BRC-2.0 Bitcoin Tokens May Eclipse Runes

Join me on X for the latest Bitcoin insights

In a recent announcement , Best in Slot , an infrastructure firm supporting popular Bitcoin wallets and applications like Xverse and Liquidium, has disclosed an upgrade for BRC-20 tokens.

The upgrade, referred to as BRC2.0, is anticipated to launch on the Bitcoin Testnet in the first quarter of 2025, aiming to introduce“smart contracts” to BRC-20s, thereby enabling competition with Bitcoin 's sidechain architectures.

Announcement from Best In Slot

Essentially, the“BRC20 Programmable Module” aims to“unlock limitless new applications for native Bitcoin assets-including seamless DeFi, Real-World Assets (RWAs), Decentralized Autonomous Organizations (DAOs), stablecoins, and much more-without depending on multisig bridges or second-layer solutions.”

Having spent several years in this sector, it's apparent we've encountered similar pledges before. However, metaprotocols distinguish themselves by being entirely on-chain, as opposed to relying on separate chains with new trust dynamics. While metaprotocols may not be the ultimate solution for decentralizing Bitcoin 's token economy, they do represent a promising beginning.

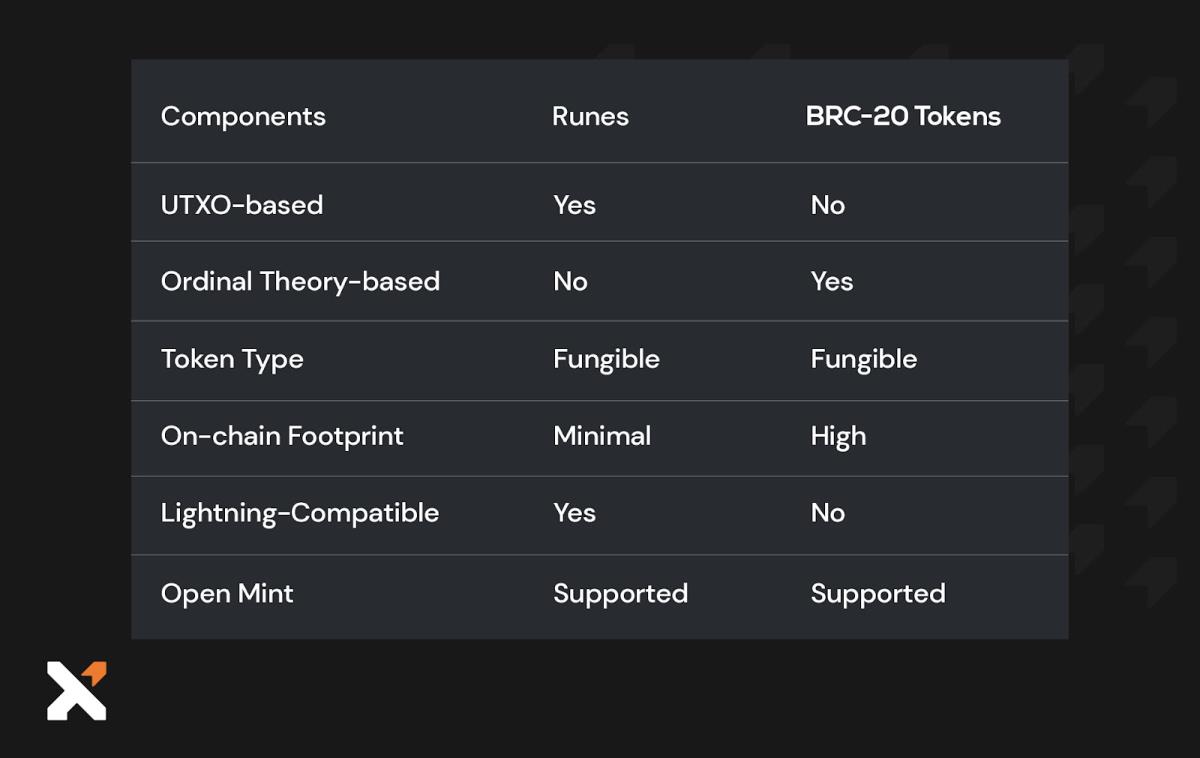

Runes faced exceedingly high expectations prior to their launch, presenting a potential opportunity for BRCs to regain momentum. Regardless of your perspective on Bitcoin tokens, the competition between various standards is likely to yield greater efficiency and decrease on-chain bloating-something everyone can agree is necessary.

The pressing question remains: for everyday Bitcoin adopters who view Bitcoin strictly as a monetary network, do we need to revisit this cycle? On-chain congestion, ineffective pump-and-dump schemes, and soaring transaction fees are all concerns...

My response is a resounding yes!

Source: Mempool

The mempool has remained“inactive” for most of the past six months.

Firstly, as Bitcoin enthusiasts, we are advocates for free-market principles. Welcoming more fee-paying users is arguably the most favorable outcome for the longevity of Bitcoin . With miners having just undergone a halving, maintaining mining profitability is essential to prevent centralization, whether by governments or financial markets-it's crucial to remember that miners' unlimited borrowing to acquire machines won't endure forever.

For reference, CoinDesk indicates that Solana validators amassed a remarkable 100,000 SOL , amounting to around $25.8 million, in fees and tips spurred by vigorous trading of the TRUMP and MELANIA tokens.

Secondly, the door has already been opened. Tokens on Bitcoin are a permanent facet. If users want more programmability, who has the jurisdiction to halt it? (Aside from anti-censorship advocates, of course.)

As Bitcoin 's ecosystem advances, the rollout of the BRC-20 upgrade presents strong arguments for why this might outshine the Runes token standard. Here are some compelling reasons:

The main appeal of BRC2.0 is its potential to boost efficiency. With the incorporation of smart contract functionalities, BRC-2.0 tokens can manage complex operations directly on the Bitcoin blockchain, possibly minimizing the reliance on additional layers or sidechains. This could result in more streamlined transactions, alleviating the on-chain bloat that Runes have been criticized for due to prior hype and consequential congestion. This enhanced efficiency could revolutionize Bitcoin 's scalability, delivering a more effective method for tokenization without compromising the security or decentralization of the core protocol. BRC2.0 is built to work with the existing Bitcoin ecosystem. Collaborations with entities like the Layer 1 Foundation could streamline user experience and enhance interoperability. Unlike Runes, which struggled with user acceptance due to complicated minting processes and poor UX, BRC2.0 seeks to offer a more user-friendly approach for token creation and engagement. This could foster broader adoption, making Bitcoin increasingly appealing to developers and users alike.My default approach towards innovations in Bitcoin is cautious optimism. We will need to await the specifics of this new protocol, but I am eager about the potential for more efficient DeFi applications within Bitcoin -not on subordinate chains.

If you're still doubtful, ponder this question: If the existence of tokens on Bitcoin is inevitable, which scenario is less favorable?

-

Metaprotocols utilizing Bitcoin 's block space in exchange for fees, without modifying the network's foundational rules?

Or Bitcoin enthusiasts transitioning their carefully secured Bitcoin to centralized, competing blockchains to access identical token markets?

As a staunch Bitcoin advocate, I yearn for all the fee income. I desire every user. Bitcoin advocates should champion FEE REVENUE MAXIMIZATION, provided the essential principles of the foundational network remain intact (with an eye on feline enthusiasts).

In summary:

-

Observe closely what BRC2.0 has in store. Will it genuinely become programmable to the degree that Bitcoin users can trust it?

Runes might become obsolete if BRCs genuinely rebound, especially with enhanced user experience.

Source: Xverse Blog

-

Let miners thrive with high transaction fees.

Tokens on Bitcoin that don't alter the existing rules are preferable to those that demand new opcodes or modified regulations.

Thankful for all the brilliant developers working on Bitcoin applications instead of vaporware projects.

This article represents a Take . The views expressed are solely those of the author and do not necessarily represent the views of BTC Inc or Bitcoin Magazine.

The topics and companies discussed in my articles may be included in my firm's investment portfolio (UTXO Management ). The opinions shared are strictly my own and do not represent those of my employer or its affiliates. I do not receive financial compensation for these insights. Readers should consider this content informational and not as financial advice or endorsement of any specific company or investment. Always conduct your research before making financial choices.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk.

Don't invest unless you're prepared to lose all the money you invest.

This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment