Poland's Sluggish Recovery Continues As Consumption Sees A Gradual Rebound

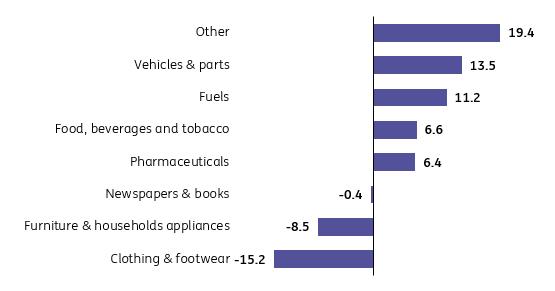

Retail sales rose by 6.1% year-on-year in March (ING: 10.0%, consensus: 6.7%), following an increase of 6.1% YoY in February. The seasonally adjusted data points to a decline of 0.2% month-on-month, which is a disappointment. However, we should keep in mind that this followed an impressive 2.9% MoM increase in February. The largest sales increases were in the 'other' category, which includes sales in large chain stores (19.4% YoY) and car sales (13.5% YoY), although for the latter the annual growth rate slowed markedly in March (after an increase in February of 26.6% YoY). Declines in sales of durable goods other than autos continued. The decline in textiles, clothing and footwear (-15.2% YoY) was shallower than in the previous month, but continued for furniture, consumer electronics and household appliances (-8.5% YoY).

Durable goods sales still subduedRetail sales, %YoY

GUS.

Real wage growth in the corporate sector has been running close to double digits in recent months and at the highest level since the end of the 90s, contributing to robust real income growth. We also expected spending to be buoyed by Easter shopping, but the data presents rather a slow recovery in consumption. On a monthly basis, sales increased by 14.2%, a similar rate to March 2023 (14.0% MoM) despite more a favourable calendar and income growth.

Sales growth lags behind wages rebound%YoY

GUS, ING.

Disappointing March industrial production and construction output data – as well as weaker-than-expected retail sales data – led us to revise our first quarter GDP growth forecast for 2024 down to 1.5% YoY from the 2.1% YoY expected so far. For 2024 as a whole, we still see economic growth of 3% on the back of a recovery in consumer demand, driven by a robust recovery in real disposable household income. While the rebound in consumption has been rather moderate so far, retail sales of goods increased by around 5.0% YoY in the first quarter of this year, compared to a decline of 0.5% YoY in the fourth quarter of 2023.

The scenario of a recovery in private consumption is materialising, albeit at a moderate oace, and Poles are slowly moving away from their austerity mindset. We are also seeing a rebound in global industry – but unfortunately, German industry is still lagging behind as today's manufacturing PMI showed. We assume that the economic recovery will eventually gain momentum in the remainder of the year, so we're sticking to our GDP forecast of around 3% for the entirety of 2024.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment