(MENAFN- SWNS Digital)

By Livy Beaner // SWNS

NEWS COPY W/ video + INFOGRAPHIC

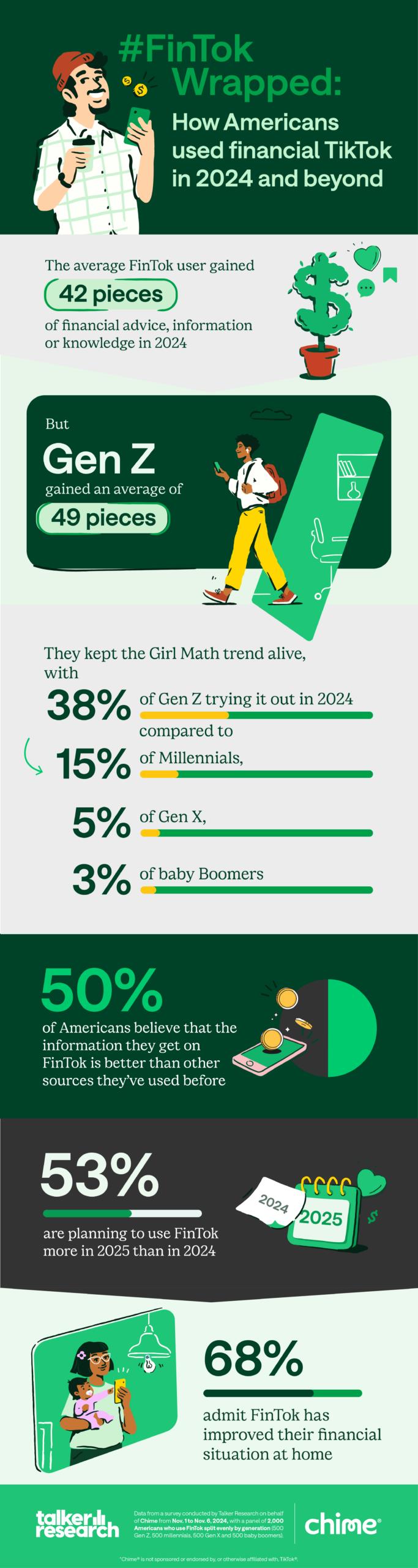

TikTok isn't just for showing off your dance moves. financial TikTok users have gained 42 pieces of financial knowledge from the platform throughout 2024, according to new research.

The survey polled 2,000 Americans who use FinTok - the financial side of TikTok - split evenly by generation.

According to the results, the younger generations are taking advantage of what's at their fingertips, as Gen Z gained an average of 49 pieces of financial advice, information or knowledge; whereas millennials gained 44, while baby boomers trailed with an average of 32 pieces.

Prior to FinTok's existence, respondents typically got their financial advice from family members (47%) or friends (40%).

Still, back then, Americans were more likely to head to other social media sites for information (40%) than they were financial websites or blog posts (37%).

More than a quarter of Gen Z (27%) even learned about finances in school or an educational setting, nearly four times as many as Gen X or baby boomers (both 8%).

Considering all the different sources, today, 50% believe that the information they get on FinTok is better than other platforms they've used.

Conducted by Talker Research on behalf of banking app Chime , the survey looked to uncover how Americans are utilizing TikTok, and FinTok specifically, to beef up their money moves - and explored the popular trends throughout 2024.

In 2024, FinTok users experimented with“side hustling” (38%) and tried the“pay off debt trend” (25%). Others sought out modern concepts and trends like“passive income” (25%),“crypto investing” (20%) and“cash stuffing” (17%).

The“no spend challenge” (20%) and“100 envelope method” (16%) were also on respondents' radars this year.

Typically, Americans stick with a new trend for an average of four weeks, and of the FinTok trends tried in 2024, Americans found an average of 44% to be successful.

“Success” isn't just defined by seeing benefits (46%), but also learning something new (36%) or feeling more confident in their financial ability (33%).

Despite less than a 50% success rate on specific trends, nearly two-thirds of all respondents (65%) feel more financially secure since using FinTok.

Another 68% even admit that it has improved their financial situation at home; this may be why 53% are planning to use FinTok more in 2025 than they did in 2024.

“Budgeting/saving” (25%),“investing” (24%),“credit/credit scores” (22%),“inflation” (20%) and“cash flow” (19%) were the most searched terms on FinTok this year.

Despite Gen Z being known as the 'TikTok Generation,' results found that just 15% of Gen Zers have never met with a financial advisor or bank worker in person, compared to 27% of baby boomers.

“It's clear that while trust levels are still growing when it comes to FinTok, many are embracing and integrating it into their everyday lives. Results found that respondents will be using FinTok to get out of debt (37%), start a business (19%) or even to file their taxes (16%),” said Janelle Sallenave, Chief Spending Officer at Chime.“The digital age is here and it's here to stay.”

Nearly one-third (32%) admit they're embarrassed about asking their loved ones for financial guidance, yet another 48% believe that they have more financial knowledge than the other people in their lives.

In fact, 76% are open with their friends and family about using FinTok for financial planning. Interestingly, millennials are the most open generation, as 36% are“very open” about their FinTok usage, compared to just 24% of baby boomers.

FinTok or otherwise, 44% of Americans polled agree that those who are not on social media are doing themselves a disservice, not just financially but culturally.

“Social media has claimed its stake in American culture and society. What was once just chatrooms and a bunch of selfies has now become a wealth of knowledge for every type of person,” said Rianka R. Dorsainvil, Chime's Consumer Certified Financial Planner.“FinTok is the perfect example of how social media has evolved in a rather short period of time, and it's a great opportunity to both learn new things and expand your current knowledge.”

Survey methodology:

Talker Research surveyed 2,000 Americans who use FinTok split evenly by generation (500 Gen Z, 500 millennials, 500 Gen X and 500 baby boomers); the survey was commissioned by Chime and administered and conducted online by Talker Research between Nov. 1 and Nov. 6, 2024.

We are sourcing from a non-probability frame and the two main sources we use are:

Traditional online access panels - where respondents opt-in to take part in online market research for an incentive

Programmatic - where respondents are online and are given the option to take part in a survey to receive a virtual incentive usually related to the online activity they are engaging in

Those who did not fit the specified sample were terminated from the survey. As the survey is fielded, dynamic online sampling is used, adjusting targeting to achieve the quotas specified as part of the sampling plan.

Regardless of which sources a respondent came from, they were directed to an Online Survey, where the survey was conducted in English; a link to the questionnaire can be shared upon request. Respondents were awarded points for completing the survey. These points have a small cash-equivalent monetary value.

Cells are only reported on for analysis if they have a minimum of 80 respondents, and statistical significance is calculated at the 95% level. Data is not weighted, but quotas and other parameters are put in place to reach the desired sample.

Interviews are excluded from the final analysis if they failed quality-checking measures. This includes:

Speeders: Respondents who complete the survey in a time that is quicker than one-third of the median length of interview are disqualified as speeders

Open ends: All verbatim responses (full open-ended questions as well as other please specify options) are checked for inappropriate or irrelevant text

Bots: Captcha is enabled on surveys, which allows the research team to identify and disqualify bots

Duplicates: Survey software has“deduping” based on digital fingerprinting, which ensures nobody is allowed to take the survey more than once

It is worth noting that this survey was only available to individuals with internet access, and the results may not be generalizable to those without internet access.

MENAFN26122024003911003267ID1109031339

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.