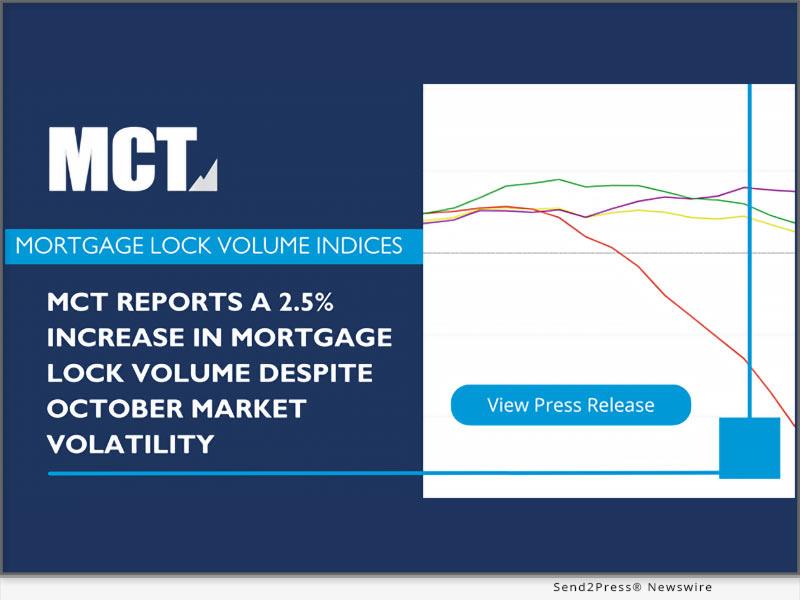

MCT Announces 2.5% Increase In Mortgage Lock Volume Despite October Market Volatility

Image caption: MCT Mortgage Lock Volume Indices Oct 2024.

October proved to be a dynamic month for the mortgage market. An increase in mortgage rates, spurred by election volatility, led to a reversal of the refinancing uptick observed in September. However, a rise in purchase volume during the month managed to counterbalance the decline in refinancing, resulting in overall month-over-month lock volume remaining relatively flat.

The uncertainty surrounding the elections caused temporary market disruptions and a downturn in markets, which has now eased following the decisive election results. This change has brought a level of stability and clarity to the market.

Andrew Rhodes, Senior Director and Head of Trading at MCT, stated,“With the election and last Thursday's Federal Reserve meeting behind us, we anticipate markets will stabilize with the new focus on November jobs and CPI data points.”

For further insights into the current mortgage market and the latest trends in lock volume, MCT invites industry professionals to download the full report.

MCT's Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT's national footprint.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT's stewardship. MCT's technology and know-how continues to revolutionize how mortgage assets are priced, locked, protected, valued, and exchanged – offering clients the tools to perform under any market condition.

For more information, visit or call (619) 543-5111.

News Source: Mortgage Capital Trading Inc.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment