403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

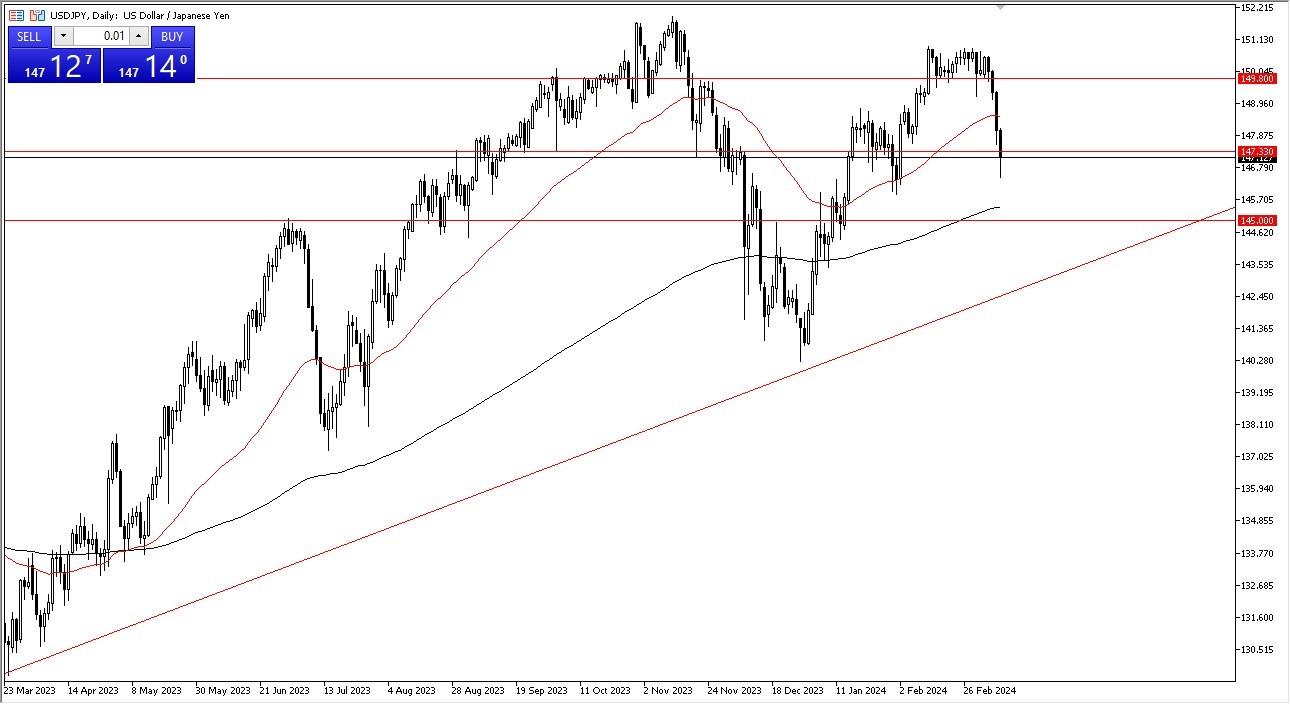

USDJPY Forecast Today- 11/03: USD Is Still Declining (Chart)

(MENAFN- Daily Forex)

USD/JPYThe US dollar has depreciated considerably versus the Japanese yen during Friday's trading, as traders appear to be placing bets on the Federal Reserve cutting rates in response to the disappointing jobs report. Nevertheless, the difference in value between these two currencies is still enormous, making it costly to short this pair in the long run. As a result, I believe it's most likely a temporary decline, and I'm keeping a careful eye on the 147.33 yen level because I believe it will signal a resumption of buying. Forex Brokers We Recommend in Your Region See full brokers list 1 Read full review Get Started We'll see whether this holds as we are currently between the 50-day EMA and the 200-day EMA indicators , which is typically a noisy region. Though I don't currently have any plans to get involved, I think it will be interesting to watch the initial outrage over the jobs number. The last few days have seen an extreme amount of volatility in the market, and given the way we have fallen, I believe that this will eventually be seen as a buying opportunity. Until we break down below the 143 yen level, I don't think there is much reason for concern regarding the US dollar versus the Japanese yen . I could be mistaken, though.It's possible that this will turn out to be a big decline, but we had one at the end of the previous year, so it could just be more of the same. You do need to keep in mind that the interest rate differential is what keeps you paid at the end of each and every session. The interest rate differential won't get small enough to make it somewhat of a fair fight until the Federal Reserve lowers rates multiple times. Naturally, the Bank of Japan has not even begun to consider tightening its monetary policy. I would scale back, but I do see this as a buying opportunity. I wouldn't rush to invest a large sum of money right away.Ready to trade our Forex daily analysis and predictions ? Here's a list of regulated forex brokers to choose from.

- Throughout Friday's trading session, the US dollar declined slightly as the jobs report was slightly below expectations. Nevertheless, the longer-term uptrend is still firmly in place. This is a market that will continue to see a lot of movement based on the interest rate situation – which is a bit in flux at the moment.

USD/JPYThe US dollar has depreciated considerably versus the Japanese yen during Friday's trading, as traders appear to be placing bets on the Federal Reserve cutting rates in response to the disappointing jobs report. Nevertheless, the difference in value between these two currencies is still enormous, making it costly to short this pair in the long run. As a result, I believe it's most likely a temporary decline, and I'm keeping a careful eye on the 147.33 yen level because I believe it will signal a resumption of buying. Forex Brokers We Recommend in Your Region See full brokers list 1 Read full review Get Started We'll see whether this holds as we are currently between the 50-day EMA and the 200-day EMA indicators , which is typically a noisy region. Though I don't currently have any plans to get involved, I think it will be interesting to watch the initial outrage over the jobs number. The last few days have seen an extreme amount of volatility in the market, and given the way we have fallen, I believe that this will eventually be seen as a buying opportunity. Until we break down below the 143 yen level, I don't think there is much reason for concern regarding the US dollar versus the Japanese yen . I could be mistaken, though.It's possible that this will turn out to be a big decline, but we had one at the end of the previous year, so it could just be more of the same. You do need to keep in mind that the interest rate differential is what keeps you paid at the end of each and every session. The interest rate differential won't get small enough to make it somewhat of a fair fight until the Federal Reserve lowers rates multiple times. Naturally, the Bank of Japan has not even begun to consider tightening its monetary policy. I would scale back, but I do see this as a buying opportunity. I wouldn't rush to invest a large sum of money right away.Ready to trade our Forex daily analysis and predictions ? Here's a list of regulated forex brokers to choose from.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment