Instant Payments, A2A Payments Poised To Reshape Global Landscape: Capgemini World Payments Report

The payments industry has undergone a significant evolution since the inaugural report in 2004. Digital technologies, including wallets, peer-to-peer (P2P) payments, and contactless payments, have become increasingly widespread, while new regulations have fostered innovation and enhanced consumer protection. As a result, the payments ecosystem is now more interconnected, streamlined, efficient, and secure than ever before.

Non-cash transactions surge, with APAC leading the way

Non-cash transaction volumes reached 1.411 bn in 2023 and are projected to reach 1.650 bn in 2024. This trend, driven by consumer preference for frictionless payment experiences, is expected to continue, with non-cash transactions forecast to reach 2.838 bn by 2028.

Asia-Pacific (APAC) stands out as one of the fastest-growing regions for non-cash transactions, experiencing a 20% year-on-year (YoY) increase in 2024, compared to Europe (16%) and North America (6%). Globally, most industry executives (77%) attribute the shift to non-cash transactions to e-commerce growth.

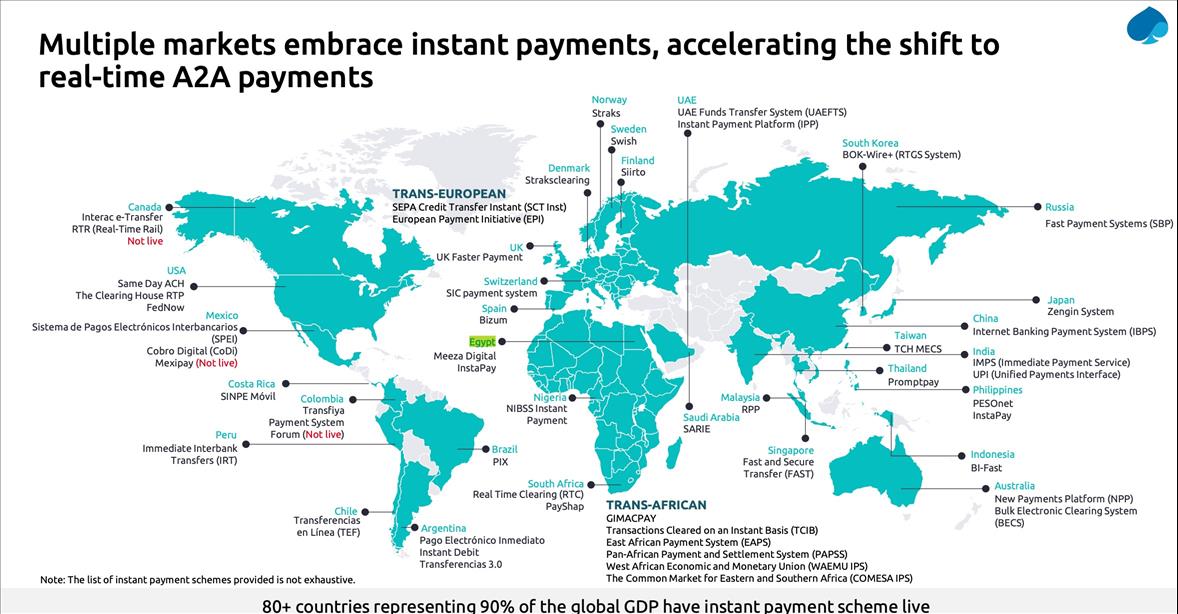

A2A payments threaten card scheme dominance

A2A instant payment solutions offer a faster and more cost-effective way to pay, circumventing expensive card networks. The report suggests that the rise in popularity of A2A payments poses a significant threat to the dominance of traditional payment cards, with estimates suggesting they could offset 15-25% of future card transaction volume growth. This could result in billions of dollars in lost revenue for financial institutions, that rely heavily on interchange fees and interest charges.

The European Payments Initiative's Wero wallet is expected to accelerate the adoption of A2A payments, with a predicted 37% reduction in card transactions across Europe by 2027.

“The continued surge in non-cash transactions marks a pivotal moment for banks and payment service providers,” said Jeroen Hölscher, Global Head of Payment Services at Capgemini.“The data clearly indicates an inevitable shift toward a future of instant and open payments.” Hölscher added,“The success of Pix in Brazil and UPI in India demonstrates that private-public sector collaboration is essential. While some financial institutions may choose to upgrade their existing payment hub or leverage shared bank infrastructure, the reality is that consumers demand instantaneity, and corporates are willing to pay a premium for innovative solutions that address real business challenges. The time to act is now.”

Egypt Embarks on a Cashless Journey

Hossam Seifeldin, CEO of Capgemini Egypt, highlighted Egypt's progress toward a cashless and instant payment future.“Egypt recorded 39 million transactions in 2023, a promising start,” Seifeldin said.“While Egyptian financial institutions face similar challenges to their global counterparts, the Central Bank of Egypt's Instant Payment Network demonstrates a strong commitment to overcoming these obstacles. With continued growth and consumer interest, Egypt is poised to foster financial innovation and accessibility for its population.”

Financial Institutions Lacking Preparedness for Instant Payments

Two-thirds of payment executives recognize the crucial role of instant payments in driving non-cash transactions. However, concerns about fraud, voiced by a majority of executives in the report, hinder progress. Many banks lack robust fraud prevention mechanisms and are concerned about potential liquidity issues, leading them to prioritise receiving instant payments over sending them. According to the survey, only 25% of banks can receive instant payments, while 53% are fully capable of sending and receiving them.

The report, which analysed survey results across various business and technology parameters, found that only 5% of banks exhibit high business and technology readiness for instant payments adoption, positioning them as potential leaders in the space. Notably, only 13% of European banks have a strong technological foundation for instant payments. This is particularly relevant for EU banks and payment service providers (PSPs) given the October 2025 Instant Payment Regulation (IPR) deadline, which mandates all institutions to offer full instant payment send and receive functionality.

Open Finance in its Early Stages

The report underscores the role of open finance, catalysed by Europe's 2018 Payment Service Directive (PSD2) regulation, in empowering consumers and businesses and driving the adoption of instant payments. Despite its significant potential to reshape the financial landscape, progress remains limited due to variations in regulatory frameworks and market initiatives. Australia, Brazil, India, and Singapore are among the few countries leading initiatives to make data sharing more accessible and convenient for individuals and companies participating in an open financial system.

According to the report, financial institutions face challenges in fully embracing open finance due to issues such as non-standardized APIs, limited control over data usage, and a lack of incentives to share data with third parties. Only 17% of banks are at an advanced stage, piloting or launching open finance products, while 39% are in the planning phase, conducting impact assessments. Another 23% of banks remain hesitant, awaiting regulatory clarity.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment