(MENAFN- Asia Times)

Ronald Reagan was quoted in 1978 as saying,“Inflation is as violent as a mugger, as frightening as an armed robber, and as deadly as a hitman.'

Reagan had spent the first years of his US presidency battling the inflation problem. Inflation was running at 9% annually, on its way to nearly 15% two years later. It was hurting the interests of politicians, businesspeople, and the common people.

Even today inflation is a nightmare for the policymaker, central banks, Political establishments, and the working class.

Recently the bank of International Settlements (BIS), the global body that operates services for the world's central banks, stated in its annual report that there is a deep“inherently stagflationary” shock hitting the world economy due to higher commodity prices and supply-chain bottlenecks.

Such transitions to high-inflation environments happened rarely but were very hard to reverse. The BIS has blamed the current geopolitical condition around the world as the main reason for it.

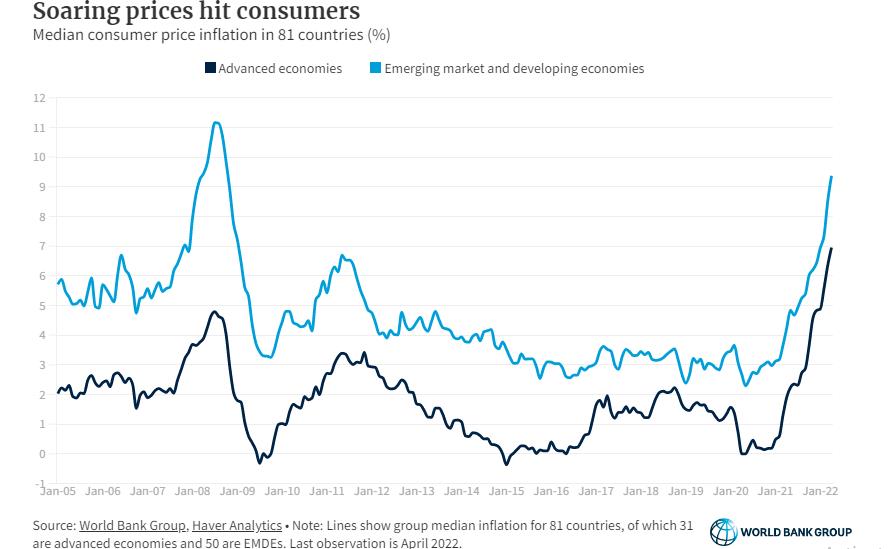

Inflation is currently at a multi-decade high in major economies such as the US, the eurozone, and the UK. The BIS has raised concerns for leading economies of North America, Europe, and many emerging markets, as inflation has neared a tipping point. In advanced economies, inflation is at its highest level in four decades.

Global economic policymakers began responding in earnest this year, with at least 75 central banks lifting interest rates, and the US Federal Reserve leading the pack. But the action taken so far does not satisfy the BIS.

The latest Consumer Price Index released in the United States exceeded analysts' expectations at 9.1% in June. In Canada, inflation is running at its fastest pace since 1983. In the United Kingdom, it is similarly at a 40-year-high.

As interest rates jump, money that has been cheap for years will now be more expensive to borrow, stoking fears among investors that the global economy could slow sharply and be plunged into painful recessions. The World Bank has warned that most countries are headed for a recession and there may be a return to 1970s stagflation, a period of high inflation and low growth.

The era of cheap money that lasted more than a decade thanks to near-zero interest rates resulted in a borrowing spree that left developing economies with record levels of debt. In some countries, it is equivalent to 60% of GDP or more.

Persistent record-level inflation has forced central banks to change the direction of monetary policy from easing to tightening. The number of economies defaulting on their debt will likely increase in near future. Until now, that risk has been limited to the poorest countries, but now it is transferring quickly to middle-income economies.

Is world entering stagflation period?

Sri Lanka is a prime example of debt distress. Soon, Pakistan is likely to face a similar fate until it gets external help. Pakistan urgently needs billions of dollars infused into its foreign reserves to ward off payment defaults.

The country's central bank said its foreign-exchange reserves declined by US$145 million to reach $9.8 billion in July, hardly enough for five weeks of imports, while the Pakistani rupee touched record lows.

Other nations facing similar issues are Lebanon, Suriname, Zambia and Russia. Another on the brink of default is Belarus.

But the list doesn't stop there. Tunisia appears one of the most at risk among a bunch of African countries going to the International Monetary Fund (IMF) for relief. That country is on Morgan Stanley`s top three list of likely defaulters. Ghana has borrowed intensely, reaching a debt-to-GDP spike of nearly 85%. Inflation in that African nation is nearing 30%.

Russia's ally Belarus is seemingly heading to the same fate of last month's default amid Western sanctions over the Ukraine conflict.

Meanwhile, Sri Lanka, Argentina, Venezuela, Zambia and others have also defaulted, and many more are likely to follow. In Europe, Germany, Greece, Spain and Portugal have announced tax rebates and energy subsidies to quell unrest. In Africa, Nigeria and Zambia have done the same.

In Asia, the Philippines, Singapore and Indonesia are boosting social spending and giving out direct cash. But experts feel the scramble to cushion the blow with such measures may widen the challenge, as containing inflation now means putting the brakes on growth, which had already begun to fizzle globally.

According to the World Bank's latest forecast, global growth is projected to slow by 2.7 percentage points between 2021 and 2024 – more than twice the deceleration between 1976 and 1979. Such developments raise concerns about stagflation – the coincidence of weak growth and elevated inflation – similar to what the world suffered in the 1970s.

The current status of the global economy resembles the 1970s era of stagflation in three key aspects: persistent supply-side disturbances fueling inflation, preceded by a protracted period of highly accommodative monetary policy in developed economies, prospects for weakening growth, and vulnerabilities that emerging-market and developing economies face with respect to the monetary-policy tightening to contain inflation.

The stagflation of the 1970s era ended with a global recession and a series of financial crises in the emerging-market and developing economies.

The fallout of the current events in the global economy are unlikely to be different. But it can be avoidable, as some structural differences still exist between the 1970s and the current situation.

The 1970s were a time of considerable structural economic rigidities, many of which have since evolved. Today's central banks have more sophisticated models than those in the 1970s. Apart from that, they also seem to be luckier, as developing countries like China have the speed and agility to meet any production demand.

But additional fiscal stimulus and sanctions on Russia may feed inflation, defeating all the monetary-policy efforts. A pragmatic approach with effective coordination among all stakeholders including the political establishment is needed to protect the global economy from falling into a long recession.

MENAFN03082022000159011032ID1104638795

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.