(MENAFN- ING) The Spanish housing market has experienced a notable decline recently. However, despite the sharp rise in interest rates, there are enough mitigating factors that make a soft-landing scenario likely. We forecast 1% average price growth this year and 0% next year In this article spanish housing market sees 21% drop in sales in april house price growth comes to a halt rising interest rates pose challenge to housing market affordability based on current trends, it appears that interest rates have not yet reached their peak an abrupt market crash seems ruled out weak price growth in 2023 and 2024

Spanish housing market sees 21% drop in sales in April The Spanish housing market has entered a clear slowdown recently, with several factors contributing to reduced demand for property. Rising interest rates, tighter credit conditions and global economic uncertainties, including geopolitical instability, have all dampened housing demand. In April, mortgage demand fell below its five-year average for the first time and the number of transactions also showed a clear downward trend in the first few months of this year. The latest figures from notaries, which are usually ahead of the official figures, suggest that this downturn is likely to continue in the coming months. According to the General Council of Notaries, home sales fell 21% in April compared to the same period last year, while the number of mortgage loans to buy a home fell by 32% year-on-year.

However, the downturn is much less severe than in other countries, where mortgage demand has fallen even more sharply. This can partly be attributed to increased interest from foreign buyers following the relaxation of Covid restrictions in 2020 and 2021. Property scarcity also remains a persistent problem. Demand has exceeded supply in recent years, slowing the downturn in demand. Moreover, Spain's economy has performed better than the eurozone average, helped by a rebound in tourism, which has also supported the housing market.

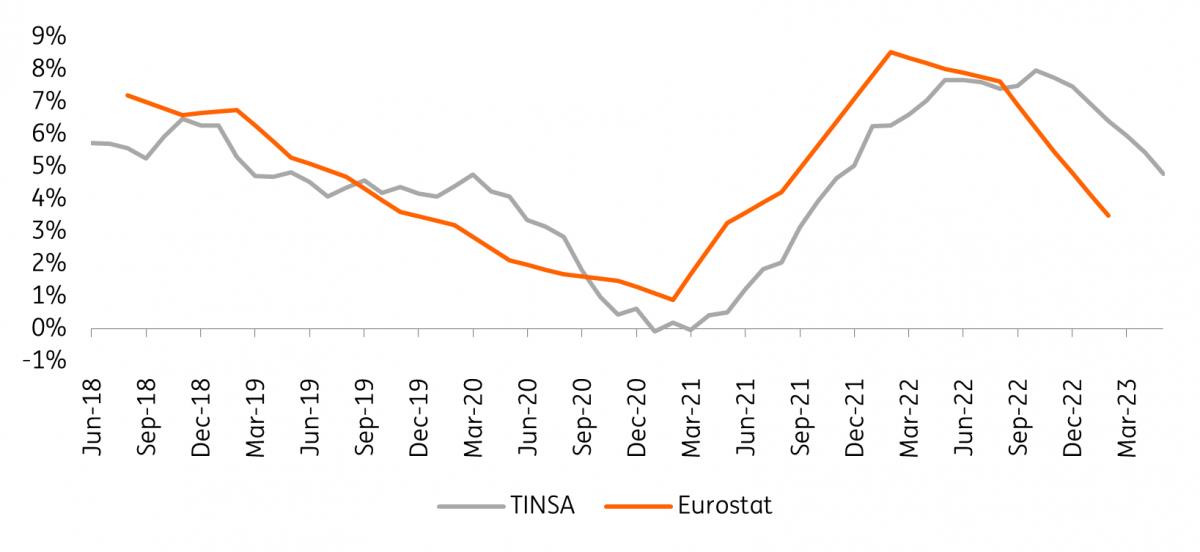

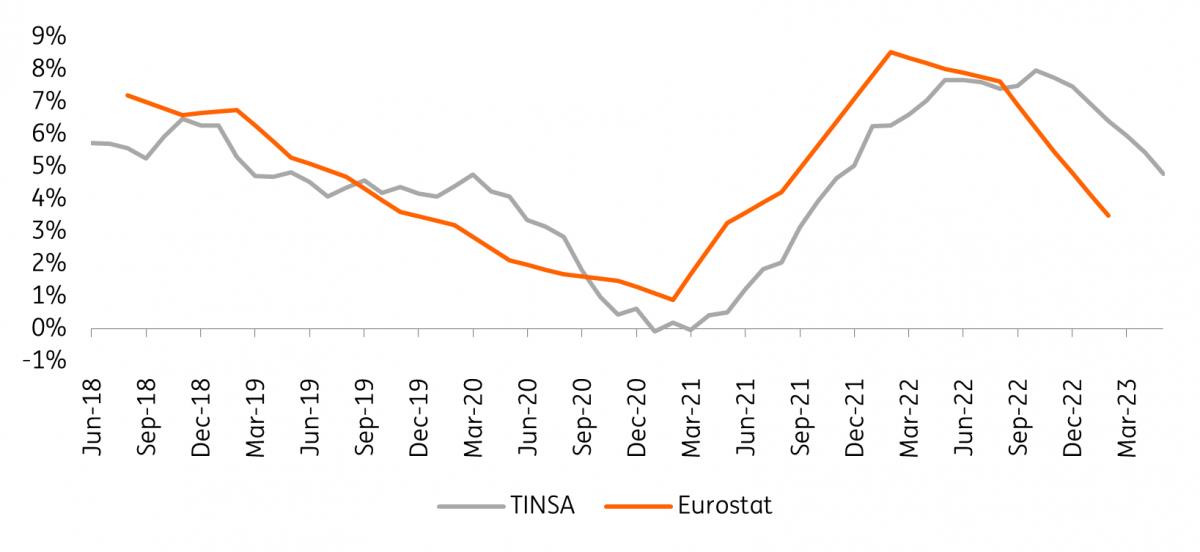

House price growth comes to a halt Due to declining demand in the Spanish property market, there has been a marked slowdown in price growth. With a reduced number of potential buyers, sellers face fiercer competition, resulting in reduced pricing power. While house price growth peaked at 8.5% year-on-year in the first quarter of 2022, according to Eurostat, it fell to 3.5% in the first quarter of this year. Other price trackers such as TINSA also show a clear downward movement.

Spanish house prices, in % YoY

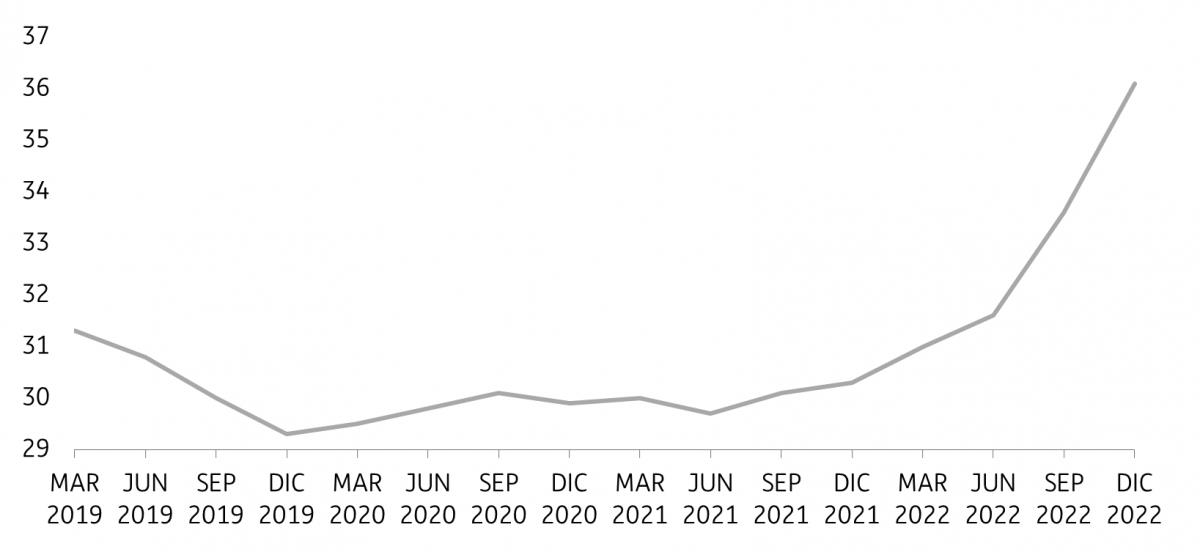

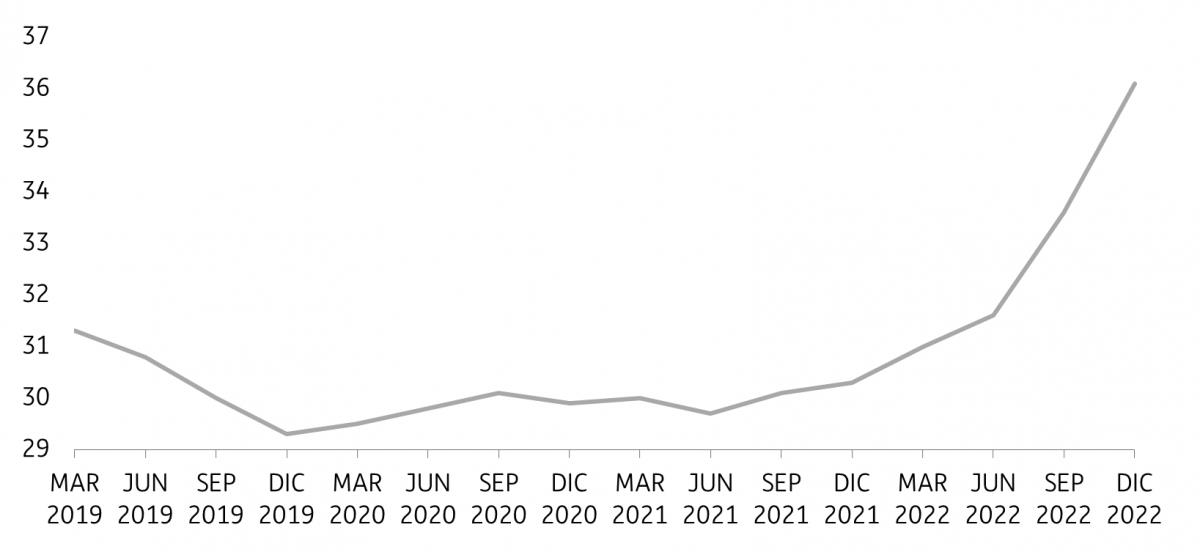

Eurostat, TINSA Rising interest rates pose challenge to housing market affordability Over the past year, the sharp increase in interest rates has put significant pressure on the buying power of potential homebuyers, making it challenging for prospective buyers to buy a home or to qualify for a mortgage loan at current price levels. According to calculations by the National Bank of Spain, affordability has dropped significantly over the past year. The bank regularly assesses the percentage of income an average household would have to spend if they bought a house with an 80% loan. These calculations show a remarkable deterioration in property affordability. At the beginning of 2022, households only needed to spend 30% of their income to repay loans, but by the fourth quarter of that year, this percentage had risen to more than 36%.

Although wages are picking up, interest rates rose further in the first half of 2023, which has likely worsened housing affordability. Affordability will continue to be under strong pressure in the second half of the year due to further increases in interest rates.

Housing affordability has significantly worsened over the past year

Bank of Spain

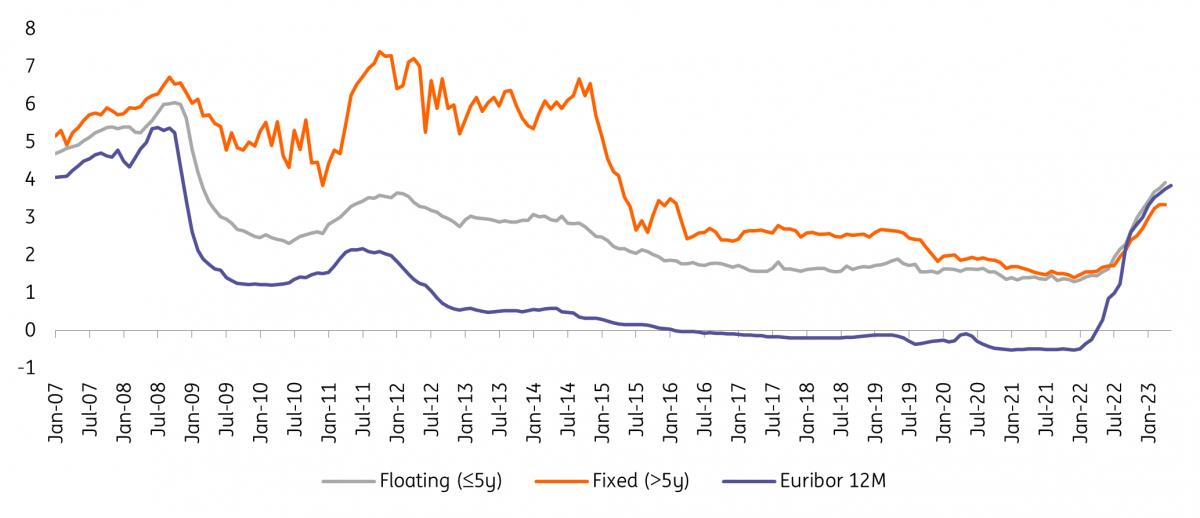

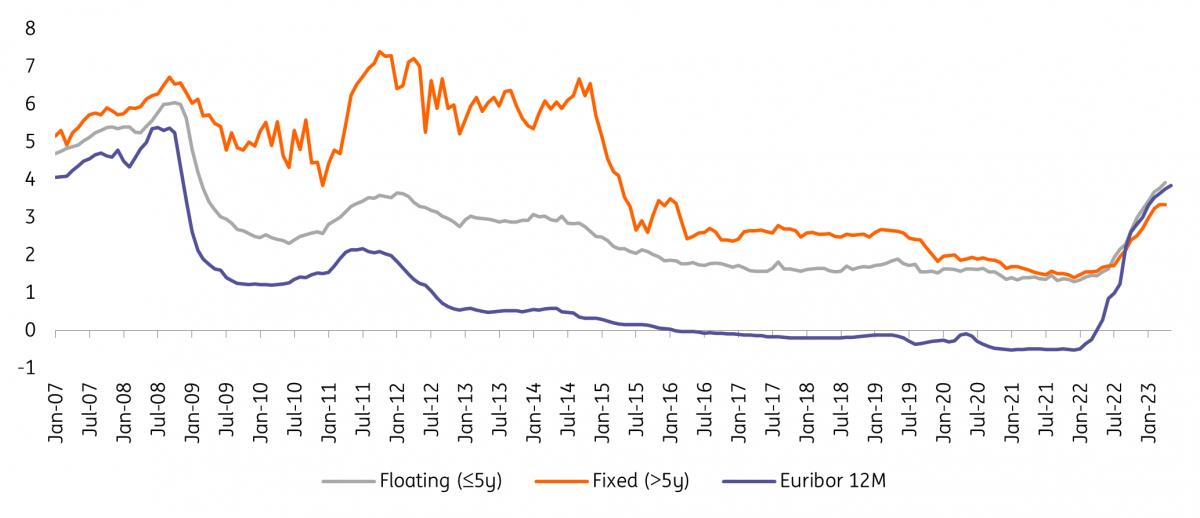

Gross monthly mortgage payments as a percentage of disposable annual income for an average household in the first year after purchasing a home with a standard loan of 80% of the home's value Based on current trends, it appears that interest rates have not yet reached their peak In the coming months, we expect more increases in interest rates, which could put further pressure on affordability. The 12-month Euribor benchmark interest rate, which guides mortgage rates, is expected to rise further, although interest rates are believed to be close to their peak. The European Central Bank (ECB) has already hinted at a 25 basis point rate hike at its upcoming meeting in July. Recent hawkish statements by some ECB members seem to indicate that one or more rate hikes will follow after the summer. This will put additional upward pressure on the Euribor. On top of that, mortgage rates have yet to catch up after the rapid rise in Euribor.

Based on current trends, mortgage rates will continue to rise in the coming months. We expect the average variable rate (with a fixed-rate period of up to five years) for mortgages to potentially peak at 5% in the second half of this year. This projection reflects a significant increase from the rate of 3.9% recorded in April 2023.

The upside potential for fixed interest rates is even bigger. Currently, there is an atypical scenario where floating rates are higher than fixed rates. This suggests that fixed interest rates have even more room to rise and again exceed floating rates.

Evolution of interest rates on mortgage loans and Euribor 12M

Bank of Spain, calculations ING An abrupt market crash seems ruled out All indicators point to a substantial slowdown in the housing market this year. A further rise in interest rates will continue to put pressure on affordability and further dampen demand for mortgages later this year. While a marked slowdown is expected, several factors are also reducing the likelihood of a severe price correction or abrupt market crash.

First, the drop in energy costs reduces uncertainty for households and frees up additional budget that can be spent on monthly mortgage payments. Second, incomes will continue to rise. Nominal wage growth will pick up after the sharp drop in real purchasing power in 2022. In addition, low unemployment ensures steady growth in gross national income. The combination of rising nominal incomes and a tight labour market will provide some support to the demand side of the real estate market.

Finally, despite this current temporary dip, demand will continue to grow structurally in the coming years. Slower supply growth will create scarcity in the market, which will put upward pressure on prices.

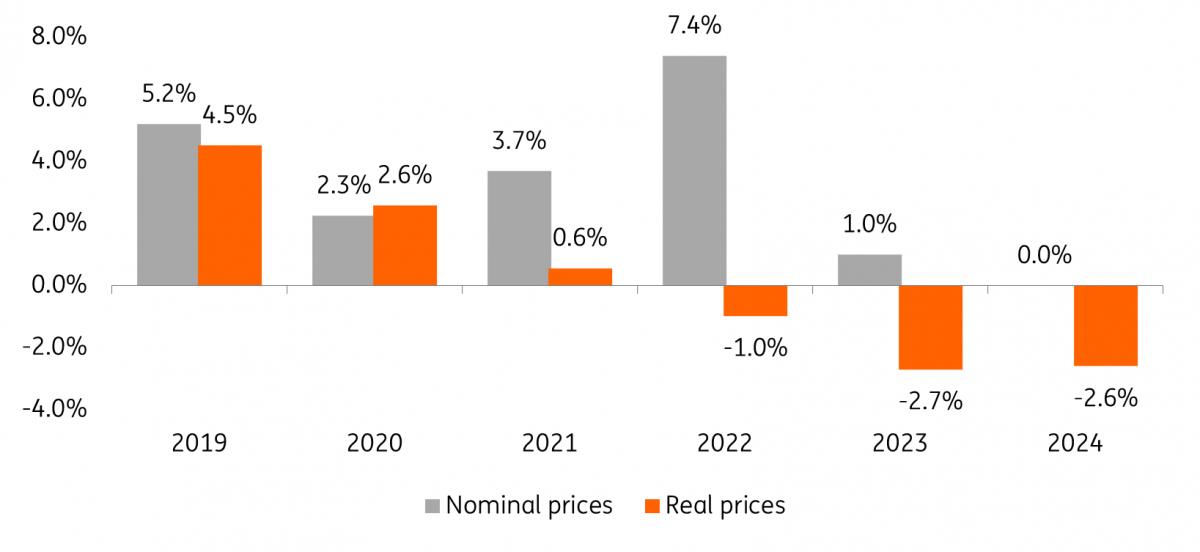

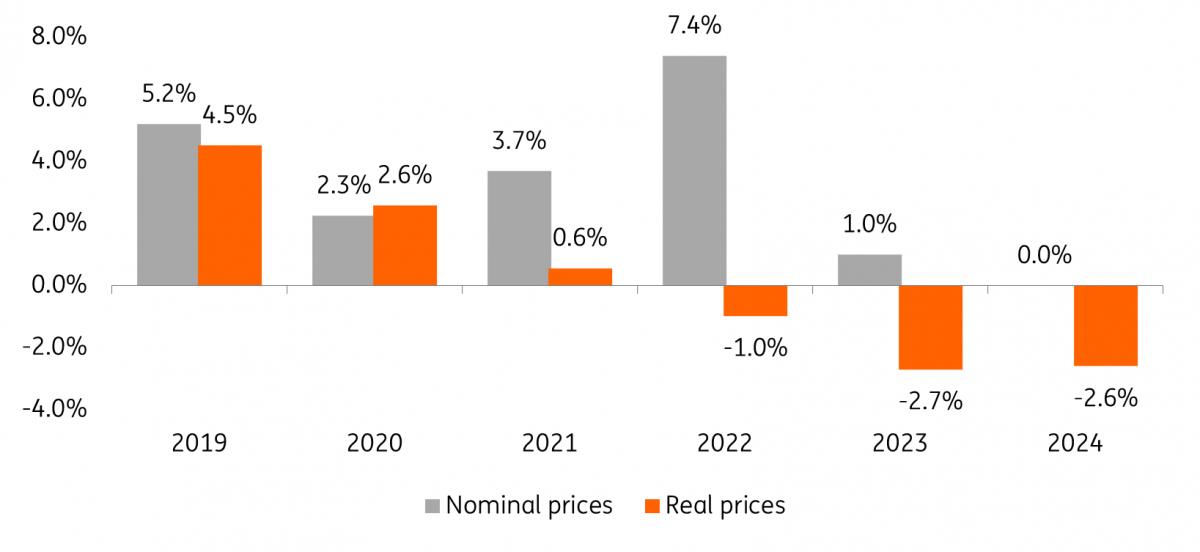

Weak price growth in 2023 and 2024 We have updated our forecast for the current year and now assume price growth of 1%, which is an upward revision from our earlier estimate of 0%. This revision is due to the continued house price growth at the beginning of the year, albeit at a slower pace. Our price forecast assumes a slight decline in prices in the second half of this year. For 2024, we have revised our forecast downwards to 0% from our earlier estimate of 1% as we expect the continued rise in interest rates will dampen any recovery in the property market next year.

Overall, this scenario forecasts a soft landing for the Spanish housing market. Although there is a risk of a slight drop in prices in the second half of this year, the overall price correction will remain modest in nominal terms. However, it is important to note that the correction in real terms will be significantly higher due to the impact of high inflation. Inflation-adjusted prices fell slightly last year and we expect further declines of around 2.5% to 3% in 2023 and 2024. Over a three-year period, the cumulative real price adjustment is expected to exceed 6%.

Evolution of Spanish house prices, including ING forecast

Eurostat, INE, ING forecast

Comments

No comment