Souhoola Completes EGP 478M Securitization Bond Issuance

The three tranches comprised EGP 280m with a six-month tenor, rated Prime 1 by Middle East Ratings and Investor Services (MERIS); EGP 139m with a 12-month tenor, also rated Prime 1; and EGP 59m with a 20-month tenor, receiving an A- rating.

Ahmed El-Shanawany, managing director of BM Consumer Finance (Souhoola), said the high ratings reflect the quality of the securitized portfolio and strengthen the company's financing base.“This step directly contributes to expanding the company's market share in line with Souhoola's expansion strategy for the coming period,” El-Shanawany said.“This achievement is part of the company's commitment to its active role in enhancing financial inclusion, according to Egypt Vision 2030, thereby supporting the macroeconomy and achieving sustainable growth.”

Fadi Elias, chief financial officer at BM Consumer Finance, added that the securitization reflects the company's continued growth and strengthens its financial position in accordance with Financial Regulatory Authority guidelines. He noted that the company's financial position saw a 52% year-on-year growth in Q3 2024, with a 50% increase in its customer portfolio compared to the previous year.

Amr Helal, chief executive officer (sell-side) of the Investment Bank at CI Capital, expressed satisfaction with completing Souhoola's first issuance, part of a planned three-year program totaling EGP 3.5bn. He highlighted CI Capital's continued leadership in diversified financial services and the efforts of its Debt Capital Markets team.

Mohamed Abbas, head of DCM at CI Capital, expressed gratitude for the successful completion of the issuance and noted the growth of Egypt's debt markets, particularly the increasing number of financing companies completing their first debt issuances with CI Capital's assistance. This reflects, he said, the growing interest from non-banking financial institutions (NBFIs) in diversifying funding sources and achieving sustainable growth.

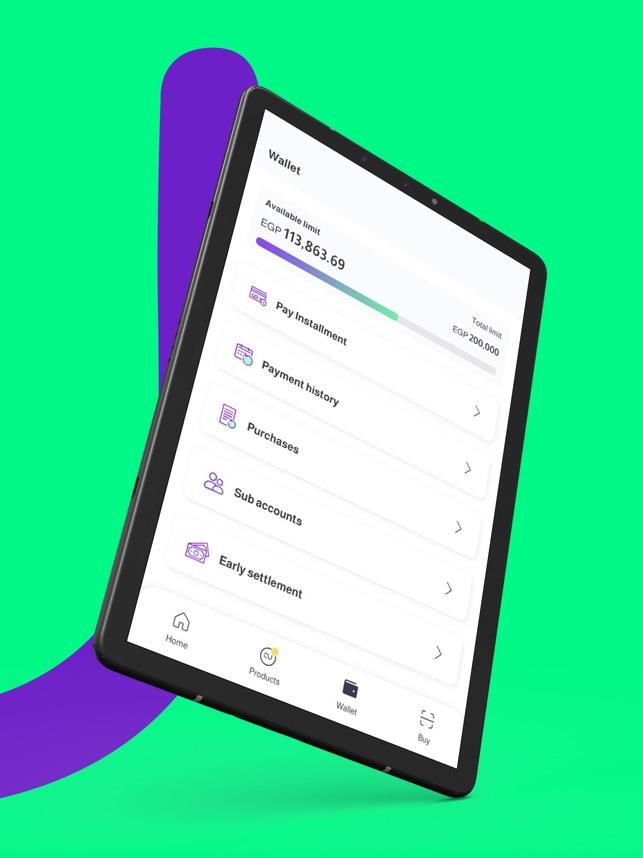

Established in 2019, Souhoola aims to provide innovative, technology-driven financial solutions to enhance financial inclusion and improve the quality of life for Egyptians. The company integrates financial and commercial expertise to develop solutions addressing economic challenges and provide customers with a seamless shopping experience.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment