(MENAFN- Asia Times) Days and nights in Kyoto

Days and nights

Night and days

In Kyoto

Welcome to information retrieval

– Michael Kamen, Brazil

As the threat of deflation stalks China's economy, the China-watching herd has resurfaced an old question from the rotation: Is China turning Japanese? The well-known script, in the words of a media-anointed analyst:

China's economic growth has followed what's sometimes called“the Japanese model.” In Japan and other Asian countries, this model has proved extraordinarily successful in the short term in generating eye-popping rates of growth – but it always eventually runs into the same fatal constraints: massive overinvestment and misallocated capital. And then a period of painful economic adjustment. In short: Beijing, beware.

According to the narrative, China is now facing a Japan-style reckoning with its property sector stuck in the doldrums for over three years. Of course, the above quote was written in 2010 when China's economy was less than half its current size and annual investment in residential property would still triple. Some people just like to be early.

Japan is sui generis. No nation's economy has underperformed so lamentably for so long after outperforming so spectacularly for even longer. It's just not true that every country that has followed“the Japanese model” has had to suffer long periods of painful economic adjustment – at least nothing approaching Japan's malaise.

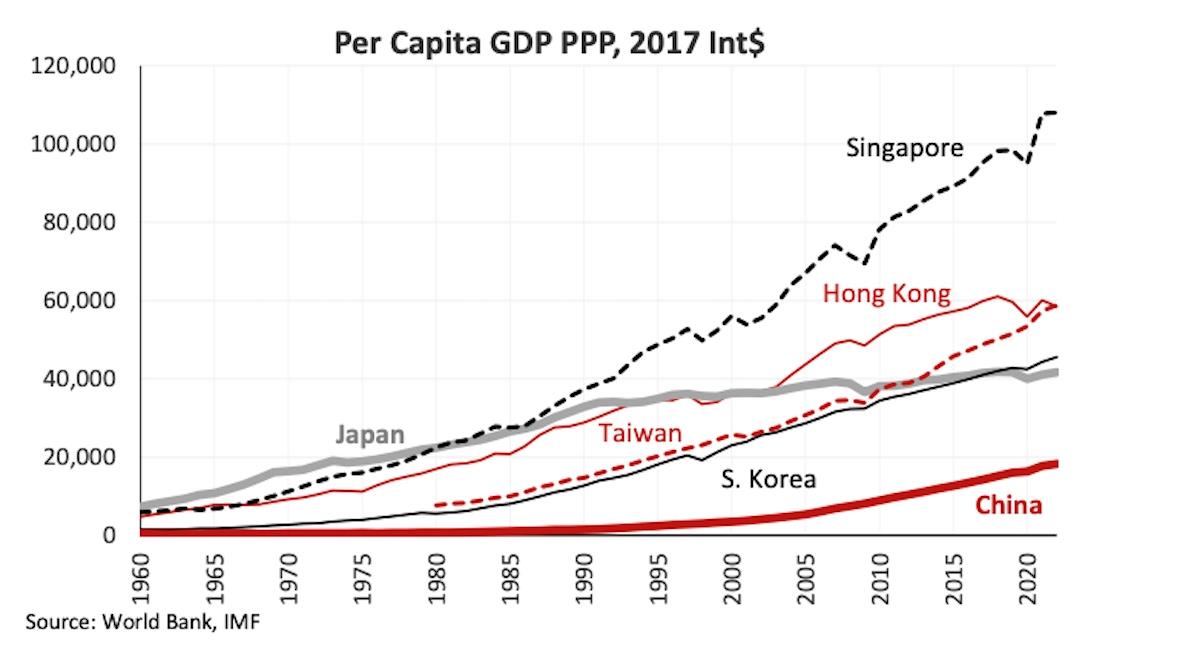

None of the four Asian Tigers (South Korea, Taiwan, Hong Kong and Singapore) have experienced multiple decades of stagnation. And all of their per capita GDPs, coming from far behind, now exceed Japan's on a purchasing power parity (PPP) basis.

South Korea shook off the 1997-98 Asian financial crisis, reformed its chaebols and moved up the value ladder. Taiwan integrated its economy with the mainland and became the world's leading producer of semiconductors.

While Hong Kong's recent decade has been lousy, it was the result of underinvestment in housing and, at the end of the day, the trade and financial hub still outperformed Japan. And Singapore is just a rocket ship with a per capita purchasing power parity GDP now 2.6 times that of Japan's.

While the Asian Tigers' birthrates started declining about ten years after Japan, they fell more precipitously and at lower per capita GDP levels. Taiwan's birthrate has just about fallen to Japan's level while South Korea's has sunk far below. Singapore and Hong Kong population charts look no better despite immigration being a viable option.

What did not happen in any of the Asian Tigers is the hoary“getting old before getting rich” canard. Collapsing birthrates did not, in fact, prevent any of the Asian Tigers from catching up to and exceeding Japan's per capita GDP.

While the night is still young and the consequences of disastrous-looking population charts may still catch up with the Asian Tigers, falling birthrates since the 1980s may have perversely allowed two generations of Asians to devote themselves to career and commerce, fueling decades of growth.

China's birthrate had been comfortably higher than those of Japan and the Asian Tigers until surging university enrollment and Covid lockdowns (see here ) caused a nosedive in recent years.

Still, China's population under 20, at 23.3%, is considerably higher than its Asian counterparts (16-18%) and in line with the US (25.3%) and Europe (21.9%). The country's 65 and older population, at 14.6%, is also lower than that of the developed world (20.5%).

MENAFN19022024000159011032ID1107869267

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.