Bitcoin Euphoria Soars To $100K, But Expert Predicts A $95K Pullback

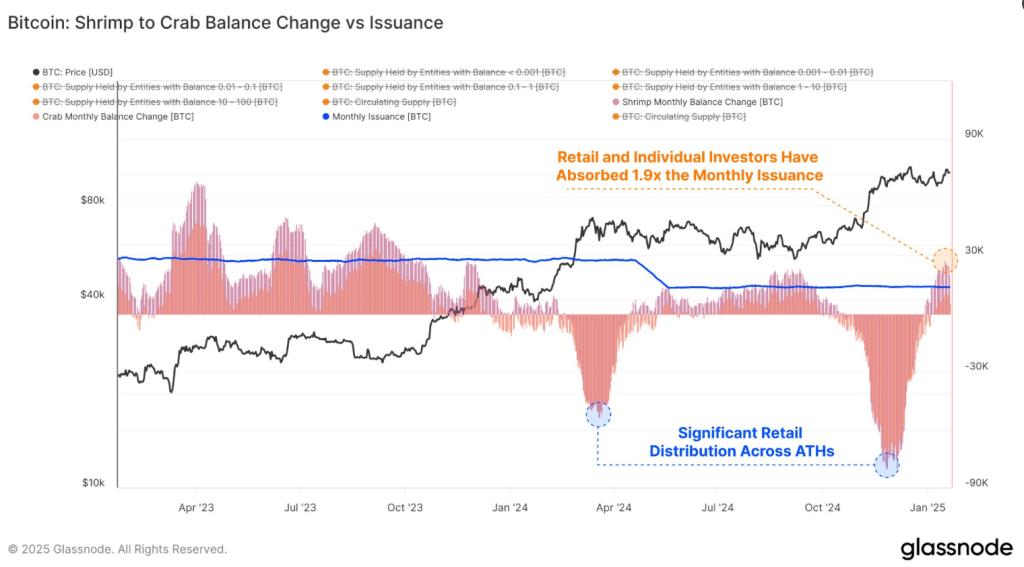

Small-scale investors, often referred to as “Shrimps” and“Crabs,” have been actively purchasing Bitcoin . According to Glassnode , these categories of investors have accumulated an impressive 25,600 BTC over the past month, nearly doubling the quantity of newly mined Bitcoin during that same timeframe. This indicates a robust appetite for the“digital gold” amid its price surges.

This buying activity from smaller investors suggests a broader enthusiasm among retail participants. Nonetheless, experts advise caution. Despite the impressive accumulation, the influence of short-term holders (STHs) dominating this trend could present risks to market stability.

Risks Associated with Short-Term HoldersSTHs are known for quickly capitalizing on minor market dips to secure profits, making them sensitive to market fluctuations. This behavior can amplify selling pressure, especially during unexpected volatility in Bitcoin prices. Market analyst Teddy emphasized that the prevalence of STHs could significantly impact short-term price movements.

Historically, markets show increased sensitivity to negative trends when STHs are involved. Analysts are recommending that investors exercise caution given the current circumstances.

Glassnode Observations: Bitcoin 's Restricted Range

Glassnode has also noted an unusually narrow price range for Bitcoin over the last 60 days, a phenomenon historically indicative of impending volatility.

This aligns with previous trends that imply a potential breakout or breakdown is on the horizon. While the sustained $100,000 mark suggests bullish sentiment, the compressed range introduces a degree of unpredictability.

Is a Pullback Imminent?

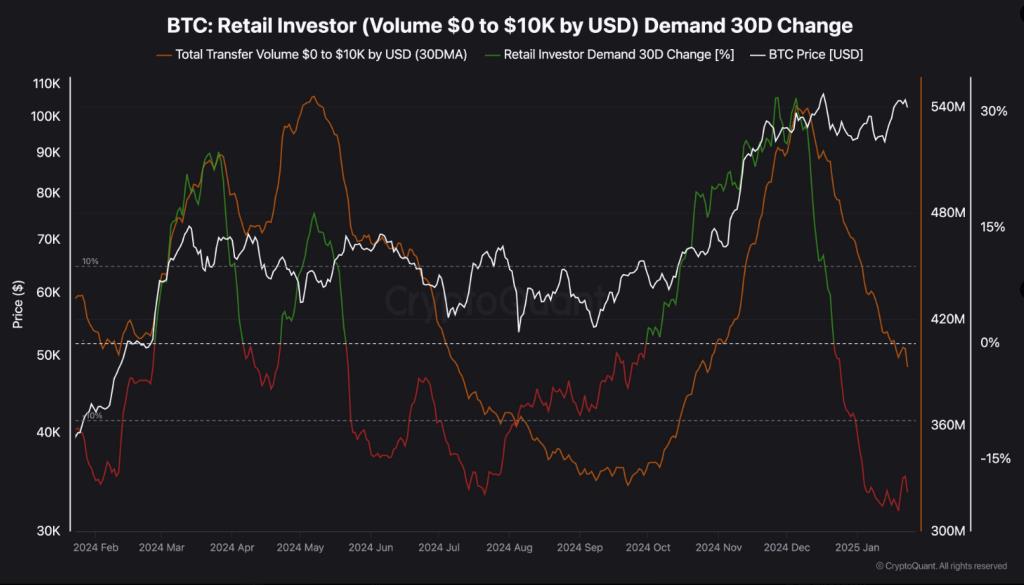

Considering these conditions, some analysts believe Bitcoin may be primed for a minor price correction soon. Experts like market veteran Michaël van de Poppe anticipate a potential decline to $95,000 , largely attributed to STHs potentially cashing in amidst market uncertainties.

As it stands, retail demand continues to provide solid support at the $100,000 level. However, investors should prepare for possible volatility and remain attentive to market signals. With Bitcoin trading near its all-time high, the interplay of retail enthusiasm and market risks will dictate its forthcoming movements.

At the time of this report, Bitcoin was valued at $105,141, reflecting an increase of 3.2% both daily and weekly.

Featured image sourced from Vecteezy, chart data from TradingView

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk.

Don't invest unless you're prepared to lose all the money you invest.

This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment