May Payrolls Disappoint. Fed to the Rescue? And Gold?

(MENAFN- Investor Ideas)

May Payrolls Disappoint. Fed to the Rescue? And Gold?

June 11, 2019 (Investorideas.com Newswire) On Friday, it was announced that the U.S. added merely 75,000 jobs in May. Needless to say, a severe disappointment on the downside. The talk of an oncoming recession, and the interest rate cut speculations - were boosted. Is it justified? How close are we actually to the end of the business cycle? Should we buy gold now?

Payrolls Below Expectations, but We Are Not Surprised

The U.S.created just 75,000 jobs in May , following a strong rise of 224,000 in April (after a downward revision). The number surprised negatively, as the economists polled by the MarketWatch forecasted 180,000 created jobs. However, the weakpayrollsconfirmed what we saw in the ADP data earlier this week. As we wrote onThursday edition of the Gold News Monitor , "ADP private-sector job growth tumbled to a 9-year low, which suggests that the Friday's official employment report from the Labor Department will be also disappointing". And this is indeed what happened.

Moreover, the weak headline number was accompanied by substantial downward revisions in April and March. Counting these, employment gains in these two months combined were 75,000 lower than previously reported. Consequently, job gains have averaged 151,000 per month over the last three months, which is lower than several months ago. Indeed, monthly job gains have averaged 164,000 in 2019, compared with an average gain of 223,000 per month in 2018.

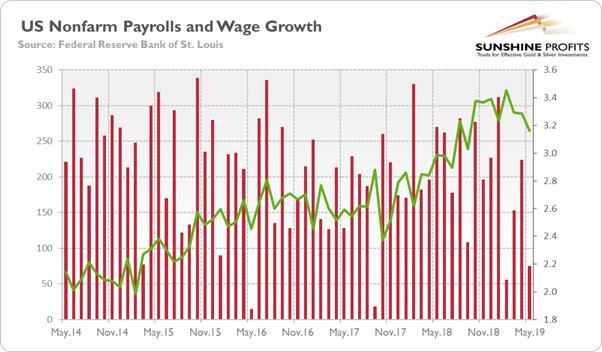

So, the pace of hiring has slowed, as the chart below shows. It is another worrisome signal of a slowing economy, especially that employment was weak everywhere except for three areas: professional and business services, education and health services, and leisure and hospitality. For example, construction companies hired just 4,000 new workers, while government and retailers cut jobs.

Chart 1: U.S. nonfarm payrolls (red bars, left axis, change in thousands of persons) and the annual growth in average earnings in the private sector (green line, right axis, %) from May 2014 to May 2019.

Unemployment Rate Stays Flat, or even Decreases

However, the employment situation report was not all bad.The unemployment ratestayed at a 49-year low of 3.6 percent. This is very important, as the unemployment rate is a powerful recession indicator, so if it had increased, we would have been very worried.

Actually, the unemployment rate decreased. We mean here U6, a broader measure of joblessness that includes part-time workers. As one can see in the chart below, that rate dropped from 7.3 to 7.1 percent, the lowest level since December 2000.

Chart 2: The unemployment rate U3 (red line) and the unemployment rate U6 (green line) from May 2009 to May 2019.

Implications for Gold

What does it all mean for the gold market? Well, the pace of hiring has slowed since the end of 2018, so it may put more pressure on theFedto remaindovishand prolong its pause in thetightening cycle , which should support the gold prices. Or, the U.S. central bank could even please the financial markets, and cut thefederal funds rate , if we see another months of weak payrolls. This should be good news for the gold market, but investors should be aware that the interest rate outlook has been already priced in to a large extent.

On the other hand, the labor market remains healthier than a few years ago, with the unemployment rate staying at a multi-year low. The May disappointing jobs number could be just an outlier. Or it might result from a growing shortage of skilled labor in the very tight job market. As the latestBeige Bookreports, many companies complain that they cannot find workers. The low jobs numbers would then mean not a recession but the late stage of the boom phase of thebusiness cycle .

Indeed, as the chart below shows, the actual unemployment rate is currently below the so-called natural unemployment rate, which is the equilibrium rate for a given economy.

Chart 3: U.S. unemployment rate (red line, U3) and the natural unemployment rate (green line) from Q1 2009 to Q1 2019.

So it is the rate resulting from the structural forces only. Hence, the current situation when the actual is below the natural rate, may result from very favorable cyclical factors. We are still in the boom phase of the business cycle. Sorry,gold bulls .

Given the healthy labor market, the Fed should not cut interest rates. But the natural rate of unemployment is unobservable, so nobody knows what is its true level. And the Fed is a hostage of the Wall Street, so who knows...

Anyway, the stock market has increased after the disappointing payrolls, anticipating the dovish Fed's reaction. Gold prices have also risen on Friday. However, the gains were temporary. And theprecious metalsinvestors should not forget that when almost all market participants have bullish expectations, there is a risk of an opposite market outcome.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthlyMarket Overviewreports and we provide dailyGold & Silver Trading Alertswith clear buy and sell signals. If you're not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe.Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits'Gold News MonitorandMarket OverviewEditor

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

More Info:

This news is published on the Investorideas.com Newswire - a global digital news source for investors and business leaders

Disclaimer/Disclosure: Investorideas.com is a digital publisher of third party sourced news, articles and equity research as well as creates original content, including video, interviews and articles. Original content created by investorideas is protected by copyright laws other than syndication rights. Our site does not make recommendations for purchases or sale of stocks, services or products. Nothing on our sites should be construed as an offer or solicitation to buy or sell products or securities. All investment involves risk and possible loss of investment. This site is currently compensated for news publication and distribution, social media and marketing, content creation and more. Contact each company directly regarding content and press release questions. Disclosure is posted for each compensated news release, content published /created if required but otherwise the news was not compensated for and was published for the sole interest of our readers and followers. More disclaimer info:https://www.investorideas.com/About/Disclaimer.aspLearn more about publishing your news release on the Investorideas.com newswirehttps://www.investorideas.com/News-Upload/

Additional info regarding BC Residents and global Investors: Effective September 15 2008 - all BC investors should review all OTC and Pink sheet listed companies for adherence in new disclosure filings and filing appropriate documents with Sedar. Read for more info:https://www.bcsc.bc.ca/release.aspx?id=6894 . Global investors must adhere to regulations of each country.

Please read Investorideas.com privacy policy:https://www.investorideas.com/About/Private_Policy.asp

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment