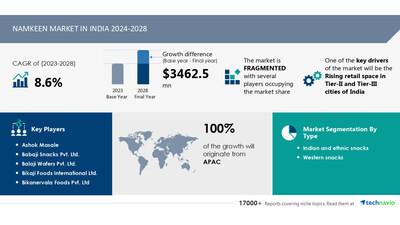

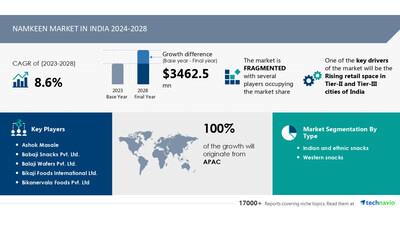

India Namkeen Market To Grow By USD 3.46 Billion (2024-2028) With AI Impact, Rising Retail Space In Tier-II And Tier-III Cities Boosts Revenue - Technavio

| Forecast period |

2024-2028 |

| Base Year |

2023 |

| Historic Data |

2018 - 2022 |

| Segment Covered |

Type (Indian and ethnic snacks and Western snacks), Distribution Channel (Offline and Online), and Geography (APAC) |

| Region Covered |

India |

| Key companies profiled |

Ashok Masale, Babaji Snacks Pvt. Ltd., Balaji Wafers Pvt. Ltd., Bikaji Foods International Ltd., Bikanervala Foods Pvt. Ltd, Bikharam Chandmal, Desai Brothers Ltd., Gopal Snacks Pvt. Ltd, Haldiram Foods International Pvt. Ltd., ITC Ltd., JABSONS COTTONSEED IND. PVT. LTD., Maa Laxmi Namkeen, Maxvita Foods Pvt. Ltd., Parle Products Pvt. Ltd., Patanjali Ayurved Ltd., Prakash Namkeen Udyog, Prataap Snacks Ltd., Priniti Foods Pvt Ltd, Shri Ajab Foods Pvt Ltd., and Sonal Foods |

The expansion of e-commerce has created new opportunities for namkeen suppliers in India. With increasing internet access and the convenience of online shopping, consumers have shown a growing preference for buying namkeens online. Major brands like Parle and PepsiCo have recognized this trend and partnered with e-commerce giants like Amazon to sell their products online. This business-to-business and business-to-consumer model allows vendors to reach a wider audience and improve customer relationships. The pandemic further fueled the demand for namkeens as people worked from home and opted for small meals. New startups such as Snackible and Evolve Snacks emerged, offering namkeens exclusively online. These factors are expected to boost the growth of the namkeen market in India during the forecast period.

The Namkeen industry in India, a significant part of the Indian Snacks Market, is thriving with trends centered around Nuts and Mix Namkeen. Leading players like Lay's, Cheetos, Doritos, Kurkure, Haldiram's, ITC, Reliance, Prabhuji, BRB, Too Yum, Farmley, and Yellow Diamond dominate the Organised Market. Published articles, company websites, magazine articles, associations, trade journals, and paid database sources provide valuable insights into industry trends. Unorganised Market players like Avadh namkeen and Tata Soulfull also contribute significantly. FSSAI regulations ensure food safety, while Nielsen reports provide consumer insights. Indore is a major hub for Namkeen production. Industry consultants forecast steady growth. LandCraft Retail is a key player in Namkeen distribution.

Insights on how AI is driving innovation, efficiency, and market growth- Request Sample!

MarketChallenges

.

The Indian snack market, specifically the namkeen segment, faces competition from various substitutes such as fried and baked snacks. Vendors in this space are introducing new product varieties and value-added ingredients to cater to health-conscious consumers. Baked snacks, in particular, are gaining popularity due to their perceived health benefits. Consumers are shifting towards these alternatives due to moderate switching costs and the availability of a wide range of flavors. Brands like Too Yum offer baked wafers and savory sticks as substitutes for namkeens. This trend is expected to hinder the growth of the namkeen market in India during the forecast period.

.

The Namkeen market in India faces several challenges in urban areas due to distribution networks and brand reputations. Urban population preference leans towards e-commerce platforms for convenience, but ensuring uniform quality, taste, texture, and flavor profile in loose packaging can be difficult. Production processes require significant investment in labor costs and machinery and equipment. Local and regional brands like Kenafric Biscuits, Bhujia, Balaji Wafers, Bikanervala, Haldiram, Bikaji, and others compete against multinational rivals like PepsiCo. Product innovation and standard packaging are essential to maintain consumer awareness and preference. Raw materials and organoleptic properties play a crucial role in the production process. The market offers various types of Namkeen, including Sev Bhujia, Dal Namkeen, Gathiya Papdi, and Farsan. Investment pockets lie in addressing these challenges while ensuring affordable pricing and catering to varying consumer preferences.

Insights into how AI is reshaping industries and driving growth-

Download a Sample Report

This namkeen market in India report extensively covers market segmentation by

Type-

1.1 Indian and ethnic snacks

1.2 Western snacks

-

2.1 Offline

2.2 Online

-

3.1 APAC

1.1

Indian and ethnic snacks-

Indian snacks, known as namkeens, offer a diverse range of traditional and ethnic savory foods. Notable options include farsaan, chiwda, sev, neyappam, bhujia, and mathri. These snacks, often prepared in Indian households, have a long preservation period of six months or more due to good quality packaging. Companies like Haldiram and Bikaji have commercialized these snacks, making them widely available. With over 1,000 different types, namkeens come in various flavors, shapes, sizes, textures, scents, bases, and fillings. India also exports approximately 300 ethnic savory food varieties. Namkeens, such as chiwda and bhelpuri, are healthier alternatives to Western snacks due to the use of Indian spices. The Indian and ethnic snacks segment is the largest and fastest-growing in the region, expected to continue during the forecast period.

Download complimentary Sample Report to gain insights into AI's impact on market dynamics, emerging trends, and future opportunities- including forecast (2024-2028) and historic data (2018 - 2022)

Namkeen Market in India is renowned for its diverse range of savory snacks, including potato-based and lentil-based snacks, crispy mixtures, spicy almonds, flavored sev, and more. These delicious treats, collectively known as farsan, are a staple in Indian households and are enjoyed during social gatherings and festive occasions. Health consciousness among consumers is on the rise, leading to a growing demand for additive-free, preservative-free, and artificial flavor-free Namkeen. Local brands like Bhujia, Balaji Wafers, Bikanervala, and others continue to dominate the market, offering authentic Indian flavors. Multinational rivals like Lay's, Cheetos, Doritos, Kurkure, Haldiram's, ITC, Reliance, Prabhuji, BRB, and Too Yum, with their standard packaging and international appeal, pose a significant challenge. Consumers' purchasing power and preference for loose packaging Namkeen versus standard packaging continue to shape the market dynamics.

Market Research OverviewThe Namkeen market in India is a vibrant and diverse sector, known for its wide array of savory snacks such as potato-based snacks, lentil-based snacks, crispy mixtures, spicy almonds, flavored sev, and more. With increasing health consciousness among consumers, there is a growing demand for Namkeen snacks that are free from additives, preservatives, and artificial flavors. Social media and digital platforms have become essential tools for brand awareness and customer engagement, with companies investing in innovative packaging designs and product variants to stand out in the market. The Namkeen industry in India includes local, regional, and national brands, with players like Kenafric Biscuits, Bhujia, Balaji Wafers, Bikanervala, and others dominating the scene. The market is divided into the organized and unorganized sectors, with multinational rivals like PepsiCo, Lay's, Cheetos, Doritos, and Kurkure also making their presence felt. The production process, labor costs, machinery and equipment, and raw materials are key factors influencing the market dynamics. Product innovation, quality, and taste are crucial elements that determine brand reputation and customer preference. The types of Namkeen include Sev Bhujia, Dal Namkeen, Gathiya Papdi, Nuts, Mix Namkeen, and Farsan, among others. Consumer awareness, purchasing power, and distribution networks are essential factors driving the growth of the Namkeen market in India. The industry is closely monitored by industry consultants, trade journals, and published articles, providing valuable insights into market trends and consumer preferences.

Table of Contents:1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

-

Type

-

Indian And Ethnic Snacks

Western Snacks

-

Offline

Online

-

APAC

7

Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

ContactsTechnavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email:

[email protected]

Website:

SOURCE Technavio

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE? 440k+Newsrooms &

Influencers 9k+

Digital Media

Outlets 270k+

Journalists

Opted In GET STARTED

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment