Will The Federal Deficit Be Trump's Nemesis?

Date

12/19/2024 3:14:27 PM

(MENAFN- Asia Times)

This analysis was published earlier this week in Asia Times' Global Risk-Reward Monitor, a weekly survey of economic and geopolitical factors affecting markets.

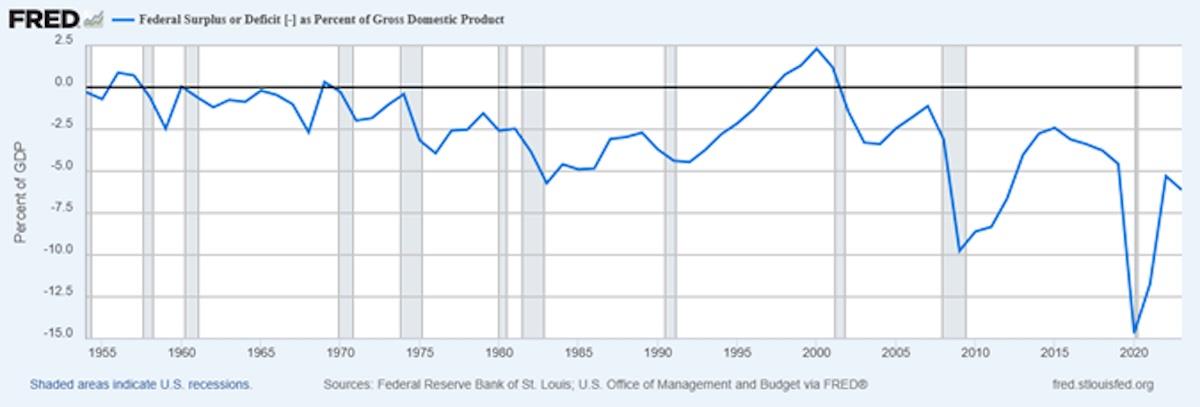

Given our current state of information about the new administration's intentions, we foresee a gradually deteriorating economic environment in 2025 with persistent high interest rates, higher than expected inflation, and weaker than expected earnings.

The Biden Administration bequeathed Donald trump the largest-ever federal deficit (at 6.1%

of GDP) in an economic expansion.

The president-elect wants to renew

his 2018 corporate tax cut at an estimated cost of $400 billion per year,

and

eliminate taxes on Social Security income at a cost of about $150 billion per year.

That would raise the federal deficit, now at $1.7 trillion, by about a quarter, minus possible revenues from additional tariffs (which now bring in about $80 billion a year in revenue), and whatever cost savings

his team can obtain from spending reductions.

What can't go on forever won't, according to Okun's Law, and the United States can't continue to run up the federal deficit indefinitely. But it can do so for the foreseeable future - at some cost. America doesn't face a“Liz Truss moment,” as Swiss Re economist Jerome Jean Haegeli told the Wall Street Journal November 21, referring to the blowup of the UK bond market in October 2022 after the short-tenured prime minister proposed deep tax cuts. For the time being, the US can finance the Treasury's borrowing requirement with domestic sources. But that comes at a steep cost, and the likelihood is that economic headwinds will stiffen during 2025.

MENAFN19122024000159011032ID1109013902

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.