Closing The Gender Gap In Msmes Key To Expanding Financial Inclusion: RBI's Swaminathan

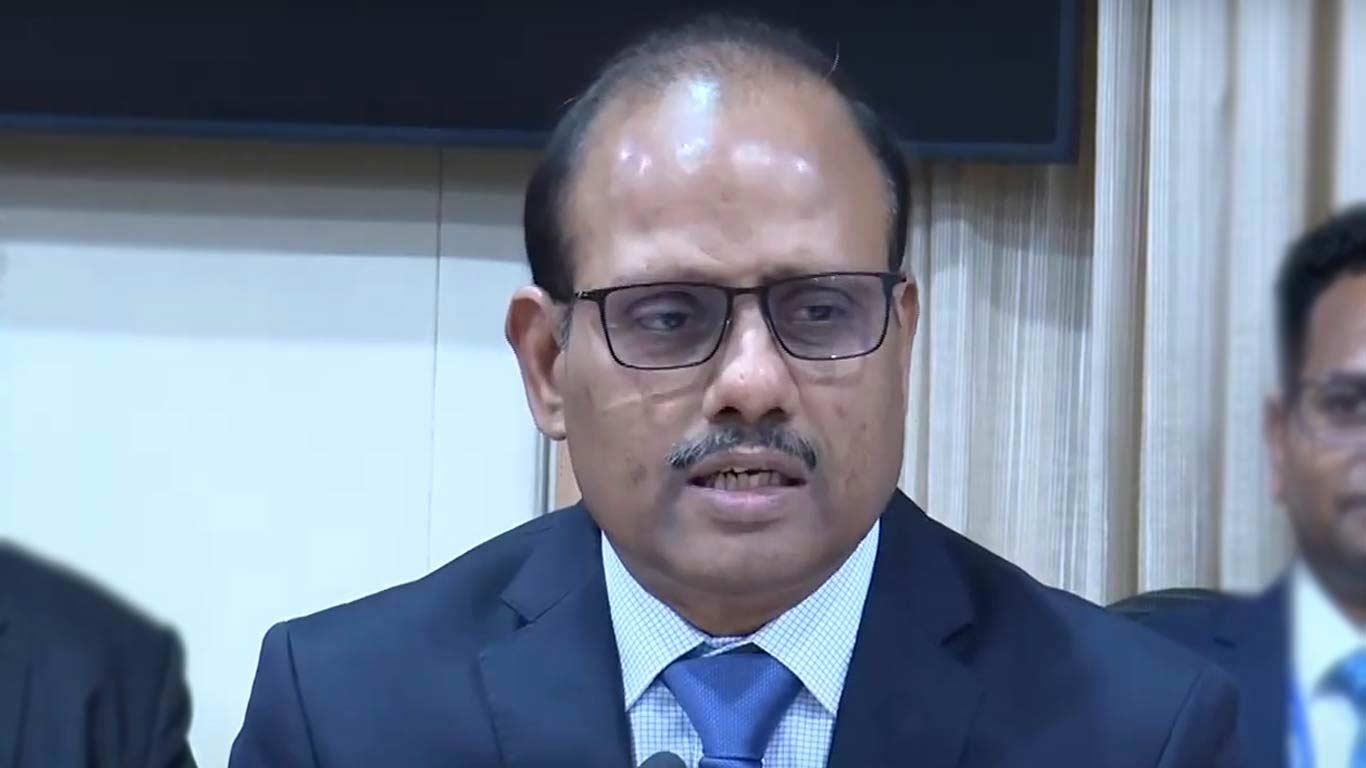

Reserve Bank of India (RBI) Deputy Governor Swaminathan J has highlighted the need to bridge the gender gap in the Micro, Small and Medium Enterprises (MSME) sector as a crucial step towards expanding banking and financial services across India.

Speaking at a conference in Hubballi, Karnataka, on Wednesday, Swaminathan emphasised the importance of MSMEs in realising India's demographic dividend and stressed the need to increase female labour participation.

"Businesses with at least one woman founder tend to have a more inclusive work culture, employ more women than men, and generate more revenue," Swaminathan stated, citing various studies.

However, he noted that less than 20 per cent of MSMEs are currently owned by women, and female entrepreneurs often face significant challenges, including limited access to funding and societal barriers.

To address this disparity, Swaminathan proposed several measures. He suggested offering support to women-led enterprises through government-sponsored programs and developing tailored banking schemes for women-owned businesses.

The deputy governor also emphasised the importance of raising awareness among potential women entrepreneurs about available opportunities and providing necessary guidance and support at the district level.

The deputy governor also addressed broader issues in the MSME sector, noting that despite progress in credit delivery to priority sectors, significant work remains to improve credit access for MSMEs.

He pointed out that nearly half of Self-Help Groups (SHGs) are not yet linked to formal credit, and many small and marginal farmers lack access to bank financing.

Swaminathan called for these credit requirements to be factored into Priority Sector Lending (PSL) as well as block and district-level credit strategies.

As India continues to focus on inclusive economic growth, addressing the gender gap in the MSME sector and improving overall access to financial services remain key priorities for policymakers and financial institutions alike.

The proposals put forth by Deputy Governor Swaminathan aim to create a more equitable and inclusive financial ecosystem, particularly for women entrepreneurs in the MSME sector.

(KNN Bureau)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment