(MENAFN- Newsfile Corp) Electric Royalties Ltd. to Acquire 0.5% Gross Revenue Royalty on Kenbridge Nickel Project in Ontario, Canada

Toronto, Ontario--(Newsfile Corp. - March 6, 2023) - Tartisan Nickel Corp. (CSE: TN) (OTCQX: TTSRF) (FSE: 8TA) ('Tartisan', or the 'Company') is pleased to announce the signing of a binding letter agreement with Electric Royalties Ltd. ('ELEC or Electric Royalties') to grant to Electric Royalties a 0.5% gross revenue royalty ('GRR') on six (6) mining patents located on the wholly-owned Kenbridge Nickel Project in northwest Ontario, Canada (the 'Kenbridge Nickel Project' or 'Kenbridge') in exchange for C$500,000 cash and 2,500,000 common shares of Electric Royalties Ltd., (the 'Transaction'). The approximate market value of the Transaction including shares and cash is C$1,350,000. Electric Royalties will also have the option, for a period of 18 months after closing of the Transaction, to acquire a further 0.5% GRR on the Kenbridge Nickel Project for C$1,750,000 cash consideration. In addition, Electric Royalties will have an option to acquire a 1% GRR on certain mining claims, mining leases and mineral tenures comprising the Kenbridge North Nickel Project (the 'Kenbridge North Project' or 'Kenbridge North'), approximately 2.5 km north of the Kenbridge Nickel Deposit, for C$1,000,000 cash, at any time during a period of 24 months from the date that Tartisan publishes an initial technical report in respect of the Kenbridge North Project which is prepared in accordance with National Instrument 43-101 and which contains an estimate of Inferred Mineral Resources.

The Transaction noted herein is subject to completion of due diligence, approval of the TSX Venture Exchange and other customary conditions including an escrow agreement pertaining to the ELEC common share consideration.

Brendan Yurik, CEO of Electric Royalties commented, 'We're excited to partner with Tartisan Nickel on advancing the Kenbridge nickel-copper-cobalt project in Ontario. The Kenbridge deposit has been well drilled since discovery and though never previously mined, has seen extensive underground development by previous owners. Tartisan has recently released a mineral resource estimate and preliminary economic assessment (PEA) on Kenbridge which describes a project that could be a profitable underground development.

'We believe there is a lot of optionality and upside to Kenbridge as the exploration potential at depth is exciting. If the deposit's depth potential is realized, there could be a meaningful extension to the potential life-of-mine. Furthermore, the Kenbridge deposit could be positioned to quickly commence production once permitted, given its manageable initial capital cost of C$133.7 million, existing infrastructure, and local mining workforce. As a modestly sized underground operation, Kenbridge would have a relatively small environmental footprint which could enable more timely permitting.

'There are very few nickel development projects like Kenbridge that could potentially be brought into production over the next three to five years, so we are thrilled to get exposure to two critical metals - nickel and copper - through this acquisition.'

Kenbridge Project Highlights

Located in a politically stable and mining-friendly region (New Gold's producing Rainy River gold mine is located approximately 80 km to the south), with access to an all-season road scheduled for completion in 2023.

The project has a 622-meter (m) three compartment shaft with two underground level workstations and has never been mined.

Mineral Resource estimate1 completed by P&E Mining Consultants Inc. at an NSR cut-off of C$100/tonne includes: Measured and Indicated Mineral Resources of 3.445 million tonnes at 0.97% nickel (Ni), 0.52% copper (Cu) and 0.013% cobalt (Co), containing 74 million pounds (Mlb) of Ni, 39.1 Mlb of Cu and 1.0 Mlb of cobalt (Co). Inferred Mineral Resources of 1.014 million tonnes at 1.47% Ni, 0.67% Cu and 0.011% Co, containing 32.7 Mlb of Ni, 14.9 Mlb of Cu and 0.2 Mlb of Co.

Preliminary Economic Assessment2 ('PEA') forecasts the following: Nine-year mine plan based on a 1,500-tonne-per-day underground mining and processing operation. The mine plan mines the potentially extractable tonnage of Measured, Indicated and Inferred Mineral Resources which assumes overall dilution of 47% (18% internal dilution from stope designs plus 29% external dilution) and a 94% mine recovery factor. Life-of-mine revenues from net smelter returns of C$837 million. Life-of-mine operating costs of C$292 million. After-tax net present value using a 5% discount rate of C$109 million and after-tax internal rate of return of 20%.

Tartisan is progressing environmental baseline studies as part of its permitting and mining approval process towards its plan to commence nickel-copper production in approximately three years3.

Tartisan continues to develop positive relationships with the surrounding First Nations communities through its First Nations consulting partner Talon Resources and Community Development Inc.

The PEA is considered preliminary in nature, contains numerous assumptions, and includes Inferred Mineral Resources that are considered too speculative, geologically, to have the economic considerations applied that would enable them to be classified as Mineral Reserves. There is no certainty that the results of the PEA (or any update thereto) will be realized. No Mineral Reserves have been estimated for Kenbridge. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. Inferred Mineral Resources are that part of the Mineral Resource for which quantity and grade, or quality are estimated based on limited geologic evidence and sampling, which is sufficient to imply but not verify grade or quality continuity. Inferred Mineral Resources may not be converted to Mineral Reserves. It is reasonably expected, though not guaranteed, that most Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

Kenbridge Project Overview

The Kenbridge Project is in northwestern Ontario, approximately 70 km east-southeast of the city of Kenora, and 50 km east of the township of Sioux Narrows by highway. Access to the property is via 23 km of road from Sioux Narrows. The project is in an area of historical and recent mine development, the most notable of which is New Gold's Rainy River gold mine (see Figure 1).

As of March 1, 2023, the Kenbridge Project is covered by patented and unpatented mining claims covering a total area of approximately 4,108.42 ha or approximately 41 km2.

Geology

The Kenbridge Deposit is an Archean-aged deposit hosted in gabbro and gabbro breccia. Mineralization (pyrrhotite, pentlandite, chalcopyrite ± pyrite) occurs within massive to net-textured and disseminated sulphide zones, primarily in gabbro breccia with smaller amounts in gabbro and talc schist. Nickel grades within the deposit are proportional to the total amount of sulphide, with rare massive sulphide zones exhibiting the highest grades. Mineralization undergoes rapid changes in thickness and grades. At least three sub-parallel mineralized zones were intersected in drilling and range in thickness from 2.6 to 17.1 m. Kenbridge is classified as a gabbro-related nickel sulphide deposit.

Figure 1: Location map of the Kenbridge Project. Source: Tartisan Nickel Corp.

To view an enhanced version of this graphic, please visit:

Exploration

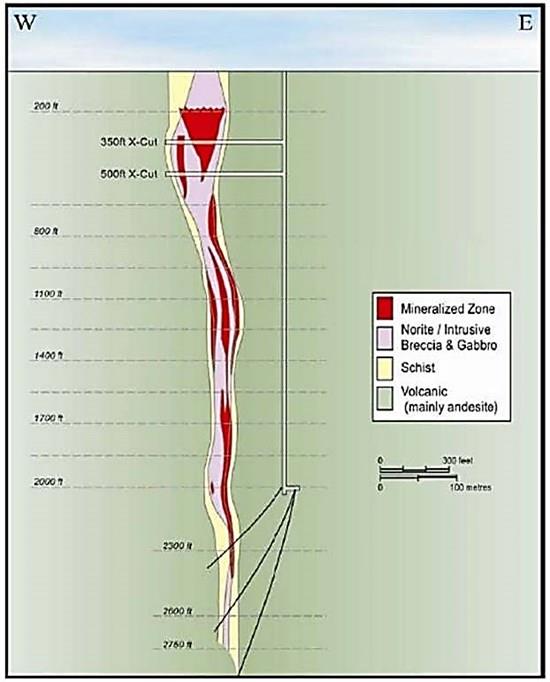

The deposit has been explored by several major and junior mining companies since 1936. There have been numerous drill programs and metallurgical programs and, in 1952, a 622-m shaft was installed, and two levels developed at 107 m and 152 m below the surface (see Figure 2).

Since 1937, 667 surface and underground holes totaling 99,741 m have been completed on the property. These holes defined a zone with surface dimensions of approximately 250 m by 60 m extending approximately 900 m to depth.

Deep drilling suggests further potential of the deposit at depth although this portion of the deposit is not well defined. The deepest holes to date are approximately 1100 meters. At least three sub-parallel mineralized zones were intersected in the 2021 Tartisan drill program and range in thickness from 2.6 m to 17.1 m. The deposit remains open at depth and along strike.

Besides the Kenbridge Deposit, there are several untested exploration targets on the property, such as the Kenbridge North target that has similar geophysical characteristics to the Kenbridge Deposit.

Mining and Processing

The PEA describes an underground development scenario and envisages a total of 4.52 million tonnes (Mt) of process plant feed over a nine-year mine life, with an average metal content of 0.81% Ni, 0.40% Cu and 0.01% Co. It is expected to operate at a daily rate of 1,500 tonnes per day, for a nominal production rate of approximately 528 thousand tonnes per annum.

The existing shaft extends to a depth of approximately 622 m from surface with 13 shaft stations cut approximately every 46 m. The plan would be to rehabilitate, expand, and refit the shaft with a new hoist and headframe to support mining in the upper areas above the shaft bottom, and later hoist material excavated from areas below the extent of the shaft.

Figure 2: Cross section showing mineralized zones, existing shaft, and depth potential. Source: Tartisan Nickel Corp.

To view an enhanced version of this graphic, please visit:

Mining areas from below the extent of the shaft will be accessed via a ramp from the lowest shaft station, with material being trucked to the bottom of the shaft for crushing and final hoisting to surface. This method of access was chosen to minimize lead time to mining and maximize scheduling flexibility, in addition to minimizing transportation costs of broken rock.

Xstrata Process Support test results on a bulk concentrate suggest that at feed grades in line with the current PEA mine plan, a 24% Cu concentrate at 89% Cu recovery and a 15% Ni concentrate at 80% Ni recovery could be anticipated.

A conventional crush-grind-float approach has been selected for beneficiation and processing at Kenbridge. Separate nickel and copper concentrates are expected to be produced at site and trucked to smelters in Sudbury (for nickel) and Rouyn (for copper). A portion of the tails would be thickened and used as backfill underground.

Socioeconomic, Environmental and Permitting

Consultation with First Nations has been ongoing since 2008. As a signatory to Treaty #3, an initial exploration agreement with six local First Nations formalizes employment and business opportunities on the project. During the summer or 2021, a formal ceremonial blessing occurred at Kenbridge and consultations are on-going and productive.

Tartisan has retained Knight-Piésold Consulting and Blue Heron Environmental to undertake environmental baseline studies which commenced in the spring 2022 to capture the spring run off to enable water studies and other essential environmental baseline studies in support of the various permitting and approvals processes for the project.

Mark Appleby, CEO of Tartisan Nickel Corp. states , 'Electric Royalties has a growing portfolio of 21 royalties, including two royalties that currently generate revenue. ELEC is focused predominantly on acquiring royalties on advanced stage and operating projects to build a diversified portfolio located in jurisdictions with low geopolitical risk, which offers investors exposure to critical metals which advance a decarbonized global economy. We look forward to our partnership with Electric Royalties as Tartisan Nickel Corp. enters the feasibility, project development stage.'

Dean MacEachern, HBSc, P.Geo., a Qualified Person has reviewed and approved the technical information in this release under NI43-101.

_______________________________________________

1 Technical report titled 'Preliminary Economic Assessment of the Kenbridge Nickel Project, Kenora, Ontario' with an effective date of July 6, 2022, available under Tartisan Nickel Corp.'s profile on Sedar.com. The Mineral Resource Estimate is based on US$ metal prices of $8.25/lb Ni, $4.00/lb Cu, $26/lb Co. The US$: CDN$ exchange rate used was 0.76. The NSR estimate uses flotation recoveries of 75% for Ni, 77% for Cu, 40% for Co and smelter payables of 92%

for Ni, 96% for Cu, 50% for Co. Mineral Resources were determined to be potentially extractable with the long hole mining method based on an underground mining cost of $77/t mined, processing of $19/t and G&A costs of $4/t.

2 Technical report titled 'Preliminary Economic Assessment of the Kenbridge Nickel Project, Kenora, Ontario' with an effective date of July 6, 2022, available under Tartisan Nickel Corp.'s profile on Sedar.com. The PEA uses a 5% discount rate and metal prices of US$10/lb Ni, US$4/lb Cu, US$26/lb Co, capital costs (including contingency of C$133.7M, total operating costs of C$64.64/t, Cu recoveries of 89% and nickel recoveries of 80%.

3 Tartisan news release dated February 10, 2023.

About Tartisan Nickel Corp.

Tartisan Nickel Corp. is a Canadian based battery metals and mine development company whose flagship asset is the Kenbridge Nickel Deposit located in northwestern Ontario. Tartisan also owns; the Sill Lake Silver Property in Sault St. Marie, Ontario, and the Don Pancho Manganese-Zinc-Lead-Silver Project in Peru. Tartisan Nickel Corp. also owns equity stakes in: Class 1 Nickel & Technologies Corp. and Peruvian Metals Corp.

Tartisan Nickel Corp. common shares are listed on the Canadian Securities Exchange (CSE: TN) (OTCQX: TTSRF) (FSE: 8TA). Currently, there are 114,297,128 shares outstanding (127,338,959 fully diluted).

For further information, please contact Mark Appleby, President & CEO, and a Director of the Company, at 416-804-0280 ( ). Additional information about Tartisan can be found at the Company's website at or on SEDAR at .

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this press release.

To view the source version of this press release, please visit