(MENAFN- Newsfile Corp) Advance United Holdings Signs Term Sheet to Acquire the Landrum Gold Deposit

Highlights

- Landrum is a past gold producer

- Gold samples up to 37.7 g/t have been obtained from drilling on the property

- Advance United would become the 100% owner and operator

Toronto, Ontario--(Newsfile Corp. - March 21, 2022) - Advance United Holdings Inc. (CSE: AUHI) (FSE: 9I0) (the 'Company', or 'Advance United' or 'AU') and Carolina Gold Resources Inc. ('CGR') are pleased to announce the signing of a non-binding Term Sheet (the 'Agreement') to acquire the Landrum gold deposit located South Carolina, USA.

CGR is prepared to sell 100% of its interest in the Landrum Property (the 'Property') to Advance United in exchange for a series of cash payments, share issuances, work expenditures, and other considerations, the terms of which the companies are negotiating in preparation of a Definitive Agreement (the 'Definitive Agreement').

The Landrum Gold Deposit

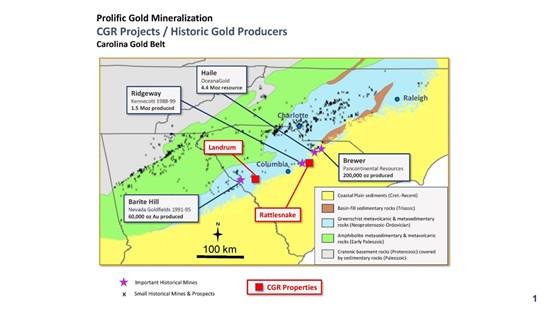

The Landrum property is situated in Edgefield County in southern South Carolina approximately 15 km from the town of Edgefield and approximately 50 km north of Augusta, Georgia (see Figure 1).

The largest historic deposits, measured by approximate million ounces of gold (Moz Au), include those in the Haile (4.2 Moz Au), Ridgeway (1.5 Moz Au), Brewer (200,000 oz Au), and Barite Hill (60,000 oz Au) mines. Noteworthy, the Haile Mine is still in production by OceanaGold.

Figure 1: Location of Landrum Project in relation to current and past producer(s).

To view an enhanced version of this graphic, please visit:

The last major recorded exploration efforts on the Landrum property were conducted by Newmont Corp. in the mid-1980s. Newmont completed underground sampling of the existing workings, soil geochemistry sampling, as well as limited VLF EM and magnetic surveys. In completing eight (8) drill holes around the known mineralization, intersections including 6 g/t over 9m and 20 g/t over 2.1m was found.

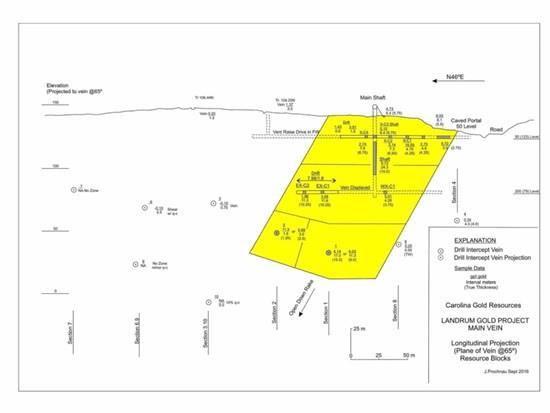

Figure 2: Cross section illustrating Landrum gold mine drifts, shafts, and drill intercepts. (From Report by J Prochnau of CGR)

To view an enhanced version of this graphic, please visit:

The Main Vein was developed historically on two levels at 50 and 200 feet and systematically sampled in the 1930's. Newmont re-sampled the 50 level in 1985. The drift sampling was used for the resource calculation. The resource is not NI43-191 compliant but was created by experienced and competent persons. The resulting resource was calculated at approximately 67,000 ounces of contained gold at a grade of 4.82 grams/tonne.

| | | | Contained Gold |

| | Tonnes | Grade (gpt Au) | Kg | Ounces |

| Main Vein | 332,500 | 4.84 | 1609 | 51,750 |

| Footwall Vein | 102,000 | 4.77 | 486.5 | 15,625 |

| Total | 434,500 | 4.82 | 2095.5 | 67,380 |

The Landrum veins consist of silicified zones generally made up of 20-50% quartz with admixed sericitized argillite containing 2-10% pyrite with trace chalcopyrite. The veins vary in thickness from less than a meter to 10 meters and occur within a broad sericite-quartz-calcite-pyrite altered shear zone in argillite. The veins and shear strike roughly N45°E and dip 60-70°NW.

Current work suggests that the Landrum system is comprised of two sub-parallel vein systems. The Main Vein has been developed by the historic workings, and the Footwall Vein delineated entirely by the drill holes.

Jim Atkinson the CEO of Advance United states, 'We are very excited to obtain a property of the quality of Landrum and are pleased to be able to expand our portfolio and reach internationally to the United States. The existing gold resources are a great addition to our asset base and adds substantial value to our portfolio, substantiating our business model. In this manner, we are designing a work program focusing on confirming the existing resources and expanding the mineralized footprint along strike and down dip - the deposit is open in all directions. Bringing this exciting project 'current', in terms of a work program and NI 43-101 will add substantial value and position the property for a potential production partner. The similarity and proximity to other major deposits of the Carolina Slate Belt which have been developed with significant gold endowment makes this project highly prospective.'

Known Historic Production in the Carolina Slate Belt

Gold was first discovered at the Haile Gold Mine in 1827, and a rich history of producing significant quantities of gold has since been established.

In January 2017, the first gold was poured from the modern Haile Gold Mine after OceanaGold acquired the operation in late 2015. Commercial production commenced in October 2017. In 2020, Haile produced 137,000 ounces of gold.1

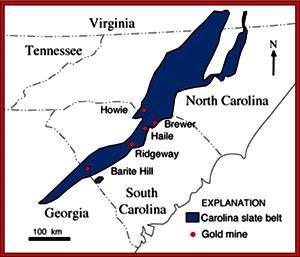

North and South Carolina have been gold mining states since before the California Gold rush of 1849 and in fact were the site of the first Gold Rush in America. At the time gold was recovered from placer operations in the 'Carolina Slate Belt' and since then large-scale, hard rock mines have been developed with production from at least five (5) significant deposits. To quote a recent USGS publication 'The Carolina Slate Belt is a highly prospective belt of rocks with a potential for containing additional undiscovered deposits of gold, copper, and other metals.' 2

Figure 3: The Carolina Slate Belt and Major Deposits

To view an enhanced version of this graphic, please visit:

About Advance United

Advance United, headquartered in Toronto, Canada, is traded on the Canadian Securities Exchange in Canada under the symbol 'AUHI' and the Börse Frankfurt Stock Exchange in Germany under the symbol '9I0'.

Advance United brings an entirely different approach to the mining industry. We don't mine. Rather, we've acquired a portfolio of undervalued gold properties and are increasing their value through the application of modern technology. We have a growing pipeline of similar properties that we are looking to acquire. And now we've launched the Au Marketplace. A first of its kind digital platform that connects owners of mineral commodities and deposits with developers and producers.

We are involved exclusively in the acquisition and advancement of past projects - with no intent to bring them back into production or to mine them ourselves. Our expertise is in identifying and acquiring undervalued properties with significant historical work, which were uneconomic at the time, but we believe have economic value at today's prices.

We fund the development of re-working historic data and applying modern technology to underwrite new qualified reports, document quantifiable resources and reserves to current standards, thereby recognizing the current value.

Our purpose is to bring immediate and long-term value to our partners and shareholders while seeking to eliminate exploration risk, so that we can all advance united in the shortest possible time frame.

For additional information about us, our projects, or to find out how you can list your project in the Au Marketplace, visit .

Contact Information

James Atkinson, P. Geo., CEO

Email:

Tel: (647) 278-7502

Qualified Person

James Atkinson M.Sc., P. Geo., a Qualified Person (' QP ') as such term is defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects, has reviewed and approved the geological information reported in this news release. The Qualified Person has not completed sufficient work to verify the historic information on the Property, particularly with regards to historical sampling, drill results, and technical work provided by Newmont and others. The Qualified Person assumes that sampling and analytical results were completed to industry standard practices. The information provides an indication of the exploration potential of the Property but may not be representative of expected results.

Footnotes

1 Robert A. Ayuso U.S. Geological Survey Mail Stop 954, National Center Reston, VA 20192

2 Gold Deposits of the Carolina Slate Belt, Southeastern United States: Age and Origin of the Major Gold Producers By Nora K. Foley and Robert A. Ayuso Invited paper for a Special Session on Mining in the United States at the 2012 Prospectors & Developers Association of Canada International Convention, Trade Show & Investors Exchange, Toronto, Canada, March 7, 2012.

Forward-Looking Information and Cautionary Statements

This news release may contain 'forward-looking information' within the meaning of applicable securities laws relating to the trading of the Company's securities and the focus of the Company's business. Any such forward-looking statements may be identified by words such as 'expects', 'anticipates', 'intends', 'contemplates', 'believes', 'projects', 'plans' and similar expressions. Forward-looking statements in this news release include statements regarding the Company's ability to increase the value of its current and future mineral exploration properties and, in connection therewith, any long-term shareholder value, the Company's ability to mitigate or eliminate exploration risk, and the Company's intention to develop a portfolio of historic gold properties. Readers are cautioned not to place undue reliance on forward-looking statements. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements to be materially different from those implied by such statements. Although such statements are based on management's reasonable assumptions, there can be no assurance that the Company will continue its business as described above. Readers are encouraged to refer to the Company's annual and quarterly management's discussion and analysis and other periodic filings made by the Company with the Canadian securities regulatory authorities under the Company's profile on SEDAR at . The Company assumes no responsibility to update or revise forward-looking information to reflect new events or circumstances or actual results unless required by applicable law.

To view the source version of this press release, please visit

MENAFN21032022004218003983ID1103883005