403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

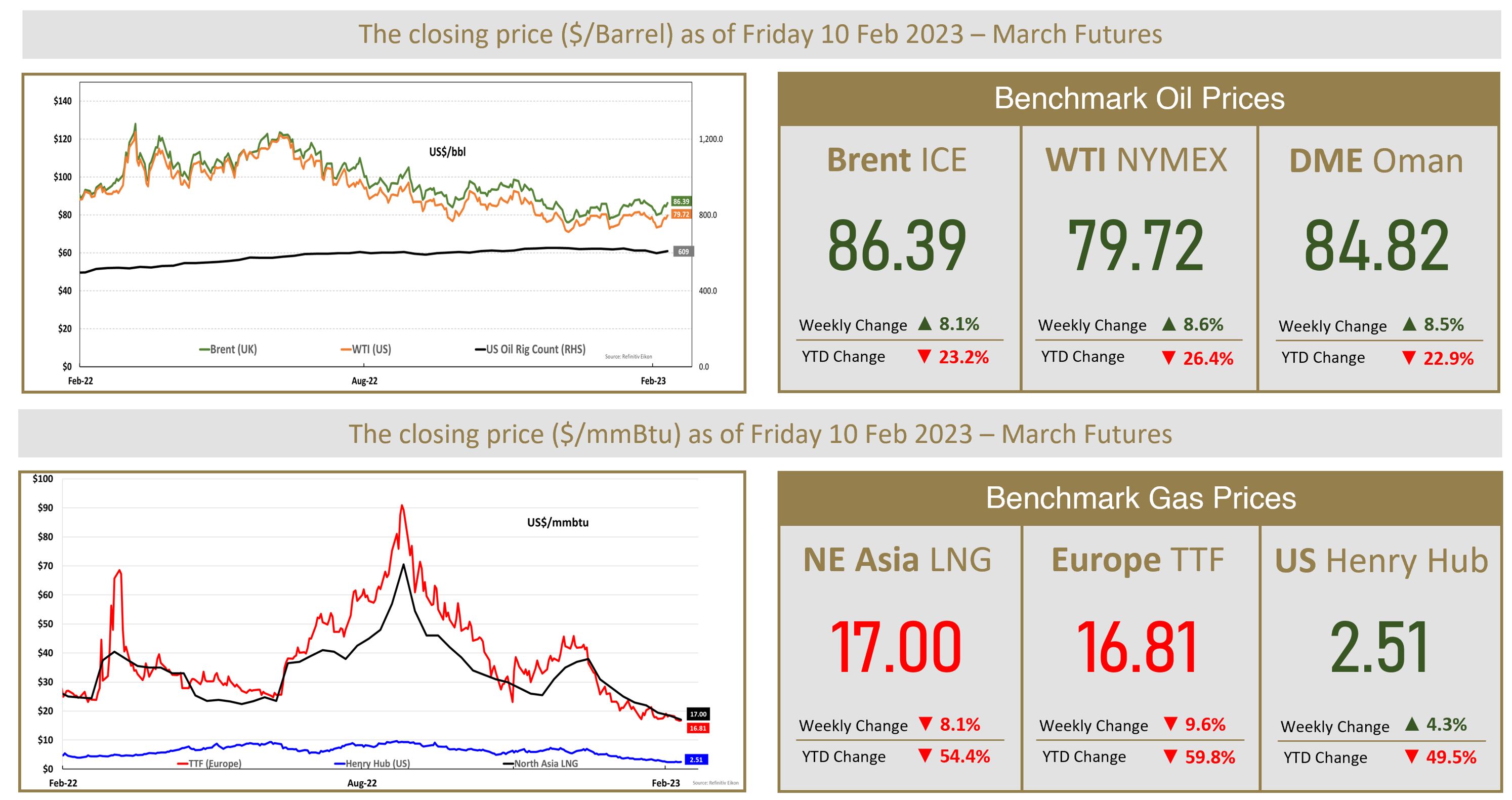

Oil Prices Rise Over 2% on Russian Plan to Cut Output

(MENAFN- The Al-Attiyah Foundation) Oil prices rose more than 2% on Friday as Russia announced plans to reduce oil production next month after the West imposed price caps on the country's crude and fuel. Brent crude futures rose $1.89 to $86.39 a barrel. U.S. WTI crude futures rose $1.66 to $79.72. Brent posted a weekly gain of 8.1%, while WTI gained 8.6%. Russia plans to reduce its crude oil production in March by 500,000 barrels per day, or about 5% of output, Deputy Prime Minister Alexander Novak said. Western nations have imposed restrictions, trying to choke off Russia's oil revenues in response to the country's actions in Ukraine. The production cut indicates that the European Union's recent price cap and ban on Russian oil products, which came into effect on Feb. 5, have had some impact. Most analysts have already predicted that Russian production could fall by 700,000-900,000 in 2023. Russia's output last year defied predictions of a decline, but its oil sales will prove more difficult in the face of the new sanctions. Meanwhile, economic concerns still pressured prices, with weak demand data from China and recession fears in the United States. Also limiting gains were a rise in weekly U.S. jobless claims and higher oil inventories.

Asian Spot Prices Fall on Tepid Demand, High Inventory

Asian spot liquefied natural gas prices slipped over the past week amid high inventory levels and as a mild weather outlook dampened demand. The average LNG price for March delivery into northeast Asia was $17 per million British thermal units (mmBtu), down $1.50, or 8.1%, from the previous week, industry sources estimated. Asian spot LNG prices are typically at a premium to European natural gas prices but traded at a discount for most of last year. After hitting a record high last August, they began sliding in late December and have shed nearly 40% so far this year and are currently at the lowest levels since August 2021. With reduced industrial gas demand and weather forecasts indicating above-average temperatures for February and March, Europe could be starting the injection season in April with stocks that could be similar to 2020 levels, if not a little higher, analysts said. Still, as Russia's piped gas volumes to Europe this year are set to be lower than 2022, Europe will still need to pull in a lot of LNG across the summer. In the U.S., natural gas futures climbed about 4% on Friday after the first vessel arrived at Freeport LNG’s export plant in Texas since the facility shut in a fire in June 2022.

By: The Al-Attiyah Foundation

Asian Spot Prices Fall on Tepid Demand, High Inventory

Asian spot liquefied natural gas prices slipped over the past week amid high inventory levels and as a mild weather outlook dampened demand. The average LNG price for March delivery into northeast Asia was $17 per million British thermal units (mmBtu), down $1.50, or 8.1%, from the previous week, industry sources estimated. Asian spot LNG prices are typically at a premium to European natural gas prices but traded at a discount for most of last year. After hitting a record high last August, they began sliding in late December and have shed nearly 40% so far this year and are currently at the lowest levels since August 2021. With reduced industrial gas demand and weather forecasts indicating above-average temperatures for February and March, Europe could be starting the injection season in April with stocks that could be similar to 2020 levels, if not a little higher, analysts said. Still, as Russia's piped gas volumes to Europe this year are set to be lower than 2022, Europe will still need to pull in a lot of LNG across the summer. In the U.S., natural gas futures climbed about 4% on Friday after the first vessel arrived at Freeport LNG’s export plant in Texas since the facility shut in a fire in June 2022.

By: The Al-Attiyah Foundation

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment