Agrochemicals Market To Reach USD 308.69 Billion By 2031, Driven By Surging Demand For Food Security

-< />

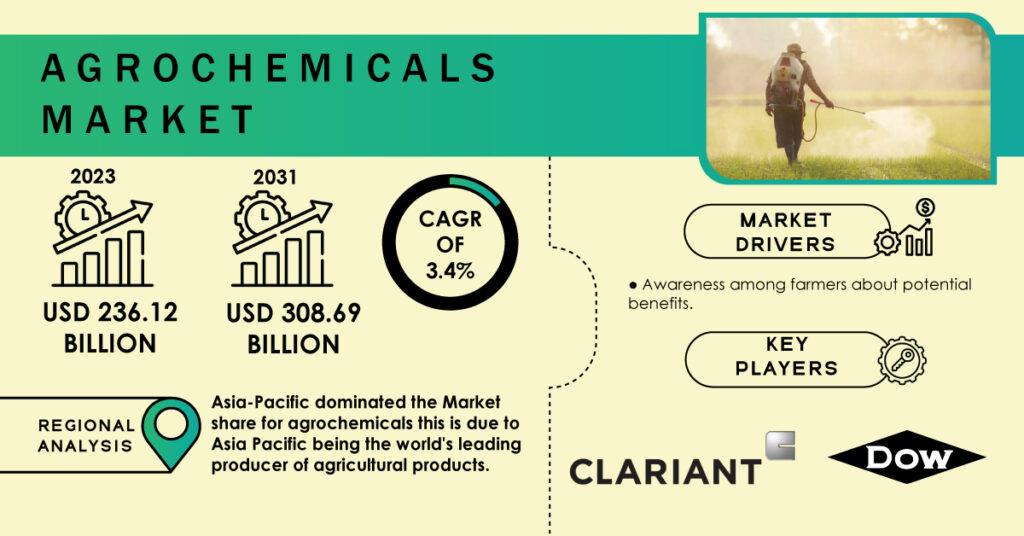

A new report by SNS Insider estimates the Agrochemicals Market will climb to USD 308.69 billion by 2031 from USD 236.12 billion in 2023, expanding at a CAGR of 3.4% between 2024 and 2031.

The necessity of feeding an expanding global population, coupled with limited arable land, is escalating the need for agrochemicals.

Farmers rely on fertilizers to enrich soils and boost crop yields, and the animal husbandry and feed sectors are positively impacting the market. The US feed industry holds a dominant position, with export values reaching USD 13 billion in 2020. Agrochemicals are vital for addressing shifting dietary demands stemming from rising affluence and combatting food insecurity which remains a pressing global challenge.

Precision agriculture plays a growing role in optimizing agrochemical use. Sensors and data analysis pinpoint crop needs, enabling farmers to target fertilizer and pesticide applications for maximum efficiency while reducing environmental impact.

Get a Report Sample of Agrochemicals Market @

Some of the Key Players Included are:

- Clariant AG The DOW Chemical Company Solvay Bayer AG Huntsman International LLC Helena Agri-Enterprises LLC Ashland, Inc. Land O' Lakes, Inc. FMC Corp. Croda International Plc BASF SE

Market Analysis

The global population is projected to hit 9 billion by 2050, placing enormous pressure on food production. Shrinking farmland adds to the challenge; for example, the UK's agricultural land area decreased from 17.27 million hectares in 2020 to 17.23 million in 2021. Agrochemicals play a crucial role in combating pests and diseases (responsible for up to 40% of annual crop losses) to optimize output within these constraints. Global herbicide, fungicide, and bactericide consumption figures from 2020 illustrate the growing reliance on crop protection chemicals.

Recent Market Developments

The agrochemicals industry is innovating rapidly

- In November 2022, Corteva Agriscience introduced Kyro herbicide, a corn-focused solution combining three active ingredients. In November 2022, ADAMA registered Araddo® herbicide for the Paraguayan market, expanding its Latin American presence. In February 2022 , Adama launched Timeline® FX, an advanced cereal herbicide with broad-spectrum action and flexible application window. In January 2022, Yara and Lantmännen collaborated to bring fossil-free fertilizers to Swedish farmers. In November 2022, Bayer AG's Adengo, a new pre-emergent herbicide, targets both broadleaf and grass weeds in corn crops. In August 2022, UPL launched IMAGINE insecticide in India, aiding farmers against destructive rice pests.

Make Enquiry About Agrochemicals Market Report@

Segment Analysis

By Product, Fertilizers led the market (64% revenue share in 2023), particularly for cereal and grain production. Their tailored application is vital to yields, with approximately 60% of global nitrogen used for the top three cereal crops. By Application, Cereals & grains dominated (over 45% revenue share in 2023). Agrochemicals are essential for fruit and vegetable cultivation, ensuring quality and safety with pesticides, and nutrient-rich produce with fertilizers.

By Product

- Crop Protection Chemicals Fertilizers

By Application

- Oilseeds & Pulses Cereal & Grains Fruits & Vegetables

Impact of the Russia-Ukraine War

The conflict has disrupted global fertilizer supply chains, particularly potash and nitrogen fertilizers. Russia and Belarus are major exporters, and sanctions have significantly impacted trade flows. This has driven up prices and created supply shortages, potentially hindering agricultural output and exacerbating food insecurity in vulnerable regions. Sanctions restricted Black Sea port access, and logistical challenges have led to reduced fertilizer exports from Russia and Belarus, a critical source of crop nutrients. Ukraine's grain export capacity has also been severely impacted. The constricted fertilizer supply, along with rising energy prices (important for fertilizer production), has driven up the prices of agrochemicals. This puts a cost burden on farmers globally.

Reduced fertilizer access or high prices could prompt farmers to cut back on fertilizer use, potentially impacting yields and worsening global food security, especially in regions already facing shortages. For Example, the price of urea, a widely used nitrogen fertilizer, surged significantly following the outbreak of the war, highlighting the volatility triggered by such a conflict.

The Asia Pacific region firmly held the largest share of the global agrochemicals market in 2023, surpassing 25% of total revenue.

Asia Pacific is home to some of the world's largest agricultural producers. Countries like India, China, and Japan heavily contribute to the demand for agrochemicals needed to optimize their cultivation of staple crops. China is the world's top manufacturer and exporter of pesticides. Moreover, India ranks among the leading producers of agrochemicals globally, demonstrating the region's capacity for meeting both internal and external demands. The agriculture sector significantly influences regional per capita income, fostering a robust market for agrochemicals to support agricultural productivity.

Check Discount on Agrochemicals Market @

Key Takeaways from the Agrochemicals Market Study

- Food security is a primary driver of the agrochemicals market. The need to efficiently feed growing populations worldwide heavily influences the need for yield-enhancing and crop protection solutions. Innovation is a hallmark, with new solutions addressing specific crop requirements. The industry is continuously developing targeted agrochemicals to optimize yields, fight pests and diseases, and address the needs of diverse agricultural sectors. External factors including war and economic trends can cause market volatility. The market reacts to geopolitical conflicts and macroeconomic downturns, highlighting the importance of adaptability for manufacturers and distributors. The Asia Pacific is likely to remain the global agrochemicals market leader. The region's combination of large-scale agricultural production, manufacturing capacity, and economic significance suggests its continued dominance in the market.

Agrochemicals Market

Table of Contents – Major Key Points

Introduction Research Methodology Market Dynamics Impact Analysis- COVID-19 Impact Analysis Impact of Ukraine- Russia war Impact of ongoing Recession

Buy the Latest Version of Agrochemicals Market Report 2024-2031 @

About Us :

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Akash Anand – Head of Business Development & Strategy

...

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment