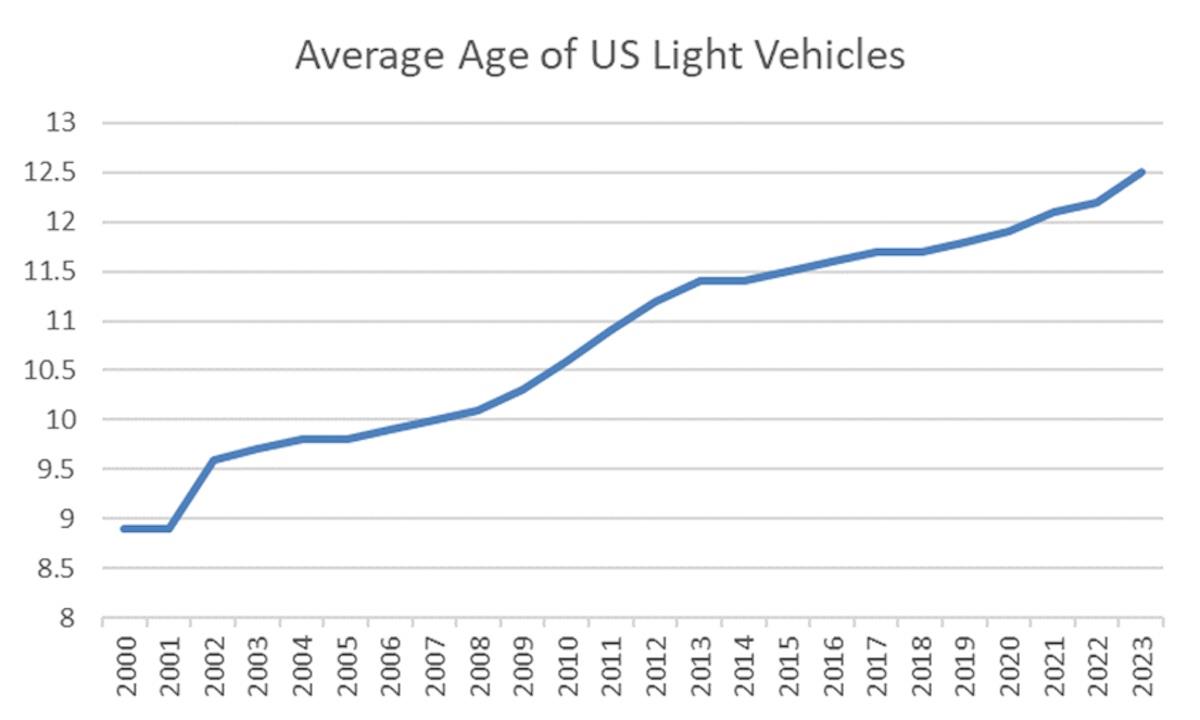

The Big Tariff era is here The average age of US light passenger vehicles rose from 9 years in 2000 to 12.5 years in 2023. It rose fastest during the economic downturn after 2008, and after the Covid recession of 2021.

The average age of Chinese cars, by contrast, is 5.3 years. America is a mature market, to be sure, and China has an enormous reserve of first-time car buyers. But Chinese auto prices are falling due to

factory automation and economies of scale, and repair costs in China show little or no inflation, according to sources in the

mainland.

China's Consumer Price Index for“vehicle use and maintenance,” the closest equivalent, has been virtually unchanged since 2007.

Automation and production in scale explain why Chinese car prices are falling while US prices are rising:

An EV is an inherently simpler mechanism than than an internal combustion engine vehicle,

with 20 moving parts vs 200 moving parts in an ICE.

The enormous difference in repair costs, though, is the result of what

auto engineer

Alan Smith

calls“parts churn” – the

deliberate de-standardization of parts by auto manufacturers to force consumers to buy expensive components from the manufacturer.

I referred to his LinkedIn post on parts churn in a

May 13 commentary , but his account deserves more elaboration.

Most Americans can't afford new cars at an average price of $47,000, so they patch up their old ones. Between 2012 and 2012, the finance rate for a four-year new car loan ranged between 4% and 5%. In January 2024 it was 8.5%. That's $948 per month assuming a $5,000 down payment. In 2019, the average cost of a car was $37,000, the interest rate was 4%, and the monthly payment was $723.

The average cost of insurance meanwhile rose from $1,470 in in 2019 to $2,543 in 2024. That's another $90 a month. The cost of owning a new car, that is, has risen on average 7.5% a year each year since 2019.

It's no surprise that America's car fleet continues to age: Consumers keep their clunkers running rather than pay

another $300 per month per vehicle over the 2019 cost. There's no escaping auto inflation, though: New car prices are exorbitant, but the cost of maintaining the clunker is even steeper.

New car price inflation peaked at 13% year-on-year in 2022 and has fallen sharply since then. But inflation in auto repair, which reached 15% in 2022, remains at around 8% year-on-year.

As Alan Smith explains:

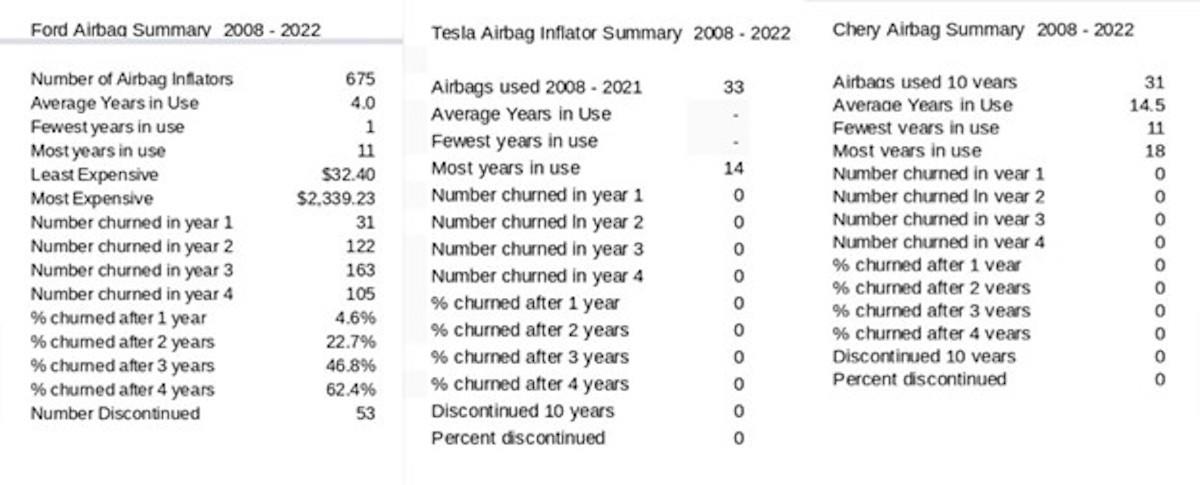

Smith appends the following table showing the degree of churn for a single part, namely airbag inflators. Between 2008 and 2022, for example, Ford Motor produced 675 different inflators, using them for between 1 and 4 years. The price of the part rose from $32.40 to $2,339.23. That helps explain the aftermarket profit margin for auto companies.

The simplest way to eliminate the auto industry's predatory practices, of course, would be

to

open the floodgates to imports.

But the demise of America's largest manufacturing industry would be devastating for the country's manufacturing base.

Donald Trump's proposed solution probably is best: Put a steep tariff on Chinese auto imports, whether

they come directly from China or via third countries like Mexico, but invite Chinese automakers to build plants in the United States and employ American workers.

Sign up for one of our free newsletters The Daily ReportStart your day right with Asia Times' top stories AT Weekly ReportA weekly roundup of Asia Times' most-read stories

China sells well-made compact cars like BYD's Seagull for under $10,000, roughly the cost of a down payment on a new American car.

Inviting Chinese automakers to build plants in the US might be the quickest way to raise the living standards of US working families.

Already have an account?Sign in Sign up here to comment on Asia Times stories OR Thank you for registering!

An account was already registered with this email. Please check your inbox for an authentication link.

MENAFN16052024000159011032ID1108223782

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.