Cetera Launches Risk-O-Meter To Help Advisors Understand And Navigate Changing Regulatory Landscape

New resource highlights compliance pressure facing financial advisors and potential election impact

SAN DIEGO, Oct. 30, 2024 /PRNewswire/ --

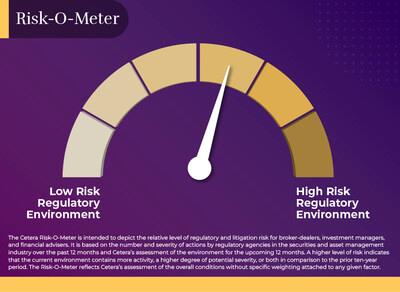

Cetera Financial Group , the premier financial advisor Wealth Hub, announced today the launch of the Cetera

Risk-O-Meter, an innovative new resource designed to help financial advisors measure and navigate developing regulatory risks in the industry. The Cetera Risk-O-Meter combines data about enforcement actions and customer claims from regulatory bodies with insights on pending regulations to provide a clear and timely picture of the challenges financial advisors face today. The tool is designed to keep Cetera advisors at the forefront of today's most pressing regulatory trends and topics, enabling advisors to stay ahead of potential compliance issues and ensuring that they can protect their businesses and continue to serve their clients most effectively.

Cetera Risk-O-Meter

Heat Map - Current

Heat Map - Democratic Administration

Heat Map - Republican Administration

"In today's rapidly changing regulatory environment, being informed is not just important-it's essential," said Mark Quinn, Director of Regulatory Affairs at Cetera. "The rules governing our industry are becoming more complex and stringent every year. At Cetera, we understand that financial advisors need to stay ahead of these changes to protect their clients and their businesses. The Cetera Risk-O-Meter is designed to provide the insights and updates advisors need to remain compliant and confident in their practice."

Key findings from the inaugural Risk-O-Meter include:

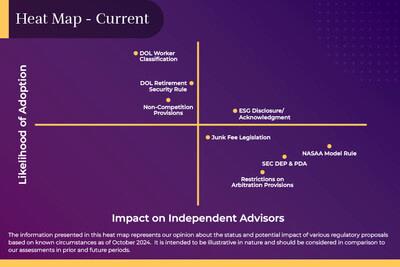

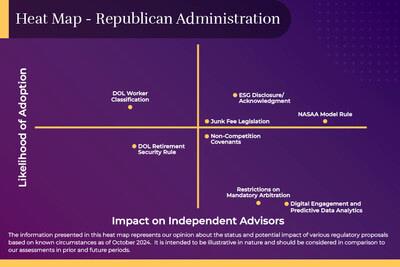

Regulatory Warming. The 2024 heat map (below) reveals several key regulatory issues that financial advisors should be watching, particularly those with a high likelihood of adoption and significant impact. Enforcement of the DOL Retirement Security Rule has been stayed by the courts, but if upheld, it will impose new and revised regulations that will reshape how advisors manage retirement accounts. The FTC has adopted regulations restricting the use of non-compete clauses in employment agreements affecting workforce management strategies. ESG disclosure requirements are also anticipated to be implemented, significantly influencing how advisors incorporate and report on ESG factors in connection with investment recommendations to clients. Among the highest-potential impact issues are changes to DOL worker classification rules, which could fundamentally alter employment practices, especially for independent contractors. Additionally, the introduction of junk fee legislation could force major adjustments in fee structures, and possible changes to SEC disclosure and pre-dispute arbitration agreements (PDAA) could profoundly impact how advisors manage client relationships and disputes.Regulatory Enforcement Actions Remain Steady Year-Over-Year. Although the regulatory environment continues to heat up, the number of regulatory enforcement actions taken by the SEC and FINRA against financial advisory firms from 2022 to 2024 to date has remained steady based on the number of press releases issued that reference financial advisory firms. SEC enforcement actions have wavered from 74 in 2022 to 66 in 2024 year to date. Similarly, FINRA actions went from 34 in 2022 to 52 in 2023 to settle back around 34 year to date. This trend underscores the steady regulatory scrutiny on the financial advisory industry, but certainly the outcome of the elections will have an impact. Looming Election Implications. The 2024 presidential election has created distinct regulatory expectations. A Democratic administration is likely to emphasize issues such as worker classification, fiduciary duties, and stricter ESG regulations. Conversely, a Republican administration might focus on reducing regulatory burdens and easing restrictions on financial practices.

"Over the past three years, there has been steady regulatory pressure, with new issues emerging while foundational topics like worker classification and fiduciary standards remain constant," Quinn continued. "As the regulatory environment continues to evolve, financial advisors must remain vigilant in their approach to compliance. By staying informed and adapting to these challenges, financial advisors can better serve their clients and uphold the integrity of the financial industry."

Visit for more information.

About Cetera

Cetera Financial Group, which is owned by Cetera Holdings (collectively, Cetera), is the premier financial advisor Wealth Hub where financial advisors and institutions optimize their control and value creation. Breaking away from a commoditized and homogenous IBD model, Cetera offers financial professionals and institutions the latest solutions, support, and services to grow, scale, or transition with a merger, sale, investment, or succession plan. Cetera proudly serves independent financial advisors, tax professionals, licensed administrators, large enterprises, as well as institutions, such as banks and credit unions, providing an established and repeatable blueprint for scalable growth.

Home to approximately 12,000 financial professionals and their teams, Cetera oversees more than $521 billion in assets under administration and $224 billion in assets under management, as of June 30, 2024. In a recent advisor satisfaction survey of nearly 35,000 reviews, Cetera's Voice of Customer (VoC) program vigorously measures advisor experience and satisfaction 24/7. Currently, it's ranked 4.8 out of 5 stars.

Visit

, and follow Cetera on

LinkedIn ,

YouTube ,

X , and

Facebook .

"Cetera Financial Group" refers to the network of independent retail firms encompassing, among others, Cetera Investment Advisers LLC, a registered investment adviser, and the following FINRA/SIPC members: Cetera Advisors LLC, Cetera Advisor Networks LLC, Cetera Investment Services LLC (marketed as Cetera Financial Institutions or Cetera Investors), and Cetera Financial Specialists LLC. Located at: 655 W. Broadway, 11th Floor, San Diego, CA

92101.

SOURCE Cetera Financial Group

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE? 440k+Newsrooms &

Influencers 9k+

Digital Media

Outlets 270k+

Journalists

Opted In GET STARTED

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment