How Our China Clients View The US Election, Economic Outlook, And Chinese Yuan

Rob Carnell and I spent the last week travelling in Shanghai and Beijing and meeting clients across different sectors to share our outlooks for China and the broader global economy. The clients we visited were primarily interested in discussing the forthcoming US election, China's economic outlook and the impact of stimulus, and the outlook for the US dollar and Chinese yuan. Several clients were also interested in the economic and monetary policy outlooks for Europe and Japan.

Some of our key takeaways are below.

Global economic and market topics:

-

Clients overwhelmingly predicted a Trump victory in the coming US election.

Among the clients who expressed a preference between Trump and Harris, the majority of respondents were in favour of Trump. The main reasons given for this included that he was seen as simpler in prioritising economic and trade-related objectives, and may be less restrictive in other areas against China.

Clients were divided in opinion on the US economic outlook , with more generally expecting a soft landing or no landing scenario in the near term.

Multiple clients expressed curiosity about how European investors viewed China in the aftermath of stimulus, and whether or not this would be affected by the outcome of the US election.

China economic and market topics:

-

Sentiment remains cautious on China's economic outlook , and unsurprisingly a rather visible divide was observable between those operating in China's new economy and those in the old economy, with new economy participants generally more upbeat.

Many clients noted that the short-term economic environment remained challenging , but some expressed cautious optimism in the aftermath of the stimulus rollout. Most adopted a“wait and see” mindset on how far policy support will go and there was not much of a consensus on the ultimate scale of the policy package.

Several clients remained fairly sceptical about the prospects for effective fiscal stimulus , with few expecting a strong enough policy push to restore growth. In particular, several clients expressed doubt that policies targeting consumption would be significant enough to be effective.

There were some indications that recent monetary policy easing has helped credit demand recover , though it nonetheless remains relatively weak compared to previous years. Most agreed that there was room for further monetary policy easing with a relatively small risk of runaway inflation or bubbles emerging in the economy.

Our CNY outlook received significantly less resistance compared to previous trips across the region. This shift is due to recent actions by the Federal Reserve and changes in Chinese policy, which have aligned the USD/CNY exchange rate closer to our target. Most though not all agreed with our 2025 outlook for the USD/CNY trading range to move a little lower towards 6.90-7.20 (versus this year's 7.00-7.30 band) and for a gradual appreciation trend to continue. The 7.00 level appeared to be a common target for those expressing interest in converting foreign currency back into CNY at some point.

Anecdotal observations support hard data in showing consumers remain cautious

Much has been made of the controversial "consumption downgrade" theme across China as households have dialled back on spending after several years of negative wealth effects and slowing wage growth. We won't tackle this issue in this report, but the general sentiment still appears to be leaning towards caution, which is in line with what the economic data indicates as well.

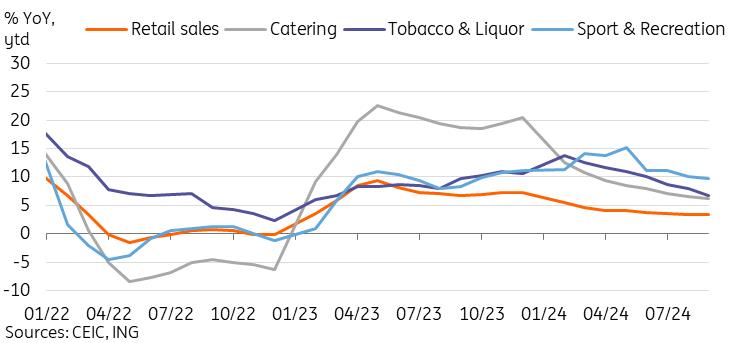

In our reports this year, we have often discussed the "eat, drink, and play" theme, which has outperformed the wider consumption environment. These categories are typically the most resilient during a downturn in consumption, as households tend to cut other areas of discretionary spending before these categories are impacted. Retail sales data from this year shows this theme has continuously outperformed headline growth numbers since the second half of 2023.

Will this outperformance continue? Momentum in these categories has slowed somewhat in the past several months. More consumers appear to be gravitating toward higher value-for-money options. Our anecdotal observations and discussions with locals were that business appeared quite robust in low-end as well as mid-end dining options, but tables were relatively easier to obtain at the higher-end restaurants compared to a year ago. Many restaurant chains appeared to be leaning into this trend with various promotions in order to attract and retain customers.

Similar to the patterns we observe on a day-to-day basis in southern China, in a small sample size, restaurants, bars, and supermarkets appeared to account for the bulk of foot traffic in the shopping malls and districts that we visited, while other physical retailers appeared to see very limited traffic.

In a vacuum, the sluggish activity at traditional retailers would likely overstate the decline of consumption; a quick look at the swarms of delivery drivers across the cities showed that e-commerce continues to boom and very much confirms the picture painted by robust e-commerce data such as the China Federation of Logistics and Purchasing's e-commerce logistics index, which has seen growth move past pre-Covid levels this year. This performance, despite an overall moderation of online retail sales, suggests that e-commerce volume continues to boom, but consumers may be gravitating towards lower-cost options.

Divergence between e-commerce volume and online retail sales value suggests shift toward lower-cost purchases

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment