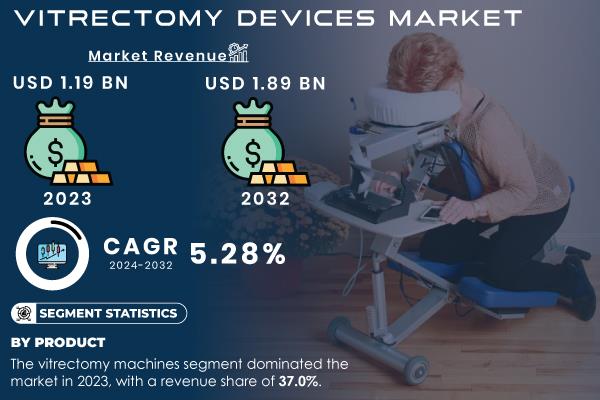

Global Vitrectomy Devices Market Size Projected To Grow To USD 1.89 Billion By 2032, With A CAGR Of 5.28% - S&S Insider

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.19 Billion |

| Market Size by 2032 | US$ 1.89 Billion |

| CAGR | CAGR of 5.28% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Do you have any specific queries or need any customization research on Vitrectomy Devices Market, Enquire Now@

Segment Analysis

By Product

The vitrectomy machines segment dominated the market in 2023, accounting for 37% of the revenue share. This dominance can be attributed to the continual improvements in machine capabilities, including advancements in fluidic management, cutting speed, and intraocular pressure control, making these devices essential for high-precision surgeries. These machines are commonly used in retinal surgeries and are considered an integral part of the vitrectomy procedure.

By Application

In 2023, the macular hole segment held the largest share of the vitrectomy devices market. A macular hole, which is a tear in the central part of the retina, leads to significant visual impairment. Vitrectomy surgery is often the only effective treatment for macular holes, especially if the hole is impairing vision. The increasing prevalence of macular holes due to aging, high myopia, and trauma is a major factor driving the demand for vitrectomy devices in this segment.

By End-Use

The hospital segment led the market in 2023, accounting for the largest revenue share. Hospitals are key players in the vitrectomy devices market, as they possess the necessary infrastructure, skilled professionals, and advanced equipment required for complex eye surgeries. The growing adoption of advanced vitrectomy machines and surgical techniques in these facilities has supported this segment's growth.

Vitrectomy Devices Market Key Segmentation:

By Product

- Vitrectomy machines Vitrectomy packs Photocoagulation lasers Illumination devices

By Application

- Diabetic retinopathy Retinal detachment Macular hole Vitreous hemorrhage Others

By End-Use

- Hospitals Ophthalmic clinics Ambulatory surgical centers

Request An Analyst Call@

Regional Analysis

North America dominated the Vitrectomy Devices Market in 2023, accounting for a significant share. The region's leadership can be attributed to the high adoption of advanced surgical technologies, a robust healthcare infrastructure, and the rising incidence of retinal disorders. The U.S. holds a dominant position in the market, with many leading manufacturers of vitrectomy devices based in the country. Additionally, the growing elderly population in North America is contributing to the increasing prevalence of retinal diseases, further propelling the demand for vitrectomy procedures.

The Asia Pacific region is expected to witness the fastest growth over the forecast period. The rapid economic development in countries like China and India, coupled with an expanding healthcare infrastructure, is contributing to the rising demand for vitrectomy devices. The region also has a large population with an increasing incidence of retinal diseases due to aging and lifestyle changes. Moreover, the growing number of eye care centers and ophthalmic surgeries in countries like Japan, South Korea, and China is expected to boost the market in Asia Pacific.

Recent Developments

- In April 2024 , Carl Zeiss Meditec AG, a leading player in the ophthalmic medical devices sector, acquired the Dutch Ophthalmic Research Center (D.O.R.C.). This strategic acquisition is anticipated to strengthen Zeiss's portfolio of digital workflow solutions in the coming years, enhancing the company's position in the vitrectomy devices market. In September 2023 , BVI, a rapidly expanding and diversified surgical ophthalmic company, announced its acquisition of Medical Mix, a specialist in supplying medical devices for ophthalmic surgeries in Spain and Portugal. This acquisition aligns with BVI's strategy for growth and geographic expansion, allowing the company to broaden its reach in the European market.

Buy a Single-User PDF of Vitrectomy Devices Market Analysis & Outlook Report 2024-2032@

About Us:

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Akash Anand – Head of Business Development & Strategy ... Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment