When Supply Creates Demand: Yellen's Errors Of Omission

This sweeping statement raises three questions:

- Is the problem overinvestment in China, or underinvestment in the United States and other Western countries? What effect does greater capacity in China have on demand for industrial products, that is, is it possible that an increase in supply can cause an increase in demand? Who is buying more Chinese products? Are Americans buying more Chinese goods at the expense of their domestic industry, or are Chinese products sold to countries that do not have competing industries?

There aren't sufficient data to provide definitive answers to these questions, but there is enough evidence to indicate that Secretary Yellen's analysis is oversimplified at best and distorted at worst.

US manufacturing employment is virtually unchanged from May 2019 (12.96 million in March 2024 versus 12.8 million in May 2019). The Fed's industrial production index is unchanged.

Except for subsidized investment in semiconductor fabrication plants, industrial investment has been weak. American manufacturers' orders for nondefense capital equipment excluding aircraft stood at $37.8 billion 1982 dollars in January 2019, but fell to $34.2 billion in January 2024, a decline of almost 10%. Investment in manufacturing structures in 2017 dollars in the fourth quarter of 2023 was $140 billion, compared with $185 billion in the first quarter of 2019.

Meanwhile the US trade deficit in goods rose to $92 billion seasonally adjusted for the month of January 2024, compared with a deficit of $72 billion in January 2019. For some reason, Americans chose to invest less in manufacturing at home and to buy more manufactures from other countries.

During this period America imposed a 25% tariff on more than $200 billion of Chinese imports. Import prices (before tariffs) for Chinese goods rose slightly between January 2019 and January 2024. Meanwhile, imports of goods from China as reported by the US statistical agencies fell from $41 billion in January 2019 to $36 billion in January 2024.

It is hard to blame increased imports of Chinese goods for the decline in US manufacturing investment and the increased dependency on foreign goods during the past five years.

Chinese imports in the past surely contributed to a loss of US manufacturing jobs. But, as noted, American imports from China fell during the past five years. These are long-term trends that were visible long before the emergence of China's EV industry.

Data don't show China cutting export prices overall

Will new police chief end Philippines war on drugs?

To be sure, Chinese investment in third countries contributed to those countries' increased exports, many of which were bought by the United States, but that is a different issue. There are many causes of weak US manufacturing performance, including a tax code hostile to capital-intensive industries, excessive regulation and inattention to training of skilled personnel.

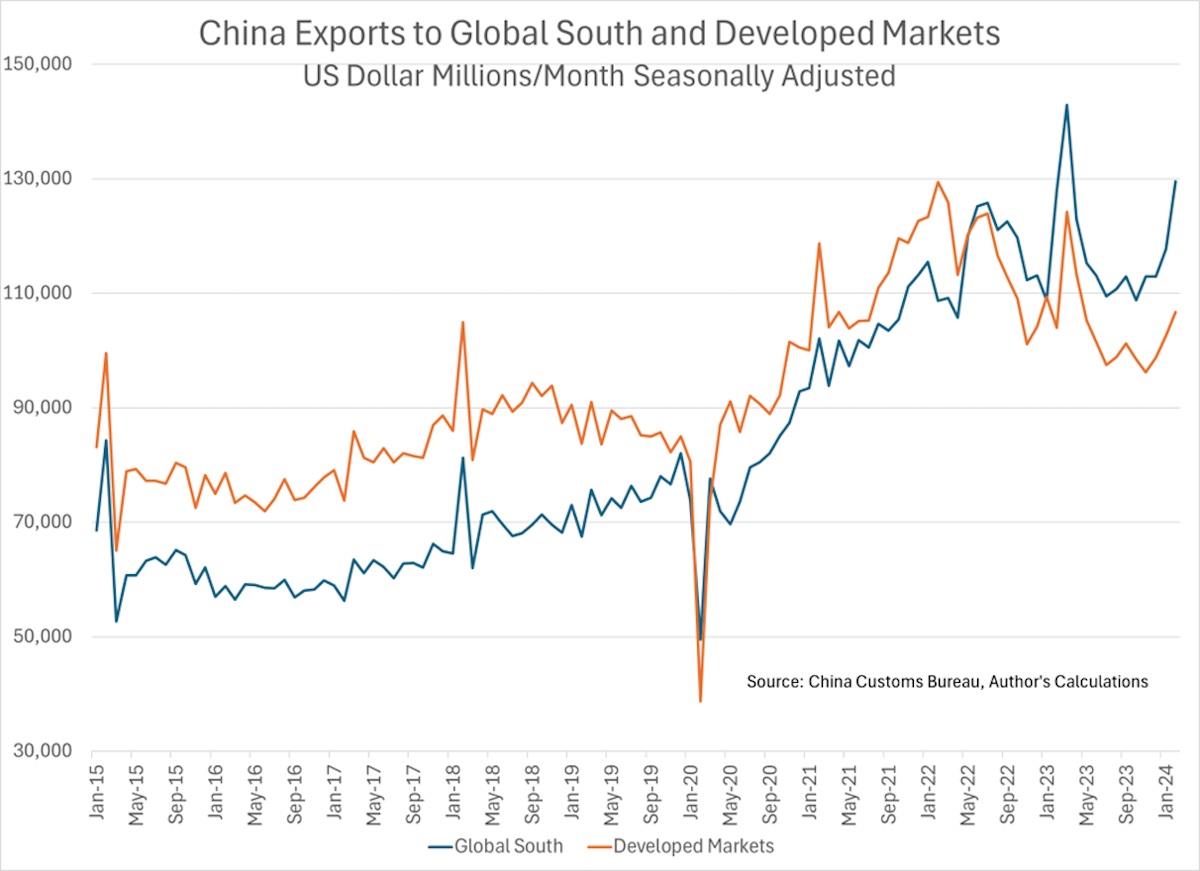

If China's exports to the US declined, where are China's exports going? China's exports to developed markets (the US, Europe, Japan and Australia) have barely risen during the past few years, while exports to the Global South (including Russia, the Persian Gulf States, Central Asia, South Korea and Taiwan) have roughly doubled. That is an unprecedented shift in world trade patterns, and in some ways the most important economic event of the past decade.

A large proportion of China's exports to the Global South consists of digital and physical infrastructure. China dominates the buildout of broadband in Southeast Asia, Central Asia, Africa and Latin America, as well as the provision of physical infrastructure. A substantial part of China's exports provides a foundation for future growth by raising the productivity of developing countries.

Inexpensive EVs also promote growth by increasing mobility. At least some of China's export boom contributes to self-sustaining growth.

Supply creates its own demand. There is strong statistical evidence that investment in broadband in the Global South contributes to business formation and leads to higher economic growth, as I showed in a recent stud y for the journal American Affairs.

There are also cases in which exports of Chinese goods may disrupt local industries. One can also find examples of excessive consumption of Chinese consumer items in the Global South, or unsuccessful infrastructure projects.

These issues deserve careful analysis and close attention to the data, rather than sweeping generalities.

The available data suggest that most of the increase in China's exports is directed to countries that do not compete with China in new industries, countries that often benefit from Chinese imports that contribute to future growth.

Information is incomplete, and it is possible to cite failures as well as successes. But Secretary Yellen should consider whether more capacity in new industries is a zero-sum game or a positive-sum game. She paid no attention to the positive-sum impact of new industries, and that is a regrettable omission.

Finally, Secretary Yellen's advice to China – to stimulate consumption and reduce investment – fails to take into account fundamental trends.

China's extraordinary growth since the Deng Xiaoping reforms of 1979 depended on urbanization. Farmers migrated to cities and became industrial workers. The rate of urbanization will decline sharply in the future, and China must increase industrial productivity, just as South Korea did after the 1997 Asian financial crisis. With an aging and perhaps declining population, rising industrial productivity is indispensable, and that requires a high level of investment.

Secretary Yellen's concerns should not be dismissed. She is right to worry that China's new industries may hurt the American economy. As an American consumer, I would like to buy an EV for less than US $10,000, but as an economist I agree with Donald Trump's warning that inexpensive Chinese EVs could cause a“bloodbath” for the American auto industry.

He proposed March 18 to impose high tariffs on Chinese EV imports but to invite Chinese auto manufacturers to build plants in the United States. That seems like the best solution for the time being.

S Treasury should identify practical policy solutions rather than dispense general advice to other countries

This essay

was first published by The Observer (guancha), a Chinese website that publishes news and commentary on China and the world. It is republished here with permission.

Thank you for registering!

An account was already registered with this email. Please check your inbox for an authentication link.

Sign up for one of our free newsletters

- The Daily ReportStart your day right with Asia Times' top stories AT Weekly ReportA weekly roundup of Asia Times' most-read stories

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment