(MENAFN- Newsfile Corp)

Vancouver, British Columbia--(Newsfile Corp. - October 9, 2024) - Spark energy Minerals Inc. (CSE: SPRK) (OTC Pink: SPARF) (FSE: 8PC) ("Spark" or the "Company"), an exploration Company focused on the discovery of battery metals in Brazil's prestigious Lithium Valley, announces that it has entered into a debt settlement agreement with an arms-length creditor (the "Creditor") to settle CAD$550,000 (the "Debt Settlement") representing the final outstanding amounts owing to the Creditor for the Acquisition of the Company's now 100% owned flagship "Arapaima Lithium Project" in Minas Gerais, Brazil.

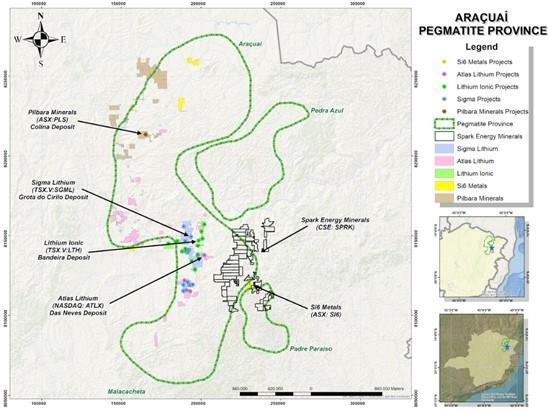

Map of Spark Energy's flagship Arapaima Lithium Project relative to other major projects in Brazil's "Lithium Valley"

To view an enhanced version of this graphic, please visit:

The Arapaima Lithium Project, located in Brazil's renowned "Lithium Valley" in Minas Gerais covers 64,359 hectares and is the largest contiguous landholding in this high-potential lithium region, offering significant exploration opportunities.

The project is strategically situated near major industry players such as Lithium Ionic, Sigma Lithium, Latin Resources, Si6, and Atlas Lithium, positioning Spark Energy Minerals at the center of this fast-growing "lithium valley."

In settlement and full satisfaction of the debt in the amount of CAD$550,000, the Company has agreed to issue to the Creditor 3,666,667 common shares in the capital of the Company (the "Common Shares") at a deemed issue price of $0.15 per Common Share. The proposed shares for debt settlement are subject to the approval of the Canadian Securities Exchange.

"We are grateful for being able to vend the largest contiguous block of mining claims in Lithium Valley to Spark Energy Minerals. We wish to thank the Board of Spark for allowing us the opportunity to convert our final payments into shares of the company. We feel the hard dollars are better spent on further advancing Spark's enormous property portfolio in this world class district," said a representative of Talisman.

"This Debt Settlement demonstrates our commitment to strengthening Spark Energy's financial position while preserving our cash resources for exploration and development activities. By converting this debt into shares, we're aligning Talisman's interests with those of our other shareholders and reinforcing our focus on advancing our substantial property portfolio in Brazil's Lithium Valley. This strategic move allows us to direct more capital towards unlocking the potential of our assets in this world-class mining district, furthering our goal of becoming a key player in the battery metals sector," stated Eugene Hodgson, CEO and Director of Spark Energy Minerals.

All Common Shares issued pursuant to the Debt Settlement are subject to a statutory hold period of four months plus a day from the date of issuance of the Common Shares in accordance with applicable securities legislation.

Depository Trust Company ("DTC") Eligibility

In addition, the Company is pleased to announce that its common shares are now eligible for electronic clearing and settlement through the Depository Trust Company ("DTC") in the United States. The Company's common shares are quoted in the United States on the OTCQB Venture Market under the symbol "SPARF". The Company's common shares will continue to trade on the Canadian Securities Exchange under the symbol "SPRK" and the Frankfurt Stock Exchange under the symbol "8PC".

DTC is a subsidiary of the Depository Trust & Clearing Corporation, a company that manages the electronic clearing and settlement of publicly traded companies. Securities that are eligible to be electronically cleared and settled through DTC are considered "DTC eligible." This electronic method of clearing securities speeds up the receipt of stock and cash and thus accelerates the settlement process for investors and brokers, enabling the stock to be traded over a much wider selection of brokerage firms.

Eugene Hodgson, CEO and Director of Spark Energy Minerals, commented, "With DTC eligibility, shareholders benefit from potentially greater liquidity and execution speeds enhancing the accessibility of our shares for both retail and institutional investors. Properly opening the door to investors in the world's largest capital market aligns with the Company's efforts to expand its potential investor base."

About Spark Energy Minerals Inc.

Spark Energy Minerals, Inc. is a Canadian company focused on the acquisition, exploration, and development of battery metals and mineral assets, with a particular emphasis on its substantial interests in Brazil. The Company holds significant land and mineral rights in Brazil's renowned Lithium Valley, one of the most prolific mining regions in the world. This region is rapidly gaining global recognition for its vast deposits of lithium and rare earth minerals, positioning Brazil as a critical player in the global energy transition.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

FOR ADDITIONAL INFORMATION, SEE THE COMPANY'S WEBSITE AT

MENAFN09102024004218003983ID1108764165

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.