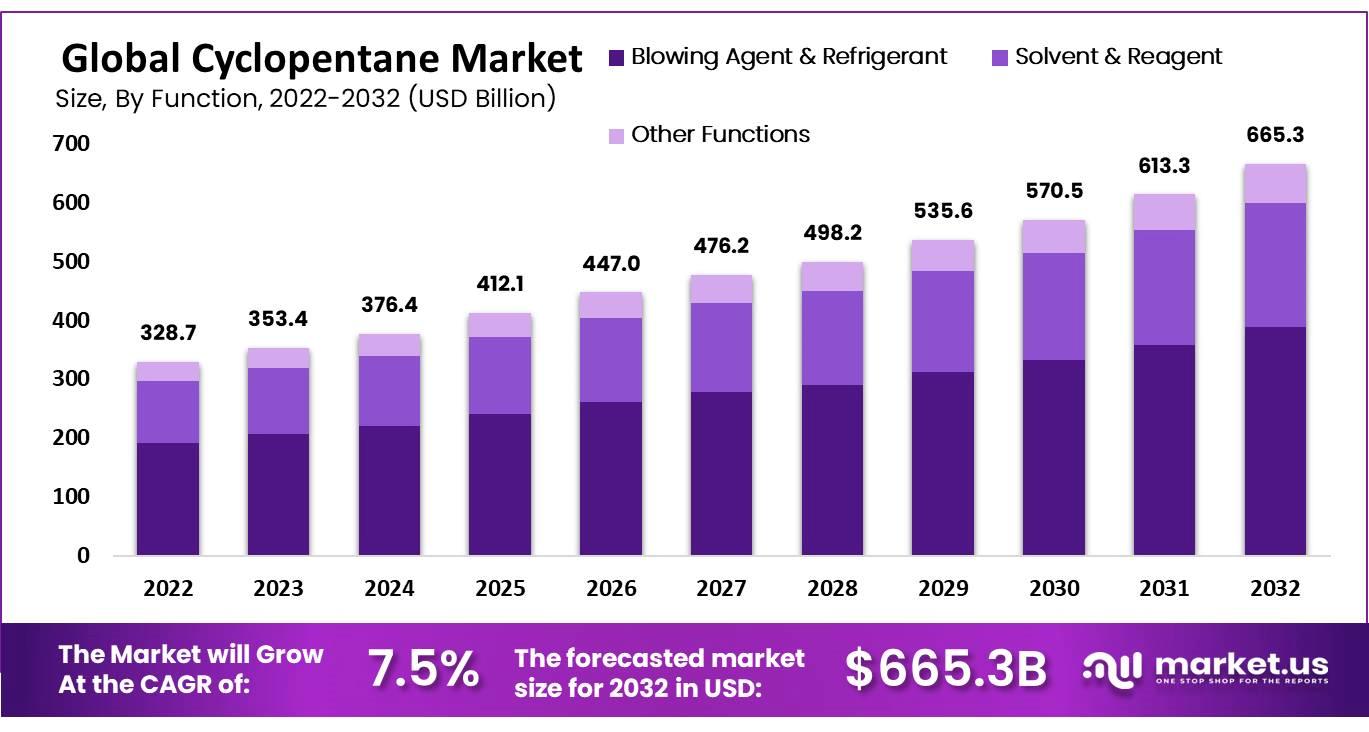

Cyclopentane Market To Obtain USD 665.3 Billion By 2032, Registering A 7.5% CAGR | Exclusive Report By Market.Us

| Report Attribute | Details |

| Market Value (2022) | USD 328.7 billion |

| Market Size (2032) | USD 665.3 billion |

| CAGR (from 2023 to 2032) | 7.5% |

| APAC Revenue Share | 43.6% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

Cyclopentane is a versatile chemical, often employed as a blowing agent in polyurethane foam production. With an almost colorless and flammable liquid and faint aroma, cyclopentane finds numerous uses across numerous industries. The cyclopentane market is driven by several factors, such as rising demand for energy-efficient buildings and appliances, rising consumer goods like furniture and mattresses, stringent environmental regulations, growing interest in renewable energy sources, increased industrialization and urbanization trends, as well as an expansion in construction materials production. Cyclopentane stands out among other chemicals due to its environmental friendliness, making it a preferred option for companies looking to meet regulatory requirements and reduce their carbon footprint. Industry analysts anticipate that demand for cyclopentane will continue growing as companies look for more sustainable and eco-friendly solutions in their manufacturing processes.

Market Restraints

One of the major restraints is the stringent health and safety regulations that govern its production, transportation, and use. Compliance with these regulations can be costly and time-consuming, which can affect the profitability of companies operating in this market. Additionally, cyclopentane is a hazardous liquid with a low boiling point and high volatility that pose health and safety hazards, necessitating increased regulations in production and handling operations. Moreover, while there are alternatives available in the market to replace cyclopentane, they tend to be cheaper and greener options. Fluctuating raw material prices and limited applications also limit the growth potential within this market. All these factors combined could potentially slow down the growth of the cyclopentane market in the coming years.

Market Opportunities

Blowing agents have become increasingly common in industries such as construction, automotive, and appliance manufacturing due to their superior insulation and physical integration properties. Polyurethane foam insulation is particularly popular due to its superior thermal insulation capabilities. This has resulted in an uptick in demand for blowing agents, such as cyclopentane. The appliance industry has seen tremendous growth throughout Europe and Asia, leading to increased consumption of this chemical compound. With the projected growth in these industries, demand for blowing agents is expected to keep increasing, leading to an eventual increase in cyclopentane usage. Cyclopentane plays a vital role in producing foam insulation used in refrigerators and freezers.

Grow your profit margin with Market.us - Purchase This Premium Report at

Report Segmentation of the Cyclopentane Market

Function Insight

Blowing agents & refrigerants held the majority share with 58.3% market share at an impressive CAGR of 7.8% over the years due to its growing demand in various industries such as refrigerant in refrigerators or insulation purposes; furthermore, increasing healthcare & pharmaceutical industries as well as food & beverage firms require it for freezers & fridges which further drive segment growth.

Application Insight

Cyclopentane market share is dominated by refrigerators with a share of 31.6%, due to government initiatives for helping these businesses expand digitally. Cyclopentane has become increasingly popular in refrigerator applications, particularly as a refrigerant and insulation, due to its ability to extend shelf life for temperature-sensitive items. There has been an uptick in demand for frozen food & beverages as well as healthcare industry storage needs - both driving up demand for refrigerators.

Recent Developments of the Cyclopentane Market

- In February 2021, HCS Group & Gevo signed a strategic agreement in Germany for developing low-carbon renewable chemicals & sustainable aviation fuel (SAF). In February 2021, SK Global Chemical Co. Ltd. announced that it will invest in a new cyclopentane production facility in South Korea which will have a production capacity of 40,000 metric tons per year. In 2021, Honeywell announced that it has developed a new low-global-warming-potential (GWP) blowing agent for foam insulation applications, which is based on cyclopentane.

For more insights on the historical and Forecast market data from 2016 to 2032 - download a sample report at

Key Market Segments:

Based on Function

- Blowing Agent & Refrigerant Solvent & Reagent Other Functions

Based on Application

- Refrigerators Containers & Sippers Personal Care Products Electrical & Electronics Insulating Construction Material Fuel & Fuel Additives Other Applications

By Geography

- North America

- The US Canada Mexico

- Western Europe

- Germany France The UK Spain Italy Portugal Ireland Austria Switzerland Benelux Nordic Rest of Western Europe

- Eastern Europe

- Russia Poland The Czech Republic Greece Rest of Eastern Europe

- China Japan South Korea India Australia & New Zealand Indonesia Malaysia Philippines Singapore Thailand Vietnam Rest of APAC

- Latin America

- Brazil Colombia Chile Argentina Costa Rica Rest of Latin America

- Middle East & Africa

- Algeria Egypt Israel Kuwait Nigeria Saudi Arabia South Africa Turkey United Arab Emirates Rest of MEA

Competitive Landscape

This is a competitive market with the presence of several global and regional players. Globally leading companies are engaged in strategic initiatives like partnerships, acquisitions, mergers, agreements, and collaborations to withstand the intense competition and increase their market share.

Key Market Players:

Listed below are some of the most important cyclopentane industry players.

- HCS Group GmbH Dymatic Chemicals Inc. Chevron Phillips Chemical Company SK geo centric Co. Ltd. LG Chem Maruzen Petrochemical Co. Ltd. Liaoning Yufeng Chemical Co. Ltd. Haldia Petrochemicals Ltd. RESOURCES ZEON CORPORATION Puyang Zhongwei Fine Chemical Co. Ltd. HPL Additives Ltd. SOUTH HAMPTON RESOURCES Inc. INEOS Group Ltd. Other Key Players

Browse More Related Reports:

- pentane market is expected to grow at a CAGR of roughly 4.4% and will reach US$ 175.3 million in 2032, from US$ 115.2 million in 2022, according to a new Market.us study. chloropentane market is estimated to be valued at US$ 13.9 million in 2032 from US$ 6 million in 2022 at a CAGR of 9.0%.

propionic acid market was valued at US$ 1.57 billion in 2022 and is expected to grow to US$ 3.12 billion in 2032. Between 2023 and 2032, this market is estimated to register the highest CAGR of 7.3%.

chlorine market was valued at US$ 39.5 billion in 2022 and is expected to grow to US$ 67.2 Billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 5.6%.

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On linkedin facebook twitter

Our Blog:

Tags cyclopentane market cyclopentane cyclopentane market size market share market growth global cyclopentane market chemicals Related Links

- cyclopentane market cyclopentane bromide market chelating agents market dry strength agent market metabolite chemistry reagents market catalyst market bottled sodium chloride injection market soda ash market antifreeze and coolants market heat transfer fluids market advanced materials market research reports in-vitro diagnostics market smart contact lenses market food emulsifiers market procurement software market

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment