403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

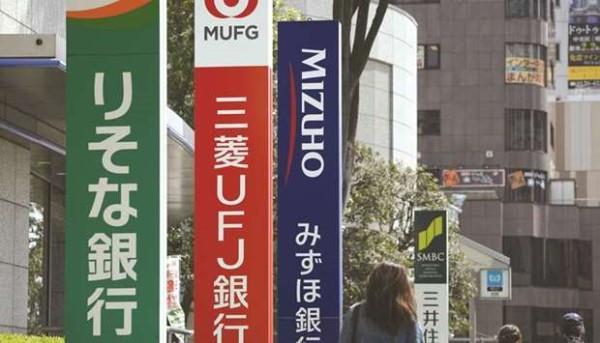

From Japan to India, why investors shun bank shares in Asian markets

(MENAFN- Gulf Times) Investors who bet on a good year for financial shares in Asia have so far seen disappointment.

After helping lead the region's surge through January's peak, spurring a clutch of positive recommendations from sell-side analysts at firms including Morgan Stanley, the sector quickly came crashing back down.

Despite a recent rally, financial shares are down 7.2% in 2018. Valuations have fallen below their five-year average, recently hitting their lowest level in more than 1 1/2 years.

Asia's lenders including Mitsubishi UFJ Financial Group Inc and KB Financial Group Inc are being pressured, with shares suffering from ultra-low interest rates in Japan eating into profit margins, the Trump Administration's tariffs, China's deleveraging efforts and an ongoing investigation of Australia's banking industry. The plunge in Indian financial shares on Friday also roiled the nation's stock market.

While some market participants say value may be emerging in some areas, they're still cautious on the outlook.

'Asian investors are saying why add now when you could wait? said Sean Taylor, chief investment officer for Asia Pacific at DWS Group. 'Who knows what's happening with Trump. And the sentiment is against it.

Japan and South Korea stand out for having the cheapest financial stocks in the region, partly because of low expectations for margin expansion amid consistent low interest rates in the countries.

While a glimpse of hope came in July for Japan, when the central bank said it would let the 10-year bond yield climb to 0.2%, scepticism remains. The nation's lenders remain down 7.8% this year, with Mitsubishi UFJ Financial, the biggest one in the Topix index, losing 13%.

'Long-term underperformance of Japanese financials arose from heightened risk perception about their investments in high- yielding foreign bonds, said Manishi Raychaudhuri, BNP Paribas SA's head of equity research in Asia Pacific. 'With pedestrian domestic growth and depressed inflation, the central bank understandably stays away from raising rates and that limits expectations about increase in interest margins.

In South Korea, growth in new loans and net-interest margins has been slow because of the government's efforts to reduce mortgages and tighten banks' finances, according to Hyun-Su Kim, a fund manager at IBK Asset Management in Seoul. He's neutral on the sector. KB Financial Group Inc, the country's major banking institution, and peer Shinhan Financial Group Co have lost more than 10% this year, compared with a 5.2% decline in the benchmark Kospi index.

The factors that boosted Chinese banking shares before the market crash earlier this year have evaporated, said Shujin Chen, chief financial analyst at Huatai Securities Co in Hong Kong. With a trade war against the US and an economy that's losing momentum, net-interest margins may peak soon and non- performing loans might worsen, she added.

That said, the downside is likely to be limited as the plunge in valuations shows investors have already priced in the possibility of crisis in China, Chen said.

'The sector may trade range-bound in the future, Chen said. 'People are quite pessimistic in the near term, and it's just too difficult to make calls on these macro uncertainties.

India has been battling for years to clean up its lenders' bad debt in a campaign that is seen as a catalyst for the sector's long-term performance. The government's latest attempt a proposal last week to merge Vijaya Bank and Dena Bank with Bank of Baroda raised concerns for some large state-owned lenders, with investors worrying such solutions risk eroding the buyers' capital buffers and swelling their bad debt.

'The sector needs consolidation, but it's not so good for large listed banks involved because that bank has to absorb the non-performing assets of smaller banks, said BNP Paribas's Raychaudhuri, who prefers private lenders in the country as they are gaining more market share.

Friday was especially brutal for the sector, with the NSE Nifty Bank Index ending the week down 5.8%, the most since February 2016. Yes Bank Ltd tanked after the nation's banking regulator refused to extend the tenure of the lender's chief executive officer, while Dewan Housing Finance Corp plunged 43% Friday, its steepest loss on record, amid speculation a debt default by a shadow bank may spread to other lenders.

Down Under, bank investors need to worry not only about a lack of growth, but also about an ongoing investigation of the industry after a public inquiry uncovered wrongdoing ranging from taking bribes to falsifying documents and lying to regulators. DWS's Taylor also mentioned the sector's high exposure to the property market is a risk.

'That's the market that I would be more concerned about its property market, he said. He is underweight Australia's banks. 'There is a lot of leverage in there, and that's banks' main earner.

Margins at Australian banks are getting squeezed by higher borrowing costs amid Federal Reserve policy tightening. Westpac Banking Corp, one of the nation's biggest lenders, is down 10% this year, and while it raised home mortgage rates last month a move that other peers may follow analysts say its net-interest margin won't recover completely.

After helping lead the region's surge through January's peak, spurring a clutch of positive recommendations from sell-side analysts at firms including Morgan Stanley, the sector quickly came crashing back down.

Despite a recent rally, financial shares are down 7.2% in 2018. Valuations have fallen below their five-year average, recently hitting their lowest level in more than 1 1/2 years.

Asia's lenders including Mitsubishi UFJ Financial Group Inc and KB Financial Group Inc are being pressured, with shares suffering from ultra-low interest rates in Japan eating into profit margins, the Trump Administration's tariffs, China's deleveraging efforts and an ongoing investigation of Australia's banking industry. The plunge in Indian financial shares on Friday also roiled the nation's stock market.

While some market participants say value may be emerging in some areas, they're still cautious on the outlook.

'Asian investors are saying why add now when you could wait? said Sean Taylor, chief investment officer for Asia Pacific at DWS Group. 'Who knows what's happening with Trump. And the sentiment is against it.

Japan and South Korea stand out for having the cheapest financial stocks in the region, partly because of low expectations for margin expansion amid consistent low interest rates in the countries.

While a glimpse of hope came in July for Japan, when the central bank said it would let the 10-year bond yield climb to 0.2%, scepticism remains. The nation's lenders remain down 7.8% this year, with Mitsubishi UFJ Financial, the biggest one in the Topix index, losing 13%.

'Long-term underperformance of Japanese financials arose from heightened risk perception about their investments in high- yielding foreign bonds, said Manishi Raychaudhuri, BNP Paribas SA's head of equity research in Asia Pacific. 'With pedestrian domestic growth and depressed inflation, the central bank understandably stays away from raising rates and that limits expectations about increase in interest margins.

In South Korea, growth in new loans and net-interest margins has been slow because of the government's efforts to reduce mortgages and tighten banks' finances, according to Hyun-Su Kim, a fund manager at IBK Asset Management in Seoul. He's neutral on the sector. KB Financial Group Inc, the country's major banking institution, and peer Shinhan Financial Group Co have lost more than 10% this year, compared with a 5.2% decline in the benchmark Kospi index.

The factors that boosted Chinese banking shares before the market crash earlier this year have evaporated, said Shujin Chen, chief financial analyst at Huatai Securities Co in Hong Kong. With a trade war against the US and an economy that's losing momentum, net-interest margins may peak soon and non- performing loans might worsen, she added.

That said, the downside is likely to be limited as the plunge in valuations shows investors have already priced in the possibility of crisis in China, Chen said.

'The sector may trade range-bound in the future, Chen said. 'People are quite pessimistic in the near term, and it's just too difficult to make calls on these macro uncertainties.

India has been battling for years to clean up its lenders' bad debt in a campaign that is seen as a catalyst for the sector's long-term performance. The government's latest attempt a proposal last week to merge Vijaya Bank and Dena Bank with Bank of Baroda raised concerns for some large state-owned lenders, with investors worrying such solutions risk eroding the buyers' capital buffers and swelling their bad debt.

'The sector needs consolidation, but it's not so good for large listed banks involved because that bank has to absorb the non-performing assets of smaller banks, said BNP Paribas's Raychaudhuri, who prefers private lenders in the country as they are gaining more market share.

Friday was especially brutal for the sector, with the NSE Nifty Bank Index ending the week down 5.8%, the most since February 2016. Yes Bank Ltd tanked after the nation's banking regulator refused to extend the tenure of the lender's chief executive officer, while Dewan Housing Finance Corp plunged 43% Friday, its steepest loss on record, amid speculation a debt default by a shadow bank may spread to other lenders.

Down Under, bank investors need to worry not only about a lack of growth, but also about an ongoing investigation of the industry after a public inquiry uncovered wrongdoing ranging from taking bribes to falsifying documents and lying to regulators. DWS's Taylor also mentioned the sector's high exposure to the property market is a risk.

'That's the market that I would be more concerned about its property market, he said. He is underweight Australia's banks. 'There is a lot of leverage in there, and that's banks' main earner.

Margins at Australian banks are getting squeezed by higher borrowing costs amid Federal Reserve policy tightening. Westpac Banking Corp, one of the nation's biggest lenders, is down 10% this year, and while it raised home mortgage rates last month a move that other peers may follow analysts say its net-interest margin won't recover completely.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment