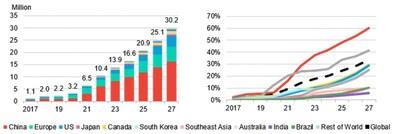

Figure 42: Projected BEV and PHEV Passenger Car Demand

(Source: Fastmarkets, 2024; Rho Motion, 2024; Bloomberg NEF, 2024) (CNW Group/Patriot Battery Metals Inc.)

Figure 43: Sources - Global Positioning of Hard Rock Lithium Assets (CNW Group/Patriot Battery Metals Inc.)

Preliminary Economic Assessment (PEA) completed by independent consultants, BBA and Primero, outlining a preliminary base case scenario for a staged development of the cornerstone CV5 Spodumene Pegmatite, via both open pit and underground mining methods.

High-grade Nova Zone1

(including 21.8 million tonnes at 2.1% Li2O of which 93% is Indicated, 7% is Inferred Resource category respectively) to be targeted and prioritised via underground mining methods, allowing direct access to higher grade material and minimizing the environmental footprint.

At the targeted Stage 2 production rate of ~800 ktpa2

spodumene concentrate, this would potentially position Patriot as the 4th largest spodumene concentrate producer globally3.

Potential pre-tax net present value ("NPV")8% of $4.7 billion (US$3.6 billion) and after-tax NPV8% of $2.9 billion (US$2.2 billion) with a pre-tax internal rate of return ("IRR") of 38% (after-tax IRR of 34%) at US$1,375 per tonne (SC5.5, FOB Bécancour basis).

Payback period of 3.6 years at an assumed average lithium price of US$1,375 per tonne (SC5.5, FOB Bécancour basis) or US$1,500 per tonne (SC6, FOB Bécancour basis), with life of mine ("LOM") of up to 24 years.

Targeting to become a North American top-tier, lower cost producer with an estimated average LOM cash operating cost4 at site

of $510 per tonne (US$387) and total cash operating cost free-on-board ("FOB" Bécancour)5 of $736 per tonne (US$560)6.

An estimated break-even SC6 price (on a fully ramped 800

ktpa, EBITDA, FOB Bécancour basis) of US$587/t highlights the potentially viable nature of the Shaakichiuwaanaan Project throughout the lithium price cycle.

Estimated to indicatively generate approximately $8.3 billion in Project Cash Flow (unlevered) over LOM.

Average annual EBITDA7 anticipated to be in the order of $850M and annual FCF8

of $515M at an assumed spodumene price of US$1,375 per tonne (SC5.5, FOB Bécancour basis).

Phased development strategy with anticipated Stage 1 capital expenditure estimate of $761M (US$579M) for the first 400 ktpa capacity including contingency and Net Capex of $640M (US$487M) leveraging the proposed 30% Canadian Clean Technology Manufacturing – Investment Tax Credit ("CTM-ITC")9.

Estimated Stage 2 expansion Capex of $504M (US$383M) including contingency and Net Capex of $408M (US$310M) leveraging the proposed CTM-ITC, to reach a production capacity of ~800 ktpa of spodumene concentrate per year.

The combined net cost10

to reach nameplate production for both Stage 1 and Stage 2 is estimated to be approximately $608M (US$462M) taking into account funding that could come from both cash flows from Stage 1 and proposed CMT-ITC tax credits.

Process plant feed rate following Stage 2 expansion at an average of ~4.5 Mtpa11

via simple DMS-only process; average LOM lithia recovery of 69.5%; spodumene concentrate grade at 5.5% Li2O.

Access to existing, high quality transportation infrastructure with potential future improvements in the region combined with a low-carbon footprint, low cost and mainly renewable electricity source.

Tier 1, stable mining jurisdiction of Eeyou Istchee James Bay region of Québec (under modern land claims agreement – James Bay Northern Quebec Agreement "JBNQA") combined with a strong relationship with the Cree Nation of Chisasibi, Cree Nation Government and all stakeholders.

The Eeyou Istchee James Bay region's unique Examination Committee "COMEX" permitting process, with its well-defined guidelines, ensures a structured and clear path to project approval, fostering strong community and stakeholder engagement.

Significant opportunities to enhance returns through further resource expansion, optimized mining to further prioritise access to the high-grade Nova Zone earlier and additional cost-saving measures indicate transformative potential.

The Company will consider progressing a Feasibility Study, which among other options may include a trade-off study for a smaller high-grade focused development scenario, to optimise the project in the event of a lower price environment.

The Project remains on track with FID targeted in CY27, indicatively paving the way for the construction to progress through CY28 and first production commencing in early CY29.

| ___________ |

| 1 |

The Nova Zone is a subset of the CV5 Resource, proposed to be accessed via the same underground mining method targeting the overall PEA underground Resource of 39.8 Mt @ 1.54% Li2O (70% is Indicated, 30% is Inferred Resource category respectively). |

| 2 |

The annual production rate of ~800 ktpa is calculated considering the period of full production, i.e. Years 4 to 18 – see Figure 34. |

| 3 |

See Figure 2. |

| 4 |

Cash operating cost at site includes mining, processing and site administration expenses calculated on an SC5.5 basis. They are non-IFRS financial measures, and when expressed per tonne, non-IFRS ratios. Refer to "Non-IFRS and other financial measures" for further information on these measures. |

| 5 |

Total cash operating cost (FOB Bécancour) includes mining, processing, site administration, and product transportation to Bécancour calculated on an SC5.5 basis. They are non-IFRS financial measures, and when expressed per tonne, non-IFRS ratios. Refer to "Non-IFRS and other financial measures" for further information on these measures. |

| 6 |

Refer to Table 4 – Cash Operating Costs. |

| 7 |

EBITDA is a non-IFRS financial measure which is comprised of net income or loss from operations before income taxes, finance expense – net, depreciation and amortization. This annual EBITDA is calculated considering the period of full production (i.e., Years 4 to 18). Refer to "Non-IFRS and other financial measures" for further information on these measures. |

| 8 |

FCF is a non-IFRS financial measure defined as cash provided from operating activities, less cash outlays for sustaining capital, and less taxes. The annual FCF is calculated considering the period of full production (i.e., Years 4 to 18). Refer to "Non-IFRS and other financial measures" for further information on these measures. |

| 9 |

The CTM-ITC (enacted on June 20, 2024) provides for up to 30% of the cost of the investment in eligible property used for eligible activities through a refundable investment credit mechanism – see Table 3 for a full breakdown of the capital cost estimate. |

| 10 |

The combined net cost includes Capex, Opex during pre-production of $108.3M, estimated CMT-ITC tax credits of $216.7M, contingency of $242.8M and potential cash flow during expansion of $548.7M – see Table 3 for a full breakdown of the capital cost estimate. |

| 11 |

The average process plant feed rate of ~4.5 ktpa is calculated considering the period of full production, i.e. Years 4 to 18. |

MANAGEMENT COMMENT

Ken Brinsden, President, CEO, & Managing Director for the Company, said: "Although studies are still at an early stage the potential outcomes of the PEA for the Shaakichiuwaanaan Project highlights the opportunity for Patriot Battery Metals to become a global lithium leader and a key supplier of lithium raw materials to the emerging North American and European battery materials supply chain.

"The PEA outlines a staged development pathway for Shaakichiuwaanaan, commencing with an initial 400

ktpa production capacity which is intended to allow us to leverage the key competitive advantages of this world-class deposit to provide lithium raw materials in emerging western markets.

"Importantly, the resources to be mined include a high-grade component in the Nova Zone that creates an opportunity for a potentially resilient project, while also giving us considerable flexibility in terms of how we progress Shaakichiuwaanaan. This flexibility and scalability could allow us to adapt nimbly to evolving market conditions, while continuing to grow the resource base.

"As we consider moving to the Feasibility Study stage, the Project's anticipated low operating costs and expected IRA-compliant high-quality lithium product could make us an ideal partner for downstream players, making this a highly strategic asset in the future lithium landscape. There is also strong inbound interest from strategic partners to support Stage 1 funding, alongside potential access to Government funding mechanisms.

"The Shaakichiuwaanaan Project is potentially well positioned to anchor the North American lithium supply chain, meeting demand for decades to come, in the process targeting significant returns for all our stakeholders while maintaining a strong emphasis on sustainability and limited environmental impact," Mr. Brinsden added.

Patriot Battery Metals Inc. (" Patriot " or the " Company ") (TSX: PMET) (ASX: PMT) (OTCQX: PMETF ) (FSE: R9GA), is pleased to announce the results of a Preliminary Economic Assessment (" PEA ") for the Shaakichiuwaanaan Project ( the "Project " or the " Property ") (formerly known as Corvette), located in the Eeyou Istchee James Bay region of Québec, Canada.

The PEA outlines a scenario for the staged development of the cornerstone CV5 Spodumene Pegmatite via both open pit and underground mining methods, thereby maximizing earlier access to the high-grade Nova Zone. This scenario provides optionality and flexibility to unlock the potential of the Shaakichiuwaanaan Project to become a leading lithium raw materials supplier in North America.

This study is based on the CV5 Pegmatite component of the recently announced updated Shaakichiuwaanaan Mineral Resource Estimate ("MRE"), which is the largest known lithium pegmatite Mineral Resource in the Americas and the 8th largest globally (see news release dated August 5, 2024).

Although no final investment decision has been reached for the Shaakichiuwaanaan Project, the compelling economic potential presented in the PEA, coupled with the expected straightforward nature of the Project in terms of geology, pegmatite geometry, mining methodology and processing, supports the Company considering to progress a Feasibility Study ("FS"). If a FS is progressed, it would be targeted for completion during the September quarter 2025, in parallel with the submission of the Project Environmental and Social Impact Assessment "ESIA" documentation.

It is contemplated that a trade-off study would also be undertaken at the early stage of a FS to explore the potential advantages of further prioritizing a potentially smaller scale underground development to access the high-grade Nova Zone within CV5, during the Stage 1 development1. This study will aim to further define and optimise the Project's potential economic returns and potentially create flexibility to increase the plant feed grade during periods of possible lower pricing outcomes. Higher plant feed grades could improve the yield-to-product, thereby directly correlating to lower unit production costs. This strategy has the potential to deliver a more financially resilient project in a low-price scenario, ensuring more sustainable returns and operations through the lithium price cycles.

A technical report prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") including the PEA and the MRE will be filed on SEDAR+ by September 19, 2024.

Unless otherwise indicated, all references to "$" or "CA$" in this release are to Canadian dollars and references to "US$" in this release are to US dollars. A foreign exchange conversation rate of US$ of 0.76US$/CA$ has been used over the LOM.

| ___________ |

| 1 |

The PEA contemplates Stage 1 as being open pit mining only, with the Stage 2 expansion phase focusing on underground mining to access the Nova Zone in parallel to the open pit mining. The trade-off study included in the FS will explore the advantages of bringing forward the underground mining operation as part of the Stage 1 development. |

PRELIMINARY ECONOMIC ASSESSMENT (PEA) SUMMARY

Cautionary Statement: The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them. Inferred mineral resources are that part of the mineral resource for which quantity and grade or quality are estimated on the basis of limited geologic evidence and sampling, which is sufficient to imply but not verify grade or quality continuity. Inferred mineral resources may not be converted to mineral reserves. It is reasonably expected, though not guaranteed, that the majority of Inferred mineral resources could be upgraded to Indicated mineral resources with continued exploration. Accordingly, there is no certainty that the preliminary economic assessment will be realized.

EXECUTIVE SUMMARY

The PEA for the Shaakichiuwaanaan Project highlights its economic potential and strategic advantages, potentially positioning it among the largest producers1

and as a top-tier low-cost producer of lithium. The PEA outlines a promising staged development scenario for the cornerstone CV5 Pegmatite deposit, utilizing both open pit and underground mining methods, to ensure earlier access to the high-grade Nova Zone.

Using DMS only processing a 5.5% Li2O spodumene concentrate will be targeted in both the Stage 1 and Stage 2 expansion production scenarios. The concentrate will be transported by road and rail to Bécancour, where the base case assumes it to be converted to lithium chemicals by the customer(s) or otherwise loaded at the Bécancour port facilities for seaborne trade.

As announced on August 5, 2024, Shaakichiuwaanaan hosts the largest known lithium pegmatite Mineral Resource in the Americas and the 8th largest known globally. Based on the preliminary economic results of the PEA for the proposed development of the CV5 Spodumene Pegmatite, the Company will consider advancing the Project to the FS level, which if progressed is expected to be completed in the September Quarter 2025. The Company's strategy will emphasize resource growth and a phased development approach, ensuring flexibility and scalability to adapt to market conditions.

The PEA incorporates a staged development strategy, with Stage 1 targeting production capacity of ~400 kpta of spodumene concentrate with an estimated Initial Net Capex of $640M (US$487M)2, including contingency and proposed CTM-ITC tax credits.

This first stage lays a solid foundation for the Project to commence production, with a subsequent Stage 2 expansion aimed at doubling the production capacity to ~800 ktpa. The Stage 2 expansion has an estimated Net Capex of $408M (US$310M) including contingency and proposed CTM-ITC tax credits3. The combined net cost requirement to reach nameplate production for both Stage 1 and Stage 2 is estimated to be approximately $608M (US$462M)4

taking into account cash flows from Stage 1 and proposed CMT-ITC tax credits.

The Company will only commit to development after considering the economic conditions that prevail or are foreseeable at the time that an initial production decision, or when a subsequent expansion decision is made. That said, through the publication of this preliminary economic assessment, the Company believes the Shaakichiuwaanaan Project has the potential to be a long-life lithium asset with unique competitive characteristics.

Staged development also opens the opportunity for the expansion capacity to be funded partly or entirely through internal cash flows expected to be generated from Stage 1. This will be further assessed in any future FS.

With the production scenario outlined in the PEA, the Shaakichiuwaanaan Project could become one of the largest spodumene producers in the world5

at the completion of the Stage 2 expansion phase, and potentially the largest spodumene producer in the Americas, offering production of SC5.5 spodumene concentrate in a stable jurisdiction.

Financial estimates in the PEA are based on a long-term weighted average spodumene concentrate price of US$1,375/t (SC5.5 – FOB Bécancour basis), which currently sits above spot pricing, but is derived from market price forecasts by independent reporting agencies, banking commodities analyst reports and recently published technical reports.

The PEA demonstrates the potential for robust economics, highlighted by a combined after-tax NPV8% of $2.9 billion (US$2.2 billion) and after-tax IRR of 34%. The Project's mine life is projected at 24 years, based on a total extracted Mineral Resource of 66% of total resources defined at CV5, generating significant net cash flows with capital payback achieved in 3.6 years.

Further analysis of the preferred project mining methodology for CV5 will be a key component of any proposed FS activities. The FS would seek to determine the most economic approach for mining the resource, based on the PEA's hybrid mining method (inclusive of both open pit and underground mining methods) for the base scope.

The FS would also include an early trade-off study that will evaluate accelerated development of the higher-grade Nova Zone, with the aim of bringing it into production as early as possible. Increasing the feed grade to the processing facility from a higher-grade zone is expected to be directly correlated to lower process plant production costs, and therefore earlier access to the Nova Zone potentially creates greater resilience to lower product pricing outcomes.

The Company's PEA mining strategy has adopted both open-pit and underground mining methods and was designed to gain earlier underground access to the high-grade Nova Zone in the northeast area of the CV5 Pegmatite than would be possible with just open pit mining. This approach has the potential to reduce the Project's operational footprint, potentially simplifying the approval process by decreasing the open pits strip ratio and therefore minimizing waste deposition at surface. The open pit strip ratio during the proposed PEA LOM scenario is estimated to be a low 3.7:1.

The mining strategy is further complemented by ramping up production in low-strip, higher-grade areas of the open pit(s), which also serves to de-risk project execution, ensuring stable production in the initial years. This phased and incremental expansion is designed to allow for managed growth and adaptability, which the Company would expect could be further enhanced by accessing the Nova Zone earlier in the mine's development.

Additionally, the strategy adopted in the PEA aligns with positioning the Company to support downstream chemical conversion in Québec, reflecting its commitment to integrating the value chain and enhancing local economic benefits.

Furthermore, this strategy has the potential to establish the Company as a key player in the development of a global North America & Europe supply chain for lithium, helping to meet the rising demand for locally sourced, high-quality lithium products which are compliant with the United States Inflation Reduction Act ("IRA"). While focusing on Québec, the Project's attributes would potentially make it attractive for downstream partners globally, potentially capable of producing significant volumes steadily for decades under various market conditions.

Considering the economic potential outlined in the PEA, the Project is now advancing to its next phase of development – with a FS being considered for completion in the September Quarter 2025. Continued drilling will aim to complete additional mineral resource upgrades from the Inferred to Indicated categories to support the FS, expand the size of the existing Mineral Resource base and explore new exploration targets, further optimizing the value of the Shaakichiuwaanaan Project.

| __________ |

| 1 |

Refer to Figure 2. |

| 2 |

The Net Capex excludes Opex during pre-production of $108.3M and assumes eligibility for a tax credit of $121.1M under the CTM-ITC legislation. Stage 1 has Capex of $761M which excludes CTM-ITC credits and pre-production opex – see Table 3 for a full breakdown of the capital cost estimate. |

| 3 |

The Net Capex estimate of $408M assumes eligibility for a tax credit of $95.6M under the CTM- ITC legislation. Stage 2 expansion has Capex of $503.9M excluding CTM-ITC credits – see Table 3 for a full breakdown of the capital cost estimate. |

| 4 |

The combined net cost includes Capex, Opex during pre-production of $108.3M, estimated CMT-ITC tax credits of $216.7M, contingency of $242.9M and cash flow during expansion of $548.7M – see Table 3 for a full breakdown of the capital cost estimate. |

| 5 |

Refer to Figure 2. |

LONG-TERM LITHIUM PRICE ASSUMPTIONS

Price forecasts are typically presented in the market on a 6% Li2O spodumene concentrate ("SC6") basis. For the purpose of this PEA the Company's pricing assumption has been calibrated to SC5.5 by adjusting for lithium content on a pro rata basis. The PEA assumes the product will be converted to lithium chemicals in Bécancour by the customer(s), or otherwise loaded to vessels for seaborne trade and therefore the forecast price is presented on a FOB Bécancour basis.

The PEA uses a long-term weighted average spodumene price assumption of US$1,375 (SC5.5, FOB Bécancour basis) per tonne. This assumed price is supported by recent market price forecasts from independent reporting agencies, banking commodities analyst reports and company disclosures and recently published technical reports, which indicate spodumene prices generally cluster around US$1,300–US$1,500 per tonne for 5.5% spodumene concentrate. Therefore, a price assumption for the PEA within this range is considered to fairly represent foreseeable longer-run market conditions applicable to the project development scenario, as compared to current spot pricing of Spodumene Concentrate US$760/t (SC6, FOB Australia basis -15/08/24).

Globally, demand for lithium remains robust, primarily fuelled by the electric vehicle ("EV") sector. Global EV sales growth reached 20% in H1 2024, with EV market share rising to 17.8% in 2023 and projected to reach 20% of all car sales in 2024, combining BEV and PHEV passenger cars. Additionally, energy storage systems and consumer electronics continue to contribute significantly to overall demand. In 2024, globally, lithium demand for energy storage systems ("ESS") should be around 200,000 US tons (compared to 1.5

M US tons for Ev's), a threefold increase in 4 years and representing the demand of the EV market from 2019. More importantly, the United States is the 2nd largest battery storage market and doubled in size in 2023.1

Despite sufficient chemical capacity supporting China's domestic consumption and export markets, refining capacity limitations in Western markets could affect the availability of battery-grade lithium products compliant with Western legal framework like the IRA and European Battery Passport process. This presents a strategic opportunity for Patriot, with its North American, potentially IRA-compliant sourced spodumene, to become a key player in the ex-China battery supply chain.

For instance, an IRA-compliant country or trading partner must have a free trade agreement with the U.S., adhere to high environmental and labour standards, ensure a stable and secure supply chain and comply with U.S. regulatory guidelines. These criteria promote sustainable practices and strategic supply chain security.

In a similar vein, the European Union's Battery Passport initiative aims to enhance the sustainability and transparency of the battery supply chain. It mandates that batteries, particularly those used in Evs, carry a digital passport containing essential information about their lifecycle. This includes data on sourcing, production, usage and recycling processes. The initiative promotes responsible sourcing of raw materials, reduces environmental impact, and ensures compliance with social and environmental standards. By providing detailed traceability, the Battery Passport fosters consumer trust, facilitates recycling and supports the circular economy. It also aligns with the EU's broader Green Deal goals, driving innovation and sustainability in the battery industry.

The importance of IRA and Battery Passport-compliant ("BPC") material and the challenges for some industry participants to comply with those restrictions puts the Shaakichiuwaanaan Project in a unique position.

These factors and the desire in Western markets for IRA and BPC compliant product further support the decision to use a long-term spodumene price assumption of US$1,375 (SC5.5, FOB Bécancour) per tonne in our PEA, reflecting a balanced and strategic approach to future market conditions and project viability.

ECONOMIC ANALYSIS

The Shaakichiuwaanaan Project is expected to yield an average annual production run-rate of ~800,0002

tpa of SC5.5 after commissioning both the initial Stage 1 and Stage 2 expansion phases. Based on this production rate and over the mine life, the Project generates an estimated after-tax NPV8% of $2.9 billion (US$2.2 billion) and after-tax IRR of 34% which is derived using an assumed average life of mine spodumene concentrate price of US$1,375 (FOB Bécancour) for SC5.5.

| __________ |

| 1 |

IEA Report, Global EV Outlook 2024, |

| 2 |

The annual production rate of ~800 ktpa is calculated considering the period of full production, i.e. Years 4 to 18 – see Figure 34. |

The financial summary and key physical parameters of the Project are provided in the following tables:

Table

1: Summary of Estimated Project Economics

| Financial Results |

Unit |

CA$ |

US$ |

| Long term price assumption (SC5.5 – FOB Bécancour basis) |

$/t |

1,809 |

1,375 |

| Pre-Tax NPV0% |

$ |

13,299 |

10,107 |

| Pre-Tax NPV8% |

$ |

4,699 |

3,571 |

| After-Tax NPV0% |

$ |

8,308 |

6,314 |

| After-Tax NPV8% |

$ |

2,937 |

2,232 |

| Pre-Tax IRR |

% |

38 |

| After-Tax IRR |

% |

34 |

| Payback Period |

year |

3.6 |

Table

2: Estimated Production Metrics

| Key Metrics |

Unit |

Value |

| Stage 1 Construction and Ramp Up Phase |

year |

2 |

| Stage 2 Expansion Construction and Ramp Up Phase |

year |

2 |

| Years of operations |

year |

24 |

| Open Pit |

|

|

| Resource mined |

Mt |

50.5 |

| Waste mined (including pre-strip) |

Mt |

188.6 |

| Total tonnes mined |

Mt |

239.0 |

| LOM open pit strip ratio (waste tonnes: resource tonnes) |

Mt |

3.7 |

| Underground |

|

|

| Resource mine |

Mt |

39.8 |

| Total |

|

|

| Total resource (Open Pit + Underground) mined and processed |

Mt |

90.2 |

| Average DMS process plant feed rate1 |

Mtpa |

4.5 |

| Average Li2O recovery |

% |

69.5 |

| Average feed grade |

% |

1.31 |

| Spodumene Concentrate |

Mt |

14.9 |

| Spodumene Concentrate grade |

% |

5.5 |

| Annual production rate2 |

ktpa |

800 |

The average process plant feed rate of ~4.5

ktpa is calculated considering the period of full production, i.e. Years 4 to 18.

The annual production rate of ~800

ktpa is calculated considering the period of full production, i.e. Years 4 to

18 – see Figure

34.

CAPITAL COST ESTIMATE

Table

3: Summary of Estimated Capital Expenditures

| Capital Expenditure |

Stage 1

Capital Cost

(M$) |

Expansion

Capital

(M$) |

Combined

Phases

(M$) |

LOM

Sustaining

Capital

(M$) |

Total

Cost

(M$) |

| General |

142.1 |

9.0 |

151.1 |

- |

151.1 |

| Mine and stockpiles |

148.4 |

29.8 |

178.2 |

256.4 |

434.6 |

| Process |

124.6 |

124.6 |

249.2 |

26.0 |

275.2 |

| Terminals (truck and train) |

8.5 |

- |

8.5 |

- |

8.5 |

| Other services and facilities |

14.3 |

- |

14.3 |

- |

14.3 |

| Underground mine lateral development |

- |

110.9 |

110.9 |

203.4 |

314.3 |

| Underground mine infrastructure & paste plant |

- |

71.3 |

71.3 |

144.1 |

215.4 |

| Fish habitat compensation |

20.1 |

- |

20.1 |

- |

20.1 |

| Indirect cost |

140.5 |

78.2 |

218.7 |

- |

218.7 |

| Subtotal |

598.5 |

423.8 |

1,022.3 |

629.9 |

1,652.2 |

| Contingency |

162.9 |

80.0 |

242.9 |

21.5 |

264.4 |

| Total Capex |

761.4 |

503.9 |

1,265.2 |

651.4 |

1,916.6 |

| Clean Technology Manufacturing (CTM) Investment Tax Credit (ITC)1 |

(121.1) |

(95.6) |

(216.7) |

(13.5) |

(230.2) |

| Net Capex |

640.3 |

408.2 |

1,048.5 |

637.9 |

1,686.4 |

| Pre-Production Opex |

Stage 1

Capital Cost

(M$) |

Expansion

Capital

(M$) |

Combined

Phases

(M$) |

LOM

Sustaining

Capital

(M$) |

Total

Cost

(M$) |

| Pre-production cost for process plant |

26.0 |

- |

26.0 |

- |

26.0 |

| Mine preproduction/preparation |

82.3 |

- |

82.3 |

- |

82.3 |

| Totals and Cash Flow |

Stage 1

Capital Cost

(M$) |

Expansion

Capital

(M$) |

Combined

Phases

(M$) |

LOM

Sustaining

Capital

(M$) |

Total

Cost

(M$) |

| Net Total Pre-Production Opex + Capex |

748.6 |

408.2 |

1,156.8 |

637.9 |

1,794.7 |

| Cash flow during expansion2 |

- |

(548.7) |

(548.7) |

- |

(548.7) |

| Net Total Pre-Production Opex and Capex + Estimated Cash Flow |

748.6 |

(140.5) |

608.1 |

637.9 |

1,246.0 |

| Gross Total Pre-Production Opex + Capex Without Tax Credit |

869.7 |

503.8 |

1,373.5 |

651.4 |

2,024.9 |

PMET may be eligible for CTM-ITC (Investment Tax Credit). This legislation has been enacted on June 20, 2024. There is no guarantee the Company will be able to access the ITC. If the ITC does not become available, the total capex including contingency will increase by the amounts shown in this row.

Cashflows from Stage 1 would be dependent (amongst other things) on reaching nameplate capacity on Stage 1, applicable pricing at the time of production/expansion and the overall economic viability of the Stage 1 operations and its cashflows, which are not guaranteed. The PEA is only a preliminary economic assessment based on mineral resources which are not reserves and there is no certainty that the PEA assessment, including Stage 1 cashflows, can be realized. Mineral resources that are not ore reserves do not demonstrate economic viability.

Management proposes to adopt a phased capital expenditure strategy to ensure financial prudence and adaptability.

Capital Expenditure

The development strategy for the Shaakichiuwaanaan Project outlined in the PEA employs a staged capital expenditure strategy, based on scalability to match customers chemical capacity and prevailing economic conditions. This approach ensures that initial infrastructure investments support future expansion while optimizing financial efficiency. The staged development strategy seeks to leverage initial cash flows from Stage 1 operations to fully fund subsequent expansions in Stage 2, potentially reducing reliance on external financing.

Stage 1

It is anticipated that Stage 1 of the development will require an initial Net Capex of $640M (US$487M)1, including contingency and proposed CTM-ITC tax credits. This phase includes building infrastructure to a scale that supports the Stage 2 Expansion Phase, which has been identified as a potentially cost-efficient strategy at the PEA level. While this strategy has been identified as cost-efficient, the infrastructure will need to be subject to further analysis and optimization during the FS to ensure it is being built in the most effective and cost-efficient manner.

General infrastructure includes the main access road, bridge, electrical powerline, and accommodation camp, all designed to serve both the Pre-production and Expansion Phases. Additionally, the Mine and Stockpiles category encompasses the garage, fuel station, and stockpile area, while the Process category includes capital expenditures for the first production train with a capacity of 2.5 Mtpa. An overall contingency has been applied to all direct and indirect costs and is expected to decrease as estimates are refined through detailed design engineering. Further detailed assessment of eligibility for the 30% CTM-ITC investment tax credit could potentially further reduce the overall cost. Refer to section on Funding Strategy below for further information on CTM-ITC. This strategic initial investment sets a solid foundation for future expansion and enhances the project's long-term viability.

Expansion Phase (Stage 2)

It is anticipated that the Stage 2 Expansion Phase, which includes focusing on developing the underground mine, will require estimated Net Capex of $408M (US$310M) including contingency and proposed CTM-ITC tax credits2. This phase assumes it could potentially be funded through estimated internal cash flows generated from Stage 1, totalling $549M. These cashflows would be dependent (amongst other things) on the Project reaching nameplate production capacity on Stage 1, applicable pricing at the time of production/expansion and the overall economic viability of the Stage 1 operation and its cashflows, which are not guaranteed3.

The Expansion Phase includes costs exclusively related to the construction and development of the underground mine, the expansion of the second train of the processing plant, and their related indirect costs and contingencies. Development of the underground mine will begin in Year

1, one year after the commencement of open pit operations. All the expansion capital allocated to the processing plant is for building the second phase (Train 2), which is identical to the first.

| ___________ |

| 1 |

The Net Capex of $640M excludes Opex during pre-production of $108.3M and assumes a tax credit of $121.1M under the proposed CTM-ITC legislation. Stage 1 has total Capex of $761M which excludes CTM-ITC credits and pre-production opex – see Table 3 for a full breakdown of the capital cost estimate. |

| 2 |

The Net Capex estimate of $408M assumes a tax credit of $95.6M under the proposed CTM-ITC legislation. Stage 2 expansion has total Capex of $503.9M excluding CTM-ITC credits - see Table 3 for a full breakdown of the capital cost estimate. |

| 3 |

The PEA is only a preliminary economic assessment based on mineral resources which are not ore reserves and there is no certainty that the PEA assessment, including Stage 1 cashflows, can be realised. Mineral resources that are not ore reserves do not demonstrate economic viability including in respect of those Stage 1 cashflows. |

Cash Operating Costs1

Table

4: Estimated Cash Operating Costs (SC5.5 – FOB Bécancour basis)

| Financials Results |

CA$/t |

US$a /t |

| Mining |

305 |

232 |

| Processing |

99 |

75 |

| Site Administration |

106 |

81 |

| Cash Operating Cost at Siteb |

510 |

387 |

| Transportation cost |

226 |

173 |

| Total Cash Operating Cost (FOB Bécancour)c |

736 |

560 |

| Sustaining Capital |

44 |

33 |

| All-In Sustaining Cost – (FOB Bécancour)d |

780 |

593 |

| a. |

Exchange rate of 0.76US$/CA$. |

| b. |

Cash operating cost at site includes mining, processing, and site administration, it is a

non-IFRS measure, and when expressed per tonne, a non-IFRS ratio. Refer to "Non-IFRS and other financial measures" for further information on these measures. |

| c. |

Total cash operating cost (FOB

Bécancour) includes mining, processing, site administration, and product transportation to Bécancour, It is a non-IFRS measure, and when expressed per tonne, a non-IFRS ratio. Refer to "Non-IFRS and other financial measures" for further information on these measures. |

| d. |

All-in sustaining costs ("AISC") includes mining, processing, site administration, and product transportation costs to Bécancour and sustaining capital over the LOM per unit of concentrate produced during the LOM, and excludes Royalties. It is a non-IFRS measure, and when expressed per tonne, a non-IFRS ratio. Refer to "Non-IFRS and other financial measures" for further information on these measures. |

| ____________ |

| 1 |

Refer to "Non-IFRS and other financial measures" for further information on these measures. |

Mining

With a strong focus on sustainability, minimizing surface disturbance and accessing high-grade zones earlier in the mining profile, management proposes adopting a hybrid method inclusive of both open pit and underground mining methods. The hybrid method emerged as the optimal choice, balancing economic efficiency with environmental considerations (e.g., reduced Project footprint), and respecting our First Nations partners.

This hybrid approach provides significant flexibility, allowing access to higher-grade zones as needed, which is essential for maximizing Project value while balancing the processing plant throughput and grade and maintaining resource quality.

In the Eeyou Istchee region, underground mining is successfully being deployed at the Éléonore Gold Mine and a hybrid of underground and open pit mining was used at the Stornoway Diamond Mine. The hybrid approach is also expected to reduce project risk throughout the commodity price cycle by allowing more immediate access to higher grade underground areas earlier in the mine plan and significantly reducing the project footprint and the impact to fish and fish habitat thereby reducing the fish compensation requirements.

Initially, open pit mining will be employed at the southwest end of the CV5 Pegmatite, accounting for approximately 56% of the LOM total production target. This method provides efficient access to near-surface and low-strip mineralization, ensuring a steady and cost-effective supply of material to the processing facilities.

As operations progress, and in parallel to continued open pit mining, the Project is expected to then transition to underground mining to extract the remaining 44% of the LOM production target. This method targets high-grade mineralized zones, minimizing surface footprint including disturbance to local water bodies.

The hybrid development of both open pit and underground areas is anticipated to give the Project significant development flexibility and optionality, allowing access to higher-grade zones as needed. This resilience is crucial in challenging market conditions, providing the benefits of a multi-asset mine.

The ability to pivot between different mining methods allows for consistent mill feed quality and recovery rates, enhancing the Project's potential economic robustness and long-term viability.

Figure

3 illustrates the high-grade stopes within the Nova Zone, located near the surface between a depth of 200

m and 500

m. This zone, with grades exceeding 2.5% Li2O, is targeted first in the underground mining sequence in Stage 2 to enhance project economics (additional high-grade stope figures are provided in the mining section of the Appendix).

The large crystal structures are anticipated to allow for easy recovery using dense media separation ("DMS") only. By mining the open pit and the Nova Zone simultaneously, a higher DMS Plant feed grade could be expected to be achieved, providing a competitive advantage, especially in a lower spodumene price environment. The Nova Zone is also well defined as approximately 93% of the mineralized material in this zone is classified as Indicated Resources.

This strategic advantage underscores Patriot's commitment to responsible and sustainable mining practices while maximizing resource extraction. Underground mining facilitates selective mining of high-grade zones, which in turn may position the Company with a competitive advantage in relation to lower operating costs (see below).

High-Grade Mining Potential

Subsets of the Shaakichiuwaanaan CV5 Resource under consideration in this PEA are high-grade, but in particular within the 'Nova Zone'1

as proposed to be mined underground. Selectively targeting the high-grade mining areas has the potential to reduce costs during periods of lower lithium pricing, improving the optionality of the mine.

While a higher-grade, smaller scale scenario has not been considered within the PEA, the Company is evaluating this approach in the FS under consideration as one of the options that could be deployed in the future, in response to a lower pricing environment.

| ____________ |

| 1

|

Approximately 93% of the mineralized material in the Nova Zone is classified as Indicated Resource. 7% as Inferred Resource. |

Table

5 further illustrates Patriot's unique position in the underground setting to have the flexibility to adopt various mining approaches in response to changing market conditions. Within the Resource, the PEA has determined that there is underground mineral resource of approximately 21.8

Mt (diluted & recovered) at 2.10% Li2O per the grade bins shown in Table

5. This resource has the potential to be targeted to reduce costs in a lower pricing environment.

Mining and processing a higher grade has the effect of increasing the 'yield-to-product' derived from processing the resource. That is, more concentrate is produced by processing the same resource tonnes at increased grade and increasing overall

spodumene recovery as the processed grade increases. Using the PEA processing metrics (outlined below and in the Appendices) it is estimated that site costs would reduce by approximately 35-45% via processing 2.1% grade as compared to the PEA LOM average grade of 1.33%.

Processing

The PEA uses a DMS-only process for resource beneficiation, selected for its processing simplicity and efficiency in commissioning and ramp-up. By adopting the DMS-only approach, the Project benefits from lower operating expenses due to the reduced complexity and energy requirements. This streamlined process is expected to enhance economic efficiency and aligns with the commitment to sustainable and responsible mining practices.

This design incorporates two parallel production lines at a feed design capacity of 2.5 Mtpa each, a plant size that has been repeatedly and successfully built and operated in the spodumene industry. Additionally, the DMS process generates a minimal quantity of dry-stacked tailings, further enhancing the Project's efficiency and reducing waste management requirements.

The DMS-only flowsheet has been validated by extensive metallurgical testwork conducted by SGS Canada and supervised by Primero, both with extensive experience in lithium processing operations.

The testwork to date (summarised in Figure

5) has confirmed that the coarse spodumene is the dominant lithium mineral, achieving concentrate grades of over 5.5% Li2O with global lithium recoveries in HLS testing ranging from 70% to 85% (for feed grades in the range 1.0% to 1.5% Li2O respectfully).

The Shaakichiuwaanaan pegmatites have repeatedly shown excellent processing performance, generating high recoveries at the target concentrate grade. This ease of processing is attributed to the consistently large spodumene crystals found in the CV5 Pegmatite. The robust recoveries exhibited across a range of feed lithium grades is a key differentiator for the Project.

The testwork results from both HLS and DMS of the CV5 material, the expected recovery curve from a 3-size range DMS plant (processing Shaakichiuwaanaan pegmatites) and, for reference, recoveries from other operating DMS-only plants (as compiled by external consultants, Primero) are shown comparatively in Figure

5. The project's higher expected recovery (compared with other DMS-only operations) is due to the wide size range being treated (9.5 to 0.65 mm), the quality of the material (large spodumene grains with a narrow grain size distribution) and the three size range DMS plant (which lessens the impact of particle size effect in the DMS process).

By achieving high recoveries with a simpler DMS process design, the Shaakichiuwaanaan Project positions itself with a competitive advantage in the lithium market. Figure

5 shows the majority of other operating DMS-only plants ('Industrial DMS Only Performance'), achieving recovery rates well below the estimated Shaakichiuwaanaan Project DMS lithia recovery performance from test work to date.

Site Support Costs

The PEA proposes operations under a fly-in fly-out ("FIFO") model, which is reflected in the projected site administrative costs. This model ensures that the necessary mining expertise is readily available on-site, contributing to higher initial administrative expenses.

The Company's development vision includes building local capacity and including a model that leverages the skills and talents of the local community, including our First Nations partners. This strategy aims to foster greater community involvement, localizing economic benefits and ultimately reducing administrative costs. By investing in local training and development, the Project will not only enhance its economic efficiency but also strengthen its commitment to sustainable and responsible mining practices.

Infrastructure

The Project benefits from being close to significant existing infrastructure, including all-season road access direct to the CV5 Pegmatite, which connects to the regional provincial network, as well as hydro powerline infrastructure and the LG‐4 hydroelectric dam complex located ~50 km from CV5. Power costs to site are estimated in this PEA to be $0.05 kW/h. The provincial power rate is very low when compared to other global mining jurisdictions and may further increase Shaakichiuwaanaan's competitive advantage during challenging lithium market cycles.

The PEA for the Project considers a comprehensive array of infrastructure to ensure smooth and efficient operations. Key facilities include garages for mining fleets, light vehicles, and highway trucks, as well as administrative offices, dry rooms, warehouses, and auxiliary buildings. These support structures are essential for day-to-day operations, maintenance, and administrative activities.

In addition, the site will include extensive waste rock and rejects management systems, complete with ditching and pond systems for effective water management. Fresh water wells and water treatment plants ensure a reliable supply of water.

The site infrastructure also includes an electrical substation and overhead powerlines to connect to Hydro-Québec's renewable energy grid. Further essential facilities include an emulsion plant, explosive storage magazines, fuel storage pads, refueling stations, and a permanent workers camp to accommodate construction and operational personnel. The Matagami Transshipment Centre is also a key logistical hub, facilitating the efficient transport of materials and resources.

Energy

The Shaakichiuwaanaan Project is set to benefit from low-cost, green renewable energy provided by Hydro-Québec. The Project's proximity to existing Hydro-Québec infrastructure ensures a reliable and sustainable power supply. A new 69 kV transmission line will be constructed to connect the site to the 315 kV Tilly substation, located approximately 55 km away.

This connection should provide ample capacity, with a new electrical substation at the site offering a firm capacity of over 30 MVA, meeting the Project's estimated power consumption of 25.7 MW. The use of Hydro-Québec's renewable electrical energy aligns with our commitment to sustainability and reduces the Project's carbon footprint considerably compared to a fossil fuel supported alternative.

Moreover, the energy consumption for the Project would be relatively low for a hard rock spodumene project, due to the adoption of a DMS only process, which is less energy-intensive compared to traditional flotation methods. This contributes to lower operational expenses and further enhances the Project's environmental credentials. The combination of efficient energy use and sustainable sourcing positions the Shaakichiuwaanaan Project as an environmentally responsible venture.

Final access to power will be subject to both further engineering assessment and application and approvals to access the Hydro-Québec system.

Transport

The CV5 Pegmatite is situated approximately 13.5 km south of the regional and all‐weather Trans-Taiga Road and is accessible year-round by all-season road. Therefore, the existing transportation infrastructure provides a solid foundation for efficient logistics. Highway trucks will transport spodumene concentrate approximately 834

km along the existing all-season regional road network to the Transshipment Centre in Matagami, QC, where it will be transferred to railcars for rail transport to Bécancour via Canadian National Railway's extensive North American railroad network.

Further to the base case transport approach, as outlined above, there are other opportunities for optimization that may help reduce transport costs and expenses. For example, the Project stands to benefit from infrastructure projects under La Grande Alliance between the Cree Nation and the Government of Québec, such as the connection between the Renard Mine and the Trans-Taiga Road, which could positively impact project logistics and reduce costs by reducing the road transport distance significantly. For more detail on the strategy on optimizing transportation and reducing costs, refer to the Key Opportunities section of this announcement.

The strategic choices made in mining, processing, site support, infrastructure, energy, and transport collectively are expected to result in highly competitive operating costs for the Shaakichiuwaanaan Project. These potential cost advantages are driven by economies of scale, the simplicity of the DMS process, and the ability to selectively mine high-grade zones. Additionally, the access to low-cost green energy from Hydro-Québec and the benefits from regional infrastructure projects further enhance cost efficiency.

EBITDA1

Lithium Price Sensitivity Analysis

Sensitivity analysis was completed to determine the impact of various factors on the Project economics. It indicates that the Project is most influenced by spodumene prices. For every US$200/t (SC6 basis) increase in the spodumene concentrate price, the PEA shows that annual EBITDA increased by CA$187.3M.

For this PEA the Company's pricing assumption has been calibrated to SC5.5 by adjusting for lithium content on a pro rata basis. The spodumene price used is US$1,375/tonne (SC5.5% FOB Bécancour basis) equivalent to US$1,500/tonne (SC6 FOB Bécancour basis).

| __________ |

| 1 |

EBITDA is a non-IFRS financial measure and ratio which is comprised of net income or loss from operations before income taxes, finance expense – net, depreciation and amortization. This annual EBITDA is calculated considering the period of full production (i.e., Years 4 to 18). Refer to "Non-IFRS and other financial measures" for further information on these measures.

|

Importantly, the PEA estimates EBITDA of CA$106M at US$700/t (SC6, FOB Bécancour basis) approximating current spot prices for Spodumene Concentrate of US$760/t (PLATTS SC6, FOB Australia 15/08/24), with the project generating positive EBITDA as low as approximately US$600/t (SC6, FOB Bécancour basis).

NPV SENSITIVITY ANALYSIS

Sensitivity analysis was completed to determine the impact of various factors on the Project NPV. It indicates that the Project is most influenced by spodumene prices. For every US$200/t (SC6 basis) increase in the spodumene concentrate price, the post-tax project NPV8% increased by CA$820M. This highlights the upside potential and strong economic leverage the Project holds in a rising market environment.

Current market conditions (as defined by current spot pricing of Spodumene Concentrate US$760/t (SC6, FOB Australia basis -15/08/24) are not representative of recent market price forecasts on a long-term basis from independent reporting agencies, banking commodities analyst reports and company disclosures and recently published technical reports, which indicate spodumene prices generally cluster around US$1,300–US$1,500 per tonne for 5.5% spodumene concentrate1. The Company has used US$1,375/t (SC5.5 FOB Bécancour basis) (which equates to approximately US$1,500/t (SC6 FOB Bécancour basis)), in its PEA with the project estimated to be NPV accretive at levels well below this price. Refer to Figure

7.

The PEA demonstrates on a preliminary basis that NPV is estimated to remain accretive, even with a significant increase in total Project capital costs. This financial resilience indicates the Project's potentially strong financial framework.

| ___________ |

| 1 |

Refer Appendix 1 – Lithium Market and Commodity Price Assumptions |

In addition to a favourable NPV at long-term price estimates, the Project can yield substantial EBITDA1

and FCF1 after the Stage 2 expansion phase and commissioning. The combination of the hybrid mining method, low strip ratio open pit(s), the DMS only processing pathway, and low-cost renewable energy anticipated from Hydro-Québec provides significant flexibility and resilience.

This approach allows for consistent mill feed quality and recovery rates, minimizes operational expenses, and enhances overall Project economics.

| ___________ |

| 1 |

|

EBITDA and FCF are non-IFRS measures. Refer to "Non-IFRS and other financial measures" for further information on these measures.

|

The Project's potential to generate significant cash flows and withstand market volatility is a key advantage. This potential resilience to market volatility is expected to attract midstream and downstream participants in the industry supply chain who are seeking a stable supply of spodumene concentrate for decades, irrespective of market conditions. By ensuring a constant feed the Shaakichiuwaanaan Project strengthens its position as a reliable and valuable long-term partner in the lithium supply chain.

KEY OPPORTUNITIES:

Given the results of this PEA, the Company will now consider the progress of a FS, with the potential of reaching a final investment decision for the Project in 2027. This demonstrates the Company's commitment to optimizing the Project and maximizing shareholder value.

This section outlines key opportunities with the potential to further enhance Project efficiency and sustainability.

Optimise early access via underground to the Nova zone : Providing access to the potential in higher-grade process plant feed and lower operating costs earlier in the production cycle.

Increase Mineral Resources : Focus on increasing Mineral Resources and mine life through further exploration of the Project and surrounding zones like CV13, including its high-grade Vega Zone. Each additional year of plant feed is expected to Project economics and optimize the mine plan.

Optimize underground development: Increase Stope Size and reduce lateral development for cost savings.

Mining Fleet Optimization: Consider the use of autonomous trucks and optimize truck size.

Optimized Material Handling : Improve material handling systems to reduce equipment reliance.

Backfill alternatives vs Paste fill Plant : Trade-off study needed to identify the optimal solution.

Project Schedule Optimization : Streamline project schedules and further refine the phased approach to optimize capital and operational expenditure.

Decarbonisation : Study alternatives for heating methods.

Labour Costs: Develop local capacity to reduce the FIFO model and establish an integrated operations centre with a strong on-site presence.

Addition of bolt-on tantalum recovery circuit: The Project contains a significant tantalum component that is anticipated to be recoverable from the spodumene concentrate tailings.

Valorizing lithium in DMS tailings: The DMS middlings and undersize still contain a meaningful amount of lithium which may be recoverable later in the mine-life through the addition of a flotation circuit.

Meet with La Grande Alliance Stakeholders: During early FS phase, meet with First Nations and government stakeholders with a goal to optimize the transportation of Shaakichiuwaanaan Project concentrate. Specifically, to investigate the timing of planned highway 167 expansion in La Grande Alliance's Feasibility Study to determine the potential reduced cost of haulage of concentrate, from site to next stage of processing at Bécancour Quebec.

OPTIMIZE DOWNSTREAM LOGISTICS

The Shaakichiuwaanaan Project stands to benefit significantly from La Grande Alliance ("LGA") Memorandum of Understanding ("MOU") between the Cree Nation and Québec government. This 30‐year, 3-phase infrastructure plan aims to connect, develop and protect the Eeyou Istchee / James Bay territory and includes several key projects that can reduce traffic on the Billy Diamond Highway ("BDH"), drastically reduce transportation costs and CO2 emissions and enhance the Project's overall sustainability, all while building on the Company's relationship with the Crees.

Connection between Renard Mine and Trans-Taiga Road:

During Years 6-15 of LGA plan, a proposed road extension between the Renard Mine and the Trans-Taiga Road is envisioned. This key piece of infrastructure could reduce trucking considerably, resulting in significant cost savings and a reduction in CO2 emissions. In addition, this road would reduce traffic on the BDH from the Shaakichiuwaanaan Project and other projects in the region. As the BDH is the only route for Crees to access their communities, increased traffic due to the cumulative effects of numerous projects has become a major concern for project development in the region. The extension of Route 167 would decrease traffic by providing an alternate route for concentrate and supply transport. This initiative demonstrates the commitment to improving infrastructure in the Eeyou Istchee region, which can positively impact logistics for the Shaakichiuwaanaan Project.

Refer to the Route 167 - Mine Renard to Trans-Taiga Road document available on the LGA website:

Railroad Extension from Matagami to the Trans-Taiga Road (junction with the BDH & TT at KM541):

The LGA plans to extend the railroad from Matagami to the Trans-Taiga junction with the BDH in two phases, which could eliminate the need for an additional 540 km of trucking. During Phase 1 (Years 1-5), the railway from Matagami to Rupert River would be established. During Phase 2 (Years 6-15), the railway would be extended between Rupert River and the ‐Trans Taiga junction with the BDH at KM541. This extension would not only reduce logistical costs but also decrease the Project's carbon footprint, aligning with our commitment to green energy and sustainability.

Details of the proposed railroad network can be found in the Proposed-Rupert-La-Grande-Rail document available on the LGA website: .

James Bay Port Development:

During Phase 3 of the LGA plan (Years 16-30), the development of a port in James Bay is proposed. Although it may not be available year-round, sea freight options could further reduce logistics costs. Utilizing a port for transportation could enhance the Project's economic efficiency, providing an alternative shipping route that supports sustainable practices.

Information about the proposed port and infrastructure improvements is available in the La Grande Alliance_Résumé-D_Rail-Route-Billy-Diamond document available on the LGA website: .

These infrastructure improvements align with the Project's goals of cost efficiency and sustainability. They also underscore the strategic importance of the partnership with the Cree community, recognizing the meaningful role the Crees play in infrastructure in Eeyou Istchee and fostering local economic development and ensuring the Project's success in the long term.

The potential incorporation of the LGA infrastructure plan into the Shaakichiuwaanaan Project highlights the potential for significant reduction in traffic on the BDH and therefore transportation cost reductions and enhanced sustainability. By leveraging these improvements, the Project can reduce CO2 emissions, contribute to the green economy, and showcase the critical importance of partnering with the Cree Nation. These advancements are expected to provide substantial benefits, making the Shaakichiuwaanaan Project a model of cost-efficient and sustainable mining operations.

FUNDING STRATEGY

The Project has the potential to be the largest known lithium project in North America and could support decades-long production as a high-quality raw material supplier in the North American supply chain. Patriot is progressing a phased development intended to optimize equity returns and reduce the upfront funding requirement. The Company aims to identify the most cost-effective and value-enhancing funding package to benefit both the Company and its shareholders.

Stage 1 phase : Phased development strategy with anticipated Stage 1 funding requirement of $870M (US$661M) for the first 400

ktpa capacity including contingency and pre-production Opex, with potential funding solutions which could include a combination of debt, strategic and listed equity and government programs.

Stage 2 expansion: Additional 400 ktpa to reach an aggregate 800 ktpa spodumene project which may possibly be funded through internal cash flows generated from the Stage 1 Operation. Cashflows from Stage 1 supporting Stage 2 funding would be dependent on (amongst other things) reaching nameplate capacity on Stage 1, applicable pricing at the time of production/expansion and the overall economic viability of the Stage 1 operations and its cashflows, which are not guaranteed1.

Refer to Figure

11 for an indicative potential funding structure.

Further, the Project has attracted strong interest from Tier 1 lithium supply chain participants, including lithium converters, OEMs, and trading houses. The Company is preliminary in exploring a range of funding options intermingled with potential downstream collaboration.

CTM-ITC Tax Credits and other government supports

The Company and its tax advisors have reviewed the initial capital budget for the Project in conjunction with the CTM-ITC first introduced in the 2023 Canadian Federal Budget and enacted on June 20, 2024. As contemplated, the tax credit would provide for up to 30% of the cost of the investment in eligible property used for eligible activities through a refundable investment credit mechanism.

Based on the review, the Company and its tax advisors estimate that up to $790M of expected costs associated with the Project may be deemed eligible under the aforementioned tax credit, leading to a potential refundable investment tax credit of approximately $217M before the end of the expansion phase. There is no guarantee the Company will be able to access all or part of the CTM-ITC. If it does not become available at all, the total Capex for stages 1 and 2 (including contingency) will increase by $217M (see Table

3).

In addition, the Project stands to benefit from Québec's new tax holiday for large investment projects, offering substantial tax relief on capital investment. This incentive is expected to enhance the financial attractiveness of the Shaakichiuwaanaan Project and has been incorporated in the tax routing. Based on the location of the Project and planned eligible investment expenditures, the new tax holiday could provide income tax savings of $146M over the first 5 year of production.

Potential participation from provincial and federal institutions, along with various infrastructure and critical minerals initiatives offered by the Canadian government, further supports the Project's funding strategy. Institutions such as the Critical Minerals Infrastructure Fund, Export Development Canada, the Canadian Infrastructure Bank and Investissement Québec have historically supported mining projects throughout all economic cycles and currently have government mandates to accelerate the development of critical mineral mining projects.

This ecosystem enhances the Project's funding prospects and aligns with North American and European priorities for sustainable and strategic development.

| __________ |

| 1 |

The PEA is only a preliminary economic assessment based on mineral resources which are not reserves and there is no certainty that the PEA assessment, including Stage 1 cashflows, can be realized. Mineral resources that are not ore reserves do not demonstrate economic viability. |

By leveraging a strategic combination of debt, equity, government programs and internal cash flows, the Company believes that it is possible to advance the Project as anticipated.

CONCLUSION

The PEA for the Shaakichiuwaanaan Project highlights its potential to become a leading global lithium producer, enhancing shareholder value while potentially minimizing dilution. By leveraging strategic partnerships and a staged development approach, the Company aims to establish a robust presence in the North American lithium supply chain.

This integrated strategy, supported by government incentives and careful financial planning, targets the long-term sustainability and viability of the Project, positioning it as a cornerstone for the future of lithium raw materials supply to the North American and European markets.

With a clear path to advance directly to a FS and an intention to reach a Final Investment Decision by 2027, the Company is committed to unlocking the full potential of the Shaakichiuwaanaan Project. This next phase of development will continue to focus on enhancing economic returns.

Cautionary Statement: The PEA remains preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

| ____________ |

| 1 |

Refer to Table 3 for relevant details. |

QUALIFIED/COMPETENT PERSON

The independent Competent Person ("CP"), as defined under JORC, and Qualified Person ("QP"), as defined by NI 43-101 for this estimate is Todd McCracken, P.Geo., Director - Mining & Geology - Central Canada, BBA Engineering Ltd. The Effective Date of the Mineral Resource Estimate is August 21, 2024 (through drill hole CV24-526).

The statements relating in this Press Release that relates to the mining section presented in the Appendix 1 is based on information compiled by BBA Inc. and reviewed by Hugo Latulippe, who is a Professional Engineer registered with the Ordre des Ingénieurs du Québec ("OIQ"). Mr. Latulippe is a mining engineer and Principal Engineer for Mining and Geology at BBA Inc., a consulting firm based in Montréal, Québec, Canada. Mr.

Latulippe takes responsibility for the mining aspects of the Shaakichiuwaanaan PEA Press Release as a CP. Mr. Latulippe has sufficient experience relevant to the style of mineralization and type of deposit under consideration and to the activity he is undertaking to qualify as a Competent Person as such term is defined in the JORC Code (2012 edition)) and a Qualified Person (as such term is defined in NI 43-101. The CP, Mr. Latulippe, has reviewed the Shaakichiuwaanaan PEA Press Release and has given his consent to the inclusion in the report of the matters based on his information in the form and context within which it appears.

The statements relating in this Press Release that relates to the project infrastructure section presented in the Appendix 1 is based on information compiled by BBA Inc. and reviewed by Luciano Piciacchia, who is a Professional Engineer registered with the OIQ. Mr. Piciacchia is a geotechnical engineer and Principal Geotechnical Engineer at BBA Inc., a consulting firm based in Montréal, Québec, Canada. Mr.

Piciacchia takes responsibility for the infrastructure aspects of the Shaakichiuwaanaan PEA Report as a CP. Mr. Piciacchia has sufficient experience relevant to the style of project consideration and to the activity he is undertaking to qualify as a Competent Person as such term is defined in the JORC Code (2012 edition)) and a Qualified Person (as such term is defined in NI 43-101. The CP, Mr. Piciacchia, has reviewed the Shaakichiuwaanaan PEA Report and has given his consent to the inclusion in the report of the matters based on his information in the form and context within which it appears.

The statements relating in this Press Release that relates to the financial and economic analysis section presented in the Appendix 1 is based on information compiled by BBA Inc. and reviewed by Shane K. A. Ghouralal, P.Eng, MBA, who is a Professional Engineer registered with the Professional Engineers Ontario ("PEO") and Professional Engineers and Geoscientists of Newfoundland and Labrador ("PEGNL"). Mr. Ghouralal is a mining engineer and Senior Mining Consultant at BBA Inc., a consulting firm based in Montréal, Québec Canada. Mr. Ghouralal takes responsibility for the financial modelling and economic analysis aspects of the Shaakichiuwaanaan PEA Report as a CP. Mr.

Ghouralal has sufficient experience relevant to the style of mineralization and type of deposit under consideration and to the activity he is undertaking to qualify as a Competent Person as such term is defined in the JORC Code (2012 edition)) and a Qualified Person (as such term is defined in NI

43‐101. The CP, Mr.

Ghouralal, has reviewed the Shaakichiuwaanaan PEA Report and has given his consent to the inclusion in the report of the matters based on his information in the form and context within which it appears.

The statements relating in this Press Release that relates to the processing section presented in the Appendix 1 is based on information compiled by Primero Group Americas Inc. and reviewed by Ryan Cunningham P. Eng., who is a Professional Engineer registered with the OIQ. Mr. Cunningham is a processing engineer and Process Engineering Manager for Primero Group Americas Inc., a consulting firm based in Montréal, Québec, Canada. Mr. Cunningham takes responsibility for the processing aspects of the Shaakichiuwaanaan PEA Report as a CP. Mr. Cunningham has sufficient experience relevant to the style of mineralization, type of deposit and processing methodology under consideration and to the activity he is undertaking to qualify as a Competent Person as such term is defined in the JORC Code (2012 edition)) and a Qualified Person (as such term is defined in NI 43‐101. The CP, Mr. Cunningham, has reviewed the Shaakichiuwaanaan PEA Report and has given his consent to the inclusion in the report of the matters based on his information in the form and context within which it appears.

APPENDIX 1 – SUMMARY OF PRELIMINARY ECONOMIC ASSESSMENT

INTRODUCTION

The Shaakichiuwaanaan Property (the "Property" or "Project") is located approximately 220 km east of Radisson, QC, and 330 km west of the Cree Nation of Chisasibi, QC. The northern border of the Property's primary claim grouping is located within approximately 6 km to the south of the Trans-Taiga Road and powerline infrastructure corridor (Figure

12) The La Grande-4 ("LG4") hydroelectric dam complex is located approximately 40 km north-northeast of the Property. The CV5 Spodumene Pegmatite, part of the Shaakichiuwaanaan MRE, is located central to the Property, approximately 13.5

km south of KM270 on the Trans-Taiga Road and is accessible year-round by all-season road. The CV13 Spodumene Pegmatite is located approximately 3

km west-southwest of CV5.

The Property is comprised of 463 CDC mineral claims that cover an area of approximately 23,710

ha with the primary claim grouping extending dominantly east-west for approximately 51

km as a nearly continuous, single claim block. All claims are registered 100% in the name of Lithium Innova Inc., a wholly owned subsidiary of the Company.

Cautionary Statement: The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

There are two primary claim groups that are relevant to the Project – one straddling KM-270 of the Trans-Taiga Road, and the second with its northern border located directly south of KM-270, approximately 5.8

km from the Trans-Taiga Road and powerline infrastructure corridor (Figure

12). The LG‐4 hydroelectric dam complex is located approximately 30 km north-northeast of the Property. The Project is located central to the Property, approximately 13 km south of KM-270 on the Trans-Taiga Road, 14 km south of the powerline, and 50 km southwest of the LG‐4 dam complex.

The Project is located in Eeyou Istchee / James Bay on the traditional territory of the Cree Nation of Chisasibi (trapline CH39), on Category III Land as defined under the James Bay and Northern Québec Agreement ("JBNQA"). The Eeyou Istchee James Bay Regional Government ("EIJBRG") is the designated municipality for the region including the Property.

The Trans-Taiga is an all-season gravel road that trends east-west through the region and connects approximately 210 km to the west of the Project to the Billy Diamond Highway (Rte. 109) at KM541, which extends north to Radisson and south to Matagami, where it connects to Québec's regional road and railroad network. The Project may be accessed by helicopter, float plane, snowmobile, and winter road. The winter road, extending south from KM-270 of the Trans-Taiga Road, has recently been upgraded to provide all-season road access to the Project.

The Property is located in a sub-arctic climate region. Over the course of the year, the temperature typically varies from -27

°C to 20

°C, with rare extremes of -35

°C and 26

°C. Snow covers the ground from mid-October to late May, limiting field work in the winter period to drilling and geophysics. The Property topography consists of forested gently rolling hills, drainages, and muskeg swamps between approximately 260

m and 350

m elevation, typical of the James Bay Region.

The CV5 Deposit is located partially under a lake named 001 ("Lake 001"). Water management is important, and the PEA considers an underground mining portion to access higher grade earlier in the mining sequence, minimize the impact on the lake, reduce the fish habit impact and still recovering the most part of the mineral resource. A water dam and diversion ditch are required.

PROJECT DESCRIPTION

The PEA is centered around open pit and underground mining of CV5, followed by DMS-only processing on site to produce a 5.5% Li2O spodumene concentrate that is then transported by road and rail to Bécancour, Québec. There are no slurry tailings produced from the process plant and therefore the study does not include the requirement for a tailings dam. The PEA assumes product will be converted to Lithium chemicals in Bécancour by the customer(s). Multiples lithium bearing pegmatites have been defined at CV5 to date. Within the PEA, most of the mineable resources is mined from a single pegmatite that has up to 140

m in thickness with the balance mined from other adjacent pegmatites.

MINERAL RESOURCE

The PEA is underpinned by the Shaakichiuwaanaan Mineral Resource Estimate (MRE or Mineral Resource), specifically the CV5 Spodumene Pegmatite component. The Shaakichiuwaanaan Mineral Resource (see news release dated August 5, 2024 ) includes both the CV5 and CV13 spodumene pegmatites for a total of 80.1 Mt at 1.44% Li2O Indicated and 62.5 Mt at 1.31% Li2O Inferred, for 4.88 Mt contained lithium carbonate equivalent ("LCE"). Presented by resource location/name, this MRE includes Mineral Resources of 78.6 Mt at 1.43% Li2O Indicated and 43.3 Mt at 1.25% Li2O Inferred at CV5, and 1.5 Mt at 1.62% Li2O Indicated and 19.1

Mt at 1.46% Li2O Inferred at CV13. The PEA, as announced herein, considers only the Mineral Resources from the CV5 Spodumene Pegmatite.

The Shaakichiuwaanaan Mineral Resource cut-off grade (which in turn is different to the assessed PEA cut-off grade) is variable depending on the mining method and pegmatite (0.4% Li2O open pit, 0.6% Li2O underground CV5, and 0.8% Li2O underground CV13). The Effective Date of the Shaakichiuwaanaan Mineral Resource is June 27, 2024. Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability.

The CV5 Pegmatite component of the Shaakichiuwaanaan Mineral Resource is supported by 344 holes (129,673 m) and 11 outcrop channels (63

m). The block model for the CV5 Pegmatite Mineral Resource is presented below in Figure

13 and Figure

14.

GEOLOGY