VIZSLA SILVER PROVIDES EXPLORATION UPDATE ON PANUCO PROJECT: OUTLINES 10KM DRILL PROGRAM TO TEST NEW TARGETS IN THE EAST AREA

| Drillhole |

From |

To |

Downhole |

Estimated |

Ag |

Au |

Pb |

Zn |

AgEq |

Vein |

|

|

| |

|

|||||||||||

| (m) |

(m) |

(m) |

(m) |

(g/t) |

(g/t) |

% |

% |

(g/t) |

|

|

||

| CS-24-356 |

219.00 |

223.90 |

4.90 |

4.20 |

1,694 |

103.20 |

- |

- |

8,817 |

|

|

|

| Includes |

219.85 |

220.60 |

0.75 |

0.64 |

9,920 |

663.00 |

- |

- |

55,769 |

|

|

|

| NP-24-429 |

433.75 |

435.10 |

1.35 |

1.30 |

2390 |

28.10 |

2.19 |

9.61 |

4,533 |

|

|

|

| CS-24-352 |

211.80 |

217.25 |

5.45 |

5.00 |

1,378 |

22.95 |

- |

- |

2,872 |

Copala |

|

|

| Includes |

213.00 |

216.00 |

3.00 |

2.75 |

2,115 |

39.10 |

- |

- |

4,681 |

|

|

|

| NP-24-431 |

428.55 |

431.15 |

2.60 |

2.40 |

1,551 |

14.08 |

0.97 |

3.84 |

2,561 |

HW4 |

|

|

| Includes |

428.55 |

429.90 |

1.35 |

1.24 |

2460 |

23.20 |

1.57 |

6.10 |

4,121 |

|

|

|

| CS-24-347 |

287.85 |

294.00 |

6.15 |

6.00 |

1,882 |

10.31 |

- |

- |

2,440 |

Copala |

|

|

| Includes |

289.00 |

291.45 |

2.45 |

2.39 |

3,859 |

20.51 |

- |

- |

4,957 |

|

|

|

| CS-24-366 |

348.85 |

357.00 |

8.15 |

7.00 |

1,898 |

9.51 |

- |

- |

2,398 |

Copala 3 |

|

|

| Includes |

348.85 |

349.50 |

0.65 |

0.56 |

3,950 |

25.40 |

- |

- |

5,385 |

|

|

|

| Includes |

351.00 |

352.50 |

1.50 |

1.29 |

3,430 |

18.95 |

- |

- |

4,457 |

|

|

|

| Includes |

352.80 |

354.00 |

1.20 |

1.03 |

3,200 |

13.00 |

- |

- |

3,829 |

|

|

|

| NP-23-359 |

80.00 |

82.05 |

2.05 |

1.65 |

1,552 |

8.37 |

0.47 |

1.22 |

2,066 |

El Molino |

|

|

| Includes |

80.90 |

82.05 |

1.15 |

0.93 |

2,630 |

14.20 |

0.62 |

1.57 |

3,480 |

|

|

|

| CS-23-304 |

468.00 |

471.30 |

3.30 |

2.80 |

1,366 |

6.80 |

- |

- |

1,722 |

Copala |

|

|

| Includes |

468.85 |

469.50 |

0.65 |

0.55 |

5,320 |

25.20 |

- |

- |

6,618 |

|

|

|

| CS-24-354 |

153.50 |

168.30 |

14.80 |

13.00 |

1,017 |

8.19 |

- |

- |

1,503 |

Copala |

|

|

| Includes |

153.50 |

155.10 |

1.60 |

1.40 |

4,124 |

35.11 |

- |

- |

6,229 |

|

|

|

| Includes |

157.55 |

159.05 |

1.50 |

1.31 |

2,540 |

21.30 |

- |

- |

3,813 |

|

|

|

| CS-24-344 |

561.95 |

573.90 |

11.95 |

8.70 |

1,096 |

5.18 |

- |

- |

1,363 |

|

|

|

| Includes |

563.10 |

564.00 |

0.90 |

0.66 |

8,720 |

36.60 |

- |

- |

10,516 |

|

|

|

| CS-24-362 |

344.60 |

346.10 |

16.10 |

10.50 |

804 |

5.27 |

- |

- |

1,103 |

Copala |

|

|

| Includes |

337.50 |

339.75 |

2.25 |

1.47 |

3,437 |

24.87 |

- |

- |

4,881 |

|

|

|

| CS-24-359 |

332.15 |

341.65 |

9.50 |

7.80 |

788 |

4.40 |

- |

- |

1,027 |

|

|

|

| Includes |

336.25 |

337.30 |

1.05 |

0.86 |

5,010 |

25.30 |

- |

- |

6,343 |

|

|

|

| Includes |

341.00 |

341.65 |

0.65 |

0.53 |

1,360 |

7.26 |

- |

- |

1,749 |

|

|

|

| CS-24-357 |

347.00 |

347.45 |

14.45 |

10.90 |

762 |

2.80 |

- |

- |

891 |

Copala |

|

|

| Includes |

345.50 |

347.45 |

1.95 |

1.47 |

3,805 |

13.58 |

- |

- |

4,419 |

|

|

|

| CS-24-342 |

627.60 |

634.25 |

6.65 |

6.00 |

487 |

3.69 |

- |

- |

703 |

Copala |

|

|

| NAP-2023-004 |

108.45 |

119.35 |

10.90 |

6.50 |

328 |

4.32 |

0.79 |

2.11 |

696 |

Napoleon |

|

|

| Includes |

109.12 |

115.25 |

6.13 |

3.65 |

505 |

6.33 |

2.89 |

0.10 |

1,038 |

|

|

|

| COP-2023-004 |

195.75 |

202.10 |

6.35 |

5.10 |

318 |

5.23 |

- |

- |

658 |

|

|

|

| Includes |

197.65 |

198.00 |

0.35 |

0.28 |

338 |

16.00 |

- |

- |

1,436 |

Copala |

|

|

| Includes |

200.90 |

202.10 |

1.20 |

0.96 |

1,270 |

13.45 |

- |

- |

2,104 |

Copala |

|

|

| NP-23-419 |

564.00 |

572.45 |

8.45 |

3.25 |

58 |

7.74 |

0.73 |

1.44 |

650 |

La Luisa Main |

|

|

| Includes |

567.00 |

568.60 |

1.60 |

0.62 |

50 |

16.74 |

0.27 |

0.99 |

1,220 |

|

|

|

| NP-23-420 |

414.60 |

418.25 |

3.65 |

2.80 |

95 |

6.97 |

0.11 |

0.17 |

568 |

La Luisa Main |

|

|

| Includes |

415.60 |

417.50 |

1.90 |

1.46 |

116 |

11.50 |

0.05 |

0.07 |

888 |

|

|

|

| COP-2023-001 |

145.30 |

158.90 |

13.60 |

13.60 |

240 |

1.61 |

- |

- |

332 |

Copala |

|

|

| Includes |

146.00 |

147.10 |

1.10 |

1.10 |

1,075 |

11.55 |

- |

- |

1,793 |

|

|

|

| NP-23-397 |

670.15 |

679.85 |

9.70 |

8.70 |

32 |

1.44 |

0.17 |

2.45 |

221 |

La Luisa Main |

|

|

| Includes |

670.15 |

671.55 |

1.40 |

1.26 |

77 |

6.55 |

0.54 |

1.32 |

577 |

|

|

|

| Note: AgEq = Ag g/t x Ag rec. + ((Au g/t x Au Rec x Au price/gram)+(Pb% x Pb rec. X Pb price/t) + (Zn% x Zn rec. X Zn price/t))/Ag price/gram. Metal price assumptions are $24.00/oz silver, $1,800/oz gold, $2,424.4/t lead and $2,975.4/t zinc. Metallurgical recoveries assumed for Copala are 91% for silver and 94% for gold (see press release dated August 16, 2023). Metallurgical recoveries assumed Napoleon veins and La Luisa are 93% for silver, 90% for gold, 94% for lead and 94% for zinc (see press release dated February 17, 2022). |

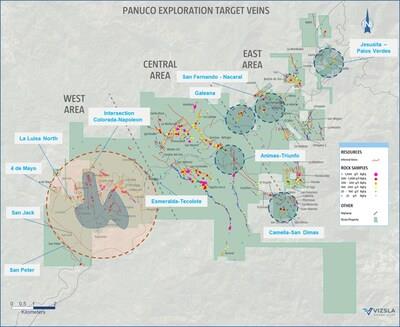

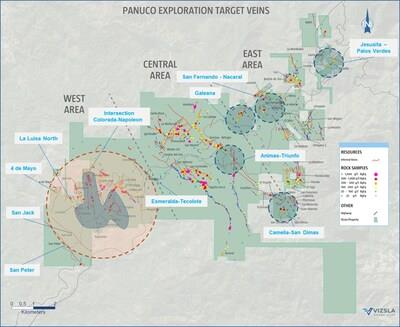

The Hunt for Project 2:

Since consolidation of the Panuco district, Vizsla has continuously conducted detailed geologic mapping and rock chip sampling. To date Vizsla has mapped ~67% of the district at a 1:1,000 scale and has collected over 5,000 rock chip samples. The mapping and sampling efforts, supported by LiDAR, have allowed the Company to define over 158 targets, in the district, of which 43 have been tested. For the remainder of 2024, Vizsla has planned a fully funded 10,000 metre exploration drill program designed to test multiple veins in five high-priority target areas: Camelia-San Dimas, Animas-Triunfo, Galeana, San Fernando-Nacaral and Jesusita-Palos Verdes.

Other important initiatives planned for Q4 2024 include a geophysical survey consisting of VTEM, airborne mag and radiometrics on ~950-line km at 100 metres at 100 metres spacing. Information derived from these surveys will be applied in combination with other tools on hand such as, geology, geochemistry, alteration and multi-spectral World View III satellite imagery to define new exploration targets and locate additional mineralized centers. Geologic evidence that supports the presence of multiple mineralized centers include: intrusions with different age and composition, ubiquitous presence of dikes and domes, extensive hydrothermal alteration across the district, many vein prospects and a vast amount of veins with variable orientations, geochemistry and recently determined 40Ar/39Ar age dates that resolved mineralization at Copala and Napoleon at 25.81 ± 0.05 Ma and 25.72 ± 0.06 Ma (identical age within error) and sericite alteration at the Guayanera dome along the Animas vein trend at 32.14 ± 0.17 Ma. The age gap of ~6 My between epithermal mineralization in the west and hydrothermal alteration (activity) farther east, supports the hypothesis that multiple hydrothermal centers operated in the district over time.

District Targets:

Notable targets to be tested in Q4 2024 located in the central and east areas of the district with potential to host similar mineral resources to that outlined in Project 1 in the west include:

-

Camelia-San Dimas, which consists of two almost vertical subparallel veins in the Camelia trend and the high-grade, flat lying and east dipping, San Dimas Vein. The San Dimas Vein is the highest ranked target due to its features that make it similar to Copala.

Animas-Triunfo is a target designed to test recent interpretations based on mapping, that indicates that the Animas Vein extends to the southeast, in the direction of the Camelia-San Dimas target veins.

The Galeana target is a northeast trending vein with significant silver anomalies observed on surface. More importantly, geologic mapping suggests that exposed outcrops of the Galeana Vein occur proximal to the paleosurface, thus providing great potential for deep drilling.

San Fernando-Nacaral are two parallel veins, that similar to the Galeana target, show indications of great exploration potential at depth.

Jesusita-Palos Verdes is a northeast trending vein target in the east area of the district. Positive drill results and alteration-based interpretations done by Prismo, combined with significant silver anomalies on surface and spectacular vein outcrops warrant additional deep drilling.

Greenfields Projects:

La Garra

The La Garra-Metates District, comprised of 16 claims covering 16,962 Ha, is located approximately 32 km north-northwest of the Panuco Project and 32 km south-southwest of First Majestic's flagship San Dimas mine. The district contains N-NNW-trending silver-gold-rich epithermal veins in a geological setting akin to that of the Panuco Project and San Dimas. Two main vein systems are known to date: the N-S trending La Garra with ~2.6 km of known strike length and the NW trending Cerro Verde – Las Playas vein system with ~1.8 km of strike length.

In December 2023, Vizsla Silver conducted a five-day site visit and collected 37 samples on vein outcrops and underground pillars on La Garra and Cerro Verde – Las Playas vein systems: fourteen rock-chip samples collected across veins ranging from 0.30 to 2.50 metres reported silver equivalent grades (AgEq) greater than 200 g/t (2.22 to 12.30 g/t Au and 22 to 1,156 g/t Ag). Because of its favourable location in the emerging Panuco – San Dimas silver-gold-rich corridor, its geologic setting, vein orientation and observed high-grades, Vizsla Silver's geologists are confident that the La Garra-Metates District has good potential for a discovery of high-grade mineralization along-strike and at depth on the La Garra and Cerro Verde – Las Playas vein systems.

San Enrique

The San Enrique prospect area is adjacent to the southern boundary of the Panuco project and comprises two titled mining claims covering 10,667.0 Ha. LiDAR and high-resolution mag data show strong NW-trending lineaments, indicative of regional faults and fractures. Two of these lineaments are aligned and seem to be the SE extensions of the Copala fault and the Cordon del Oro - Animas vein structures at Panuco. The San Enrique prospect contains several indicators that suggest it is a highly prospective area, namely: location (Panuco – San Dimas corridor), high-grade deposits immediately north (Copala and Panuco), structural controls (southeast extensions of the Copala fault and Cordon - Animas lineament), domes and an operating mine to the south along another NW regional fault (Santa Fe mine, Inca Azteca). The recently acquired multispectral World View III satellite image covering the Panuco and San Enrique claims will help Vizsla with target definition at San Enrique.

Key Exploration Objectives for 2024

-

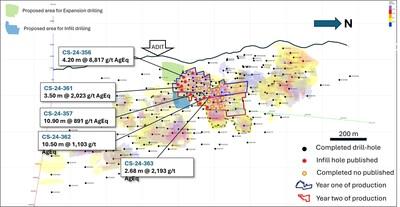

Complete +10,000 metres of exploration drilling in the central-east area of the district.

Complete +5,000 meters of resource infill/expansion drilling in Copala central.

Complete VTEM, airborne mag and radiometric surveys on 950 l-km.

Advance mapping of the district to 70% coverage.

Provide updated resource estimate in Q4 2024.

About the Panuco Project

The newly consolidated Panuco silver-gold project is an emerging high-grade discovery located in southern Sinaloa, Mexico, near the city of Mazatlán. The 17,856.5-hectare, past producing district benefits from over 86 kilometres of total vein extent, 35 kilometres of underground mines, roads, power, and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

On January 8, 2024, the Company announced an updated mineral resource estimate for Panuco which includes an estimated in-situ indicated mineral resource of 155.8 Moz AgEq and an in-situ inferred resource of 169.6 Moz AgEq (please refer to our Technical Report on Updated Mineral Resource Estimate for the Panuco Ag-Au-Pb-Zn Project, Sinaloa State, Mexico, by Allan Armitage, Ben Eggers and Peter Mehrfert, dated February 12, 2024 and to our Company ́s press release dated January 8, 2024).

About Vizsla Silver

Vizsla Silver is a Canadian mineral exploration and development company headquartered in Vancouver, BC, focused on advancing its flagship, 100%-owned Panuco silver-gold project located in Sinaloa, Mexico. To date, Vizsla Silver

has completed over 368,000 metres of drilling at Panuco leading to the discovery of several new high-grade veins. For 2024, Vizsla Silver

has budgeted +30,000 metres of resource/discovery-based drilling designed to upgrade and expand the mineral resource, as well as test other high priority targets across the district.

Quality Assurance / Quality Control

Drill core samples were shipped to ALS Limited in Zacatecas, Zacatecas, Mexico and in North Vancouver, Canada for sample preparation and for analysis at the ALS laboratory in North Vancouver and rock samples were shipped to SGS Lab in Durango Mexico for sample preparation and analysis. The

ALS Zacatecas, North Vancouver facilities and SGS lab are ISO 9001 and ISO/IEC 17025 certified. Silver and base metals were analyzed using a four-acid digestion with an ICP finish and gold was assayed by 30-gram fire assay with atomic absorption ("AA") spectroscopy finish. Over limit analyses for silver, lead and zinc were re-assayed using an ore-grade four-acid digestion with AA finish.

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's quality assurance / quality control protocol.

Qualified Person

In accordance with NI 43-101, Jesus Velador, Ph.D. MMSA QP., Vice President of Exploration, is the Qualified Person for the Company and has reviewed and approved the technical and scientific content of this news release.

Information Concerning Estimates of Mineral Resources

The scientific and technical information in this news release was prepared in accordance with NI 43-101 which differs significantly from the requirements of the U.S. Securities and Exchange Commission (the "SEC"). The terms "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" used herein are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum Standards (the "CIM Definition Standards"), which definitions have been adopted by NI 43-101. Accordingly, information contained herein providing descriptions of our mineral deposits in accordance with NI 43-101 may not be comparable to similar information made public by other U.S. companies subject to the United States federal securities laws and the rules and regulations thereunder.

You are cautioned not to assume that any part or all of mineral resources will ever be converted into reserves. Pursuant to CIM Definition Standards, "inferred mineral resources" are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures.

Canadian standards, including the CIM Definition Standards and NI 43-101, differ significantly from standards in the SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the "SEC Modernization Rules"), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". Information regarding mineral resources contained or referenced herein may not be comparable to similar information made public by companies that report according to U.S. standards. While the SEC Modernization Rules are purported to be "substantially similar" to the CIM Definition Standards, readers are cautioned that there are differences between the SEC Modernization Rules and the CIM Definitions Standards. Accordingly, there is no assurance any mineral resources that the Company may report as "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the resource estimates under the standards adopted under the SEC Modernization Rules.

Website:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain "Forward–Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward–looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward–looking statements or information. These forward–looking statements or information relate to, among other things: the exploration, development, and production at Panuco; the publication of an updated mineral resource estimate in late Q4 2024; and exploration objectives and targets.

Forward–looking statements and forward–looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Vizsla Silver, future growth potential for Vizsla Silver and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold, and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Vizsla Silver's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Vizsla Silver's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward–looking statements or forward-looking information and Vizsla Silver has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company's dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company's mining activities in Mexico; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding mineral resources and reserves; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities and artisanal miners; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption "Risk Factors" in Vizsla Silver's management discussion and analysis. Readers are cautioned against attributing undue certainty to forward–looking statements or forward-looking information. Although Vizsla Silver has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Vizsla Silver does not intend, and does not assume any obligation, to update these forward–looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

SOURCE Vizsla Silver Corp.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment