The Top 5 Tech Stocks For 2020

(MENAFN- Baystreet.ca) The tech bubble will never burst.

Now for those of you who remember the dotcom boom, that may seem like anoutlandish statement…

But there were clear winners…

Companies that survived the bust, only to become some of the world's mostvaluable companies.

That's not to say that the Googles and Facebooks of this world will maintaintheir astounding growth and near-monopoly on tech innovation.

In fact, they are almost certainly going to experience serious competition inthe near future.

But, for savvy investors, tech is going to be the hottest sector of not justthe next year, but the next decade.

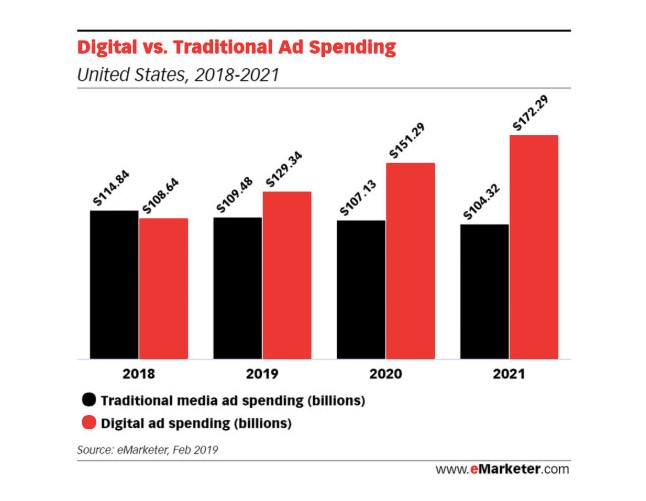

Everything from transport to digital advertising and even space exploration isbeing transformed by up and coming tech disruptors.

And it's all built on data. The life blood of the world's new digital reality.

In fact, in February this year, data overtook oil as the most valuableresource on earth.

And now a new breed of tech company is taking investors by storm.

The tech bubble isn't bursting, it is simply being reshaped. And when the dusthas settled, these are the five companies that could end up on top:

#1 Facebook (NASDAQ: FB)

Mark Zuckerberg's social-media giant suffered through a terrible 2018. Badpress, missteps by management, and a skeptical market saw Facebook plunge by astaggering (and record-breaking) $126 billion.

But even with a shaky market,don'tcount Facebook out quite yet.

The company weathered its storm of bad press in 2018, and its fundamentalsremain strong. In Q2 of 2019, for instance, Facebook recorded aYOYrevenue increase of 28%.

Facebooks daily active users (DAUs) continue to grow, increasing 8% over thecourse of a year, to over 1.5 billion. The company continues to dominate thedigital advertising landscape.

Even with the body-blows of 2018, more than 20% of ALL HUMANS use Facebook on adaily basis. That's incredibly impressive.

The fact that it continues to increase revenue and grow its user base in theface of tougher privacy regulations andlimits todata gathering.

The news that CEO Mark Zuckerberg is dumping shares shouldn't frighteninvestors—Facebook, the social media pioneer, is still astrongplayeron the tech landscape.

#2 Frankly Inc. ( TSXV:TLK ,OTCQX:FRNKF )

This is a tiny company with a big plan, and about it hopes to disrupt the multi-billiondigital advertising market.

Frankly is a new kind of data company. Not only does it have a plan totransform the world of digital media, it is providing publishers andbroadcasters a much-needed alternative to advertising giants like Google andFacebook.

Frankly takes the three most lucrative sectors of digital media - engagement,monetization and data - and gives control back to publishers and broadcasters.

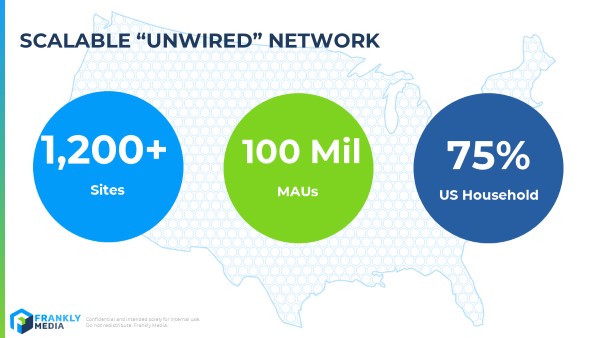

It may be small— with a market cap of $30 million—butits user base of 100 million, if valued at $175 in terms of activated revenueper user (ARPU), constitutes an asset worth $20 billion.

And as publishers grow increasingly weary of working with Big Tech, Frankly hasthe potential to disrupt the entire digital advertisingmarket - a market that is expected to reach $665 billion by 2026.

See, Facebook and Google have become greedy.

Together, they make up 60% of the market, and their billion-dollar revenuestreams dwarf traditional media platforms—the New York Times, for instance, generatesonly $259million.

And publishers have had enough…

That's because both Google and Facebook refuse to sharethe most important data that they collect.

First party data, which includes everything from clicking habits to browsingpatterns and personal information, is all collected and owned by these big techgiants. Publishers then have to pay out huge sums of money to get that databack.

That's where Frankly comes in.

Frankly offers an alternative to Big Tech. It's already signed on with 1,200outlets, including CNN andVice Media.

And Frankly's latest mammoth deal with Newsweek, adding 40 million users to itsbase, suggests the company's incredible growth is only just beginning.

It's also inked a deal to acquire Vemba , a leading video asset management,syndication, and monetization platform. This will give Frankly the ability tomonetize Over-the-Top (OTT) video content, a market estimated to reach $332billion by 2025,accordingto Allied Market Research.

Frankly ( TSXV:TLK ,OTCQX:FRNKF ) is breaking into advertising in a waythat takes advantage of Big Tech's weaknesses - positioning itself in line withthe future of both broadcasting and digital advertising.

Frankly's platform has already scaled up to reach 75% of Americanhouseholds. Now its deal with Newsweek is set to add another 40 million users.

That means that over 140 million people will be leaving a digital footprintwithin Frankly's network…

And that's all data that can be used to help companies build better products,reach more interested users and create content more suited to their customerbase.

And all Frankly (TSXV:TLK ,OTCQX:FRNKF ) needs to do is claw away 1% of the digital ad market, and itsrevenues could hit $1 billion.

Not bad for a company currently valued at only $30 million.

With the monopoly of Big Tech cracking, this is a tech company for the future.

And with 2020 elections looming, big data and advertising is only going tobecome more important.

#3 Walt Disney Co. (NYSE:DIS)

It's not just the biggest media company in the world…Walt Disney Co. is now thebiggest media company IN HISTORY.

Just ten years ago, investors had counted Disney out—the once-powerfulanimation studio had a number of missteps and was losing the content popularitycontest to companies like Pixar, Marvel and Lucasfilm.

Now, all three of those premier brands belong to the Mouse House—which toppedoff its decade-long spending spree by acquiring most of the brands owned byTwentieth-Century Fox,thebiggest media deal in history , for a cool $71 billion.

Disney has snapped up the best brands in the media landscape, and it's about tocapitalize by taking on its remaining competition.

This fall, Disney will launch Disney+, a streaming service designed to take outstreaming juggernaut Netflix.

Disney is loading the platform with premier content—all the Marvel and StarWars films, plus a raft of new properties , shows, and films designed to pull eyeballsaway from Netflix.

And the company's execs are feeling bullish—they predict they can pull 60 to 90million subscribers by the end of 2024. And that's just the beginning:the newstreaming platform could prove incredibly disruptive.

#4 Amazon (NASDAQ: AMZN)

The world's biggest online retailer has been a little stuck lately. But that'sabout to change.

The company is about to roll out its ambitious one-day delivery plan, promisingthe capacity to deliver goods to consumers across the United States in lessthan twenty-four hours.

This stock is incredibly expensive— sharestrade for nearly $2000 —but that's just a sign of its incrediblevalue. The stock has grown 427% over the last five years—nothing to sneeze at.

And despite the risks of regulatory pressures, there are few signs that Amazonwill slow down any time soon. The plans to put in a massive new headquarterscomplex near Washington DC is moving forward, which should give the companyconsiderably more clout in the Capitol.

Amazon has proven it's more than just a retail company—the firm's original techdivision has chalked up some impressive wins, such as the Fire Stick and Alexa,the voice command household aide that has become ubiquitous across the U.S.

A good sign that Amazon is heading in the right direction? Increased investmentfrom none other thanBerkshireHathaway , which increased its stake in Amazon to $937 million inmid-August.

#5 Uber Technologies Inc. (NYSE: UBER)

The big story in tech had been the Uber IPO—the ride-sharing app joined themarket with a tepid showing, and it hasn't done much business since.

It's the cherry on top of a cake of trouble for the revolutionary tech company,which has suffered from a mountain of bad press. It's controversial CEO TravisKalanick was forced out over his behavior and the company's struggle togenerate revenue, but the new management hasn't been able to do much better.

Uber keeps burning through money: in Q2 of 2019 it posted a$5 billionoperating loss , linked in part to the expensive IPO.

Bears have been circling the wagons for a while, warning the Uber's ration isunsustainable. But bulls have been quick to point out how other revolutionarytech companies like Amazon and Facebook posted losses after their IPOs, beforegoing on to becomefabulouslyprofitable .

Plus, Uber's losses are partly linked to its IPO and its rapid expansion rate:once the company solidifies its dominance of ride-sharing and makes inroads toself-driving cars, Uber's profits are likely to prove sturdy.

Moreover, while $5 billion sounds like a lot, it pales in comparison with whatother big companies have suffered through— GM posted$48 billion loss in 2009 , and it's held on despite it.

Other companies looking to step up in the tech sector:

Blackberry Ltd (NYSE:BB, TSX:BB) This well-known cell-phone pioneer is engaged in the saleof smartphones and enterprise software and services. The Company's products andservices include Enterprise Solutions and Services, Devices, BlackBerry TechnologySolutions and Messaging.

Blackberry used to be aworldwide leader in phones, but Apple, Google and other Android manufacturershave rapidly acquired market share. Blackberry has since focused on softwareand is now developing systems for autonomous vehicles. Tech giants such asApple and Google won't be able to repeat Blackbery's success in this sectorthat easily.

Kuuhubb Inc. (TSXV: KUU) is a company active in the development and acquisition oflifestyle and mobile video game applications. Its strategy is to createsustainable shareholder value through its groundbreaking AI and big dataapplications suggest that its stock is currently undervalued, but it's notlikely this opportunity will last for much longer.

Though it's focus is on mobile video games, Kuuhubb's innovative technologymakes it a likely target of acquisition and could be a key player in the mobileindustry.

Kinaxis Inc (TSX:KXS) is a provider of cloud-based subscription software for supplychain operations. The Company offers RapidResponse as a collection ofcloud-based configurable applications. The Company's RapidResponse productprovides supply chain planning and analytics capabilities that create thefoundation for managing multiple, interconnected supply chain managementprocesses, including demand planning, supply planning, inventory management,order fulfillment and capacity planning.

Kinaxis is a growing company, but the company has already carved out asignificant piece of the pie. As a leader in its field, Kinaxis is a forcewhich investors are keeping an eye on.

Computer Modelling Group (TSX:CMG) is a software technology company producing reservoirsimulation software for critical infrastructure. Computer Modeling Group LTD.Is a tempting trade for investors as it brings together two essentialindustries - tech and resources- which are going anywhere any time soon.Especially as the need for security grows, a tech company involved in the oiland gas industry has an incredible opportunity to offer other services.

While Computer Modelling Group focuses on the resource industry, its technologyis definitely breaking ground. Founded nearly 40 years ago by Khalid Aziz, arenowned simulation developer, the company has proven that it has stayingpower. As the resource industry meets technology, this will be a stock topay attention to.

Redline Communications Group Inc. (TSX:RDL ): Redline is not a giant, but it does operate inmore of a niche environment—in hard-to-access places, providing wireless forcritical industries, including oil and gas, and anywhere from the rainforestsof South America to the slopes of Alaska and the deserts of the Middle East.

While the company has struggled in the past, weexpect it to improve its operations results. The company's main challengeremains to expand and attract new customers for its new products.

By. Amy Farrah

IMPORTANT NOTICE ANDDISCLAIMER

PAID ADVERTISEMENT. This communication is a paid advertisement.Safehaven.com, Leacap Ltd, and their owners, managers, employees, and assigns(collectively "the Publisher") is often paid by one or more of the profiled companiesor a third party to disseminate these types of communications. In this case,the Publisher has been compensated by Frankly, Inc. to raise public awarenessof the company and to advertise and market the company's products and services.Frankly paid the Publisher fifty thousand US dollars to produce and disseminatethis and other similar articles and certain banner ads. This compensationshould be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties insiders and/ortheir affiliates may liquidate shares of the profiled companies at any time,including at or near the time you receive this communication, which has thepotential to hurt share prices. Companies profiled in our articles frequentlyexperience a large increase in volume and share price during the course ofpublic awareness marketing, which often ends as soon as the public awarenessmarketing ceases. The public awareness marketing may be as brief as one day,after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed tobe, an offer to sell or a solicitation of an offer to buy any security. Neitherthis communication nor the Publisher purport to provide a complete analysis ofany company or its financial position. The Publisher is not, and does notpurport to be, a broker-dealer or registered investment adviser. Thiscommunication is not, and should not be construed to be, personalizedinvestment advice directed to or appropriate for any particular investor. Anyinvestment should be made only after consulting a professional investmentadvisor and only after reviewing the financial statements and other pertinentcorporate information about the company. Further, readers are advised to readand carefully consider the Risk Factors identified and discussed in theadvertised company's SEC, SEDAR and/or other government filings. Investing insecurities, particularly microcap securities, is speculative and carries a highdegree of risk. Past performance does not guarantee future results. Thiscommunication is based on information generally available to the public and onan interview conducted with the company's CEO, and does not contain anymaterial, non-public information. The information on which it is based isbelieved to be reliable. Nevertheless, the Publisher cannot guarantee theaccuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Safehaven.com owns sharesand/or stock options of the featured companies and therefore has an additionalincentive to see the featured companies' stock perform well. The owner ofSafehaven.com has no present intention to sell any of the issuer's securitiesin the near future but does not undertake any obligation to notify the marketwhen it decides to buy or sell shares of the issuer in the market. The owner ofSafehaven.com will be buying and selling shares of the featured company for itsown profit. This is why we stress that you conduct extensive due diligence aswell as seek the advice of your financial advisor or a registered broker-dealerbefore investing in any securities.

FORWARD LOOKING STATEMENTS. Thispublication contains forward-looking statements, including statements regardingexpected continual growth of the featured companies and/or industry. ThePublisher notes that statements contained herein that look forward in time,which include everything other than historical information, involve risks anduncertainties that may affect the companies' actual results of operations. Factorsthat could cause actual results to differ include, but are not limited to,changing governmental laws and policies concerning, among other things, dataprotection and data privacy, the size and growth of the market for thecompanies' products and services, the companies' ability to fund its capitalrequirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By readingthis communication, you acknowledge that you have read and understand thisdisclaimer, and further that to the greatest extent permitted under law, yourelease the Publisher, its affiliates, assigns and successors from any and allliability, damages, and injury from this communication. You further warrantthat you are solely responsible for any financial outcome that may come fromyour investment decisions.

TERMS OF USE. By reading this communication you agree thatyou have reviewed and fully agree to the Terms of Use found herehttp://Safehaven.com/terms-and-conditions If you do not agree to the Terms ofUse http://Safehaven.com/terms-and-conditions, please contact Safehaven.com todiscontinue receiving future communications.

INTELLECTUAL PROPERTY . Safehaven.com is the Publisher's trademark.All other trademarks used in this communication are the property of theirrespective trademark holders. The Publisher is not affiliated, connected, orassociated with, and is not sponsored, approved, or originated by, thetrademark holders unless otherwise stated. No claim is made by the Publisher toany rights in any third-party trademarks.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment