Japan's Plan To Dominate Software-Defined Vehicles

SDVs are cars whose functions update regularly via the internet, similar to computer programs and smartphone apps.

In METI's estimation, 30% of the global market would be 11-12 million vehicles in 2030 and 17-19 million by 2035. By comparison, Toyota, produced 10.8 million vehicles in 2023. Toyota, Honda and Nissan combined produced 18.3 million.

The METI roadmap covers electric vehicle hardware, software and infrastructure, the application of generative AI for autonomous driving, a globally compatible data service, cybersecurity measures, scenario planning and business models for robo-taxis and self-driving trucks.

A new program to promote the training of engineers and other relevant human resources is scheduled to begin later this year. By 2035, METI plans to establish a“Mobility DX Platform” with the participation of the auto and related industries, start-ups, universities, research institutions and knowledgeable individuals.

This will be a continuation of JASPAR (Japan Automotive Software Platform and Architecture), which was established in 2004 to enable the standardization of in-vehicle electronic control systems and software.

The idea is to boost collaboration between companies, increase competition to secure software talent and accelerate the number of new projects, all toward the aim of building a “community” or eco-system for the development and practical use of digital mobility technologies.

Huawei plans to make 3nm chips, but when?

Drones filling the skies over Ukraine battlefields

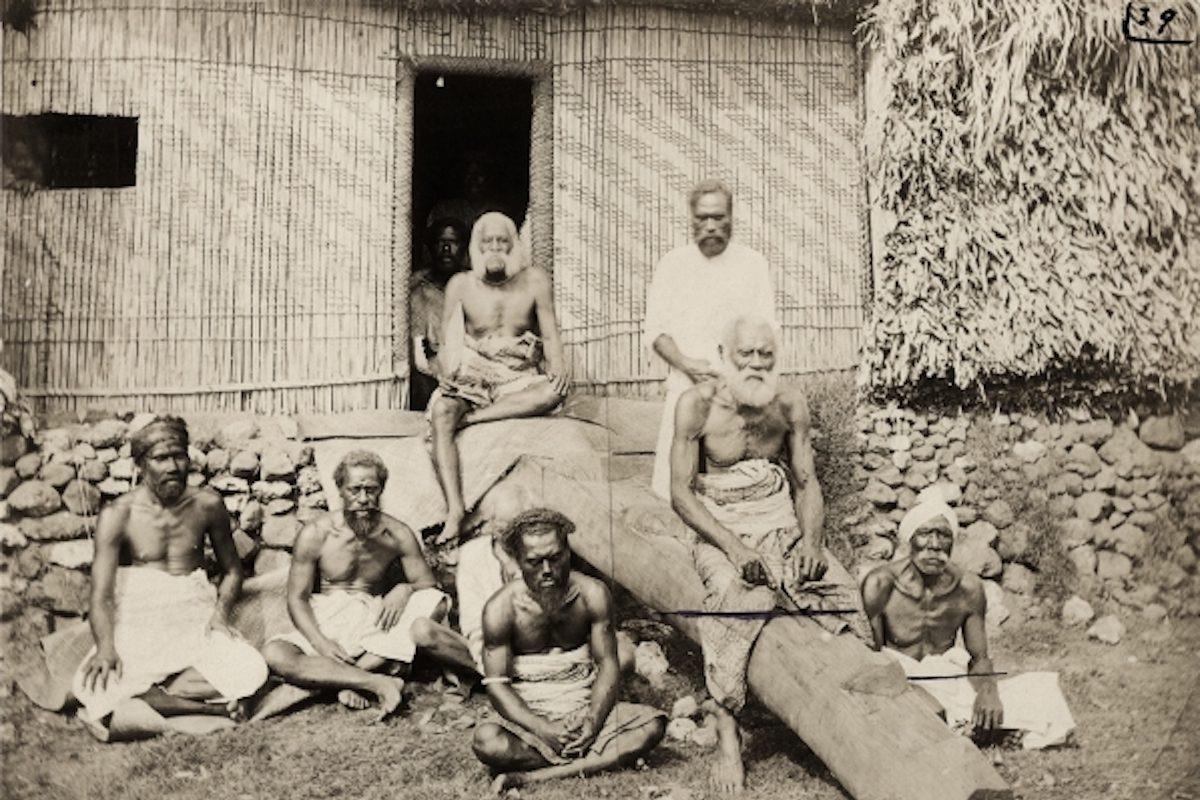

Traditional leaders can boost Pacific Islands unity

In a statement released on May 24, METI notes that digital technology is bringing major changes to the value chain of the auto industry, which is in the midst of“a global game change.” Together with electrification, it expects DX to become a competitive axis along which“all Japan” public-private collaboration should be promoted.

Japanese automakers are already moving in this direction. On May 15, Honda and IBM announced that they had signed a memorandum of understanding (MOU) outlining their intent to collaborate on SDV development. A joint statement on the announcement said:

IBM defines brain-inspired computing as“Computer architecture and algorithms that mimic the brain's structure and function while optimizing for silicon.”

Honda, which would likely struggle to do this independently, plans to increase its R&D budget by 23% this fiscal year to a record 1.2 trillion yen ($7.6 billion). The spending will focus on electrification and software.

Honda has also formed an alliance with Nissan for the joint development of in-vehicle software, batteries and other electric vehicle components as well as autonomous driving in preparation for the introduction of SDVs around the end of the decade.

This should make it easier for them to compete with larger companies such as Toyota, Volkswagen and Hyundai-Kia, and catch up with Tesla and Chinese electric vehicle (EV) makers like BYD.

Meanwhile, Sony Honda Mobility plans to use Japanese mobile telecom carrier KDDI's Global Communication Platform to provide network services for their AFEELA EV, scheduled for sale in 2025, and other EVs to follow. Sony Honda Mobility is a 50-50 joint venture established in September 2022.

For its part, Toyota plans to spend 1.7 trillion yen ($10.8 billion) this fiscal year on AI, software, battery-powered EVs and hydrogen fuel cell vehicles. Nissan, which is restructuring to restore its competitiveness, plans to invest 2 trillion yen in vehicle electrification by the end of the decade.

At the leading edge, Turing, a Japanese start-up with the mission“We Overtake Tesla,” aims to develop a Level 5 autonomous driving system by 2030. A vehicle operating at Level 5 is completely self-driving, able to go anywhere in all road conditions without a driver.

Supported by Japanese venture capital funds and mobile telecom carriers NTT DOCOMO and KDDI, Turing is headquartered in Tokyo and has a factory situated in Kashiwa to the northeast.

Turing was founded in 2021 by CEO Issei Yamamoto, who previously created an AI software program called“Ponanza” that plays shogi (Japanese chess) at a professional level.

Shunsuke Aoki, the company's chief technology officer, holds a doctorate in electrical and computer engineering from America's Carnegie Mellon University. Research into autonomous driving began at Carnegie Mellon in the 1980s.

Asserting that“what is necessary for autonomous driving is not good eyes, but a good brain,” Turing is developing AI that“directly issues driving instructions from camera images... without using many sensors or high-precision maps.” According to Turing, this entails:

- End-to-End (E2E) Autonomy: Using vast driving datasets, we develop E2E autonomous driving AI that transforms camera imagery directly into driving commands with our powerful neural networks.

- Generative AI: Driving isn't just about the rules learned in driving school. At Turing, we see generative AI's common sense as a key to unlocking complete autonomous driving.

- “Gaggle Cluster”: We are constructing Japan's premier GPU cluster-powered by 96 Nvidia H100 units-dedicated to our technological advancements.

Aoki announced in April that Turing has accelerated its software development with the goal of running a driverless car on the streets of Tokyo for more than 30 minutes by the end of this year. Toyota and other Japanese automakers are hot on their tail with plans to start introducing SDVs in 2025.

Sign up for one of our free newsletters

- The Daily ReportStart your day right with Asia Times' top stories AT Weekly ReportA weekly roundup of Asia Times' most-read stories

Follow this writer on

X: @ScottFo83517667

Thank you for registering!

An account was already registered with this email. Please check your inbox for an authentication link.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment