QNB Sets Global Benchmarks In Digital Banking And Innovation

Doha, Qatar: QNB Group, the largest financial institution in the Middle East and Africa, continues to solidify its position as a global leader in digital banking and technology, coinciding with the celebration of its remarkable 60 years in the financial landscape.

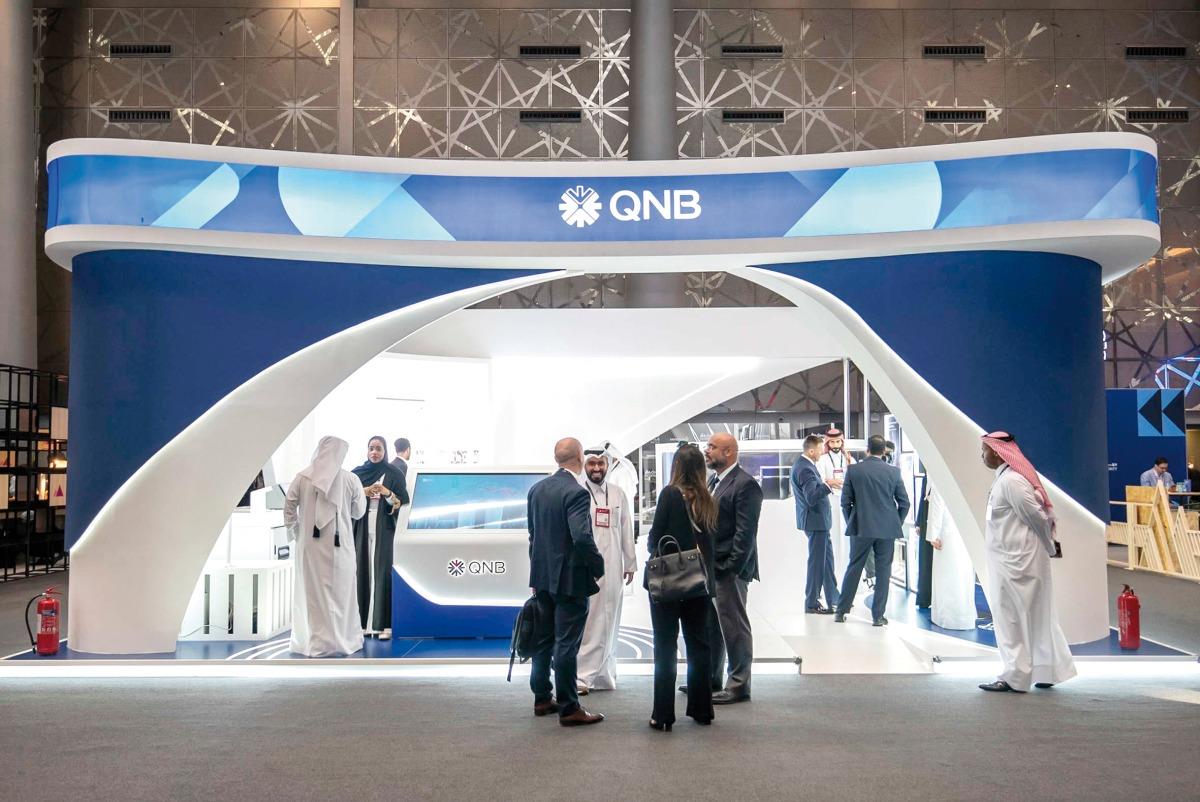

The Group, represented by its Chief Operating Officer, Ali Rashid Al Mohannadi, has officially signed an agreement to sponsor the Web Summit Qatar for the next four years. This collaboration with the Web Summit Qatar, symbolizes a harmonious intersection of cutting-edge innovation and a six-decade journey of financial leadership.

Following the success of the inaugural edition held in Doha, this partnership underscores QNB's commitment to driving innovation and technological advancements in the region.

QNB's pursuit of innovation is evident in its cutting-edge solutions that redefine the banking experience. The implementation of pioneering technologies, such as artificial intelligence, block-chain, and digital onboarding (digital account opening), advanced contactless solutions underscores QNB's dedication to staying at the forefront of the industry.

Embracing the latest advancements, the bank has seamlessly integrated digital services, offering customers with unparalleled convenience. With more than 90% of QNB's customer interfacing processes being digitized, from QNB Mobile Banking to Self-Service Machines, the Bank ensures a seamless and secure customer experience for its customers.

QNB's strategic partnerships with global tech leaders have played a pivotal role in its technological prowess. Collaborations with industry giants, including Apple, Google, Visa and Mastercard, have enabled the bank to leverage the latest innovations, ensuring its services remain not only current but also anticipatory of future trends (Google Pay, Apple Pay, etc)

The Bank has gathered prestigious awards and accolades for its contributions to banking technology and innovation. Adding to its array of achievements, QNB has recently received the“Best Mobile App” award at the Qatar Digital Business Awards 2023.

Recently, it received“Best Digital Bank in the Middle East” and“Best Digital Bank in Qatar” awards from The Digital Banker. QNB also won“Best Bank for Digital Solutions in Qatar” award from Euromoney Magazine, and“Best Mobile Banking App,”“Best Payment Innovation,” and“Excellence in Product Marketing” at MEED's MENA Banking Excellence Awards. These recognitions serve as a testament to QNB's commitment to excellence and to providing innovative banking solutions both within the region and globally.

In line with its commitment to innovative advancements, QNB Group has displayed its technological ability on a global scale with the launch of QNB Bebasata, a digital banking platform in Egypt that provides customers with a seamless digital banking experience.

QNB Bebasata offers customers the convenience of opening Current, Savings, Time Deposit, and Certificate of Deposit accounts, applying for loans, issuing debit and credit cards, making payments, executing safe and secure international transfers, and much more, all through a single platform.

Furthermore, QNB Finansbank continues to lead the way in Retail Banking. Enpara, Turkey's first branchless bank provides exclusive services through digital channels, catering to thousands of customers with cost-free digital banking solutions. With a primary focus on customer satisfaction, Enpara experiences daily growth, largely driven by customer recommendations across the region.

This omni-channel approach exemplifies the bank's forward-thinking and innovative approach to market-leading digital banking solutions.

QNB Group currently ranks as the most valuable bank brand in the Middle East and Africa. Through its subsidiaries and associate companies, the Group extends to 28 countries across three continents providing a comprehensive range of advanced products and services.

The total number of employees is more than 30,000 operating from approximately 900 locations, with an ATM network of over 4,800 machines.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment